yuelan/iStock via Getty Images

Beer, Ketchup, Cereal and Other Defenses

Market Overview

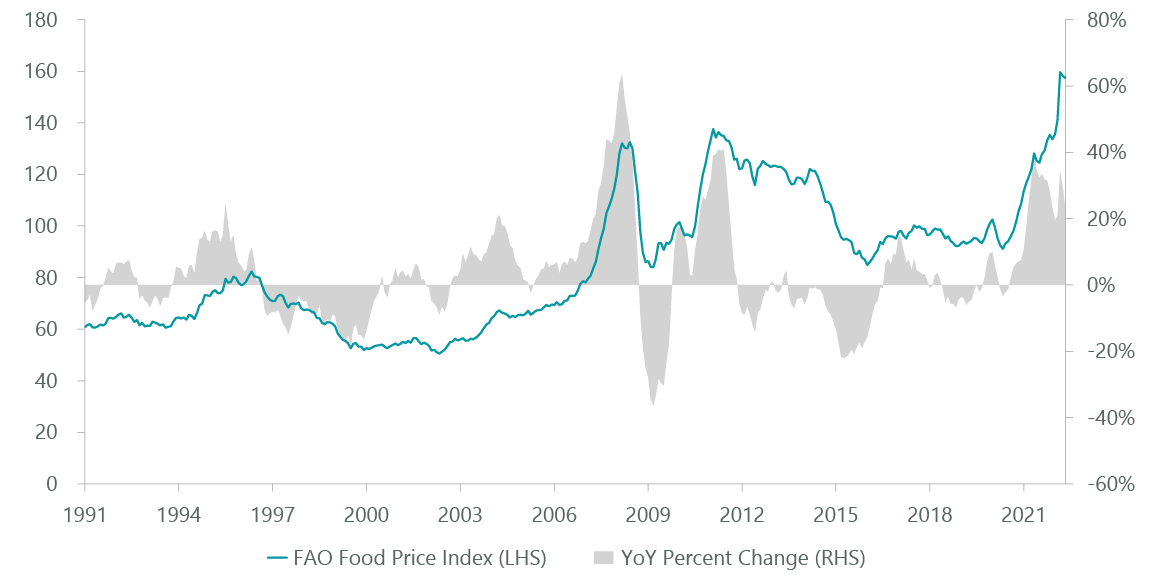

The surprising resilience of the S&P 500 Index that we noted in our first-quarter commentary gave way to a dramatic decline of -16% in the second quarter. Issues that concerned us earlier in the year only deepened: the war in Ukraine has no end in sight; inflation in wages, food and energy remains persistent (Exhibits 1 and 2); the Federal Reserve has stepped up its hawkish rhetoric; and valuations remain elevated by historical standards. The signposts we referenced as predictive of future economic activity and equity market opportunity also deteriorated. Credit spreads continue to widen, parts of the yield curve are flat, economic surveys look bleak and the Fed remains intent on draining liquidity via aggressive interest rate increases and shrinking its balance sheet.

Equity investors had nowhere to hide in the second quarter as all 11 GICS sectors declined. Market leadership was largely unchanged from the first quarter — remaining decidedly defensive — with the energy, consumer staples, utilities, and health care sectors producing the best relative returns. Energy sector performance remained buoyed by stubbornly high oil and natural gas prices while investors took shelter within the regulated returns of the utilities sector. The historically defensive food and beverage industries (within consumer staples) also offered a slight refuge as investors bet consumers will still buy Corona, ketchup and Cheerios regardless of the economic outlook. A look at the health care sector provides the best example of the market’s defensive tone as the staid pharmaceutical industry buoyed returns while health care equipment and life science tools underperformed.

Exhibit 1: Wages are Up…

As of May 31, 2022. Source: ClearBridge Investments, Atlanta Fed, Bloomberg Finance.

Exhibit 2: …But So are Prices

As of May 31, 2022. Source: ClearBridge Investments, United Nations, Bloomberg Finance.

Lagging sectors were also similar to those in the first quarter. Consumer discretionary, communication services and information technology (IT) all declined more than 20% April through June. Consumer discretionary weakness was broad based. Bellwethers such as Amazon.com (AMZN) and Target (TGT) fell more than 30%, caught flat-footed with excess warehouse capacity and bloated inventories as post-pandemic consumer behavior shifted away from bigger-ticket items such as electronics and home furnishings to apparel and grocery — and as consumers retrenched from inflation shock. The shift to smaller-ticket items stoked fear of deteriorating consumer spending and contributed to the staggering decline in cruise lines and casino stocks, many of which fell more than 50% in the second quarter alone. Communication services was dogged by the entertainment industry due to concerns over the growth and profitability outlook for streaming services. Finally, although technology weakness was also broad based, it was especially acute for the semiconductor industry where fears of a cycle downturn built throughout the quarter as evidence of an inventory correction mounted.

Outlook

While the market decline has begun to create opportunities, we believe a cautious stance is appropriate. Valuations still look high, and the economic path ahead looks fraught. The Federal Reserve faces a tricky path. Either it tightens sharply, hurting earnings, or it tightens too little to reduce inflation, increasing the intermediate-term level of interest rates. In both cases stock prices seem vulnerable.

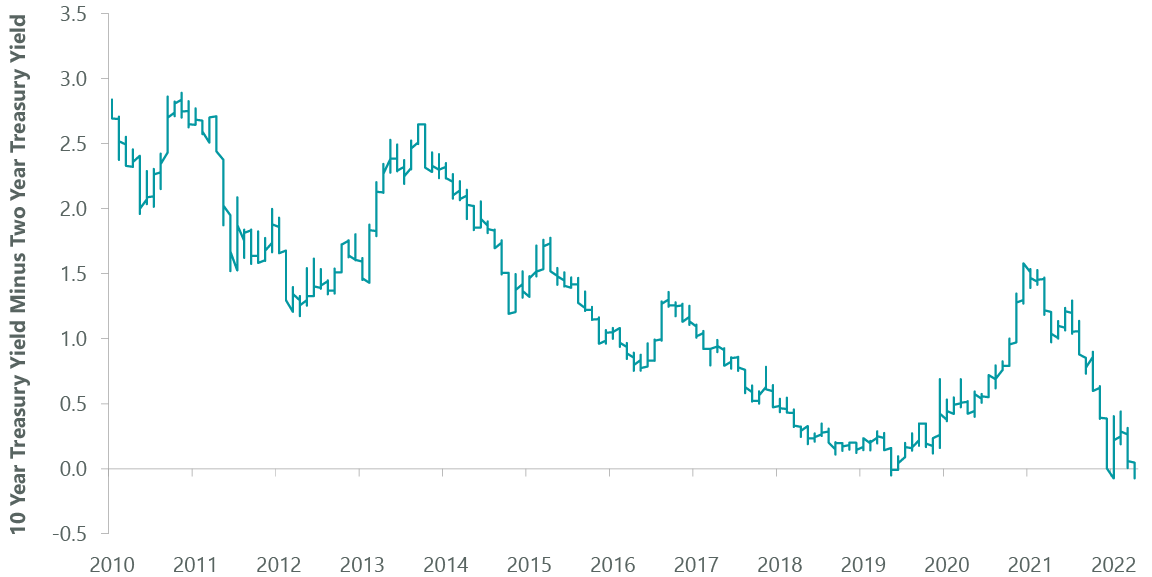

We believe liquidity is a (if not the) primary determinant of equity market performance, and the best environment for stocks is one where the Fed provides liquidity to achieve economic acceleration. Today’s environment is exactly the opposite. For the first time in decades the U.S. money supply turned negative in May. It will be another six to nine months before the impact of quantitative tightening will be felt. Several key economic indicators are flashing warning signs. Initial jobless claims have turned up, the ISM is below 50 and the Treasury yield curve is inverted (Exhibit 3).

Exhibit 3: Treasury Yield Curve is Inverted

As of July 7, 2022. Source: ClearBridge Investments, Bloomberg Finance.

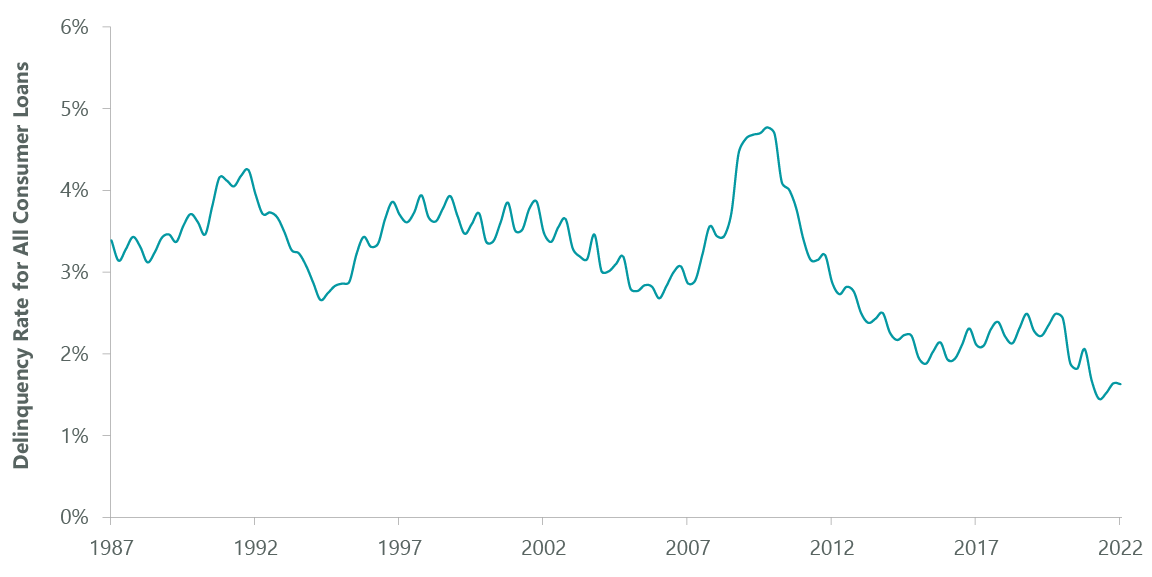

Not all is gloom and doom. We start from a very good place. Unemployment at 3.6% is full, credit costs and delinquencies are near all-time lows (Exhibit 4), consumer balance sheets are in good shape, significant pent-up demand exists for houses and cars and many raw materials are off sharply from first quarter and early second-quarter spikes.

Exhibit 4: Delinquency Rate for All Consumer Loans

As of March 31, 2022. Source: ClearBridge Investments, Federal Reserve, Bloomberg Finance.

Although the market decline brought P/E ratios optically in line with the 15-year average of 16x, we remain concerned about the market’s valuation. In the mid-2000s, when the federal-funds rate fluctuated between 2% and 5%, a 16x market P/E multiple was more of a ceiling than a floor. Consensus earnings estimates have yet to be revised lower to reflect more challenging economic fundamentals — so the “E” in P/E is too high. Alternative measures of the market’s valuation (such as the Buffett Indicator, which pits the total market valuation to GDP, or the CAPE or Shiller P/E ratio, which is cyclically adjusted) suggest stocks remain aggressively valued (Exhibit 5). It seems we are in the early innings of an expectation adjustment period and although the market is down it is hard to argue it is cheap.

Exhibit 5: Hard to Argue Market is Cheap

As of June 30, 2022. Source: ClearBridge Investments, Bloomberg Finance.

Our emphasis is always to own companies with robust earnings and cash flow throughout the business cycle. The investment environment is likely to remain hazardous for hyper growth companies who have yet to produce profits or free cash flow. We believe software companies with high gross margins and pricing power can perform relatively well even in a high-inflation environment. We remain cautious on semiconductor stocks. Oil and materials prices appear to have peaked. Coatings and other specialty chemicals companies will benefit from lower raw materials prices while volumes should remain healthy even in a recession. The market decline has created opportunities in some stocks in the renewables and renewable energy sectors.

Conclusion

We continue to believe investors should stay the course in equities, although total return expectations should be muted for the near term. We continue to recommend a balanced approach to the markets, including both growth and value stocks with an emphasis on high-quality companies. That said, we believe effective Fed policy will reduce inflation over time and offer patient, long-term investors the opportunity to purchase high-growth shares at better prices later this year.

Portfolio Highlights

The ClearBridge Appreciation Strategy outperformed the benchmark in the second quarter. On an absolute basis, the Strategy had gains in two of 11 sectors. The positive contributors to performance were the health care and real estate sectors. The IT, financials, communication services and consumer discretionary sectors were the main absolute detractors.

In relative terms, stock selection accounted for most of the outperformance, while sector allocation effects were also positive. In particular, stock selection in the health care, IT, industrials, consumer discretionary, communication services and real estate sectors boosted relative returns. An underweight to the consumer discretionary sector and an overweight to the energy sector were also beneficial. An underweight to the utilities sector, meanwhile, detracted.

On an individual stock basis, the biggest contributors to absolute performance during the quarter were Merck (MRK), Eli Lilly (LLY), T-Mobile (TMUS), Pfizer (PFE) and UnitedHealth Group (UNH). The biggest detractors were Apple (AAPL), Microsoft (MSFT), Amazon.com (AMZN), Alphabet (GOOGL, GOOG) and Berkshire Hathaway (BRK.A, BRK.B). During the quarter, we sold our positions in Texas Instruments (TXN) and Salesforce (CRM) in the IT sector.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment