kennethnokman/iStock via Getty Images

REITs have been traditionally a nice asset class to shield investors against inflation waves. However, severe interest rate increases to fight inflation, have traditionally harmed REIT valuations. For more information on the subject, you can read my blog article “REITs and interest rates: A love – hate relationship”. Since my last article about City Office REIT (NYSE:CIO), the company has provided a total return of 40% to its shareholders, outperforming the S&P 500 by far. Today, I am revisiting the investment case for the company and maintain a positive view about the company’s prospects.

Recent developments and company snapshot

The past year was marked by increased dispositions on behalf of City Office REIT. In the beginning of the year, they sold their Cherry Creek property and they closed 2021 with the sale of their San Diego life science portfolio, with total profit of $477 million or $10.80 per share. During the 4th quarter of 2021, the company went on with three acquisitions of a total cost of $614 million. More specifically, they purchased Bloc 83 building in Raleigh for $330 million and a cap rate of 5.2%, based on 3rd year NOI. The property has no significant lease expirations until 2027 and onwards. They also purchased the Terraces building in Dallas for $134 million, with a going in cap rate of 5.2% and the Block 23 building in Phoenix for $150 million, at a cap rate of 5.3% and no significant lease expirations until 2026. The company doesn’t plan to move forward with more acquisitions in this year and expects core FFO to range between $1.56 and $1.60 per share while 2021 closed with a core FFO figure of $1.36 per share. This stands for a nice, 15% expected rise in core FFO per share.

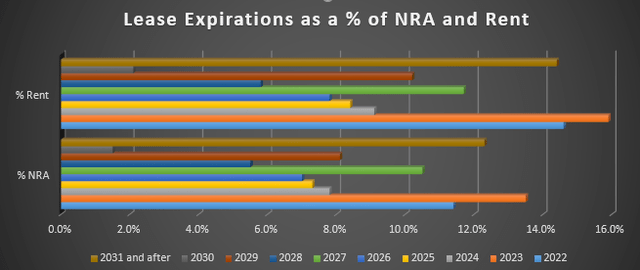

As of now, the company has a generally well laddered lease expiration profile, although there is some gravity towards 2022 and 2023, with regards to lease expirations as a percentage of total rent. And we can also see that in the NRA segment, things are a little smoother, which leads us to the conclusion that in 2022 and 2023, some of the highest rented properties of the company come to lease expiration.

City Office REIT lates 10K, graph created by the author

Indeed, by looking at their latest 10K, it is obvious that especially the leases that mature this year, cost their tenants $29.29 per square foot on average, which is the second largest figure behind leases expiring in 2030. From a property market perspective though, this is a good thing, as markets still have some strength in them. The company should have the bargaining power to negotiate a strong lease rate.

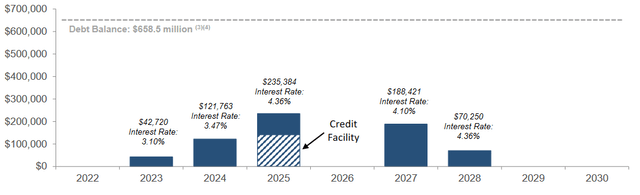

Moving into the debt department, as I wrote in my previous article, City Office REIT was a very well laddered debt maturity profile, with the majority of its debt being in fixed interest rate, thus not being prone to base interest rate increases.

City Office REIT Investor Presentation, February 2022

The company’s cost of debt is 3.4% on a weighted average basis, and its $659 million in total debt account for a 5.9x net debt to adjusted EBITDA figure.

Are shares trading at a fair price?

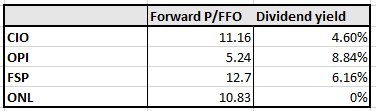

I’m going to try and approach this question by using the price to FFO multiple and comparing it to the respective figures of CIO’s peers. Right now, shares of the company are trading for $17.41 and the lower end of the company’s full year 2022 core FFO guidance is $1.56 per share. That brings us to a P/FFO multiple of 11.16x. In other words, City Office REIT shares are trading at approximately 11 times their forward core FFO per share.

For the purpose of this comparison, I will set up a peer group, comprised of office REITs with similar market cap to that of CIO. My peer group will contain Franklin Street Properties (FSP), Orion Office REIT (ONL) and Office Properties Income Trust (OPI).

So, from a P/FFO multiple perspective, it seems that City Office REIT is reasonably priced, as compared to its peers, with the only exception of OPI, which seems quite conservatively valued.

Reitwatch 2022

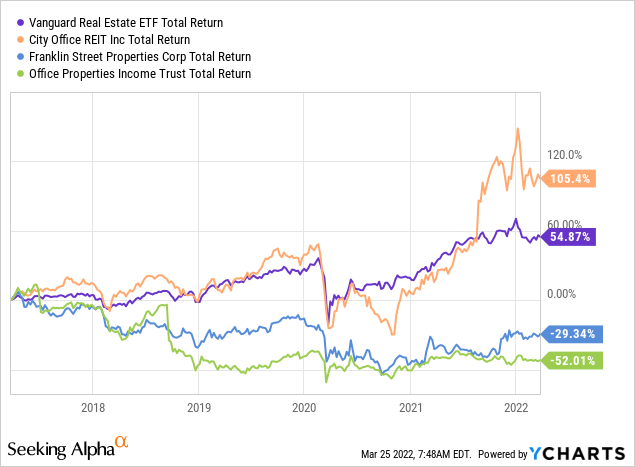

By comparing the members of the peer group against the benchmark of Vanguard Real Estate ETF (VNQ) we can see that City Office REIT has significantly outperformed its peers and the benchmark during the last five years. Please note that Orion Office REIT is not included in the calculation, because that wouldn’t allow to extend the comparison period more than a few months.

So, combining the graph presented above with the P/FFO figures, I come to the conclusion that City Office REIT is very well priced, given the similar pricing of its peers and the severe outperformance observed historically.

Conclusions

There is no doubt that we’re talking about a quality REIT here and a quite competent management team. However, voices advocating for a more aggressive monetary tightening have increased and this is something that will affect REIT profitability. It is also true that in the case of City Office REIT, we’re looking at a company with a well laddered, mostly fixed interest rate debt which has secured nice and strong leases for its newly acquired properties. On top of that, the company is paying a nice 4.6% dividend yield, which stands for almost 50% of its core FFO per share. That is, it has adequate room to grow this year. Overall, despite its nice run since my last article, it still represents a nice long opportunity for investors looking for office property exposure in secondary markets with strong demographics and economic profile. However, we’re living in times of unprecedented uncertainty, so more technical analysis oriented investors should search an entry point close to the 200 – day moving average, which right now stands at $16.61.

Be the first to comment