Justin Sullivan

Citigroup (NYSE:C) is one of the most misunderstood large U.S. banks, especially so, following its latest strategy resulting in the divestiture of the global consumer bank.

Still, many investors likely perceive Citi as a risky Emerging Markets bank even though its global consumer footprint has massively shrunk.

Citi’s valuation is certainly not reflecting the quality of the franchise and especially so when it comes to Citi’s corporate and investment bank (otherwise known as “ICG”).

This article is all about Citi’s moat in ICG.

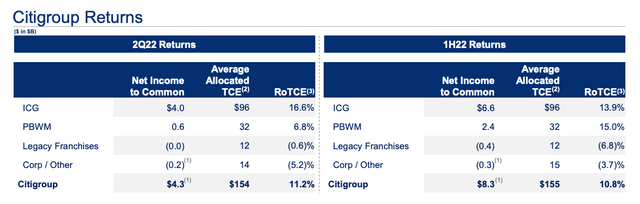

Capital and return on capital

To understand a bank, one has to understand a number of parameters:

- Where it allocates its capital

- The returns it is generating on that capital throughout the cycle

- The risks it takes to generate the returns on capital (or saying it differently, its cost of capital)

Obviously, the above factors are a function of the business and the geographic mix of the business. The 2008/09 global financial crisis (“GFC”) was a watershed moment for banks. Afterward, there was a paradigm shift in the regulatory framework which changed the industry completely. The post-GFC regulatory system made the banking system much safer, banks are now required to hold 3x-5x more capital than previously, the risk-weighting of most assets has increased materially and banks were required to literally build fortress-like liquidity buffers.

The banking system is now exceptionally strong and a systemic banking crisis is a remote possibility. Hence, this is a key reason why I strongly rebuked the recent widespread rumors about the imminent collapse of Credit Suisse (CS) and highlighted that it is not solvency, liquidity, or systemic issue. Nor is it a Lehman moment.

But the post-GFC capital and liquidity rules made some banking businesses more attractive and others less so. For example, wealth management and other capital-light businesses are much more attractive now and valued at a premium. So are business strategies that are focused on lending to superprime clients which result in a much lower capital charge compared to subprime clients. Other areas such as fixed-income trading, though, which was booming prior to the GFC, were much more disadvantaged and several banks struggled to earn their cost of capital and were forced to retreat from this business line.

It is important to understand that capital treatment does not necessarily reflect the economic risks inherent in the business model. So for example, the capital charge on fixed-income trading is very high but highly disproportionate to the actual risks inherent in that business. In other words, the regulatory-driven capital rules are somewhat notional and should not be viewed as true economic capital.

Understanding Citigroup

Consider Citi’s capital allocation as demonstrated in the below slide:

A few observations on the above slide:

- Most of Citi’s capital is allocated to ICG (the corporate and investment bank). In fact, 3x as much as is allocated to Personal Banking & Wealth Management (“PBWM”)

- ICG is delivering mid-teens ROE (note the 1Q was impacted by a one-off reserve build of ~900m due to Russia exposure)

- The legacy franchises (~$12b) should be exited (at a premium to book) by end of 2023.

The conclusion though is very clear, 75% of Citigroup’s business is the ICG. This is what Citi is about. The consumer bank is not as meaningful size-wise.

It is also a business that is delivering quite high returns (and consistently so).

A deep dive into ICG

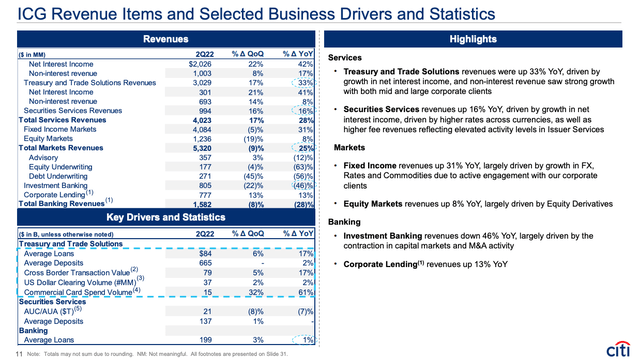

A revenue snapshot for Q2’2022 is shown below:

I will break down below the key businesses of ICG.

Treasury and Trade Solutions (“TTS”) is Citi’s crown jewel and a great platform to cross-sell additional products such as FX, trading, financing, and advisory services. TTS provides integrated cash management, working capital, and trade finance solutions to multinational corporations, financial institutions, and public sector organizations around the globe. It benefits from a closed-loop payment system in close to 100 countries leveraging Citi’s unparalleled geographic presence. TTS is market-leading (#1 global transaction bank by far) and in the current rates environment is estimated to generate ~30% of ROE. It is also a significant source of operational deposits and as such greatly benefits from rising rates. In the last quarter, it generated over $3 billion in quarterly revenues which I expect to grow further in subsequent quarters with the benefits of rate tailwinds.

Citi Securities Services provides direct custody and clearing, investor services, and capital markets origination and is a leader in domestic and cross-border transaction services for intermediaries (banks, broker-dealers, depositories), and investors (institutional and asset managers). It is a very capital-light business and also benefits from rising interest rates. In the last quarter, it generated ~$1 billion in revenue.

Fixed Income Services (“FICC”) encompasses fixed income, currencies and commodities trading. Citi is the global #2 behind JPMorgan (JPM). I estimate that the return on equity on this business is ~10% given the high capital charge under the post-GFC rules. The revenue is quite volatile and highly dependent on market conditions. However, it is important business for Citi given the material quarterly revenue (on average ~$4 billion). Importantly though, this business is a great diversifier and counter-cyclical. During periods of high volatility (such as Covid, recessions, etc), it tends to outperform and compensate for losses or reserves build in the consumer area. As a point in case, during the worst time of Covid, Citi remained profitable due in big part to increased FICC trading income.

Equities trading has traditionally been a much weaker business for Citi. It is currently a global #5 or #6 but it has been catching up. There are a number of reasons for the relative underperformance compared to peers. Firstly, banks with large wealth management divisions tend to outperform in Equities trading given connectivity to products utilized by HNW customers, for example, Morgan Stanley (MS) is exceptionally strong in this business given its strong wealth management business.

Investment banking comprises debt and equity underwriting as well as M&A advisory services. This is a capital-light business but at the moment it is challenged with the industry wallet down approximately 50% given the bear market and rising rates.

Corporate lending is utilized as an anchor offering that subsidizes the cross-selling of higher-returning products. Citi typically hedges the credit risk exposure on a portfolio basis using CDS. Hence, there is some volatility in the revenue line in this line item.

So in summary, ICG is a quality, scale, and moderately low-risk business with substantial and high barriers to entry. The fixed costs and investments in people, systems, technology, controls, legal and compliance, and banking licenses across over 90 jurisdictions are almost impossible to replicate.

Citi is a top #2 global player in the lucrative transaction banking and FICC businesses and a top #5 in most other business lines.

Final thoughts

Citi is too cheap to ignore especially given its leading and quality corporate and investment bank franchise. Citigroup’s market cap is currently only around ~$83 billion. A stand-alone valuation of ICG should be ~$150 billion based on a cost of capital of 10% and ROE of ~15%. And this excludes the $32 billion allocated to PBWM and $12 billion of legacy (less $15 billion allocated to corp/others which also includes disallowed DTA).

Citi, in my view, has an exceptionally strong and sustainable moat in its corporate and investment bank. I remain very bullish and Citi is a conviction buy for me.

Be the first to comment