niphon

Investment Thesis

Church & Dwight Co., Inc. (NYSE:CHD) has faced a challenging year so far. The inflationary environment and supply chain issues along with demand degradation in three of its brands (Waterpik, Flawless, Vitafusion), comprising 20% of the company’s business, adversely impacted the results of the third quarter. However, the remaining 80% of the business is experiencing healthy demand and gaining market share. The company also acquired Hero Cosmetics, Inc in mid-October which is the leading brand for acne treatment in the U.S. which should help growth. Moving forward, while declining demand in 20% of the business is a concern in the near term, 80% of the business performing well due to healthy demand should help the company deliver revenue growth. In addition, revenue growth should benefit from improving fill rates, volume growth, easing supply chain issues, and the company’s efforts to support the three troubled brands along with revenue synergies from its recent acquisitions. For margins, the company should benefit from improving price realizations, and productivity along with volume leverage from higher fill rates and lower supply chain constraints. Moreover, the stock is currently trading at a discount from its historic rate, which makes it a good buy.

Revenue Analysis and Outlook

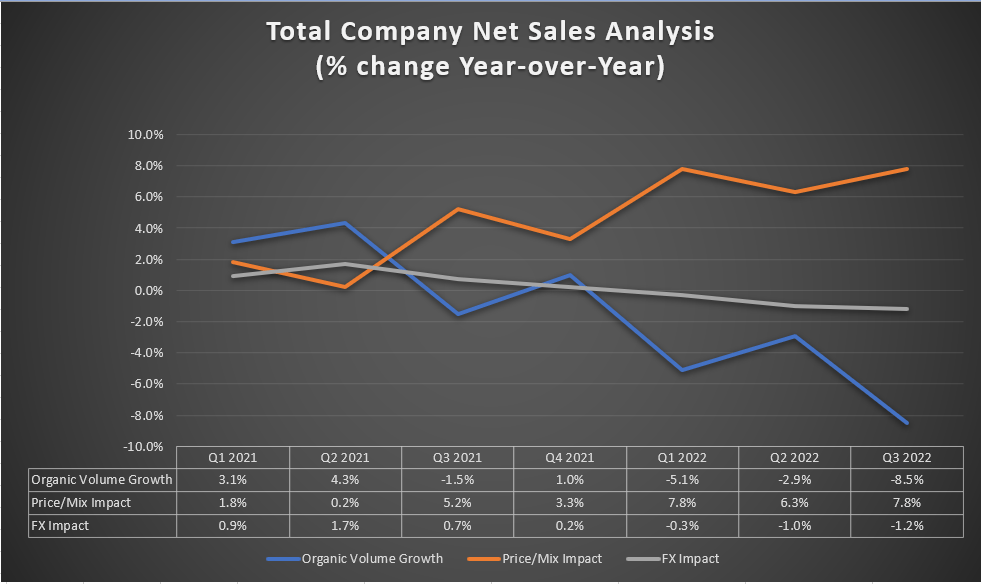

In the third quarter, Church & Dwight reported net sales of $1.3 billion, up 0.4% Y/Y, reflecting 2.3% growth from acquisition and the increase in sales due to 80% of the product portfolio performing well as a result of healthy demand and market share gain in 7 out of 14 power brands. On a constant currency basis, organic net sales declined 0.7%, reflecting a favorable price/mix of 7.8%, more than offset by an 8.5% volume decline and a negative 1.2% foreign exchange headwind. The volume decline was attributable to demand degradation associated with price increases in the Waterpik, Flawless and Vitafusion businesses. The two discretionary brands, Waterpik and Flawless, comprising 10% of net sales, and the vitamin business comprising another 10% of net sales, accounted for a combined 6% headwind on net sales in the quarter. In addition, continued supply constraints and retailer destocking also negatively impacted organic sales growth.

CHD’s Historic Net Sales Analysis (Company Data, GS Analytics)

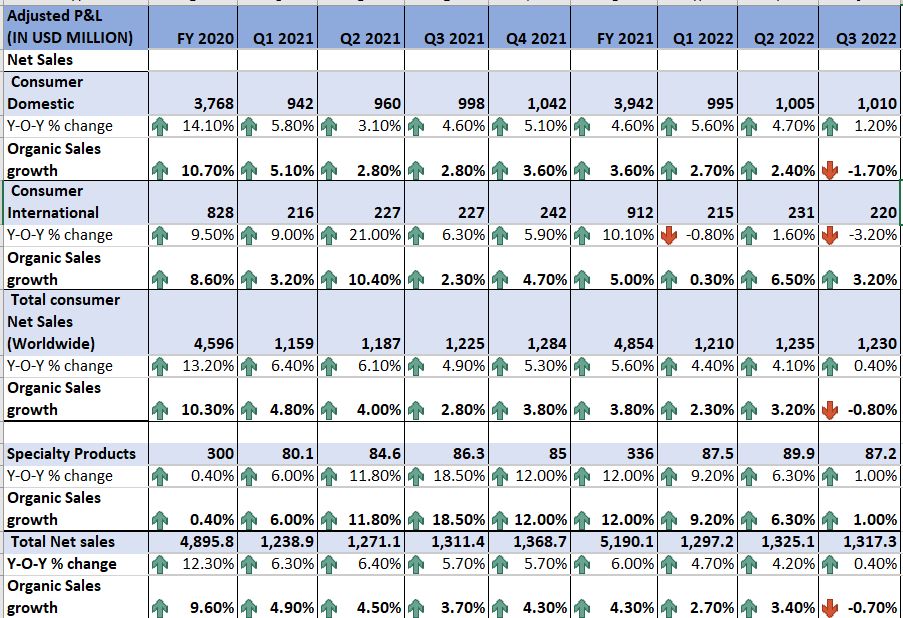

The Consumer Domestic segment, which is the company’s largest segment, reported revenue of $1 billion, up 1.2% Y/Y, reflecting 2.9% growth through acquisition. The sales also benefited from healthy demand trends for Arm & Hammer Liquid Detergent, OxiClean Versatile Stain Remover, Batiste dry shampoo, Arm & Hammer Cat Litter, and Zicam cold shortening along with the growth of TheraBreath mouthwash which achieved all-time high market share. The company also saw consumers trading down to value products in an inflationary environment. The company has a diversified product portfolio comprising 40% of value products and this portfolio benefitted growth as a result. On an organic basis, net sales declined by 1.7%. The decline reflected a favorable 8% price increase, being more than offset by a 9.7% volume decline. The decrease in volume was due to slowing demand for Waterpik and Flawless brands which were impacted by a reduction in consumer spending. The market share growth of the Flawless brand was also impacted by delays in launching new products caused by plant shutdowns in China due to the lockdown. In addition, the decline in volume for the segment was also impacted by softening demand for gummy vitamins in the Vitafusion brand due to reduced consumption because many consumers exited the market as they are no longer concerned about COVID infection. Moreover, the business is also lapping higher demand for vitamins and supplements due to the COVID Delta variant in the prior year’s quarter along with lower fill rates.

For the Consumer International segment, net sales declined 3.2% Y/Y to $220 million, as FX headwinds more than offset healthy demand trends and 0.7% benefit from acquisitions. The decline also reflected weakening demand in China due to the lockdown. On a constant currency organic basis, net sales increased by 3.2%. The increase reflected a favorable price/mix of 6.2%, partially offset by a 3% volume decline and a negative 7% foreign exchange headwind. The increase was due to healthy demand across the majority of the international markets.

Lastly, for the Specialty Product segment, net sales, as well as organic sales, increased 1% Y/Y to $87 million. The increase was due to a favorable price/mix of 9.5% in the dairy and specialty chemicals division, partially offset by an 8.5% volume decline.

CHD’s Historic Revenue Generation (Company Data, GS Analytics)

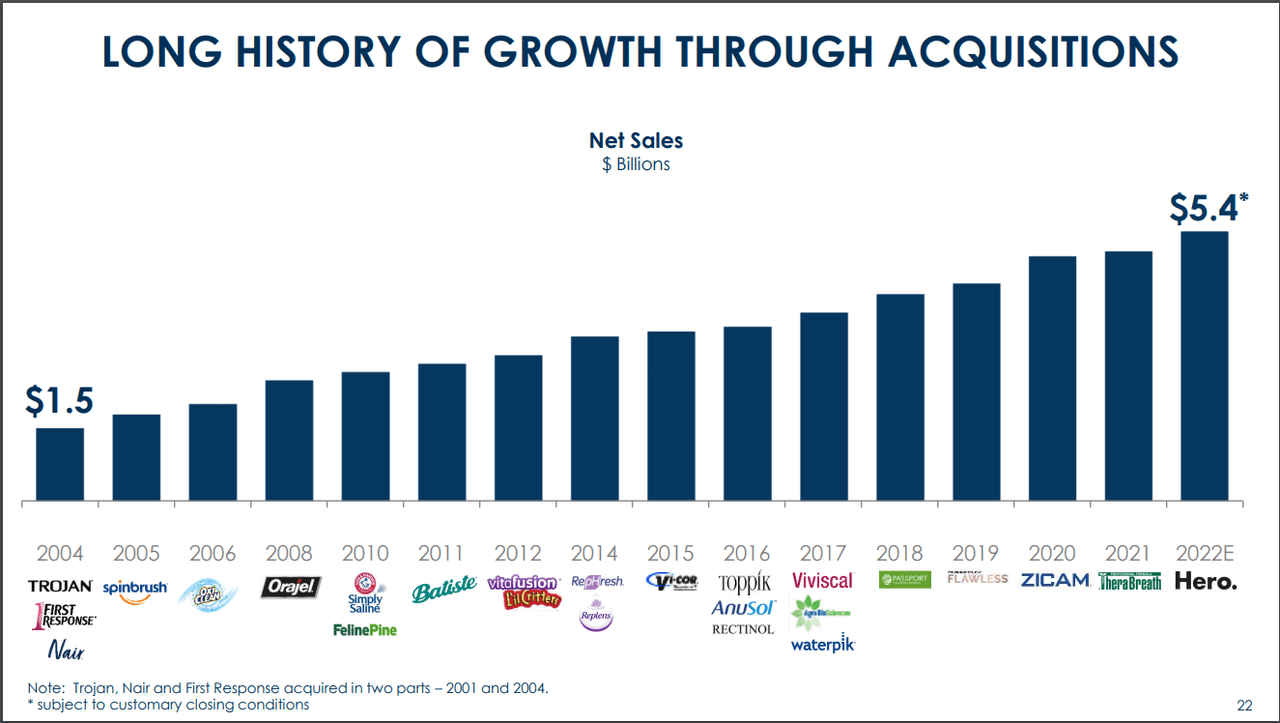

The company aims to achieve annual organic growth of 3%, gross margin expansion of 25 basis points (bps), SG&A reduction of 25 bps, and EPS Growth of 8%. One of the key strategies for the company to achieve these targets is growth through synergistic acquisitions. The company has specific criteria for key acquisitions which help it deliver growth synergies. These criteria are #1 or #2 share brands with higher growth and higher margins, an asset-light nature, and the potential to leverage Church & Dwight’s manufacturing, logistics, and purchasing, and sustainable competitive advantage. This business model has helped the company grow from $1.5 billion in net sales per annum in 2004 to $5.2 billion per annum in 2021. The company recently acquired HERO cosmetics, Inc in mid-October in line with this strategy. The brand is the #2 acne care brand overall in the United States with a 14% market share in the total acne treatment category. The brand will become the 15th power brand in Church & Dwight’s portfolio.

CHD Growth through M&A (Investor Presentation, Barclay’s Global Consumer Staples Conference 2022)

Looking forward, I believe the company should be able to deliver revenue growth in 2023 and beyond. The company is experiencing healthy demand in 80% of its business, especially in 40% of its portfolio comprising value products that are benefitting from trade downs. To meet up with healthy demand the company is focusing on improving its fill rates back to the pre-pandemic level of approximately 98% from the current fill rate of ~91%. The company is improving the fill rates by taking steps to increase short-term manufacturing capacity for many of its products as well as raw material and packaging capacity. In addition to improving fill rates, the company plans to invest incrementally in the marketing of its brand in Q4, which should help with volume growth along with favorable price/mix moving ahead.

The slowing demand in the remaining 20% of the company’s business – Waterpik, Flawless, and the vitamin business under Vitafusion – is a concern and should continue to adversely impact the revenue growth in the near term. However, the medium to long-term outlook of these businesses also looks good. The company is constantly investing in demand-driving activities for Waterpik, such as Lunch & Learns with dentists and hygienists to increase household flosser penetration. Moreover, currently, only 16% of the U.S. population use flosses every day. Management believes that there is ample room to grow with increasing gum health concerns, which should help the business deliver growth in the longer term.

Turning to the other discretionary brand Flawless, the company expects to launch new products in 2023 that were delayed in 2022. Moreover, the company plans to shift its focus from older consumers to digitally targeting younger consumers in the beauty space. The market shift to younger consumers along with the new product launch in 2023, should help the business deliver revenue growth in the longer term.

Lastly, for the vitamin business, which saw a consumption decline of 8% in Q3 2022, management believes that the business has bottomed and reached its inflection point as the sales in October were down 4% and turned flat Y/Y in November. Additionally, overall improving fill rates and the trend of consumers shifting from pills to gummies should also aid this business’s long-term growth.

Hence, I am optimistic about the company’s revenue growth prospects and believe they should benefit from healthy demand, improved fill rates, price increases, easing supply chain issues, completion of inventory adjustments, and increased marketing and promotional spending along with healthy M&A growth.

Margin Outlook

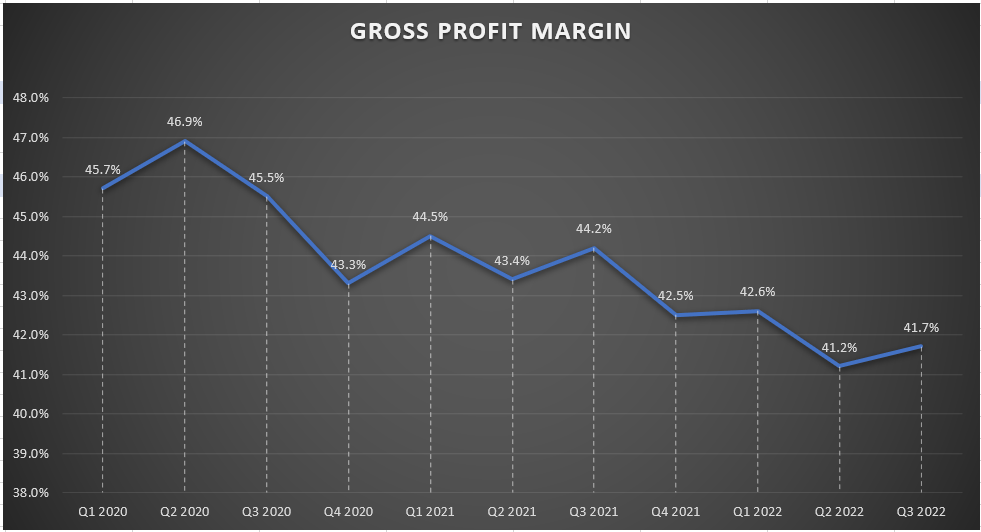

In the third quarter, the company reported a gross margin of 41.7%, down 250 bps Y/Y. The decline was attributable to higher manufacturing costs, primarily related to inflationary commodity, distribution, and labor costs. The decline was partially offset by pricing, acquisition, and productivity. The adjusted operating margin declined by 60 bps Y/Y to 19.3%. The decline in adjusted operating margin reflects lower volume leverage, partially offset by a Y/Y decline in adjusted SG&A and marketing expense as a percentage of net sales.

CHD’s Historic Gross Profit Margin (Company Data, GS Analytics)

Management expects a contraction in the gross margin in Q4 as well, due to higher inflationary costs including higher commodity, labor, and raw material costs. However, in FY2023 and beyond, the company should be able to deliver gross margin growth, benefitting from acquisitions synergies, higher productivity, and a potential moderation in inflation. In addition, the gross margin should also benefit from price increases and volume leverage through improving fill rates. Hence, the medium to longer-term gross margin growth prospects look favorable.

Valuation and Conclusion

Church & Dwight is currently trading at a P/E of 25.61x 2023 consensus estimates of $3.12. The stock is trading at a discount to its 5-year historical average forward P/E of 27.97x. I believe the company is poised to see good growth in 2023 and beyond, benefitting from its key acquisitions, healthy demand in the majority of the business, improving fill rates, easing supply chain conditions, moderating inflation, and increasing productivity. Hence, I believe the stock is a good buy.

Be the first to comment