Mario Tama

For the last few years, Citigroup (NYSE:C) hasn’t traded well, regardless of the financial prospects of the business. The ongoing rate hikes by the Fed and normalization of credit trends should help investors realize the large bank is a profit machine now. My investment thesis remains ultra Bullish on a stock trading far below tangible book value, with more catalysts ahead.

More Rate Hikes

The Federal Reserve is expected to hike rates again at the next meeting on December 14. The rate hike might be reduced to 50 basis points, but even the most bearish expectations has the Fed hiking rates at least 75 basis points, with the general forecast for a terminal rate of 5% versus the current 4% level.

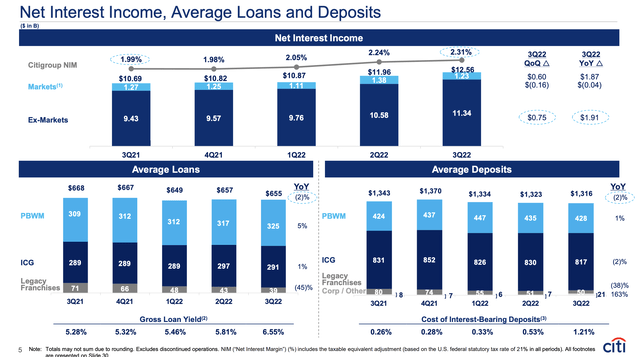

Citigroup isn’t generally seen as the best beneficiary of rate hikes, yet the large bank has already boosted net interest income by $1.9 billion in the last year. The NIM has bumped up to 2.31% from 1.99%. Other large banks have seen far higher hikes.

Source: Citigroup Q3’22 presentation

The company even saw average loans decrease YoY to just $655 billion, though the gross yield has soared from 5.28% to 6.55% now. The additional rate hikes should provide tailwinds to the business with higher NII, though Citigroup hasn’t generated a huge benefit to match the 375 basis points of rate hikes this year so far.

As investors can see, Citigroup got a huge income boost from the higher rates regardless. Nearly $2 billion in higher NII isn’t something to sneeze at, but other banks such as Bank of America (BAC) boosted Q3’22 NIM by 38 basis points to boost NII by $2.7 billion. The lower NIM starting point made the NII boost by BoA even larger.

Buybacks To The Rescue

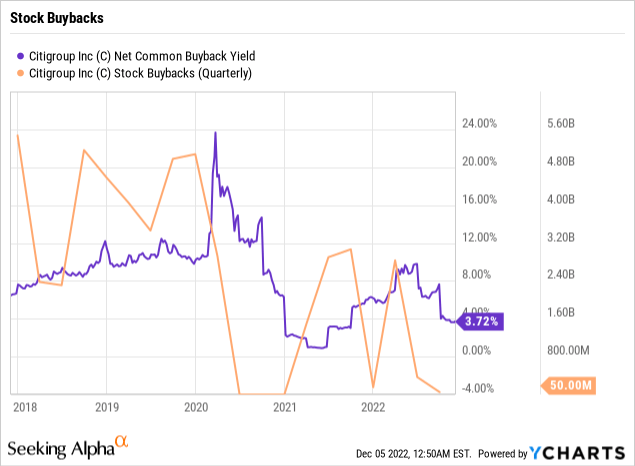

Despite Citigroup reporting a quarter where the large bank earned $3.5 billion in profits and is on pace for an impressive $7+ EPS this year, the bank has basically been prevented from aggressive share buybacks. The large bank has only repurchased $3.5 billion worth of shares this year, despite plenty of capital to survive the next recession.

Citigroup has been prevented from aggressive stock buybacks off and on since the start of the Covid. The latest issue preventing stock buybacks is very restrictive regulatory requirements for the large financial to maintain 12.0% of CET1 capital.

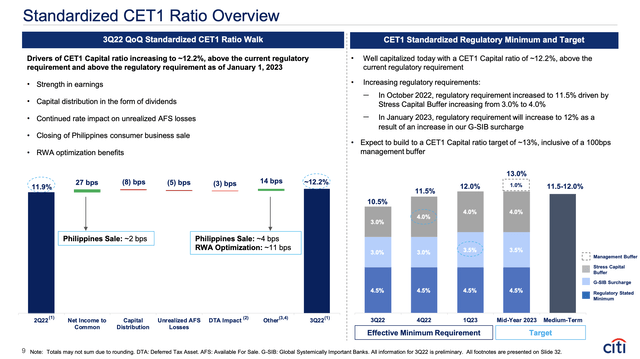

Source: Citigroup Q3’22 presentation

The bank has a CET1 ratio of 12.2% ending Q3’22, but the bank has a goal of exceeding the regulatory target by 100 basis points for a management buffer. Citigroup has far too much capital now having hiked the capital ratio far above the required ratio of 10.5% during Q3’22, yet regulators have now instituted an increase in the Stress Capital Buffer by 100 basis points and the G-SIB surcharge by 50 basis points.

Remember, banks only have a minimum capital requirement of 4.5%. Regulators have added the additional charges, causing capital ratios to soar in the process.

As usual, regulators are still busy fighting the last crisis, despite banks surging through the Covid recession and current economic slowdown with flying colors. As the CFO mentioned on the Q3’22 earnings call, stock buybacks are on hold for now:

Turning to Capital, we returned $1 billion to our shareholders through common dividends during the quarter, while buybacks continue to be on hold. We will keep evaluating that decision on a quarterly basis, as due to increasing regulatory requirements we build our CET1 ratio to 13% or so by mid next year and that includes a management buffer of 100 basis points. We ended the quarter at a CET1 ratio of 12.2%, as we actively managed our RWA usage throughout our lines of business.

Between the extra management buffer and the higher stress buffer, Citigroup has $29 billion in excess capital just from these capital restrictions, with CET1 capital at $145 billion at the end of Q3. The company still offers a 4.3% dividend yield with a nearly $4 billion annual payout, so investors are still obtaining strong capital returns from the bank due to the stock trading below $50.

One analyst even brought up the question on the earnings call of why Citigroup wants a 100 basis point buffer. The whole point of the SCB capital add-on was to take the Fed objection to capital plans on quantitative grounds, with the new buffer limiting capital returns. As such, JPMorgan Chase (JPM) discussed a 50 basis point buffer over the regulatory requirements.

Citigroup has a market cap of only $88 billion with the stock at $45 making stock buybacks painfully absent here. The large bank could easily repurchase 20% to 30% of the outstanding shares without these unnecessary buffers, but these buybacks will return sometime mid-2023, if not before.

Takeaway

The key investor takeaway is that Citigroup is absurdly cheap, trading $35 below tangible book value. The large bank is painfully held back from making extremely cheap share buybacks here, but the share repurchases will return next year with the bank loaded up with far too much capital.

Naturally, the bank sector faces a difficult environment with a recession, but Citigroup is currently priced for the next Great Recession, not a normal recession. Investors should continue using weakness to build a position in the bank stock at below 7x EPS targets.

Be the first to comment