35007/iStock via Getty Images

By Reed Cassady | Albert Grosman | Sam Peters

Evaporating Capital Less a Problem for Value Stocks

Market Overview

The years of central bankers fighting to stimulate their economies are over. Quantitative easing has given way to a new, transitional economic phase defined by persistent inflationary pressures and setting the stage for a potential new crop of winners among U.S. equities. The sources of this inflation are no secret; a lack of investment in commodity production, fiscal stimulus used to prop up an economy infected with COVID-19, global supply chain disruptions and an energy crisis stemming from Russia’s brutal war on Ukraine have been regular topics of the nightly news. As the Fed advances its plan to subdue inflation through aggressive policy, market woes have been further exacerbated by interest rates’ rise off their artificially low starting points. The result has been to overturn a two-year regime of negative real interest rates (Exhibit 1).

Exhibit 1: Real Rates Revert from Historic Lows

As of Sept. 30, 2022. Source: Bloomberg Finance, L.P., ClearBridge Investments.

|

*U.S. 10-Year Real Rate data is from Feb. 28, 2010 through Sept. 30. 2022. **U.S. 30-Year Real Rate data is from Jan. 31, 2003 through Sept. 30, 2022. |

This period of COVID-induced negative real rates left investors with minimal options at the lower end of the risk/reward spectrum, as the return on even “risk-free” assets failed to sustain the purchasing power of their interest payments. Supported by fiscal stimulus and accommodative monetary policy, investors sought riskier and longer-duration growth stocks, resulting in the frenzied boom in demand which peaked in late 2021.

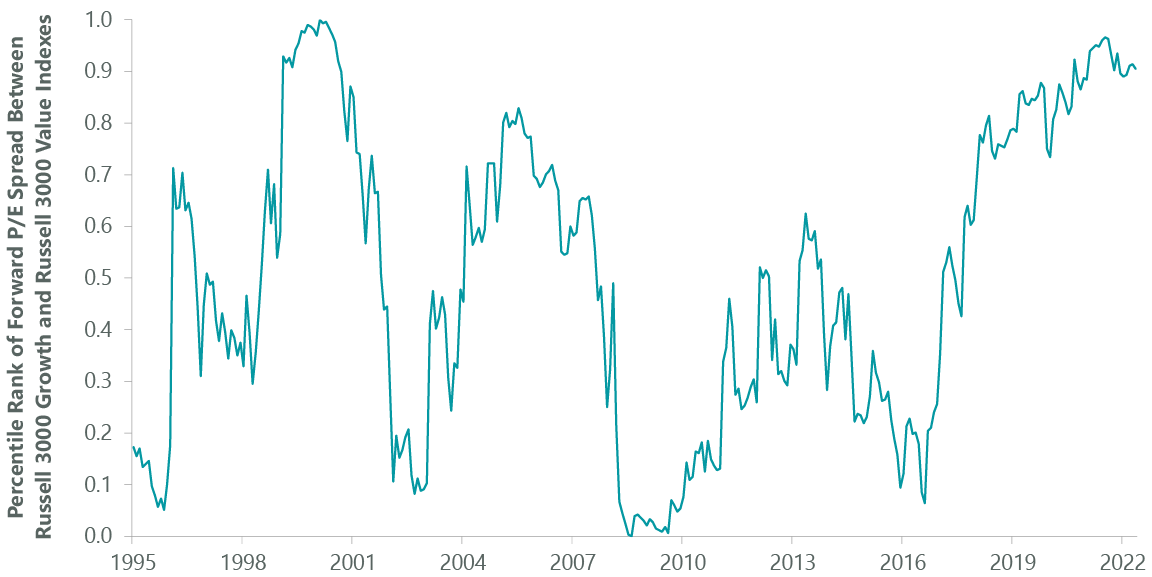

As 2022 has seen rates go higher and monetary policy contract, the feedback loop that helped propel growth to its zenith has begun to unwind. The result has been to set the stage for value stocks to cement their place as the leaders of this new phase of the market cycle. However, even given this recent resurgence, value has counterintuitively gotten cheaper. In fact, relative valuation spreads between growth and value have returned to the same level they were just prior to the bursting of the Internet bubble in 2000 (Exhibit 2).

Exhibit 2: Spreads Similar to Two Decades Ago

As of Sept. 30, 2022. Source: Bloomberg Finance, L.P., ClearBridge Investments.

The collapse of the Internet bubble saw value massively outperform growth through the resulting recession in the early 2000s. While an incoming recession would certainly have its own distinct flavor, it is hard not to see the similarities given their valuation starting points. Add to that value’s generally greater fundamental resiliency compared to growth, and it presents quite a compelling picture in favor of value.

However, investors continue to overlook the many compelling value stocks offering more than adequate compensation for their cyclical risks, to clamor for glamorous growth stocks. The reasons why are unbeknownst to us.

“Investors continue to overlook many compelling value stocks to clamor for glamorous growth stocks. The reasons why are unbeknownst to us.”

Market movements now are increasingly driven by violent swings in sentiment and outlooks. For example, economically sensitive cyclical names, in which every declining data point results in multiple compression with no consideration of its earnings or current valuation. One striking example of this is OneMain Holdings (OMF), a consumer lending company. We believe the company is substantially undervalued, even by value stock standards.

Under a worst-case scenario where credit losses skyrocket to levels seen during the Global Financial Crisis in 2008 (GFC), which we think is highly unlikely, our work shows the stock is trading at just 7x its cash P/E ratio. Given the high returns on investment, strong management team and long track record serving its customer base through economic downturns, this distressed valuation is dramatically too low.

As fundamental, bottom-up investors, we have little expertise in being able to call or gauge the magnitude of recessions. However, if it turns out that the next downturn is more benign than the GFC, we expect it would be to the benefit of OneMain’s investors.

Likewise, natural gas producer EQT (EQT) is currently trading at the lowest forward EV/EBITDA multiple in the company’s history. While the market is worried the company is overearning on the current highs in natural gas prices, this discount is blown out of all proportion with an underappreciated wall of cash flow coming to shareholders in coming quarters.

EQT plans to use strong cash flow to deleverage its balance sheet and accelerate share repurchases over the next two years. The resulting decline in enterprise value through debt and share count reduction would be in excess of 40% cumulatively from current levels.

Mathematically, even if earnings power in out years gets cut in half, the stock would still be trading at an all-time low multiple as a result of the magnitude of cash coming back to shareholders. As such, cyclical concerns are overwrought, particularly given the company’s leadership within U.S. natural gas, long-term prospects from elevated demand in Europe and increasing application as the bridge between dirty fossil fuels and greater renewable power generation.

At the antipode of this extreme pessimism in cyclical value stocks has been the unbridled optimism in innovation growth stocks, fueled by the virtually “free” capital of negative real rates. As rates rise and investor risk appetites fall, many of these companies are now confronted with the harsh reality of having to wean themselves off it. Many capital-light companies rely on stock-based compensation as a significant component of their funding.

As this capital evaporates, it will likely prompt tough choices for these growth companies who now find themselves at odds between further equity dilution to make employees whole or making painful cuts in order to raise the cash to keep salaries competitive. The simple fact is that when stock-based compensation is treated as an economic expense, rather than removed from adjusted earnings (as is common practice in this cohort), these companies are not profitable.

They are not isolated incidents either: nearly 31% of companies in the Russell 3000 Growth Index are expected to lose money this year, and 26% in 2023, even before any further recession adjustments. As such, we are skeptical of those who continue to claim value stocks have inherently more risk entering a recession than their growth counterparts.

Portfolio Positioning

While we continue to have high conviction in our holdings and positioning, the work of seeking out opportunities to improve the risk/return of the portfolio is a never-ending process. We believe the ability to traverse different market caps affords us the flexibility to construct a portfolio of the best value opportunities the market has to offer, and we maintain an extensive list of opportunities with which to refine our positioning as conditions evolve. As a result, during the quarter we added five new positions and exited 10 existing holdings.

We initiated a new position in Meta Platforms (META), in the communication services sector, which operates the Facebook and Instagram social media platforms and is a leading digital advertising provider. We have been carefully watching the company over the last few quarters and believe headwinds from lower monetizing in Facebook and Instagram Reels and pressures from consumer privacy measures are poised to lessen.

We believe the company has begun to fully acclimate to this new environment, will achieve greater effectiveness in Reels monetization and find ways to adapt to new privacy standards which will rebound advertising efficiency. Combined with a greater focus on cost control, we believe these initiatives will help contribute to further margin expansion and leave the company well-positioned moving forward.

We also increased our exposure to the health care sector through the inclusion of Tenet Healthcare (THC), the third-largest for-profit hospital in the U.S. We believe the company is fundamentally undervalued relative to its peers and, as pressures on margins stemming from labor shortages and wage inflation peak, we believe the new management’s team focus on its high-growth ambulatory surgery center business should help it deliver positive free cash flow in 2023.

We are also encouraged by the possibility that by applying these funds to deleverage the company’s balance sheet, Tenet should be able to reduce its elevated cost of capital and compound its current valuation.

Among the positions we exited was Synchrony Financial (SYF), in the financials sector. Synchrony is a private label credit card issuer that works with retailers and affinity groups. While we still believe the company is substantially undervalued, we ultimately decided to consolidate our exposure to the private credit industry in our investment in Capital One (COF). While both companies share similar drivers, Synchrony has greater exposure to late fees, which the Consumer Finance Protection Bureau is actively focused on reducing, increasing the risk of a decline in the company’s earnings.

Outlook

We believe mispricings between growth and value spreads and of cyclical risks present exactly the kind of opportunities that our philosophy and process are designed to capture. While we may have to ride out a recession spurred on by an aggressive Fed, we believe that the strong cash generation, well-capitalized balance sheets and expertise of the companies we own will allow them to leverage this as a chance to create substantial value for investors.

We believe these circumstances point to a changing of the guard in long-term market leadership that will further close the gap in relative valuations and cement value’s leadership for this upcoming economic cycle.

Portfolio Highlights

The ClearBridge All Cap Value Strategy outperformed its Russell 3000 Value Index during the third quarter. On an absolute basis, the Strategy had negative contributions from all 11 sectors in which it was invested during the quarter. The leading detractors were the information technology (IT) and health care sectors, while the consumer discretionary, materials and consumer staples sectors detracted the least.

On a relative basis, overall sector allocation effects benefited performance, but were slightly offset by negative stock selection effects. Specifically, stock selection in the utilities and materials sectors, an overweight to the energy sector and underweight allocation to the communication services sector benefited returns. Conversely, stock selection in the energy, IT and health care sectors weighed on returns.

On an individual stock basis, the biggest contributors to absolute returns in the quarter were EQT (EQT), Murphy USA (MUSA), Constellation Energy (CEG), ON Semiconductor (ON) and Sprouts Farmers Market (SFM). The largest detractors from absolute returns were OneMain, Suncor Energy (SU), DXC Technology (DXC), Meta Platforms and Pfizer (PFE).

In addition to the transactions listed above, we initiated positions in Hess (HES) in the energy sector, Micron Technology (MU) in the IT sector and Haleon (HLN) in the consumer staples sector. We also exited positions in Sprouts Farmers Market in the consumer staples sector, Kinder Morgan (KMI) in the energy sector, Western Digital (WDC) and ON Semiconductor in the IT sector, Goodyear Tire & Rubber (GT) in the consumer discretionary sector, Stanley Black & Decker (SWK) and United Rentals (URI) in the industrials sector and Paramount Global (PARA) and Altice USA (ATUS) in the communication services sector.

|

Past performance is no guarantee of future results. Copyright © 2022 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment