FinkAvenue/iStock Editorial via Getty Images

Cisco Systems (NASDAQ:CSCO) consistently generates excellent cash flows and has good profit margins. But, the lack of revenue growth is a challenge for the company. The company may be fully valued, given the lack of revenue growth coupled with the potential global recession. Cisco is currently trading at 10x EBITDA. The company offers a safe dividend with a yield of 3.5%, but the U.S. 10-year Treasury note provides a similar yield. Given the lack of growth and a dividend yield slightly less than the U.S. Treasury, it may be best to wait for a further pullback in the stock before buying it. The stock trades in line with the market’s volatility; hence, if there is more selling pressure on the S&P 500 Index, Cisco Systems may sell off further.

Cisco Lacks Revenue Growth But Offers Great Margins and Cash Flows

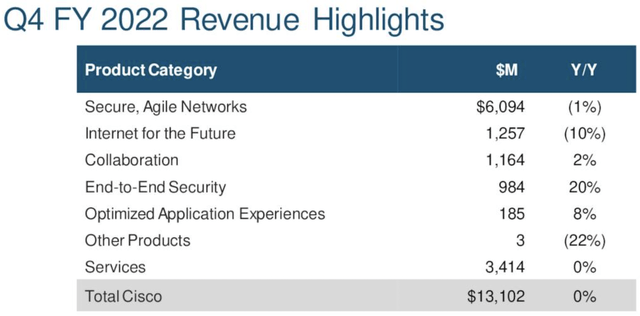

The company is suffering from a lack of revenue growth. In Q4 2022, the company had 0% y/y revenue growth [Exhibit 1]. Cisco’s End-to-End Security product portfolio showed impressive revenue growth of 20%, while the Optimized Application Experiences category showed 8% revenue growth. But, the company’s Secure, Agile Networks product category continued its losing streak with a 1% revenue loss. This Networks product category accounted for 46% of Cisco’s total revenue.

Exhibit 1: Cisco Systems Q4 FY 2022 Investor Presentation

Cisco Systems Q4 2022 Revenue by Product Category (Cisco Systems Q4 FY 2022 Investor Presentation (August 17, 2022))

The Remaining Performance Obligations [RPO] can drive revenue for Cisco. The company had $31 billion in RPO at the end of 2022. Nearly 30% or $17 billion of the company’s annual revenue for 2023 is already in the bank. The lack of overall revenue growth is a persistent challenge for Cisco Systems. But, the company has consistent and impressive profit margins. Its gross margin for 2022 was an impressive 62.55%, and its net income margin is over 22% [Exhibit 2].

Exhibit 2: Cisco’s Excellent and Consistent Profit Margins [2013 – 2022]

Cisco’s Excellent and Consistent Profit Margins [2013 – 2022] (Seeking Alpha, Sec.gov, Author Compilation)![Cisco's Excellent and Consistent Profit Margins [2013 - 2022]](https://static.seekingalpha.com/uploads/2022/9/21/saupload_1_euq8q5_R_V7G2KwVDoN-Un1YRsOQWh3ijPlUw_shDTGGTN3fkld4ErAoXLadTQCozkgSTpVWBPIqFwb60-hH2BwtweUUTc_VfOp6RhqQrJNxfeyJDwQkcZ8S7kaiX9qIU0mpexLuCnv3Q77k0N6ZcPhed-Yh3k52oG1RA6qkeB7Q18Lqp-0jmdJQ_thumb1.png)

Dividends, Stock Buybacks, and Financial Performance

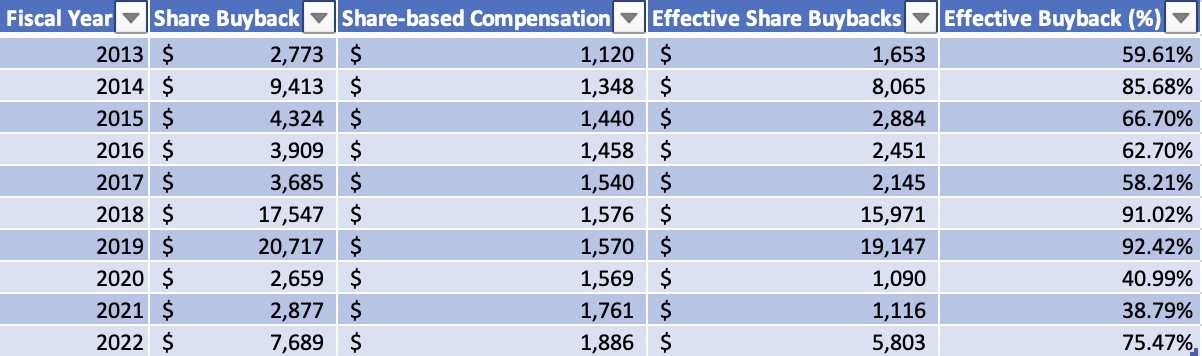

Since the fiscal year 2013, Cisco Systems has spent $75.59 billion on stock buybacks. With these buybacks, the company reduced its diluted share count from 5.38 billion to 4.19 billion, a 22% reduction. The share buybacks must overcome the headwinds of dilution in outstanding shares caused by stock issued for executive compensation [Exhibit 3]. The company has spent $15.26 billion in share-based compensation since 2013. In essence, $15.2 billion of the share buybacks have gone towards countering the dilutive effects of the company’s share-based compensation program.

Exhibit 3: Cisco’s Share Buybacks, Share-based Compensation

Cisco’s Share Buybacks, Share-based Compensation (SEC.GOV, Author Compilation)

Even as the company conducts buybacks, this dilution in outstanding shares increases the effective price paid for each share. Cisco Systems paid an effective average cost of about $64 per share [$75.593 billion / 1.188 billion shares reduction in share count] since the fiscal year 2013. The shares currently trade at $43.30, about 32% below the effective price paid for each share. Management pitches share buybacks as “returning money to shareholders,” but in most cases, it prevents further dilution of shares and helps prop up earnings per share. It also helps increase the return on equity for the company [See next section]. The company returns a massive amount of money in the form of dividends. In 2022, the dividend paid by the company totaled $6.22 billion, while share buybacks totaled $7.68 billion. The company reported an operating cash flow of $13.22 billion in 2022. In essence, Cisco Systems’ dividend and share buybacks were greater than its operating cash flow.

How Cisco Systems Increased its Return on Equity by 1000 Basis Points in a Decade?

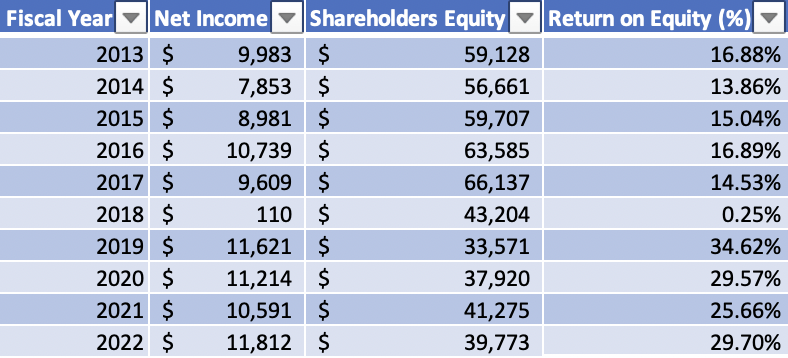

The company’s shareholder’s equity stood at $59.128 billion in 2013. By the end of the fiscal year 2022, shareholder’s equity was reduced to $39.77 billion. Most of this reduction in shareholder’s equity can be blamed on share buybacks. The company’s net income has not grown fast enough to compensate for the adverse effects of buybacks on shareholder’s equity. Since the shareholder’s equity is much lower in 2022 compared to 2013, the company’s return on equity increased from 16.8% in 2013 to 29.7% in 2022 – over a 1000 basis points increase in returns [Exhibit 4]. This increase in return on equity wouldn’t be possible without the decrease in the shareholder’s equity since this equity forms the denominator for the ROE calculation.

Exhibit 4: Cisco’s Net Income, Shareholder’s Equity, and Return on Equity

Cisco’s Net Income, Shareholder’s Equity, and Return on Equity (SEC.GOV, Author Compilation)

The company’s net income has increased from $9.98 billion in 2013 to $11.81 billion in 2022 – a CAGR of 1.89%, while shareholder’s equity reduced by -4.3% annually. Even market darling and the world’s most valuable company, Apple (AAPL), has done massive amounts of share buybacks, thus lowering its shareholder’s equity. Apple has also seen its net income rise while Cisco’s has barely budged.

Cisco’s return on invested capital [ROIC] is a very healthy 23% [Source: Seeking Alpha/YCharts]. Apple’s return on equity is a massive 153%, while its return on invested capital is a more “mundane” 53% [Source: Seeking Alpha/YCharts]. Investors need to look at the quality of the company’s financial returns rather than just the headline numbers.

Cisco’s Price Volatility and Monthly Return Comparison with the S&P 500 Index

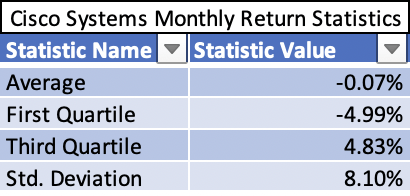

From June 2019 until August 2022, Cisco Systems had a subpar average monthly return of negative 0.07%, and 75% of the time [third quartile], the company’s monthly return fell below 4.83% [Exhibit 5]. The company has returned a negative 23% in the past year compared to a negative 11.4% for the Vanguard S&P 500 Index ETF (VOO). Although Cisco has badly underperformed the market, its monthly returns have a solid positive correlation of 0.62 with the S&P 500 Index. Most of the time, Cisco’s stock tends to move closely with the market and closely tracks the market’s volatility, given that it has a Beta of 0.94. A linear regression of the monthly returns [June 2019 – August 2022] of Cisco and the Vanguard S&P 500 Index yielded a Beta of 0.91.

Exhibit 5: Cisco Systems Monthly Returns – Average, Standard Deviation, First, and Third Quartile Monthly Returns [June 2019 – August 2022]

Cisco Systems Monthly Returns – Average, Standard Deviation, First, and Third Quartile Monthly Returns [June 2019 – August 2022] (iexcloud.io, Author Compilation)

The market may be fully valuing the company at this time. It may be best for existing investors to continue holding the stock. New investors should jump at the opportunity to accumulate the stock at close to $40 in any near-term market turmoil. But if the Fed’s interest rate increases are ending, the U.S. economy may not suffer a further slowdown, and the global economy may avert a deep recession. If that happens, Cisco might fare better under those circumstances. There are signs that inflation may start easing soon. It is trading at a forward GAAP PE of 14.6x and an EV to EBITDA multiple of 10.6x.

The company’s remaining performance obligations [RPO] may provide some protection for its revenue and earnings in 2023. Wall Street analysts are projecting $3.53 per share in 2023. The majority of the revisions to its EPS have been to the downside in the past three months.

Conclusion

The stock cannot protect a portfolio from the volatility in the S&P 500 Index, given its Beta of nearly 1. It does not offer much revenue or profitability growth, and a recession could impact the company. Cisco’s customers will likely prioritize digital investments even in a recession, it might be the last line item that might get the ax. Digitization and cyber security are essential for any company to derive better financial returns and protect valuable digital assets. It is also difficult for any company to entirely shut down any digitization efforts and ramp up again when the economy recovers. Companies may slow specific projects but be reluctant to shut down projects entirely. But, even a modest slowdown in spending may put further pressure on Cisco Systems. It may be best to wait before buying Cisco Systems.

Be the first to comment