hapabapa/iStock Editorial via Getty Images

Warren Buffett attributes Benjamin Graham with first saying, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” And since the summer of 2020, nowhere does the first half of Graham’s maxim seem more true than with GameStop (NYSE:GME). However, as we approach the two year anniversary of Ryan Cohen’s initial share purchases, this month’s release of the February-April Q1 earnings and 10-Q provided another weigh-in for the company’s fundamentals and opportunity to consider the longer-term outlook.

Three main points jump out from the Q1’22 earnings report and surrounding discussions. First, the positive Q4’21 pivot to growth for the software category accelerated, somewhat confirming a bucking for GameStop of the secular trend to digital. Second, the continuing and hard to reconcile collapse of gross margins, coupled with new management’s increased SG&A structure, led to a record quarterly earnings loss. Last, good progress was seen in the digital asset space with the release and strong reception of the GameStop Wallet. But official confirmation the company divested their promising Immutable X (IMX-USD) tokens partially dampened sentiment around the crypto segment.

The Pivot: GameStop’s Game Sales Grow

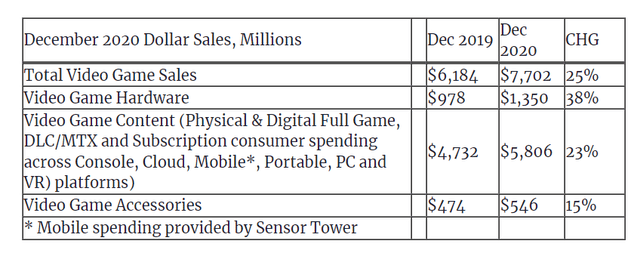

Because of GameStop’s high rate of game attachments to new hardware sales, one may have expected a cyclical boost in software revenues associated with 2020 holiday launches of the PS5 and Xbox Series X/S. However, despite the strong hardware revenue gains at GameStop during the 2020 holiday, software sales fell over 25% during the launch quarter. By contrast, industry-wide content sales over the 2020 holiday were particularly strong on the back of the console refreshes. Note the 23% gain in content during the large December month in the second chart below. Importantly, GameStop likely underperformed due to a combination of factors led by the continued shift to digital delivery, retail effects of COVID-19, and a conservative inventory strategy.

GameStop Holiday Software Revenues

| 2017 | 2018 | 2019 | 2020 | 2021 | |

|

Software Sales (Holiday Quarter) |

$1042* | $961* | $984 | $731 | $786 |

|

PowerUp Rewards Members Paying (Year) |

5.8 | 5.6 | 5.0 | 4.4 | 5.8 |

[Data in millions. *2017 & 2018 Software Sales presented above do not include substantial pre-owned sales that are included in current reporting methods. Sourced from Form 10-Ks.]

Industry-wide Gaming Sales By Category, December 2019 and 2020

December 2020 NPD (venturebeat.com)

Source: December 2020 NPD: Nintendo dominates with half of the top 20 games, venturebeat.com, 1/15/2021

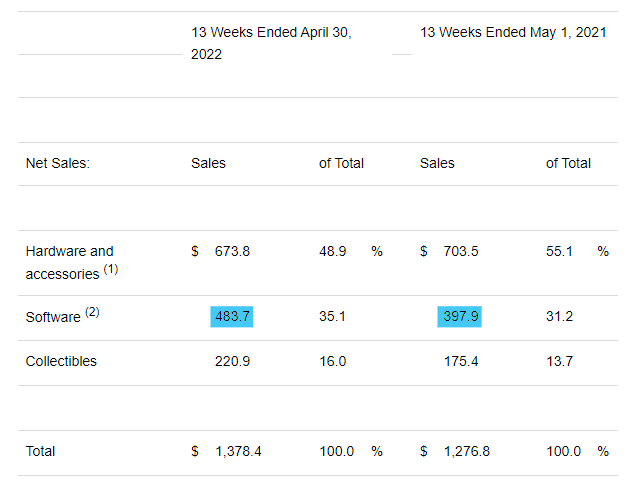

Fast forward to the 2021 holiday and the scenario has largely reversed. GameStop’s software grew 7% QOQ, while industry-wide content sales were flat in the large December month. And importantly, we got confirmation of this pivot in the growth trajectory with the recent Q1 release (see blue highlighted chart below). And though there is no mention in the 2021 Annual Report or the latest 10-Q, one could assume a portion of this software turnaround relates to the lifetime revenue deal with Microsoft (MSFT) from October of 2020.

GameStop Q1’22 Sales Mix

GME Q1’22 Sales Mix (seekingalpha.com)

[Source: GameStop Reports First Quarter Fiscal Year 2022 Results, seekingalpha.com, 6/1/2022]

As seen above, GameStop’s February-April quarter saw a 21% QOQ increase in software sales, and for reference, industry-wide content sales were down 7% in the calendar first quarter.

After years of decline, GameStop’s game sales are growing and recouping share. Combined for all segments, total growth during the second year of cycle looks to be mid-to-high single digits. And though GameStop still does not have a high profile gaming sales executive, the recent COO hire brings traditional retail experience from Belk and Kohl’s (KSS) to augment management’s heretofore sole focus on online retailing experience.

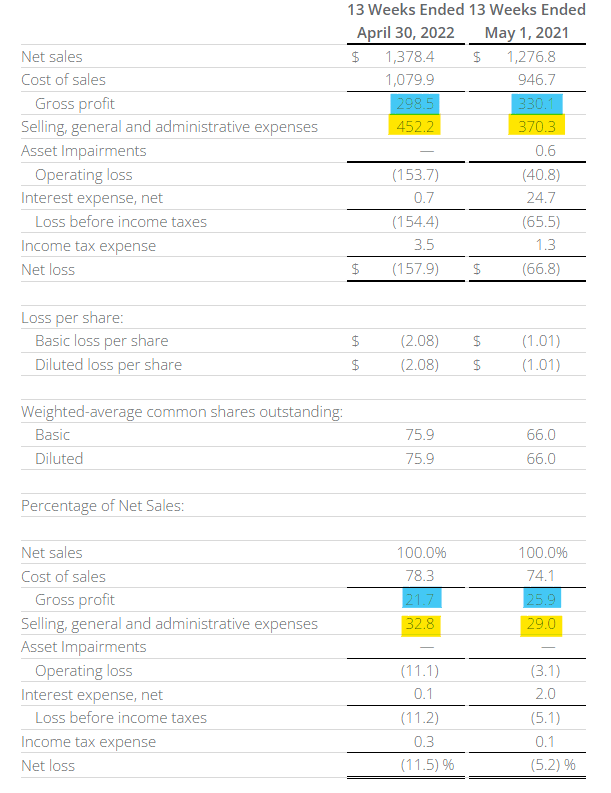

Continuing Profit Collapse: GME’s Margins Down Despite Improving Mix, SG&A Up Structurally

Gross profit percentage is the percent of sales remaining after subtracting the cost of sales (cost of goods). For fiscal 2019 gross profit was 29.5%, fiscal 2020 came in at 24.7%, with last year falling further to 22.4%. The prior trend of declining margins can primarily be attributed to a mix shift away from profitable software sales, especially the decline in the share of ultrahigh-margin pre-owned games.

GME Q1 Statement of Operations (gamestop.gcs-web.com)

In Q1’22 there was a further, small decline in margins with gross profit at 21.7%. This is particularly hard to reconcile as the mix had shifted to the historically higher-margin categories of software and collectibles and away from the lowest margin hardware category (see Q1’22 Sales Mix graphic above). On a QOQ basis, hardware’s share was down from 55% to 49%, with software up from 31% to 35%.

Fully reconciling the above contradiction is difficult as stockholders now have less insight into the business than in the past. In reporting, GameStop now comingles categories with different customer and margin profiles, such as new game software and pre-owned software. Further, analysts are not allowed to ask questions during conference calls and prepared comments provide little color on company trends and strategy.

The following is the complete entry for gross profit changes in the recent 10-Q.

Gross profit decreased $31.6 million, or 9.6% during the first quarter of 2022 compared to the same period last year. Gross profit as a percentage of net sales declined to 21.7%, or 420 basis points, compared to 25.9% in the prior year quarter. Our gross profit for fiscal 2022 reflects increased freight costs driven by supply chain disruptions, incremental inventory reserves, market pressures, and a shift in product mix towards higher dollar lower margin categories.

Source: Form 10-Q, news.gamestop.com, 6/1/2022

Note “incremental inventory reserves” likely relates to possible discounting or unsold merchandise accounting. A mix shift to “higher dollar lower margin” items makes sense in light of the expansion of items like TVs and computers. And since the company no longer provides insight into the new/pre-owned breakout, both software and hardware margins may be down with a shift to a higher percentage of lower margin new sales across the two largest segments. Though it should be noted this last idea was not mentioned in the 10-Q.

Moving to the SG&A, despite 132 store closures during the preceding year, quarterly expenses increased $82 million. The increase appears to be structural from the new fulfillment centers, a new digital asset team and the filling out of upper management. The 10-Q gives the following color

SG&A expenses as a percentage of sales increased primarily due to costs associated with our transformation into a technology company, which include increased labor costs as the Company in-sources talent, investments in technology to support growth, and expansion of fulfillment capabilities.

The increase is also attributable to the net impact of digital asset related activities…

Source: Form 10-Q, news.gamestop.com, 6/1/2022 (link above)

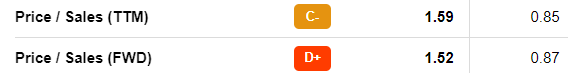

Putting the above together, the operating loss for the first quarter was about $150 million. Gross profit, about $300 million, was 22% of sales; SG&A, about $450 million, was 33% of sales. At current run rates, revenues would need to increase a material 50% to reach a somewhat break even position during a non-holiday quarter. This fact, coupled with the company’s relatively expensive price to sales ratio, makes GameStop shares uniquely speculative based solely on the fundamentals of the legacy business.

GME Price to Sales (seekingalpha.com)

[Seeking Alpha Factor Grades: GME in bold, Sector Median in regular – Market Cap is $9.6 billion, Sales TTM were $6.1 billion.]

Digital Asset Marketplace: Profitable Adjacency or Latest Reinvention Trap?

Over the past five years GameStop’s primary model and profit center, the resale of pre-owned games, became at odds with a growing segment of players and major software developers. To combat this change, various management groups during the period attempted to reinvent the company, though with mixed results and considerable balance sheet stress.

Because past attempts at reinvention have not been completely successful and current management does not have Web3 experience, it is reasonable to closely scrutinize GameStop’s new digital asset marketplace plans. And a more complete look at the partnership with Immutable X can be found in my February article titled, GameStop Is To NFTs And Crypto As Zynga Was To Social And Mobile.

I have two main thoughts. First, an important part of the agreement with Immutable X is that $100 million is earmarked for developer grants. These developers will build on Immutable X’s platform and distribute through GameStop’s marketplace. GameStop will now be somewhat connected to content creation, something unseen since the company sold Kongregate in 2017.

Ironically, GameStop got off to a rocky start in February with existing builders as they immediately sold the IMX tokens they received from Immutable X though the contract’s milestone grants. This was widely reported at the time on sites like Benzinga and The Block, and shown with data from Etherscan.

GameStop was able to capture a small premium for the tokens around the time of the announcement, but angered developers in the Immutable X ecosystem by not adopting a HODL stance. This was especially true as GameStop already had a decidedly strong balance sheet due to last year’s share sales and did not need the USD generated from divesting the IMX tokens for current operations.

Second, Immutable X enables developers to have in-game NFT trading. This setup will provide players the best and most frictionless experience. This bias away from GameStop’s marketplace, especially for larger developers and those not receiving grants, will tend place GameStop’s marketplace outside the gaming ecosystem. Additionally, Immutable X also sells and trades the NFTs they enable on their digital asset marketplace (link here).

As way of conclusion, I want to draw a parallel to this possible in-game NFT trading bias. Consider the fundamental issue of direct to player digital downloads that has substantially eroded GameStop’s revenues and margins by impacting both new and pre-owned software sales over the past five years. The majority of players frictionlessly buy their games though their platform stores or direct from the game developer’s store, which cuts out GameStop. These developers and console makers are incentivized to sell directly and digitally to the players for the increased margins. This direct sale method also facilitates future attachments of other services. This same dynamic likely develops with gaming NFT sales as players want to trade in-game, and for margin reasons, developers would rather come to market without GameStop.

Author’s notes:

- To be fair, a meaningful portion of the highlighted SG&A increase discussed in the middle section above is directly tied to the new digital asset business and GameStop has only just begun to recognize related income. In the 10-Q linked above (pages 6 and 7) one can find a portion of the accounting policy regarding digital assets. Impairments, gains on sales, and even digital asset income from the partnership milestones with Immutable X will be passed though SG&A expenses.

- At the end of May GameStop launched the GameStop Wallet. The well regarded crypto industry source Bankless on YouTube gave the wallet a sterling review and introduction (starting at the 22:10 mark).

Be the first to comment