Sundry Photography

This story was written for the subscribers of Reading The Markets and has been updated as of July 21, 2022, where italicized.

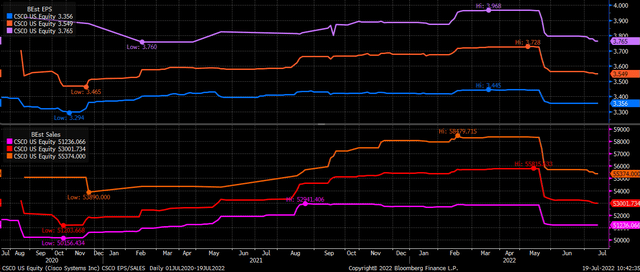

Cisco (NASDAQ:CSCO) shares have struggled in 2022, along with the broader markets. Cisco’s weakness is tied to the company’s poor underlying fundamentals, resulting in analysts lowering their earnings and sales outlook.

Estimates for 2022, 2023, and 2024 are all well off their highs and may have only started to bottom. Whether estimates fall further will have to wait until the company reports fiscal fourth quarter results in the middle of August.

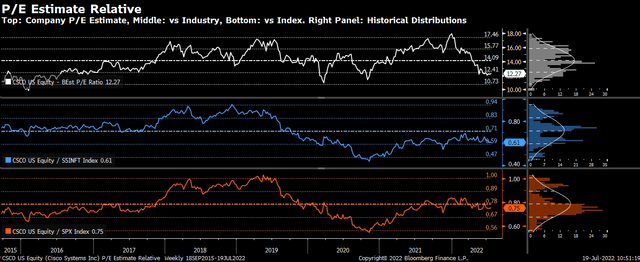

The weak business outlook has led the stock and PE ratio lower. Based on several conditions, the stock appears to be cheap. The stock trades more than one standard deviation below its five-year historical PE ratio. The current one-year forward PE ratio of 12.27 is below that average of 15.31. On a relative basis, the stock trades at a discount versus the S&P 500 IT sector and the S&P 500.

Fourth Quarter Results

Of course, the only thing that will matter is what the company has to say when they report results. Fiscal fourth quarter results are expected to be very weak, with earnings declining by 3% to 0.82 per share, on a 3% revenue decline to $12.73 billion. Gross margins are forecast to decrease by 1% vs. a year ago to 64.7% from 65.6%.

Betting Shares Rise

With expectations for a weak quarter baked into a stock price, someone is betting that Cisco will turn things around. On July 19, the open interest for the August 19 $40 puts and calls rose by roughly 11,500 contracts each. The data shows this was a spread transaction with the trader paying $3.89 per contract for the calls and receiving 0.71 per contract for the puts. The trader spent $3.18 per contract for the bullish bet. It would suggest that Cisco is trading above $43.18 by the middle of August.

Additionally, on July 18, the open interest for the same pair of options increased by 10,500 contracts. The data showed the August 19 $40 calls were bought for $3.81, while the $40 put contracts also were purchased for $0.84, creating a straddle. In this case, the trader is betting the stock will trade above $44.65 or below $35.35 by expiration.

Bullish Trend Emerge

The chart shows that the stock has broken out, clearing a trend line and rising above $44. It has the potential to run much higher, maybe as high as $48.5.

Following the company’s third-quarter results, shares of Cisco fell sharply, creating a gap from $48.5 to down to $43.90. Typically, when stocks fall sharply and gaps form, over time, those gaps tend to get filled. Now that the shares have moved above resistance around $44, there would be no resistance to prevent the stock from filling the gap back to $48.5.

Additionally, momentum may be swinging back to the bullish side of things. The relative strength index is now trending higher. It also rose above a significant resistance zone at 52. Now that the RSI climbed above the 52 level, it would indicate that momentum has shifted from bearish to bullish, suggesting bullish momentum in the strong.

While Cisco is not the most exciting name, the options and technicals suggest there may be further room to rally in the coming weeks. Earnings are still about a month away, but with low expectations, this could be one equity that provides a positive report since estimates have already been cut drastically.

Join Reading The Markets Risk-Free With A Two-Week Trial!

Investing today is more complex than ever. With stocks rising and falling on very little news while doing the opposite of what seems logical. Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

Be the first to comment