Tippapatt/iStock via Getty Images

Dear Investor

I hope this letter finds you well. Choice Equities Fund generated gains of +6.5% on a net basis in the fourth quarter, taking performance for 2022 to -31.6%. This compares to the Russell 2000’s +6.2% gain for the quarter and annual loss of -20.5% and the S&P 500’s quarterly gain of +7.6% and annual loss of -18.1%. Since inception in 2017, the fund has generated annualized gains of +15.2% versus +5.8% and +11.4% for the Russell 2000 and S&P 500, respectively.

Quarterly Commentary

2022 closed as a tough year for owners of nearly all asset types. The year was dominated by adverse macroeconomic developments and declining markets. Highly unusual geopolitical events collided with still-recovering supply chains and post-pandemic fundamental imbalances of supply and demand to send inflation to 40-year highs, subsequently ushering in the fastest Fed rate hiking cycle in four decades. Increasing interest rates compelled a re-evaluation of financial markets, as investors reassessed not only what earnings multiples could be sustained, but what future earnings growth could be in an economy with aggressively tightening monetary policy.

Together, this confluence of factors produced one of the worst years on record for owners of stocks and bonds. Most domestic equity markets were down on the order of twenty to thirty percent for the year, with the S&P 500 declining -18.1% and the Nasdaq Composite declining -32.5%. Bonds provided little buffer for the equity market weakness, down double digits or more in nearly every category. Both stocks and bonds fell by more than ten percent in the same year for the first time ever, with the traditional 60/40 portfolio also experiencing its worst ever annual performance.

Our performance was similarly dissatisfying. While I would have expected to lose money in a year that unfolded such as this one, given our portfolio orientation toward participating in the upside of equities as owners, I certainly would have liked and expected to preserve our historical tradition of outperforming our primary benchmark comparisons in a down market. However, early year declines in a portfolio that was not positioned for the shocks experienced in the first quarter were too much to overcome, as early losses remained the primary detractor to our annual performance.

For the fourth quarter, our stocks were up ~+7%. For the year, our stocks were down ~-34%, while hedges added ~+3. For the market and our portfolio, December closed much like the year began, negatively. On a more positive note, our purchases of undervalued securities have been rewarded to some degree thus far year, and it is good to see our portfolio off to a strong start to begin the year. Though it is early, it is welcoming and encouraging to see the market beginning to differentiate across equities rather than treating them as one singular asset class. These conditions have proven to be positive developments for our forward performance in the past.

Portfolio Commentary

Our holdings are generally performing as anticipated. As a general statement, despite the potential economic headwinds, we continue to expect growing cash flows, and in nearly all cases operating margin expansion, into next year and beyond.

CROX – Croc’s Inc. continues to execute well as the brand targets continued international expansion and HeyDude continues to benefit from the increased distribution and marketing efforts of the parent company. I am pleased to share our analysis of this company won the 2023 SumZero Top Stocks competition for its category. This write-up is attached and included as Appendix 2. We will be hosting a virtual presentation on this subject on February 9th on the SumZero platform. You can find more information about this presentation here: SumZero.

Industrials – Orion Engineered Carbons (OEC) and Wesco International Inc. (WCC) continue to execute as expected. Both market leading companies trade at single digit earnings multiples and offer strong growth prospects.

Restaurants – Signs suggest our restaurant margin expansion thesis continue to play out as expected, as restaurants have historically been slow to walk back inflation-based menu price increases with their customers by lowering prices even if incoming food costs decline. Papa John’s Inc. (PZZA) and Brinker International (EAT) continue to execute well.

We continue to find new attractive investments, particularly under a broader theme of normalization. Somewhat like our restaurant margin expansion thesis, we are finding ample opportunities in other industries where companies look poised for margin expansion on the back of cost relief from normalizing prices on items such as freight, cotton or merchandising margins.

Outlook

Consumer sentiment and business confidence remain low as businesspeople and market participants continue their preparations for the recession that consensus opinion suggests will emerge this year. To be sure, there is no shortage of negative factors which support this view: inflation remains too high; the lagged effect of tightening monetary policy may induce a further decline in economic activity; geopolitical wildcards remain unpredictable; and the US labor force is rife with fundamental imbalances of supply and demand as a result of pandemic era government policies. Some fear a potential wage inflation / price hike spiral could be on the come – portending high sustained inflation necessitating further interest rate increases beyond those currently anticipated. Layoff announcements have begun and consumer balance sheets, though starting from positions of unprecedented strength, are weakening.

The bear case for domestic equities that embodies these views is fairly straightforward: earnings weakness, primarily driven by contracting operating margins, will be a negative for market cap weighted indices that as a group still looks expensive if earnings do in fact contract meaningfully. This view is built on readily observable cost increases and measurable impacts to margins. It is further supported by quantifiable negative potential impacts to earnings and measurable suggested declines resulting from a haircut to the multiple on which those earnings trade. The bear case, as usual, sounds cautious and prudent. It is finite, supported by facts and figures, concrete and definable and nearly always seems more responsible than the bull case.

By contrast, the bull case for the equity market at large is built around a view that valuations have become more attractive, and maybe earnings won’t quite be so terrible. As if often the case, it embeds some unquantifiable assumption of a capitalistic response to these economic challenges by corporations and depends on their ability to preserve their profitability. It often sounds uninformed, complacent or even irresponsible. Even worse, its best supporting argument is often invisible – literally – as it relies on the antiquated notion Adam Smith’s “invisible hand” that efficiently guides the allocation of limited resources across an economy from one group of self-interested individuals to another, will again come to the rescue and things will get better simply because people want to do better.

So, in today’s case, might it be possible that some recent layoff announcements and deterioration in consumer balance sheets – almost always considered economic negatives – might actually be economic positives? Clearly, a tremendous misallocation of resources has occurred since the pandemic, with today’s critical issues centered around a domestic labor force that is short of supply with many laborers having exited the workforce for one reason or another. Given the considerable economic peculiarities of the pandemic and the recovery thereafter, perhaps these so-considered negatives, could actually be positives as Adam Smith’s invisible hand once again brings supply and demand back into balance by bringing workers back to the labor force in a productive way that dampens the potential for a sustained wage inflation / price hike spiral. And if that were the case, what sort of implications might this have for markets and economies?

This seems a large, grandiose and difficult question to answer, and from my vantage point, one that falls mostly into the camp of interesting food for thought. Though this big-picture thinking does provide some view into actionable investment theses we have been identifying where we see opportunities in areas where we believe costs, margins and multiples are normalizing, it is not our principal focus.

Our primary focus continues to be dedicated to bottoms up analyses of specific stocks. In that regard, many of the themes discussed in recent letters remain the case. Big stocks are expensive; small ones are not. [Please see Appendix 1 for the latest charts that highlight these views.] Trends of disinflation and normalization are at hand. Equity markets have been in a protracted bear market for well over a year now and investor and consumer sentiment remain depressed. We have homed in on a number of selectively chosen equities of businesses that look particularly well positioned to continue to thrive in this environment. I’m pleased with recent portfolio activity and believe if markets are willing to differentiate between equities as an asset class, we are quite well positioned for attractive future returns from here.

Conclusion

Though our asset class of focus has become historically attractive on a valuation basis, I would like to continue to outperform it as we have over time. That is why we run a concentrated portfolio, where we can focus on just a few of our preferred assets within this class. In time, I believe we will again be rewarded for this approach. As we emerge from this bear market, I am quite enthused about our prospects for the years to come.

Accordingly, I know our approach will not yield outperformance each and every quarter, but I continue to believe it will be well worth our while over the long haul. Perhaps more importantly, given the overwhelming majority of my investable assets are invested alongside yours, we would never ask investors to assume risks we ourselves will not.

Thank you for your continued support as we work to grow our capital together. As always, we are happy to discuss our investment outlook with you at your convenience. Please reach out any time. Best regards,

Mitchell Scott, CFA, Portfolio Manager

Footnotes1All market and company data is sourced from Factset and company filings and is current as of 12/31/22. 2CEF uses the S&P 500, Russell 2000 and the Barclays Hedged Long/Short indices as its primary benchmarks. The S&P 500 and Russell 2000 are common large and small cap US equities-based indices. The Barclays Hedged Long/Short index (an index of equities-based hedge funds) serves as an appropriate benchmark over the long-term given the index has a similar long-term goal of capital appreciation through equities investing. 3CEF Net Returns are consistent with the 1% management fee and 18% performance fee offered to clients. |

Appendix 1

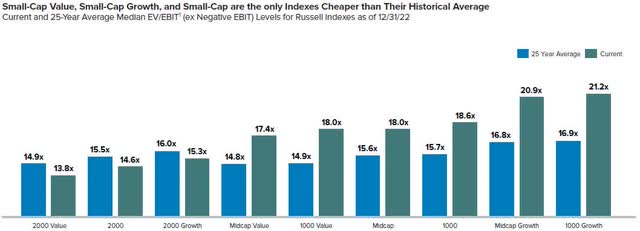

Various Market Indices with Current and 25 Year Average EV/EBIT Multiples

➢ Valuations become more attractive further down the cap scale relative to 25year averages

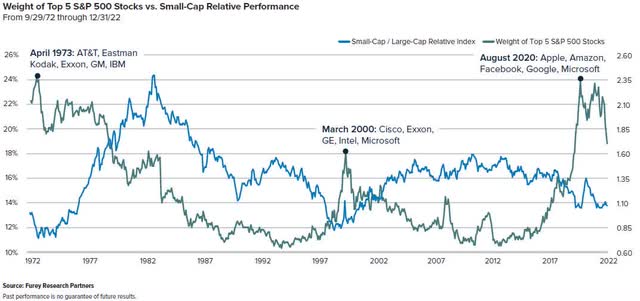

Weight of Top 5 S&P 500 Stocks versus Small-Cap Relative Performance

➢ Prior periods which have been marked by top heavy market cap weighted indices have been precursors to significant and sustained outperformance of smaller stocks valuation versus larger cap peers is near or below 25-year lows

Charts sourced from Royce Investment Partners US Small Cap Market Overview: https://www.royceinvest.com/insights/chartbook/us–small–cap–mrkt–overview/index.html.

Appendix 2

December 1, 2022

Investment Thesis: Crocs, Inc. (CROX)

Crocs, Inc. (CROX: $101.00; $6.2B market cap) is a business that specializes in the design, development, distribution, marketing, and sale of lightweight footwear products for men, women, and children. In recent years, CROX has successfully executed an aggressive turnaround plan designed to create a more efficient organization that can sustain profitable multi-channel global growth, benefitting from larger trends in casualization and personalization. The corporation recently acquired HeyDude for $2.5B, Crocs’ largest acquisition in the firm’s history. The upstart loafer company was poorly understood by investors and the deal was widely panned at the time. However, we believe the acquisition will be highly accretive for the company and adds another complementary product offering to a management team that has demonstrated strong acumen in marketing, distribution, and brand-building.

Today trading at 9.5x PE and an 8.4x EV/EBITDA, we believe shares offer a highly attractive risk/reward dynamic as current valuation incorporates little value for the company’s credible growth prospects that suggest earnings CAGRs well into mid-teens annualized rates or better are quite achievable. In an upside case we find surprisingly defensible, one could envision the company earning $33 per share or more in three to four years’ time with shares approaching $500 at a 15x EPS multiple.

Reason for Opportunity

Many consumer goods companies have come to be regarded as one-time pandemic beneficiaries with investors viewing current margins and recent growth trajectories as unsustainable. Croc’s acquisition of HeyDude likely exacerbated these fears, as the company paid $2.5B for a company most investors hadn’t heard of the time. The payment, made mostly in cash and supported with debt financing alongside ~3M in common shares, was a sizeable one for a company that at the time that was anticipated to generate ~$700M in EBITDA that year. The change in capital allocation strategy and capital structure further necessitated the company pause their existing share repurchase plans. In the midst of a meaningful market selloff, shares were punished, subsequently declining nearly 65% at one point from the beginning of this year.

Variant Perception

Despite some investors holding a stigmatized view of the brand given a prior boom/bust cycle from the 2006/2009 time period, we believe the brand remains quite strong. Over the last ten years, Croc’s legacy brand volumes have grown subsequently each year, with only a modest contraction in one year in 2016. More recently and like many of its peers in the consumer space, today’s low valuation implies the company is a one-time pandemic beneficiary and business prospects offer little growth beyond this year. While it would be ill-advised to suggest the company did not benefit from the pandemic’s effects on consumer spending on goods, we believe this view is incomplete and neglects to incorporate the success the management team has achieved since they arrived five years ago.

Management’s successful plan has reinvigorated the brand and enabled growth across multiple channels prior to the pandemic. Since becoming CEO in 2017, Andrew Rees implemented a strategic plan focused on taking costs out, shrinking SKUs, increasing operating margins, and reallocating capital away from stores to enable greater investments in digital marketing initiatives to drive improved brand awareness. This strategy has been successful, with operating margins up from flat in 2016 to 12% in 2019 and 19% in 2020 on a top-line CAGR of 6% in the three years leading up to 2020.

Importantly, looking forward the legacy Croc’s brand is now positioned with four young growth vectors alongside a strong brand in its more mature market (the US clog) that is still growing at a healthy clip. The four major growth drivers currently for its legacy brand are across underpenetrated geographies in both AsiaPac and EMEALA and across underpenetrated product lines in Sandals and Jibbitz. Lastly, the recent HeyDude acquisition offers meaningful promise moving forward. CROX has just begun to integrate this brand using the same formula that drove its legacy brand’s growth over the last few years. We believe that HeyDude has the potential to eventually become an even bigger brand than its legacy products.

The Business

What it is – CROX is a leading designer, manufacturer, and marketer of a distinctive line of casual footwear and accessories for men, women, and children. The company’s Crocs brand is well known for its unique line of molded footwear that is focused on fun, comfort, color, and functionality as key brand attributes. The products utilize a proprietary closed-cell resin (“Croslite”) that enables the footwear to be lightweight, non-marking, and odor resistant. CROX also allows consumers to personalize their shoes with Jibbitz. Jibbitz are a smaller add-on item that comes in the form of letters, numbers, characters, or images that attach to the clog. CROX also now owns the HeyDude company, a high-growth, young brand focused on comfortable and casual loafers.

Market dynamics – CROXis best known for its classic clog shoes. The company’s products are sold across more than 65 countries globally via a network of third-party wholesale partners and distributors as well as the company’s direct channels that include retail stores, outlets, E-Commerce channels, and kiosks. The company has smaller businesses in sandals, personalized Jibbitz, and comfort technology. Crocs sell its products in more than 125 countries, through three distribution channels: wholesale, retail, and e-commerce.

Corporate history – Most recall Croc’s original success as having come pretty much out of the blue, as the funny looking but comfortable clogs sent the stock on a meteoric rise shortly after its IPO in 2006. Many also conflate the stock chart with a fad-driven boom and bust cycle, even though a closer look at clog volumes actually shows fairly consistent growth over the last twenty years. Even so, the company was not without its problems, primarily from management missteps as an overburdened cost structure created profit headwinds. Accordingly, when Andrew Rees became CEO in 2017, he initially focused his efforts on taking costs out and making the operation more efficient. He shrunk the store count by more than a third and began optimizing their go-to-market strategy by emphasizing sales through the direct-to-consumer digital channel and through wholesaler channel partners. This enabled the company to devote greater resources to product innovation and marketing, a smart reallocation of corporate resources that offered great payoffs for the branded consumer products company.

Investment Considerations

Strategic initiatives have driven strong results – In recent years, CROX has implemented a strategic turnaround plan intended to create a more resourceful business that can maintain profitable multi-channel global growth for the long term. Over the years CROX has been successful in streamlining the global product portfolio, prioritizing direct investment towards larger geographic markets, reorganizing the business structure, and rationalizing underperforming retail units. Today and prior, the progress has been most evident in the domestic market but has been gaining momentum within Europe and is being applied within China, which is expected to accelerate in 2023. Looking ahead, CROX has outlined plans as a stand-alone company (prior to announced plans to acquire HeyDude) to reach $5B+ in annual revenue by 2026 (17% CAGR).

Distinctive product placement – The core Crocs formed footgear style and the iconic clog outline is widely familiar universally as comfortable, functional, and fun given the versatility of the company’s proprietary Croslite material that allows for many different color and design variations. The current global strategies have aligned around driving enhanced relevance for classic clogs, which is currently an estimated $8B total addressable market (~71% of 2020 CROX sales), driving awareness for sandals, roughly a $30B+ global market (~16% of 2020 CROX sales), and enhancing visible cushioning technology such as LiteRide & Reviva. Over the last few years, the company has expanded brand awareness with distinctive digital marketing campaigns, partnered with celebrities & influencers, and perpetuated the shoe’s relevance by collaborating with popular household brands, while also increasing the opportunities for personalization.

Becoming a two-brand organization– In late 2021 CROX announced plans to acquire HeyDude for $2.5 billion in a deal that closed in February of this year. HeyDude is a casual footwear brand founded in Italy in 2008 that focuses on comfortable and lightweight footwear that is versatile enough to be worn for multiple occasions. The company is digitally-led with online sales accounting for roughly 30% of sales, while still largely a domestic brand with >95% of revenues from the U.S. To date, the brand is most popular in the South and Midwest regions. Current brand awareness remains low at just ~20% and CROX sees the opportunity to apply a similar playbook that has proven successful to drive HeyDude awareness closer to Croc’s current levels of ~92%. The brand is expected to generate Pro-forma revenue of $850-890 million in 2022E and to grow 20%+ over time, with an operating margin expected to sustain 26% after incremental investment.

Expanding margin structure – Management expects sales increases over time along with targeted cost reductions associated with its performance improvement plan to lead to higher operating margins over time. The company recently released long-term targets of 26%+ adjusted operating margin seen by 2026.

Improving the DTC segment and enhancing distribution – DTCoperations reached 50% of total revenue in recent years with total digital penetration across owned E-Commerce and third-party e-tailers reaching 41.5% in 2020.

Balance Sheet / Capital Allocation – CROX currently has $143 million in cash & short-term investments, along with $2.62 billion in debt. Recent increases in the company’s debt load are attributable to the borrowings used to finance a portion of the HeyDude acquisition earlier this year. Management has stated that they are committed to quickly deleveraging and targeting to be below 2.0x gross leverage by mid-year 2023. Once the firm has reached this stated goal, the company plans to reengage in its existing share repurchase program.

Ownership / Management – CEO Andrew Rees took over the top job in the middle of 2017. Previously, Rees was a consultant working on a growth plan assignment for Crocs and soon thereafter moved to the company in the Role of President in 2014, before ascending to the CEO position. As CEO, he has refocused the company on core lines, slimmed down the company-owned store portfolio, and done an impressive job on the marketing and branding front.

Growth Prospects

We view the legacy Croc’s brand as having five critical growth vectors, four of which are just hitting their stride. Additionally, the HeyDude acquisition offers the company an entry into a significantly broader category with one of the fastest-growing brands the space has seen in quite some time.

Americas – Even though the CROX legacy brand is no longer in its nascent growth phase within the Americas, management has proven adept at driving continued engagement with customers through consistent product innovation. The company is continuing to create new silhouettes to reach new consumers and increase its overall margin profile. CROX plans to remain committed to doing collaborations and to license out popular influencers or trends to keep their products within the mainstream realm of pop culture. One of the biggest potential growth drivers for the CROX legacy brands is its product innovation and its expansion into the sandals category. Sandals currently represent a very large total addressable market as previously mentioned and can appeal to a different subset of consumers that don’t favor the traditional Crocs clog silhouette. Management has stated their goal is to grow the sandals business by 4x to $1.2B+ in annual revenues in coming years.

AsiaPac – Management’s goal within the region is to see a long-term growth rate of ~25% through 2026. For context, during the most recent quarter revenue growth in this region was +82% on a constant currency basis. This strong growth was broad-based across India, Southeast Asia, Japan, and South Korea. Over the past few quarters, the South Korean market has been particularly strong. Typically, consumer brand preferences within the region can be made or broken in South Korea and tend to be a trendsetter. We are encouraged to see that this market has shown strength thus far. Management has also stated on its most recent earnings call that they expect this region to be a large growth driver as consumer demand trends (particularly in sandals) are projected to accelerate in the next few years. China also continues to be underpenetrated and could provide an additional boost in increased revenues. The country is currently the second-largest footwear market behind the United States. As of last quarter, less than 5% of CROX revenue is derived from China. CROX expects to execute this plan by increasing brand awareness with brand ambassadors and key opinion leaders, while also making investments in brand relevance, digital capabilities, and talent. The company also has strategic initiatives to augment its distribution network within the region, while also opening up stores throughout the geography tactically. The board of directors views this segment as a priority for growth as the latest management incentive plans specifically highlight growth for its sales in China.

EMELEA –Within Europe, Middle East, Africa, and Latin America, consumer demand trends continue to increase. Last quarter, revenues increased by ~$132M on a revenue growth rate of 45.6% on a constant currency basis and now represent roughly 19% of Croc’s legacy brand sales. Based on our recent conversation with management, CROX is seeing very strong momentum in the UK and France. Its most mature market within the segment is Germany.

Currently, operating margins are lower in this region in comparison vs. the more mature Americas division. This has been due to a function of scale, timing in volume increases, and the more recent go-to-market strategy. As this region matures, the profitability metrics should start to close the gap with the figures seen in the Americas segment. Within these regions, CROX will also have the opportunity to take pricing in the next few years and to increase its Jibbitz sales significantly.

Jibbitz – Another large area of growth potential for the company is to increase its personalization opportunities through Jibbitz. CROX has seen Jibbitz grow from $35M in 2019 to $65M in 2020 and to $162 in 2021. The company expects that Jibbitz should double in revenue by 2026. Jibbitz charms range in price from $5 to $20 for more complex sets and drive high levels of engagement and frequency of purchase because they allow the shoe to be transformed depending on the contexts and moods of the buyer. Based on our recent discussion with management, Jibbitz costs cents on the dollar to manufacture. CROX enjoys licensed partnerships with Disney (Marvel and Lucasfilm) Warner Bros, Nintendo, and Nickelodeon and have recently participated in collaborations with brands such as Vineyard Vines and KFC. Jibbitz has assisted CROX in accelerating its operating margins and helps keep current footwear owners engaged with the brand. Jibbitz remains underpenetrated in markets abroad like Europe and Asia and has a large opportunity to generate outsized growth in markets outside of the United States.

HeyDude – The company’s December 2021 purchase of HeyDude was initially unwelcome by investors. Despite the initial share price reaction, the HeyDude acquisition looks quite promising, particularly when considering the company catapulted to half a billion dollars in sales and a low 30s EBITDA margin in just over a decade’s time. Over the last three years, sales have grown from $191M in 2020, $580M in 2021, and will grow to $960M in 2022, while achieving 30%+ EBITDA margins in that same time frame. During the most recent quarter, HeyDude’s revenues exceeded expectations with $269M in sales last quarter with adjusted operating margins of 29.3%. Over the next few years, CROX believes that the brand will generate $1B+ in annual revenues with an annualized growth rate of 20% through 2026. Management plans on investing in industry-leading marketing to build brand awareness, enhance digital capabilities for further acceleration, and leverage the existing CROX network. The company has brought in industry veteran and former President of Sperry, Rick Blackshaw, to lead the new division. Mr. Blackshaw is a well-regarded industry veteran with over 25 years of experience in the business.The brand only has 20% awareness and is popular in the Midwest and Southern regions. The shoe has yet to hit the East and West coasts in a meaningful way and has no international presence. With an estimated $120B TAM loafer market, the HeyDude brand has a long runway for continued outperformance.

Valuation

Analyst coverage is robust, with 11 different bank analysts currently covering CROX. The stock is trading below its category peers on a P/E basis, though we believe current multiples reflect little of the anticipated EPS growth.

|

Price |

EV |

EV/Sales FY23 |

P/E FY23 |

EV/FY23 EBITDA |

|

|

SHOO |

$34.53 |

$2.55B |

1.2x |

12.3x |

8.7x |

|

DECK |

$399.02 |

$10.14B |

2.6x |

18.5x |

13.1x |

|

SKX |

$42.18 |

$6.61B |

0.8x |

11.0x |

7.8x |

|

NKE |

$109.53 |

$168.93B |

3.2x |

29.1x |

21.9x |

|

CROX |

$101.00 |

$8.71B |

2.2x |

9.5x |

8.4x |

Prospective Returns

Overall, we believe that CROX presents a compelling upside over the next 3-5 years as their business continues to grow due to their recent HeyDude acquisition and the natural growth of their core brand. Over the recent six to eight quarters, gross margins have increased due to a lack of discounting because of supply chain constraints the company experienced. For our estimates, we are assuming a normal pace of discounting will return, however, we also believe this can be somewhat offset by the airfreight costs that were incurred over recent months because of limited containership availability.

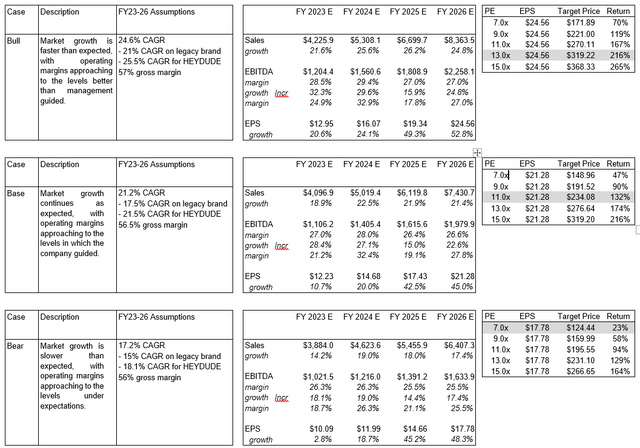

In our projections, the base case assumes that in 2026 CROX can produce revenues of just over $7.4B, with an EBITDA margin of 26% by 2026, along with an annualized top-line growth rate of 21% over 2023 through 2026. Our base case for CROX legacy product revenue growth includes 2023-2026 CAGRs of 14%, 18%, and 27% in North America, EMEALA, and Asia Pacific. In addition, we break down these assumptions further and estimate that clogs will grow at a CAGRs of 15%, 26% for sandals, and 19% for Jibbitz. Lastly, in our base case assumption, we estimate that HeyDude will reach $2.4B in sales by 2026.

We note all our projections exclude potential share repurchases. However, in the past the company has been an active acquiror of their own shares and has stated they will likely resume purchases once their gross leverage again falls below 2x. From 2.5x currently, management estimates their leverage ratio will approach these levels within a quarter or two, sometime next spring/summer. In the upside case we alluded to in the summary introduction, a ~20% shrink in the share count would produce EPS at or above $33 per share in 2026. At a 15x PE multiple, we find this to be a surprisingly defensible upside scenario for shares to approach the $500 level.

Our Base case price target assumes a P/E multiple of 11x on 2026 projections based on the similar levels where its peers currently trade. Based on the assumptions above, we project a four-year price target of $232.

Our Bull case price target assumes a P/E multiple of 13x on 2026 projections based on an additional valuation increase as execution is better than expected. Based on the assumptions above, we project a four-year price target of $319.

Finally, our Bear case price target assumes a P/E multiple of 7x in 2026 under the assumption consumer trends and purchasing habits of CROX consumers have been negatively altered. Based on the assumptions above, we currently have a four-year price target of $124.

Risks

- Global consumer slowdown: CROX’s sales slowed during the 2008-2009 recession and the company could remain vulnerable to future swings in the overall economic position of its core customers.

- Competition: CROX operates in a highly competitive environment and must produce differentiated products at competitive price points to maintain and grow its market position.

- Fashion preferences: Changing fashion trends and consumer preferences can have a substantial impact on the CROX brand and the ability of the company to generate sales.

- Managing input costs: Fluctuations in key input costs, including raw materials, labor, and transportation could adversely impact profitability.

- Integration: CROX needs to continue successfully integrating the HeyDude brand including hiring to support key functions required to drive the financial projections for the business.

Catalysts

- China reopening: If China were to experience a snapback to a pre-covid environment, this could help accelerate CROX’s expansion plan within the region.

- Reinstatement of the buyback: Should the HeyDude integration come to fruition quicker than anticipated, this will allow the company to reach its targeted debt levels and reinstate the stock repurchase program.

Increases in consumer confidence: One of the worries hanging over CROX is that customers may be feeling pressure from external inflationary forces. Should the macroeconomic situation change, this may be a positive catalyst for the company.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment