Mario Tama

Citigroup (NYSE:C) stock prices decreased by 25% since the beginning of the year as the company’s quarterly results in 2022 were not as strong as C’s quarterly results in 2021. However, I expect the company’s net income to increase in 4Q 2022, driven by higher Personal Banking and Wealth Management (PBWM) revenues, higher Legacy Franchises revenues, and lower cost of credit. Federal Reserve will continue increasing interest rates as inflation is still high. Thus the company will continue benefiting from the higher interest rates. Also, the equity market improved in the past few weeks, meaning that C’s revenues from its clients’ activities in the equity market will improve. I am bullish on Citigroup.

Quarterly results

In its 3Q 2022 financial results, C reported a net income of $3479 million, compared with a 2Q 2022 net income of $4547 million (down 23% QoQ) and 3Q 2021 net income of $4644 million (down 25% YoY). The bank’s total revenue (net of interest expense) increased from $17447 million in 3Q 2021 to $19638 million in 2Q 2022 and then, decreased to $18508 in 3Q 2022. C’s total operating expense increased from $11777 million in 3Q 2021 to $12393 million in 2Q 2022 and increased further to $12749 million in 3Q 2022. The company reported a 3Q 2022 total cost of credit of $1365 million, compared with $1274 million in 2Q 2022 and $(192) million in 3Q 2022, as its Net ACL release of $1162 million in 3Q 2021 turned into a net ACL build of $1274 million in 2Q 2022 and $1365 million in 3Q 2022. “Revenues increased 6% from the prior-year period, primarily due to the gain on sale of the Philippines consumer business versus a loss on sale of the Australia consumer business in the prior-year period,” the company explained.

C’s common equity TIER 1 (CET1) capital ratio increased from 11.7% in 3Q 2021 to 11.9% in 2Q 2022 and 12.2% in 3Q 2022. C’s return on average common equity (ROCE) increased from 9.5% in 3Q 2021 to 9.7% in 2Q 2022; however, it decreased to 7.1% in 3Q 2022. Also, the company’s return on average tangible common equity (ROTCE) increased from 11.0% in 3Q 2021 to 11.2% in 2Q 2022 and then, decreased to 8.2% in 3Q 2022.

“Banking was the business most adversely impacted by the macro environment with reduced deal flows and a lower appetite for M&A. While the backdrop for wealth management was difficult, our revenues were up outside of Asia. U.S. Personal Banking further solidified its growth trajectory with double digit revenue growth in both of our cards businesses,” the CEO commented. “Given the strength of our balance sheet, capital levels and liquidity, we are well positioned to help our clients navigate very challenging markets and slower growth,” she continued.

The market outlook

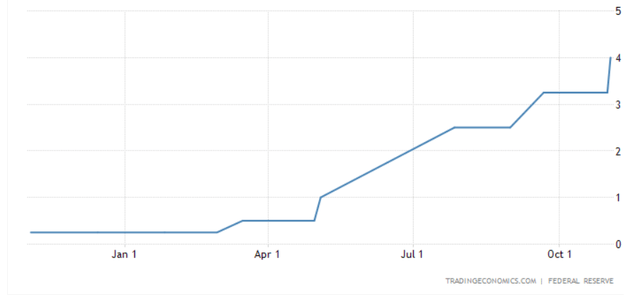

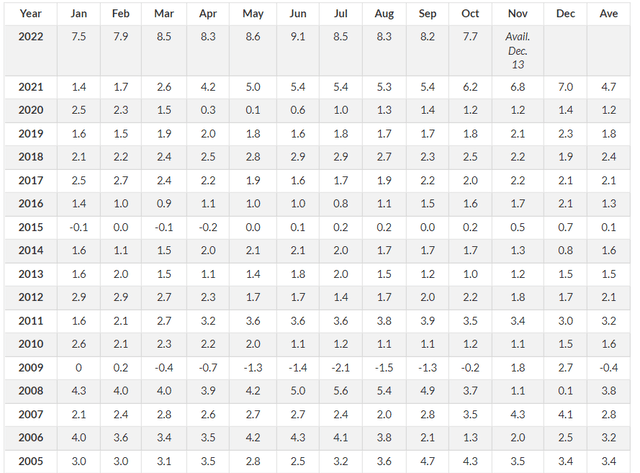

According to Figure 1, in November 2022, Federal Reserve increased the funds rate by 75 bps to 3.75% to 4% to combat inflation. Figure 2 shows that in the United States, the monthly inflation rates in July, August, and September 2022 were 8.5%, 8.3%, and 8.2%, respectively. In October 2022, the U.S. monthly inflation rate decreased to 7.7%. As a result of the Federal Reserve’s continuing tight monetary policy, the U.S. inflation rate in October 2022 was lower than in the last 8 months. However, inflation rates are still historically high. Thus, I expect Federal Reserve’s tight monetary policy to continue in the following months. According to the Fed chairman, interest rate increases are likely in the last month of the year. “Despite some promising developments, we have a long way to go in restoring price stability,” Powell said. Citigroup’s services revenues are positively affected by higher interest rates. Thus, I expect C’s Services segment revenues to increase in 4Q 2022. Furthermore, C’s PBWM revenues are positively affected by higher interest rates, too. Thus, in the fourth quarter of 2022, the company’s PBWM revenues may increase.

Also, C’s equity market revenues decreased 19% QoQ as its clients’ activities in the equity market decreased in the third quarter of 2022. From I July 2022 to 30 September 2022, S&P 500 index decreased by 6%. However, since the beginning of the fourth quarter of 2022, S&P 5000 index increased by 14%. Also, Dow Jones Industrial Average index increased 20% since 30 September 2022. Thus, I expect the company’s Markets segment revenues in 4Q 2022 to be higher than in 3Q 2022.

Finally, due to heightened macroeconomic uncertainty and volatility, C’s revenues decreased as a result of lower investment banking and corporate lending revenues. Inflation rates are still high and Fed’s tight monetary policy is still going on. According to U.S. recent job report, U.S. employers added 263000 jobs in November, which is lower than July, August, and September 2022. Thus, I don’t expect C’s investment banking and corporate lending revenues in the fourth quarter of 2022 to be higher than in the previous quarter. Due to lower investment levels as a result of the continuing macroeconomic uncertainty, C’s investment fee revenues cannot be recovered in the fourth quarter of 2022.

Altogether, I expect C’s total revenues in the fourth quarter of 2022 to be higher than in 3Q 2022. Also, due to increasing loan growth in the PBWM segment and net ACL build for loans and unfunded commitments driven by macroeconomic uncertainty, I expect the company’s cost of credit to be significant. However, the market condition in the fourth quarter of 2022 has improved compared with 3Q 2022. Thus, the company’s cost of credit in 4Q 2022 will be lower than in 3Q 2022. In means that in 4Q 2022, the company’s net income will not get hurt by the allowance for credit losses on loans as much as it got hurt in the previous quarter.

Figure 1 – United States Fed funds rate (%)

Figure 2 – U.S. monthly inflation rates

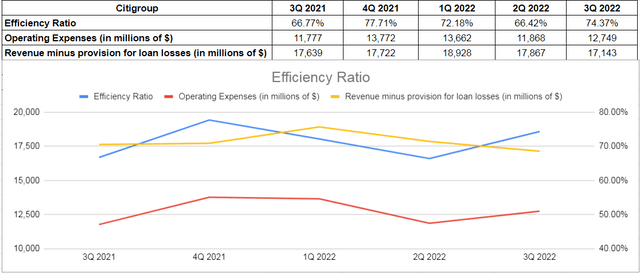

C’s efficiency ratio

To analyze the management’s ability to keep expenses and revenues in check, I consider C’s efficiency ratio in 3Q 2022 and compare it with the previous quarters. C’s quarterly efficiency ratio increased from 66.77% in 3Q 2021 to 77.71% in 4Q 2021. C’s efficiency ratio decreased to 72.18% in the first quarter of 2021, driven by lower operating expenses and higher revenue (see Figure 3). However, the company’s efficiency ratio increased to 74.37% in the third quarter of 2022, which is higher than in the same quarter last year and the previous quarter. The efficiency ratio of Citigroup increased in 3Q 2022 as its operating expense increased by 7% QoQ and its revenue (minus provision for loan losses) decreased by 4% QoQ. Citigroup reported 2Q 2022 and 3Q 2022 provisions for loan losses of $1769 million and $1365 million, respectively. With a lower cost of credit, Citigroup’s efficiency ratio will improve to its past standards. However, according to the macroeconomic outlook, I don’t expect the company’s provision for loan losses to decrease significantly in the following quarters. It is worth mentioning that the company’s efficiency ratio of 74% is not something to worry about.

Figure 3 – C’s efficiency ratio

Credit risk management

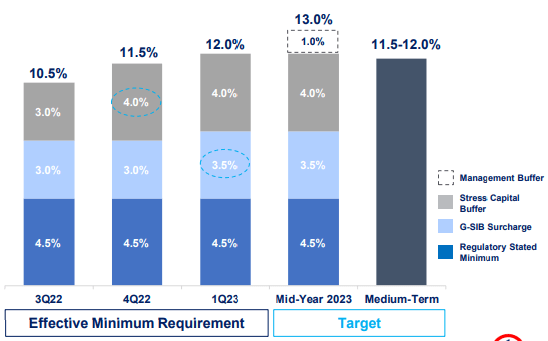

C’s common equity Tier 1 ratio increased from 11.7% in 3Q 2021 to 11.9% in 3Q 2022 and increased further to 12.2% in 3Q 2022. Figure 4 shows that Citigroup’s CET1 capital ratio is above the current regulatory requirements. In October 2022, due to Stress Capital Buffer increasing from 3.0% to 4.0%, the CET1 regulatory requirements increased to 11.5% (compared with 10.5% in 3Q 2022). Also, in January 2023, due to an increase in C’s global systemically important banks (G-SIB) surcharge, the company’s CET1 ratio regulatory requirement will increase to 12.0%. C expects its CER1 ratio in 2023 to be around 13.0%. As the company’s total assets are increasing, its risk-weighted assets (RWAs) in 4Q 2022 and 1Q 2023 will be higher than in 3Q 2022. Thus, the company will have to increase its common equity tier 1 capital in the following months. As I expect C’s net income in 4Q 2022 to be higher than in 3Q 2022, increasing its CET1 capital will not be challenging.

Figure 4 – C’s CET1 standardized regulatory minimum and target

3Q 2022 presentation

Summary

Despite the challenging market condition in the past months, Citigroup reported an EPS of $1.63 for the third quarter of 2022. The inflation rate is still high and Fed’s tight monetary policy will continue, meaning that C’s net interest income will remain high. Also, the company’s revenue from its client activities will be better than in the third quarter. The stock is a buy.

Be the first to comment