eclipse_images/E+ via Getty Images

Investment Thesis

Cintas (NASDAQ:CTAS) provides uniform rental services. Despite investors’ concerns as to the near-term impact of inflation, Cintas’ top-line continues to grow at a steady clip.

Furthermore, its share repurchase program has meant that Cintas’ bottom line continues to shine, and is undoubtedly a big driver behind the bull thesis.

While the business does carry a small amount of leverage, this is nothing extraordinary.

Altogether, the stock is priced at approximately 33x its fiscal 2023 EPS. Thus, it’s challenging to make a full-blown bull case for new investors to the stock at this valuation.

Again, I’m not talking about investors that are now riding the wave. But new investors, with fresh capital to deploy into the name, they’ll struggle to be strong bulls in this name.

Cintas’ Revenue Growth Rates Steadily Moving Up

Cintas revenue growth rates

Cintas puts behind the Covid-period and starts to lap the first ”normalized” quarter of Q4 2021, with management guiding to be up 9% y/y for Q4 of this year.

What’s more, keep in mind that when Cintas reported its Q4 2021 results, it originally guided for this fiscal year’s revenues to reach $7.63 billion at the high end of its range.

Then, Cintas steadily upgraded its outlook with each passing quarter, giving the investor community exactly what they crave — a steady dose of positive surprises.

What’s more, keep in mind that throughout the last several quarters, including the strenuous Covid period, Cintas has regularly marginally beaten analysts’ revenue consensus.

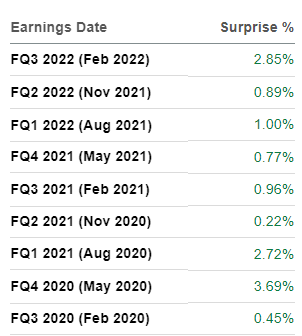

Cintas revenue surprise results

There’s really no other way to put it, but to say that Cintas is a steady compounder.

Why Cintas? Why Now?

Cintas is North America’s leading provider of corporate identity uniforms through rental and sales programs. More specifically, approximately 80% of its top line is generated by its Uniform Rental and Facility Services.

Cintas contends that as businesses shed non-core competencies to reduce costs and minimize the impacts of inflation, this provides Cintas with strong tailwinds.

On the other hand, its share price in the past few months has been quite volatile as investors attempt to grapple with its near-term prospects and whether or not Cintas will be able to pass on higher prices to its customers, on the back of higher inflation.

The other big consideration for investors is that during Q3 of last year, First Aid and Safety Services saw its revenues jump nearly 18% y/y as PPE was in very high demand, driven predominantly by the sale of safety equipment.

Consequently, Q3 of this year went against that elevated period a year ago, one would have expected to see tough comps this time around. However, despite the challenging comparisons, Cintas’ First Aid and Safety Services still increased 6.2% y/y organically.

On the other hand, as noted earlier, the bulk of its operations are derived from its Uniform Rentals segment, and its First Aid segment ends up as mostly a distraction on the true underlying bullish thesis here.

Highly Cash Flow Generative

Cintas’ balance sheet carries approximately $2.8 billion of net debt. This is compared against approximately $2.0 billion of net debt in the same period a year ago. A large portion of the differential y/y is the share buyback program Cintas embarked on.

On the other hand, keep in mind that at the present rate, Cintas’ free cash flow this year is on target to surpass the $1.2 billion it generated in fiscal 2021.

Indeed, the crown jewel here has to be that Cintas’ free margins for the trailing 9 months reached 14.2%. That being said, keep in mind that in the same period a year ago, Cintas’ free cash flow margins were approximately 100 basis points higher at 15.2%.

On the other hand, despite the 100 basis point free cash flow margin contraction, however, one considers this margin, Cintas is clearly steadily growing and highly free cash flow generative.

CTAS Stock Valuation – Reasonably Priced

Cintas’ management believes that the current share price offers shareholders value. Along these lines, from December 2021 through to March, Cintas’ management repurchased approximately $585 million worth of stock.

Altogether, this implies that Cintas is on target to finish fiscal 2022 with its EPS reaching approximately $11.39.

Consequently, its shares are now priced at approximately 36x this year’s diluted EPS. If we assume that Cintas’ top line continues to grow by high single digits in fiscal 2023, it’s not unreasonable to estimate that this year’s share repurchases, together with some operational margin improvement that Cintas’ EPS figures next year could reach roughly $12.53.

Thus, looking ahead to next fiscal year the stock is now priced at roughly 33x next year’s EPS.

The Bottom Line

Cintas is a compounder, pure and simple. The positive side of the thesis has to revolve around this business not only generating strong earnings but turning these earnings into free cash flows at a very high rate.

On the other side of the equation, however we look at this investment, we are looking at a business that’s growing its EPS in the best case at double digits, but priced at mid-30s times its next year’s EPS figures.

Thus, it’s difficult to argue in another way, other than to say that expectations here are already very high and baked into the share price.

In sum, I believe that there are better investment opportunities elsewhere. In fact, one thing is certain, there are meaningfully cheaper stocks than Cintas’. Whatever you decide, good luck and happy investing.

Be the first to comment