Galeanu Mihai/iStock via Getty Images

Co-produced by Austin Rogers

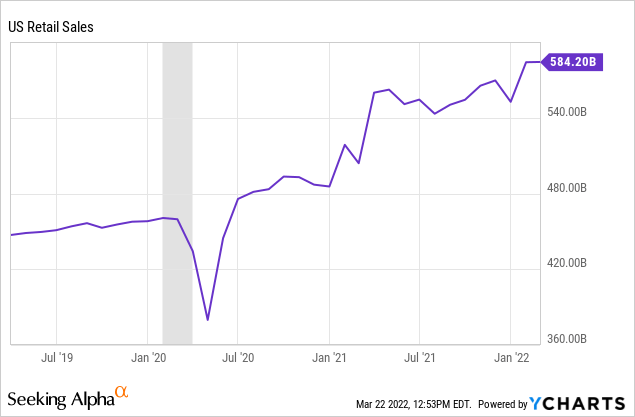

If one looks at retail sales, the COVID-19 recession was an extremely short one, dipping only a few months before surging far higher.

US retail sales surpass pre-pandemic levels (YCharts)

Total retail and food service spending reached $7.4 trillion in 2021, rising 19.3% over 2020’s number, as shoppers return to physical stores and diners returned to eating in restaurants. The National Retail Foundation expects retail sales to rise 6-8% this year, well above the 10-year pre-pandemic average of 3.7% annually.

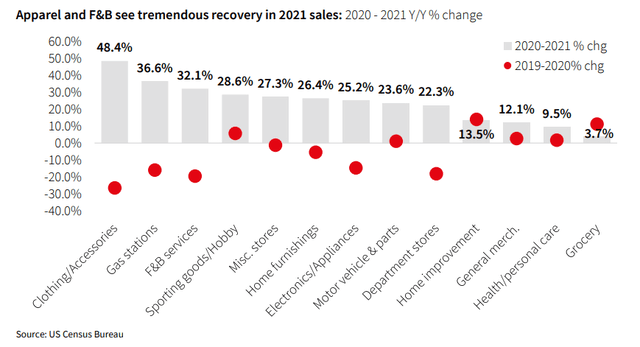

And this has been a broad-based recovery in retail spending. It isn’t all going to Amazon (AMZN) and Walmart (WMT). The biggest gains unsurprisingly came from the hardest-hit industries during the pandemic: apparel, gas stations, and food & beverage services.

Retail sales recover rapidly (US Census Bureau)

Meanwhile, though grocery, general merchandise, and home improvement saw smaller gains in sales in 2021, these industries also enjoyed continued growth in 2020, so they don’t have ground to make up.

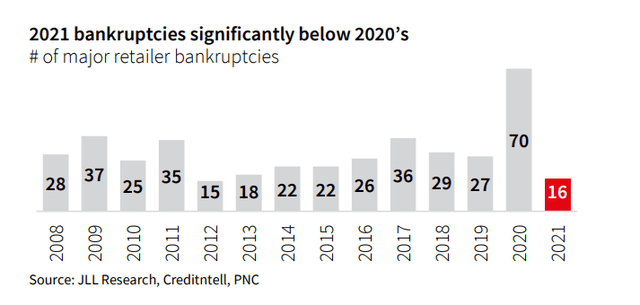

What’s more, in 2021, the number of retailer bankruptcies slumped to its lowest level in five years – a five-year period, mind you, that was marked by widespread store closures and major retailer bankruptcies.

2021 retail bankruptcies are significantly below 2020’s level (JLL Research)

Speaking of store closures, in a sign of brick-and-mortar resilience, U.S. retailers announced more than twice as many store openings as store closings in 2021. This marked the first year since the “retail apocalypse” narrative began to grip Wall Street in the late 2010s that retail openings outnumbered closings. And it wasn’t even close.

According to the National Retail Federation, U.S. retailers announced the opening of 8,100 stores last year while announcing only 3,950 store closures. That number of store closures is down ~63% from the 10,700 store closures announced in 2020, a year that will probably mark the zenith of the physical retail bloodshed.

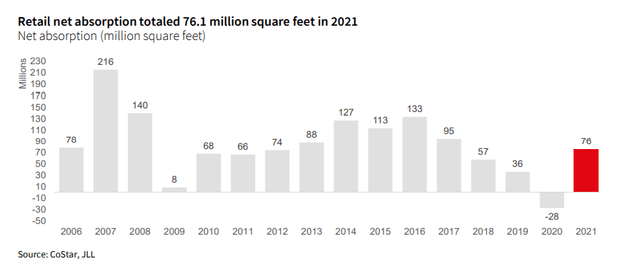

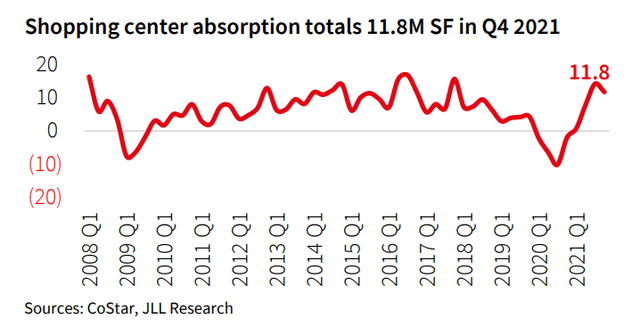

As a corollary to store openings, leasing activity also made a strong resurgence in 2021, with net absorption at its highest level since 2017.

Retail net absorption is historically high (CoStar)

This doesn’t return retail to its “glory days” of the late 2000s or even the steady growth of the mid-2010s, but it’s a much-needed sign of strength.

Of course, looking at an average for the entire retail sector is a bit deceiving, because some types of real estate enjoyed much stronger absorption than others. While low-end malls struggled, for instance, open-air shopping centers enjoyed some of their highest net absorption at any time in the last decade:

Shopping center absorption is hugely positive (CoStar)

Most of the total retail net absorption came from open-air centers, with fitness tenants like Planet Fitness and home furnishing tenants like Floor & Decor and HomeGoods aggressively gobbling up space. For the full year of 2021, shopping center rent growth averaged 6.8%.

The Evolving Retail Landscape

Now, none of the above indicates that retail is going back to the way it was before the rise of e-commerce. Amazon and its digitally native ilk have indelibly changed the retail landscape. The types of brick-and-mortar retailers that are thriving and expanding in this new environment are not the same as the ones they are replacing.

Store openings in 2021 were heavily concentrated in the dollar store, discount/off-price, and warehouse club spaces, which together accounted for almost half of all retail store openings last year. Dollar General (DG), for instance, opened over 1,000 stores in 2021 alone, and it plans to open over 1,100 in 2022.

Five Below, T.J. Maxx (TJX), Burlington (BURL), Ross (ROST), Citi Trends (CTRN), AutoZone (AZO), Costco (COST), Sam’s Club, and BJ’s Wholesale Club (BJ) also round out the top store opening announcements from 2021.

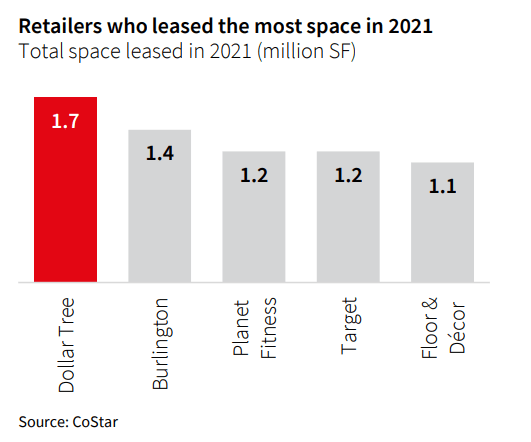

By space leased in 2021, DG’s competitor Dollar Tree (DLTR) actually took the top spot at 1.7 million square feet, followed by some of the other names mentioned above.

Retailers who leased the most space in 2021 (CoStar)

In order to compete with e-commerce, brick-and-mortar retail is skewing toward low price point goods, service-based and experiential businesses, and integrated omnichannel platforms.

Nor are retailers choosing the same kinds of locations as they used to. The pre-COVID trend of diverging fortunes between high-end and low-end malls seems to be continuing, with retailers eschewing low-end malls for open-air and freestanding formats. But high-end, Class A “destination” malls continue to attract foot traffic and thrive.

Consider the vacancy rates of various types of retail (according to JLL):

- Class A malls: 5.6%

- Class C malls: 12.6%

- Freestanding: 2.7%

- Power centers: 5.3%

- Neighborhood centers: 7.1%

Class A malls like those owned by Simon Property Group (SPG) ought to be treated more like power centers (only enclosed rather than open-air), because that is much closer to how they perform than Class B or C malls.

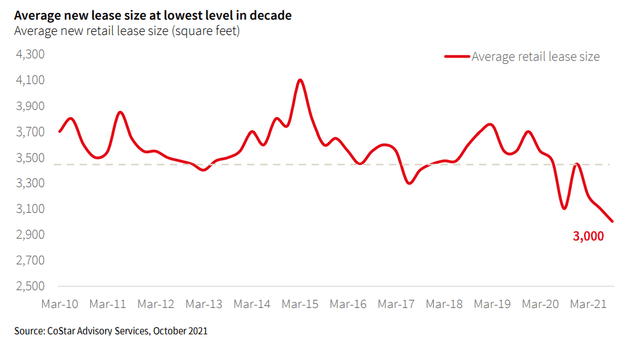

Moreover, retailers seem to be opting for smaller format stores.

Average new lease size at lowest level in decade (CoStar)

Gone is the heyday of the giant department store you could get lost in. Even those legacy department store names like Macy’s (M) and J.C. Penney are increasingly moving to smaller stores in open-air centers.

One of the huge benefits of multi-tenant shopping centers over and against the freestanding net lease property type concerns performance through inflationary periods such as the one we are in right now.

Unlike net lease properties with long lease terms (10+ years) and contractually fixed rent escalations typically around 1-2%, multi-tenant retail centers tend to have much shorter lease terms lasting 3-7 years. This allows rents to adjust to the market rate more frequently, thereby keeping pace with inflation more easily.

Currently, we still have Buy ratings on three different shopping center REITs, and in today’s article, we review their third-quarter results and end the article with a discussion of what’s our Top Pick for 2022:

Currently, we own 6 retail US REITs that primarily own Class A malls, grocery-store anchored shopping centers, and mixed-use open-air retail centers.

As we will see below, these REITs did a great job overall at raising rents last year in order to keep up with inflation. Let’s dive into their 2021 performance and finish with a discussion of which REITs make the best buy today.

Federal Realty Investment Trust (FRT): We are reporting no change to our Buy rating. All hail the REIT King of Dividend Growth! Even strict pandemic-era lockdowns weren’t enough to break this blue-chip REIT’s now-53-year dividend growth streak. FRT’s mostly coastal, best-of-breed, high-end shopping center and mixed-use center portfolio suffered mightily in 2020 but rebounded in 2021 beyond management’s “most optimistic expectations.” The portfolio ended the year 91.1% occupied and 93.6% leased, about 250 basis points above their levels at the end of 2020. Notably, the residential units at FRT’s mixed-use properties ended 2021 97.2% leased, well above the 94.8% leased rate at the end of 2020. For the retail space, FRT signed leases for 2.2 million square feet of space in 2021. On a comparable basis, it signed 2.1 million square feet worth of leases at a leasing spread of 7% on a cash basis and 16% on a straight-line basis, indicating significant built-in rent escalations. After a rebound year in 2021 in which FRT’s FFO per share surged over 27%, management has guided for 2022 FFO per growth of 5% at the midpoint. With a 2022 payout ratio of only 73%, FRT has plenty of room to continue raising its 3.6%-yielding dividend in the years to come.

FRT shopping center (Federal Investment Realty Trust)

Regency Centers (REG): We are reporting no change to our Hold rating. The primarily grocery-anchored portfolio (80% of ABR) sheltered REG from the worst retail bloodshed during the pandemic, but the REIT still suffered around a 10% pullback in revenue from its non-essential tenants. Most of those missed rent payments were deferred rather than lost or abated, and most of that deferred rent was collected in 2021. That explains the massive, 136% leap in reported FFO per share in 2021. It also partially explains why management has guided for lower 2022 FFO per share of $3.76 at the midpoint. This is almost entirely due to roll off of deferred rent payments. Core operating earnings, a better measurement of true earnings, rose 23.9% in 2021. For 2022, it’s expected to drift lower by a little over 2% to $3.60 at the midpoint of guidance. It’s hard for any REIT, let alone a mostly slow-and-steady grower like REG, to continue growing after such a strong year as 2021. Last year, REG’s same-property NOI rose 16.2% on the back of blended (new and renewal) rent growth of 5.5%. In the fourth quarter, blended rent growth reached 12.9%. The double-edged sword of investing in Class A grocery-anchored shopping centers is cap rate compression, which increases the value of REG’s properties but narrows the investment spread over the REIT’s cost of capital. In 2022, REG expects to acquire $30 million of properties at an average cap rate of 5% while disposing of $150 million of properties in a cap rate range of 2.25% to 2.5%. You read that correctly. But with a payout ratio of slightly under 70%, REG’s 3.6% dividend yield looks very safe.

REG shopping center (Regency Centers)

Brixmor Property Group (BRX): We are reporting no change to our Buy rating. BRX is the more value-oriented and Sunbelt-concentrated version of REG, with a similar allocation to grocery-anchored centers in its portfolio. Unlike REG, BRX suspended its dividend during the pandemic only to reinstate it at the beginning of 2021 at a ~25% lower level. At this point, after a small bump, BRX’s dividend sits 17.5% below its pre-COVID level, but with a payout ratio of ~55% based on FFO, the REIT has plenty of room for future raises. That is especially true considering the REIT’s organic growth rates. BRX performed a lot of leasing in 2021, with a leased to billed occupancy spread of 330 basis points in Q4 (meaning lots of new leases recently signed). For the full year of 2021, blended rent growth was 11.4%, and same-space rents for new leases surged 27.6%. Momentum picked up throughout the year, with Q4 blended rent growth coming in at 14.5% and 1 million square feet of new leases signed at 41.7% higher rates than the same spaces’ previous rents. Unsurprisingly, same-property NOI spiked 8.9% in 2021 and 9.7% in Q4 specifically. And the momentum isn’t slowing down. After 19% FFO per share growth in 2021, management expects another 8.6% at the midpoint of guidance in 2022. This is largely due to BRX’s redevelopment projects, which rendered 11% stabilized NOI yields last year. Between a ~4% dividend yield, mid-single-digit FFO growth, and at least 10% upside to fair value, BRX still offers close to 20% total returns at its current price.

BRX shopping center (Brixmor Property Group)

Whitestone REIT (WSR): We are reporting no change to our Strong Buy rating. WSR can be thought of as a “baby BRX,” with a very similar grocery-heavy, Sunbelt-focused portfolio. This REIT has been one of our best picks in recent times. Though the REIT used to be poorly managed by an overpaid and self-interested CEO, the underlying assets held by the REIT were high-quality and well-located in fast-growing markets. Also keeping buyers away from the stock was the REIT’s highly leveraged balance sheet. But one of those problems has already been remedied, and the other is on the way to being remedied. Recently, the board fired the previous CEO with cause, and the refreshed management team has expressed its commitment to act strictly in shareholders’ best interest. That includes through further deleveraging. WSR generated same-property NOI of 5.7% for 2021 and 12.8% in Q4. Interestingly, WSR’s renewal rent rates rose more than for its newly signed leases in Q4: about 11% for new leases and 15% for renewals. Also, leasing activity has been strong, as occupancy rose over 300 basis points from Q4 2020’s 88.2% to Q4 2021’s 91.3%. On the back of these strong fundamentals, management hiked the dividend by 11.6% early this year. Even after that dividend hike, WSR is still paying out less than half of core FFO, leaving lots of room for further raises. We believe WSR has another ~15% upside to fair value on top of mid-single-digit growth and a 3.6%-yielding dividend for potential total returns of around 20%.

WSR shopping center (Whitestone REIT)

Simon Property Group (SPG): We are reporting no change to our Buy rating. In 2021, high-end mall REIT SPG was one of the primary beneficiaries of the economic reopening and fading of COVID-19 concerns. FFO per share of $11.94 in 2021 amounted to a 31% rebound from 2020’s depressed number of $9.11, while Q4’s FFO per share alone increased 42.4%. Total portfolio NOI increased 22.3% year-over-year. Investors were disappointed by management’s 2022 FFO per share guidance of $11.60 at the midpoint, which has caused the stock price to drift lower recently. But keep in mind that 2021’s FFO per share included a $0.50 one-time net gain, which makes normalized FFO per share $11.44 in 2021. This means that normalized FFO per share is expected to edge up by about 1.5% in 2022, an understandable year of consolidation after a very strong year in 2021. With properties all over the globe, SPG is a complex giant. But shareholders can rest assured that the management team, led by SPG scion David Simon, is one of the best in the business.

SPG mall (Simon Property Group)

Macerich Co. (MAC): We are reporting no change to our Strong Buy rating. After some brief time in the sun as a meme stock in early 2021 (then again in November 2021), MAC’s stock price stayed mostly rangebound last year. Unlike other retail REITs, the high-end mall landlord actually turned in a lower FFO per share in 2021 than in 2020 – about 6% lower, in fact. That is not because the fundamentals of the business suffered. Indeed, total FFO rose ~25% in 2021. But in order to deleverage, management made the decision to issue large quantities of shares when the stock price reached into the high teens during meme stock rallies. Weighted average shares outstanding leaped 32.5% year-over-year in 2021 and by an even more astounding 39% in Q4 2021. In exchange for this hefty equity issuance, MAC paid off $1.7 billion in debt, representing 20% of its debt load at the end of 2020. Even so, the REIT’s nearly $7 billion of total debt remained around 80% of enterprise value at the end of 2021. To add to the struggles, MAC’s 2022 FFO per share guidance of $1.95 at the midpoint implies another 4% drop in FFO per share from 2021’s $2.03. On the bright side, MAC’s operational fundamentals are strong and improving. In Q4 2021, same-property NOI soared 36% while finishing the year at 7.3%. Occupancy increased 120 basis points sequentially to finish the year at 91.5% and renewal rent rates are being signed 5% higher than their previous levels. Priced at a steep discount to NAV, we continue to think that MAC will handsomely reward investors who are patient.

What To Buy Today

As we survey the retail REIT landscape, we see both challenges and opportunities. Performance varied widely among our six holdings last year:

|

2021 FFO/Share Growth |

2021 Dividend Growth |

|

|

FRT |

27.2% |

~1% |

|

REG |

23.9% |

5% |

|

BRX |

19.0% |

Dividend Resumed |

|

WSR |

6.5% |

Flat; 11.6% Raise In January |

|

SPG |

31.1% |

26.9% |

|

MAC |

(6%) |

Flat |

The mall space faces some challenges going into 2022. We do still believe in high-end malls, but organic growth will likely be more muted going forward than it has been in the past.

SPG’s massive size will make needle-moving growth difficult, but it does have plenty of redevelopment opportunities. And MAC’s financial management in 2021, though necessary to deleverage, has weakened its ability to grow the bottom line. It would be nice to see MAC be acquired by SPG, but it will need to continue deleveraging to make itself a more attractive prospect. And with the messy acquisition of Taubman Centers still fresh for SPG, it likely isn’t looking to engage in further M&A anytime soon.

Meanwhile, on the open-air side, blue-chips FRT and REG are plugging along nicely. FRT’s diversification into residential and office space at its mixed-use centers has proven a boon. But REG will need to resort to capital recycling in order to generate growth going forward, considering how low cap rates have gotten in its space.

Our favorite names in retail right now are the two Sunbelt REITs: BRX and WSR. We believe both are going to have a great year in 2022, and both have ample upside. Both offer probable total returns of 15-20%.

BRX is proof that a value-add approach to real estate investing can work well even on a large scale when you have the right management in place. And even after gaining 30% year-to-date, WSR remains around or slightly below its pre-pandemic price. That makes no sense given the REIT’s stronger balance sheet, refreshed management team, and better shareholder alignment today than back then.

Be the first to comment