Lisa Lake/Getty Images Entertainment

Cigna (NYSE:CI) is an underappreciated health insurance company behind popular players like UnitedHealth Group (UNH) and Anthem (ANTM). However, the company’s management is making smart decisions to diversify the revenue in its Evernorth segment and shift slightly more away from pharmacy benefits. Furthermore, the company’s healthcare segment is growing rapidly and is even doubling the industry average. Cigna will also benefit greatly from the rising costs of health insurance and increased number of people with insurance. With all of this in mind, management’s outlook for FY22, the share buyback program, a nice dividend, and current valuation make the stock attractive for an investment.

Evernorth is Diversifying and Healthcare is Doubling the Industry Growth Rate

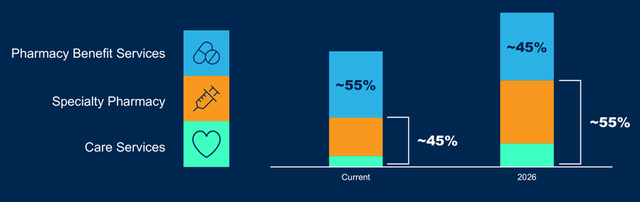

Evernorth is Cigna’s segment that includes pharmacy benefits management, specialty pharmacy services, clinical solutions, home delivery, and health management services. Evernorth is Cigna’s largest segment by far and accounts for nearly 71% of revenue. In the company’s recent investor day, management explained their goal to diversify its revenue away from pharmacy benefit services and more into specialty pharmacy and care services. Currently, the segment generates 55% of its revenue from pharmacy benefit services and 45% from specialty pharmacy and care services. Management would like to swap these percentages and have specialty pharmacy and care services account for 55% of revenue.

Evernorth Segment Composition (Cigna Investor Day Presentation)

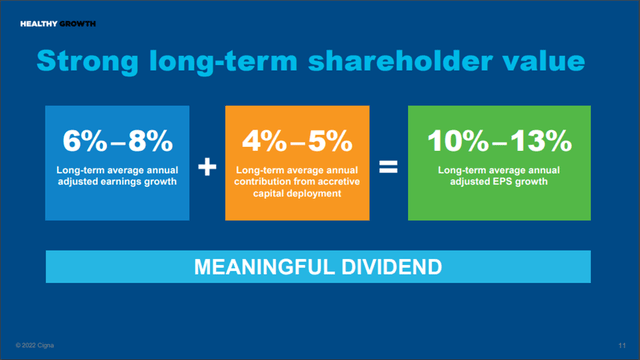

Cigna’s Healthcare segment is also seeing major success from management’s decisions. This U.S. Commercial subsegment is growing by over double the industry average growth rate. From 2018-2021, Cigna U.S. Commercial healthcare grew its revenue by 7.1% annually, while the industry average only came in at 3.5%. One reason for this is Cigna’s rising popularity among employers, as total employment will improve the segment’s total revenue by about 1%. Furthermore, rising prices for health care will improve the company’s revenue growth by up to 6% in the upcoming years. Finally, Cigna’s general baseline growth the company has already been experiencing will increase the company’s revenue growth by 4%-7%. With all of this combined, Cigna will easily be able to outperform the rest of the industry and provide great shareholder value.

Rising Insurance Costs and Number of People Employed Will Drive Fundamentals Higher

As stated previously, a large portion of Cigna’s expected growth will come from higher health care spending and more people paying for health care. The Centers for Medicare & Medicaid Services, or CMS, recently announced they expect national health spending to increase 5.1% annually through 2030 to reach a total of $6.8 trillion. It is important to mention that this is also accounting for the decline in healthcare spending that came after the COVID-19 pandemic began fading. This trend is expected to begin normalizing in 2024 as federal supplement funding for COVID-19 wanes. In 2024, the government’s share of national health spending is expected to decrease to 46%, which was at an all-time high at 51% in 2020. After the declining trend normalizes in 2024, the average annual growth rate in healthcare spending is expected to increase to 5.3%. This growth in spending will allow Cigna to improve its fundamentals massively and drive the stock price higher.

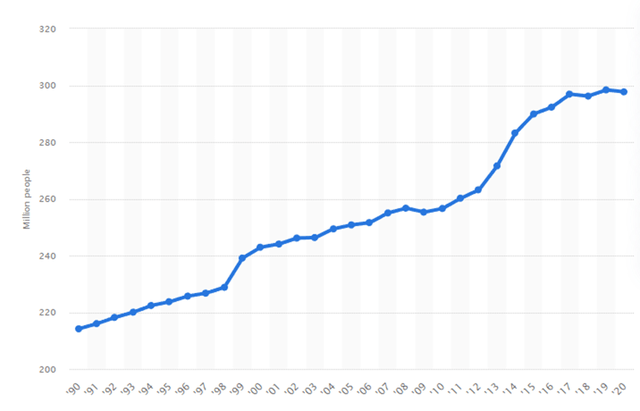

Another large portion of Cigna’s future growth will be caused by more people paying for health insurance. The increased number of people with health insurance will cause more consumers to use Cigna’s services and lead to the company’s fundamentals driving higher. From 1990 to 2020, the number of U.S. consumers with health insurance increased by 83 million people. As long as this trend continues, the demand for Cigna’s services will increase with it.

Number of Americans with Health Insurance, 1990-2020 (Statista)

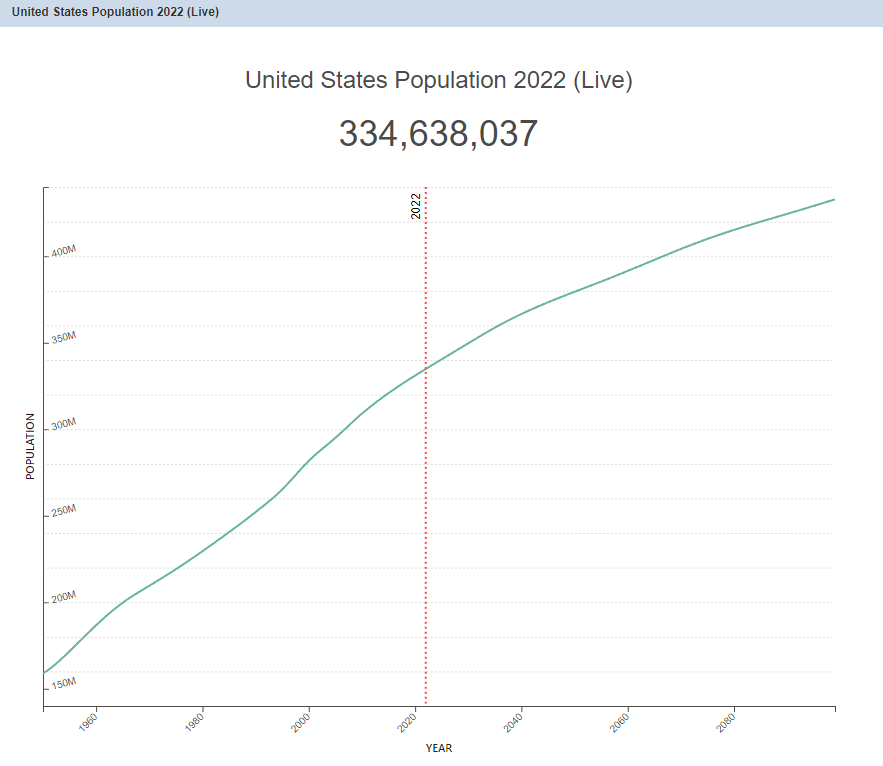

The rising population in the United States will also lead to more consumers using Cigna’s services. The average annual growth rate of the United States population is about 0.9%. In the long-run, this will allow Cigna to have more customers every year and more people employed that will get Cigna’s services through their employer.

U.S. Population Growth & Projections (World Population Review)

Management Gave Great Guidance and Is Continuing to Buy Back Shares

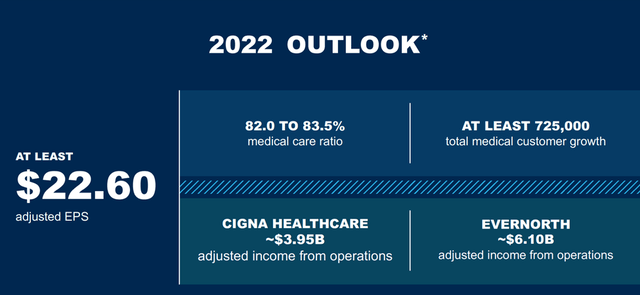

In the company’s recent investor day, management gave great guidance in-line with analyst estimates. For FY22, management is expecting an EPS of at least $22.60. Furthermore, the medical care ratio will be between 82%-83.5% and the total growth of medical customers will be at least 725,000. Furthermore, Evernorth is expecting about $6.1 billion for income from operations, while Cigna Healthcare is expecting about $3.95 billion for income from operations.

FY22 Outlook (Cigna Investor Day Presentation)

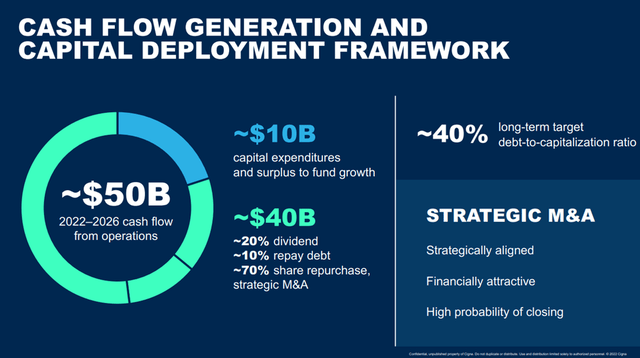

Also, the company is continuing to follow its share buyback program and pay off its debt. From 2022-2026, the company is expecting about $50 billion in cash flow from operations. $40 billion of this will be used to return value to the shareholder. Specifically, 20% will be given in the form of a dividend, 10% will be used to repay debt, and 70% will be used for share buybacks and M&A. It is also important to mention Cigna has the highest dividend yield of any of the major healthcare competitors at 1.8%. With all of this extra value a shareholder receives, it may be a good buy if the price is attractive.

Capital Deployment (Cigna Investor Day Presentation)

Valuation

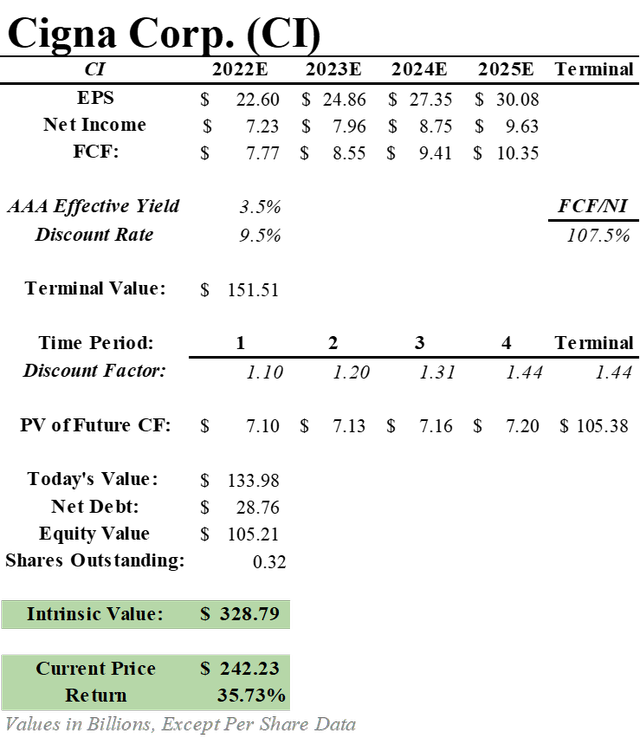

For valuing Cigna’s stock, I used both a discounted cash flow and relative valuation. For the DCF, I used management’s expectation for EPS of $22.60 in FY22, as well as their estimated 10% annual growth rate to determine future EPS.

Future Growth of Cigna’s EPS (First Quarter Presentation)

After using the company’s average FCF/Net Income ratio of 107.5%, I projected out future free cash flows. By using a 9.5% discount rate to give a nice premium over average AAA corporate bonds and a 2.5% perpetual growth rate, a fair value of $328.79 can be calculated. This gives the stock an implied upside of about 35.73%.

Cigna DCF with 9.5% Discount Rate

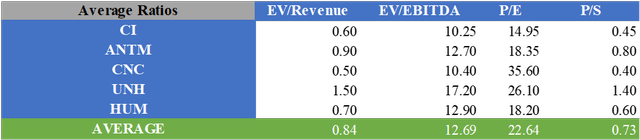

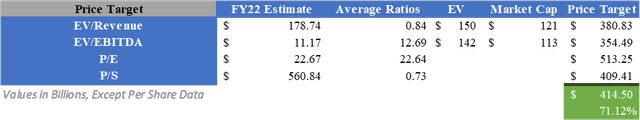

For the relative valuation, I used the average multiples for EV/Revenue, EV/EBITDA, P/E, and P/S of Cigna and its competitors and combined them with consensus analyst estimates for FY22. After adjusting for the company’s cash and debt and dividing by the number of shares outstanding, a fair value of $414.50 can be calculated, implying an upside of 71.12%.

What Does This Mean for Investors?

Cigna is an underappreciated healthcare stock that often gets pushed aside of leaders like UnitedHealth Group and Anthem. Management is making key decisions to diversify its revenue in its Evernorth segment, while the U.S. Healthcare segment is growing at over double the rate of the industry average. The company will see great benefits from the increasing price of healthcare, the rising number of people who have health insurance, and the rising U.S. population. Furthermore, a shareholder is getting a stock with a great margin of safety and extra value through a leading dividend and high share buybacks. With all of this in mind, I believe applying a Buy rating is appropriate at this time.

Be the first to comment