PM Images/DigitalVision via Getty Images

Market Overview

Volatility spiked to 12-month highs in the first quarter as Russia’s invasion of Ukraine combined with monetary tightening, stubbornly high inflation and lingering effects of the COVID-19 Omicron variant to pressure equities. The S&P 500 Index suffered a 10% correction mid-quarter before recovering to finish down 4.60%, while the NASDAQ (-9.10%) flirted with a bear market before paring losses. Growth stocks bore the brunt of the selling, with the benchmark Russell 1000 Growth Index declining 9.04% compared to a loss of 0.74% for the Russell 1000 Value Index.

The Federal Reserve raised short-term interest rates 25 basis points in March, ending a period of unprecedented accommodation, and projected at least six more rate increases through year end. We believe the rate cycle could last through 2023 with the neutral interest rate approaching 3%. Yields were volatile, declining in a flight to safety during the early days of the invasion before resuming their climb, with the 10-year U.S. Treasury rising over 80 bps in aggregate to end the period at 2.3%.

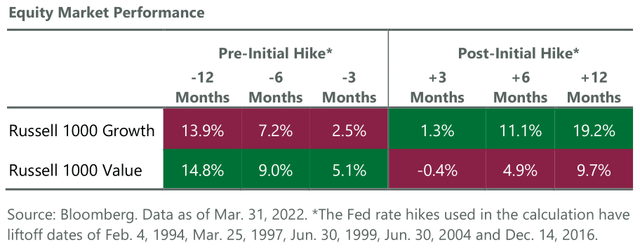

Growth stocks have historically been pressured leading into a tightening cycle and the past three months have tracked that pattern (Exhibit 1). What’s different this time is the speed of the Fed’s shift from a gradual withdrawal of liquidity in the second half of 2021 to an aggressive program to attack the highest U.S. inflation in 40 years. Growth equities tend to stabilize and deliver better performance once a tightening cycle is underway and we view the ClearBridge Large Cap Growth Strategy as well positioned to participate in this potential leadership shift.

Exhibit 1: Growth and Value Performance Around Rate Increases

The Russian invasion drew an immediate and united response from Western democracies in the form of economic sanctions on one of the world’s largest commodity producers. Beyond the wrenching humanitarian toll of the conflict, the cutoff of Russian oil, natural gas and raw materials for such high-demand applications as semiconductor manufacturing and electric vehicle production has exacerbated global inflation and further complicated supply chain bottlenecks. While the Strategy has no direct exposure to Russia or Ukraine, the secondary effects of rising input costs and constrained raw material availability could further blur already challenged corporate earnings visibility. In the current market, companies are being punished for being conservative in their guidance.

We manage the Strategy to promote diversification and participate through the full market cycle, especially during turbulent periods like the current one. The unusual confluence of factors experienced recently has meant that some typically defensive sectors in the portfolio like consumer staples or health care have not been as defensive as one would expect. While portfolio construction hurt relative returns when a narrow band of mega cap growth names dominated performance, first-quarter underperformance was due to lackluster stock selection. Earnings shortfalls impacted three names in particular: Netflix (NFLX), PayPal (PYPL) and Facebook (FB) (now Meta Platforms).

After being a prime beneficiary of increased viewing patterns during the stay-at-home period of COVID-19, Netflix is recalibrating what a normal growth trajectory will look like as global economies fully reopen. The stock fell sharply after the company modestly reduced its net subscriber additions for the current quarter, calling into question its ability to continue to deliver double-digit subscriber growth.

We believe one of our edges as active managers is our long-term orientation and willingness to be both early and patient with additions to the portfolio. With Netflix, we remain convinced that our thesis for owning the stock is intact. While some fear the U.S. streaming market is becoming saturated, Netflix’s penetration of global broadband homes is still less than 50%, a figure that doesn’t even include the opportunity to attract more mobile-only smartphone users. We believe Netflix can improve returns even if growth is weighted towards lower average revenue per user international markets while the company’s nascent video game strategy and potential pivots into advertising represent upside scenarios not reflected in its current valuation.

Most of the net subscription growth will occur outside the U.S., as will much of the content creation, which will be much lower cost. In retesting the competitive landscape for streaming, we are encouraged that Netflix has been able to pass on price increases without existing subscriber attrition. Churn remains exceptionally low and engagement exceptionally high. The company is also committed to reducing its content spend if subscriber growth remains challenged.

We entered a position in PayPal in December well aware of the electronic payment platform’s ambitious goals for user growth. The company has started to experience a reduction in revenue growth due to weakening in the macro environment and a deceleration in e-commerce broadly due to reopening headwinds and difficult comps. This led to a sharply reduced outlook for 2022 revenue and long-term earnings that has weighed on the stock. We initiated a position after the shares had already fallen 40% from their all-time high but were wrong in modeling that a muted outlook was already priced in. Nevertheless, we believe PayPal is fundamentally holding share in the industry and is set up for continued growth in e-commerce once reopening headwinds pass. The company onboarded nearly 120 million net new users over the last few years; naturally, many users will churn off the platform. We also see the company’s strategy to add additional use cases to its wallet such as investing, crypto, savings accounts and bill pay as catalysts to accelerate revenue growth over time. In addition, Venmo continues to be under- monetized and a new partnership with Amazon.com (AMZN) will be something to watch.

Facebook shares derated following fourth-quarter earnings results and first-quarter revenue guidance that was weaker than expected. We knew going into Facebook’s latest reporting period that Apple’s iOS14 privacy changes (measurement, loss of signal) would have a near-term impact on earnings, but competition in the social media space (primarily from TikTok) further catalyzed multiple compression in the stock.

While TikTok is a competitive threat and Apple’s privacy changes have impacted the industry, we believe these risks are manageable and Facebook retains a number of advantages around user scale, advertiser scale, new product development and sophistication of its digital advertising technology that are not being valued at current levels. New product innovation, including Reels, are currently being under-monetized, as were many previous product introductions initially over the last decade. Furthermore, we believe the company’s bigger profile with small and midsize (SMB) customers, who reduced spending during the Omicron surge and due to supply chain issues that kept product off the shelves, was partly responsible for its conservative guidance. Facebook properties still have three billion monthly active users and the overall platform remains the highest return on advertising spend for advertisers.

Among mega caps, Facebook is our second-largest active overweight relative to the benchmark, but we trimmed the position slightly in the first quarter while adding to our overweight in Amazon.com. With Amazon’s capex build largely done in 2020 and 2021, we believe it is now set up to generate robust revenue growth and margin expansion in all three of its key segments: e-commerce, cloud (AWS) and advertising.

Amazon rebounded off post-invasion lows on the strength we experienced in e-commerce. United Parcel Service (UPS), a key provider of delivery services for both B2B and B2C commerce, continued to execute well with its pricing power and focus on improving margins (better, not bigger strategy), while Visa is benefiting from increasing debit card usage for purchases, along with early signs of high-profit cross-border travel returning. The portfolio also saw solid performance from cybersecurity names Palo Alto Networks (PANW) and Splunk (SPLK), which are gaining prominence as the risk of global cyberattacks increases as part of the Russian offensive, as well as Raytheon Technologies (RTX), which is levered to the likelihood of increased defense spending among Western countries.

Portfolio Positioning

Growth company valuations tend to anticipate changes to input variables (in this case, interest rates) well in advance, and they have largely derated following a predictive path. That said, valuations are largely in check after a significant drawdown and are now set up much better than just six months ago. The market is challenging growth where, in some cases, there is not a fundamental issue. This creates an opportunity for us to underwrite investments where our advantage over consensus is the durability of growth. Clearly, the impact of higher interest rates has been most acutely felt in the longer-duration assets of the market where interest rate pressures are most acute. Given our overall positioning, we have room to increase our tech exposure and did so with the additions of Unity Software (U) to the select growth bucket and Intel as a cyclical play on the reshoring of semiconductor production.

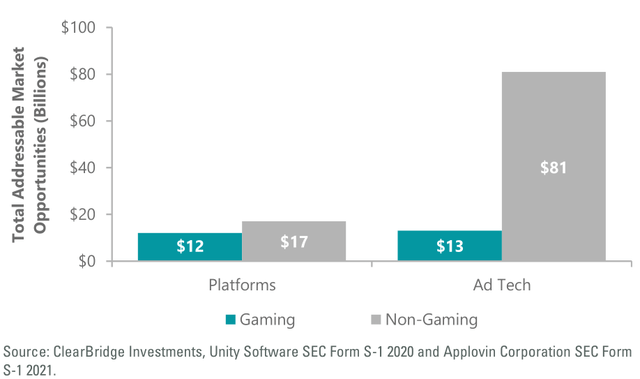

Gaming is an attractive end market within the media/technology sector with strong growth and a long runway, particularly in mobile gaming. Unity’s platform provides an engine and toolkit for development and monetization of games, e-commerce and industrial applications, adding to our industry exposure, which also includes Nvidia (NVDA) in graphic processing chips and Sea Ltd. (SE), which operates an international gaming platform. Unity is levered to growth of the overall gaming market, offering developer tools for designing, rendering and publishing games. It maintains leading share in the third-party game development market and helps game publishers monetize games with advertising tools. The company is also expanding its total addressable market by making its editor and 3D content creation tools available to other industries like auto manufacturers and architecture/design firms (Exhibit 2). Risks we are monitoring include competition in game development, execution risk in balancing growth while nearing profitability and delays in shifts to newer technologies like the metaverse.

Exhibit 2: Growth Potential Outside Gaming is Growing

Intel (INTC) is the world’s largest manufacturer of semiconductors, especially CPUs for computers and mobile devices. The company had been mismanaged in the past, hurting its competitive position. CEO Pat Gelsinger has completely revamped the organizational structure and burned down technology sharing between its owned product and fabrication customers to better compete in this latter area. Intel has differentiated technologies and a roadmap to achieve product leadership in its core PC and data center markets and is using operating leverage to reinvest in new business opportunities such as chip production and GPUs.

Chip production has become a bipartisan national security and intellectual property issue due to geopolitical tensions and Intel is expected to be a prime beneficiary of U.S. and European government subsidies to develop new leading-edge fabrication capacity outside of Asia.

We believe Intel has underappreciated growth/margin drivers over the next several years as it regains technology leadership. The company’s defensive characteristics should allow it to outperform other semi names in the event of an industry downturn. We are adding Intel as we trim exposures to our other semiconductor holdings tied to secular growth trends in electric vehicles (NXPI) as well as gaming, data center and the metaverse (Nvidia).

Other actions during the quarter included the sale of consumer names Home Depot (HD) and Booking Holdings (BKNG). The Home Depot move is based on where we are in the consumer and housing cycle as we come out of a period of nesting and dedensification and as government stimulus related to COVID-19 expires. The company has effectively pulled forward demand over the last two years and taken share because of in-stock inventory availability relative to peers. Many of those tailwinds are now turning neutral to negative and our thesis for Home Depot of optimizing the business in terms of merchandising/inventory, omnichannel, PRO/DIY mix, labor and distribution centers has played out. The exit is part of our efforts to reduce consumer discretionary exposure and provide better downside protection if volatility persists. We sold Booking, the owner of online travel agencies Booking.com, Priceline and Kayak, due to its higher exposure to Europe where we believe a rebound in travel will be slowed by the spillover effects of the Ukraine invasion on consumer spending.

Outlook

We are entering a period of policy reversal that should lead to a normalization of capital market returns and economic growth from a peak everything environment (liquidity, profit margins, global growth). This is the type of environment where GDP growth is likely to slow and liquidity becomes less abundant and our diversified approach to portfolio construction and focus on quality growth should thrive. Heightening levels of volatility should also be an advantage, allowing us to be opportunistic given our longer- duration growth horizon for the companies we target and own in the portfolio. We did not deliver on our objective this quarter to have better down capture in a volatile market due to consequential poor performance in a select few names.

We still have high conviction in the benefits of our diversified approach and will not waver from our large cap mandate in pursuit of alpha. Instead, we will continue to apply the learnings of the last several years, both the decisions we got right as well as the situations where we misjudged the timing of improvement stories, the competitive risks of specific industries or the growth drivers of certain mega caps that maintain significant weightings in our benchmark. We will remain patient when our business case for owning a company is unchanged by near-term pressures.

However, we have been and will continue to be more disciplined sellers if we see fundamental issues or anticipate such issues on the horizon. This was the case with Booking as well as our recent exits from Ecolab (ECL), Nutanix (NTNX) and Comcast (CMCSA).

Positioning moves through the pandemic were focused on improving our up capture in strong markets through increasing our weighting to select growth companies in technology and shadow tech. More recently, we have been adding countercyclicality to the portfolio with our additions in health care. We believe medical device makers such as Alcon and Intuitive Surgical will see a ramp-up in activity post-COVID-19, while innovators like DexCom (DXCM), a new position in the quarter that has leading share in the market for glucose monitoring systems for diabetes patients, stand to benefit. These companies offer a more efficient solution to managing chronic health conditions and provide a key point of differentiation for our portfolio from passive strategies going forward.

We are also committed to participating in the most powerful secular growth trends our research efforts have identified. These include cloud computing/software-as-a-service, gaming, digital payments as well as electrification. A new trend that has emerged with rising geopolitical tensions between the West and China and now Russia is the need for reshoring of production and fortifying supply chains. We have exposure to this theme which we believe will involve a multiyear, if not longer, commitment by most multinational companies.

Portfolio Highlights

The ClearBridge Large Cap Growth Strategy underperformed its Russell 1000 Growth Index benchmark during the first quarter. On an absolute basis, the Strategy suffered losses across seven of the eight sectors in which it was invested (out of 11 sectors total). The leading detractors from performance were in the communication services and information technology (IT) sectors, while the financials sector was a contributor.

On a relative basis, overall stock selection detracted from performance. In particular, stock selection in the communication services sector had the most significant negative impact on results while selection in the IT, health care and consumer staples sectors was also detrimental. On the positive side, an overweight to the industrials sector, an underweight to communication services and stock selection in financials contributed to performance.

On an individual stock basis, leading contributors to absolute returns in the first quarter included positions in Palo Alto Networks, Splunk, DexCom, Raytheon Technologies and S&P Global (SPGI). Facebook, Netflix, PayPal, Sea Ltd. and Adobe (ADBE) were the primary detractors.

In addition to the transactions mentioned above, the Strategy gained shares of S&P Global in the financials sector following its acquisition of existing holding IHS Markit.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment