Paul Morigi

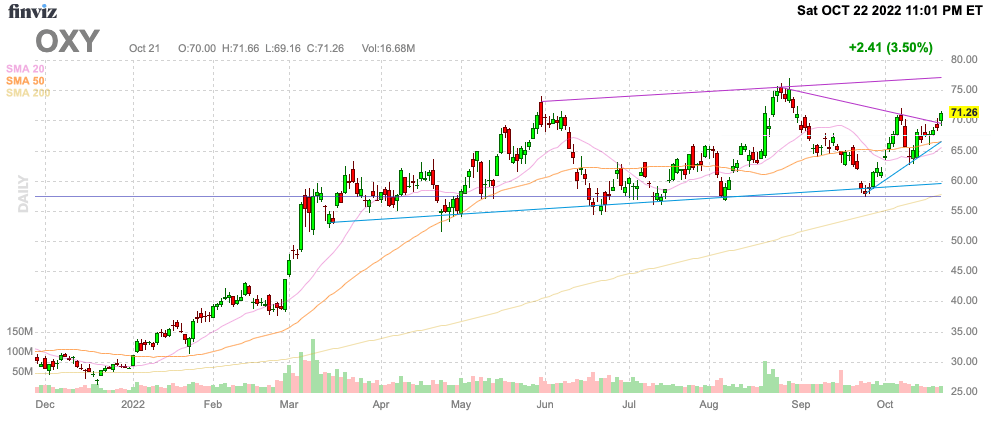

As predicted, Occidental Petroleum (NYSE:OXY) has rallied to $70 providing an ideal exit point. Warrant Buffett has continued snapping up shares, but the investment guru shows no interest in paying premium prices for the energy stock. My investment thesis is Bearish on Oxy now trading at levels where Berkshire Hathaway (BRK.B) appears uninterested in snapping up shares.

Source: FinViz

Buffett Not Paying Above $60

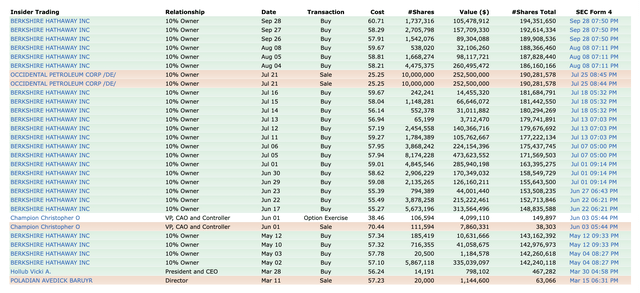

Warren Buffett clearly wants to purchase as much of Oxy as possible with his investment firm now owning 194 million shares. Berkshire Hathaway last bought 1.7 million shares on September 28 at an average price of $60.71.

The company bought all of the previous shares since March in the $50 price range. Amazingly, Oxy hasn’t traded below $60 for many days since March, yet Berkshire has repeatedly bought millions of shares on the dips without needing to pay up.

Buffett now has FERC approval to buy up to 50% of the outstanding shares and the latest purchase has the investment company’s holdings at ~21% of the outstanding common shares.

Per the calculation from Truist, the actual total diluted share count will soar to 1.3 billion shares when preferred shares are converted. Oxy has $10 billion in outstanding preferred shares with Buffett owning 100,000 shares of series A preferred shares and warrants for an additional 83.9 million shares at an exercise price of $59.624.

The valuation equation clearly changes when the diluted share count jumps to 1.3 billion from 925 million shares. J.P. Morgan predicted a corporate priority to cut the preferred shares from the $9.7 billion level at the end of Q2 as the company has already made substantial cuts to debt levels via repayments.

Even without purchasing shares, Buffett will slowly takeover the company. Oxy repurchased 18 million shares through August 1 to reduce the share count by a couple percentage points. The company has prioritized repaying debt with $7 billion spent to cut debt loads in the 1H’22.

Either way though, the ultimate key is that Buffett hasn’t bought more than a handful of shares at prices above $60.

Collapsing Energy Prices

With Oxy above $70 now, investors have to worry about energy prices and wonder why Buffett isn’t interested in loading up on shares at any price. After all, the independent energy company earned over $3 billion last quarter alone and the stock only has a listed market value of $65 billion.

The company earned $3.2 billion, or $3.47 per share in Q2’22. The numbers were down from Q1 and investors should expect lower numbers for the 2H with energy prices falling.

In Q2, Oxy realized the following energy prices versus current levels:

- WTI at $108.41 vs. $85.11

- Brent at $111.69 vs. $93.50

- Nat gas at $6.25 vs. $4.99

The average energy price is down ~20% setting up Q3/Q4 EPS estimates below $2.50 per share. Analysts generally forecast quarterly EPS targets to dip below $2.00 per share going forward with a normalized annual profit in the $5 to $6 range when the war in Ukraine ends and elevated energy prices disappear.

These numbers explain why Buffett isn’t willing to pay much above $60 per share to snap up Oxy shares. Berkshire has no reason to rush into paying up for shares when the company can use solid cash flows to repurchase shares, thereby increasing the ownership position of Buffett.

As the debt levels dip towards $15 billion, Oxy can further shift towards repurchasing more shares with debt under control. Though, the U.S. continues toward record production levels and any shift in the White House following mid-term elections could open up domestic production even more. Domestic natural gas production is already at record levels despite an administration focused on shifting to green energy at all costs.

Takeaway

The key investor takeaway is that Buffett has no reason to pay a premium price for Oxy. Investors should use rallies into the $70s to unload the stock. Buffett is highly unlikely to offer a premium to the current price to acquire Oxy knowing normalized earnings wouldn’t warrant a $90 purchase price, or some 50% above the highest purchase price by Berkshire so far.

Quarterly results going forward aren’t likely to impress with energy prices falling even with the war in Ukraine still ongoing. Buffett is correct to not chase prices higher and investors should follow the lead of Berkshire Hathaway in this case.

Be the first to comment