smshoot

Blue Chips Were Ready for Higher Rates

Market Overview

There was no place for investors to hide in the second quarter of 2022. The stock market declined 16.1% and the bond market declined 4.7%.1 Against this challenging backdrop, the ClearBridge Dividend Strategy proved defensive, declining only about two thirds as much as the S&P 500 Index.

Our conservative approach aims to deliver compelling long-term performance through participation in up markets and managing risk in down markets. We invest in high-quality companies which tend to be resilient and whose dividend yields tend to cushion volatility. Over time, earnings growth drives both dividend growth and capital appreciation. Of course, stocks do not move consistently higher: prices cycle up and down with the ebb and flow of headlines, geopolitics and economics. 2022 is one of those years where stock prices have gone south. We firmly believe, however, that our portfolio of high-quality dividend growers is well-positioned to ride out the storm.

The last 13 years, since the Global Financial Crisis (GFC), were terrific for stockholders. The S&P 500 compounded at 19% per year over that timeframe (Exhibit 1). Ironically, investors profited despite a lackluster economy: the post-GFC recovery was one of the weakest on record. Rising share prices were driven not by torrid sales, but by unusually high profit margins combined with historically low interest rates. Elevated margins fed shareowners a bigger piece of the corporate pie, while low interest rates induced investors to pay higher multiples for those earnings streams.

Exhibit 1: S&P 500 Index Post-GFC Returns

As of Dec. 31, 2021. Source: ClearBridge Investments, FactSet.

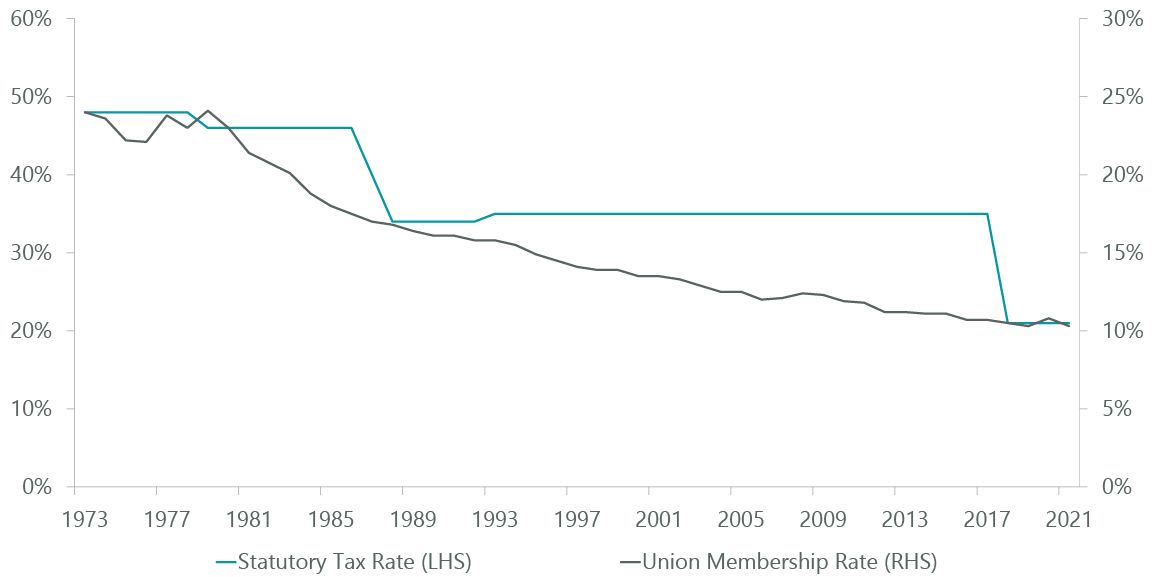

As the markets soared, economists wondered aloud if we had entered a new regime of secular stagnation where lower growth and higher savings combined to result in permanently lower inflation and interest rates. With growth scarce and discount rates low, valuations on growth stocks became unmoored and climbed to unprecedented heights. In hindsight, however, it seems clear the last few years were not the harbinger of a new paradigm, but rather the cyclical nadir of the disinflationary wave unleashed in the 1980s through deregulation, globalization and the broad embrace of laissez-faire economic policies (Exhibit 2).

Exhibit 2: An End to Regime of Deregulation and Globalization?

As of Dec. 31, 2021. Source: Author’s analysis of Bureau of Economic Analysis National Income and Product Accounts data (Table 1.1.1), Internal Revenue Service Statistics of Income Historical Table 24, and Gravelle (2006).

Note: 1982 union membership not available; extrapolated from average of 1981 and 1983.

Recently, the zeitgeist seems to have changed and the pendulum swung toward deglobalization, more muscular antitrust regulation and increased bargaining power for labor. These shifts may lead to positive changes in society (reduced inequality, higher median standards of living and more resilient supply chains), but they almost certainly augur lower corporate profit margins.

Since late 2020 we have consistently worried that the unprecedented stimulus of the pandemic era could lead to inflation and rising rates. Guided by these concerns, we reinforced our valuation discipline, reduced our exposure to high-multiple stocks, and increased our exposure to commodity producers and banks.

During the first quarter we added natural gas producers EQT (EQT) and Chesapeake Energy (CHK) and in the second quarter we initiated a position in copper producer Freeport-McMoRan (FCX). In the current inflationary environment, these companies are well-positioned. They also have all recently embraced thoughtful dividend policies with small base payouts that are sustainable in tough environments, and the potential for variable dividends that shift as profits move with commodity prices.

In the second quarter we made a sizable add to our position in Bank of America (BAC) as our bank holdings have significant leverage to rising interest rates.

The Fed, unfortunately, was late to realize inflation’s magnitude, maintaining for far too long that inflationary pressures were merely transitory. This mistake caused inflation to accelerate, necessitating a larger intervention than if the Fed had moved sooner.

In the second quarter, the Fed finally got its act together. On June 15, in a move unimaginable just days before, the Fed raised rates by 75 basis points. The June meeting represents a sea change in Fed Policy. For over 30 years — since the days of Alan Greenspan — Wall Street has taken “the Fed put” for granted, believing the central bank would ride to the rescue anytime the stock market started to wobble. With headline inflation above 8%, however, the Fed has made clear that its mission is to sap inflation, not save investors.

As always, we have no explicit forecast for inflation, interest rates or GDP growth. We embrace the inherent uncertainty of investing and endeavor to position the portfolio so that satisfactory performance is not dependent upon the realization of any one outcome. For the last many years, the elevated prices of high-multiple stocks implicitly required the endurance of low interest rates in perpetuity. Given our conservative approach, we were never comfortable buying stocks whose valuations required interest rates to remain near zero forever. Rather, we worked to position the portfolio for salutary returns even if interest rates were to rise.

In the second quarter of 2022 this has meant strong relative performance driven by our overweight to energy, an inflation beneficiary, and our underweight to the consumer discretionary sector, dominated as it is by high-multiple growth companies. Likewise, our sizable but underweight positions in Apple (AAPL) and Microsoft (MSFT) — two excellent companies with high valuations that have called for active position sizing in an expensive market in the last two years — helped our information technology (IT) holdings outperform. In health care, our focus on reasonably valued large cap pharmaceutical and managed care companies proved defensive as higher multiple more speculative issues sold off. On the downside, while our modest overweight to utilities was helpful, our holdings there modestly underperformed the sector.

Despite the significant recent repricing of markets, it appears to us the market still discounts a relatively benign interest rate cycle. While this is possibly correct, we worry the Fed may need to raise rates more than currently expected to sufficiently tame inflation. We question if 8%+ inflation can be brought to heel with 3%–4% nominal interest rates. Traditional economic theory would suggest higher rates are needed.

We continue our disciplined, bottom-up approach to investing. We focus on high-quality companies with strong balance sheets, recurring revenues, high margins and returns, strong free cash flow and healthy dividend profiles. We expect continued healthy dividend growth from our holdings, and we believe our portfolio is well-positioned to navigate the turbulence.

Portfolio Highlights

The ClearBridge Dividend Strategy outperformed its S&P 500 Index benchmark during the second quarter. On an absolute basis, the Strategy had gains in one of the 11 sectors in which it was invested for the quarter: the health care sector. The IT, financials and materials sectors, meanwhile, were the main detractors.

On a relative basis, sector allocation and stock selection contributed positively to performance for the quarter. In particular, stock selection in the industrials, health care, IT, communication services and consumer discretionary sectors as well as underweights to the consumer discretionary and IT sectors and overweights to the energy and consumer staples sectors proved beneficial. Stock selection in the utilities sector and an underweight to health care detracted.

On an individual stock basis, the main positive contributors were Merck (MRK), Northrop Grumman (NOC), Pfizer (PFE), American Tower (AMT) and Coca-Cola (KO).

Positions in Apple, Microsoft, Apollo Global Management (APO), Bank of America and Walt Disney (DIS) were the main detractors from absolute returns in the quarter.

Besides portfolio activity discussed above, during the quarter we initiated a position in SAP (SAP) in the IT sector and closed a position in NextEra Energy (NEE) in the utilities sector.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment