bhofack2/iStock via Getty Images

Bill Ackman’s Pershing Square recently released a bullish thesis on Chipotle (NYSE:CMG) stock, citing “shareholder value creation” as a catalyst. Having looked at the stock holistically, we also believe Chipotle provides appreciative value for money as its fundamental growth metrics are aligned due to its impressive operating leverage.

Furthermore, we think Chipotle is a “best-in-class” consumer staple stock to buy in the current environment and therefore assign a strong buy rating to the stock.

Operational Growth In-Sync

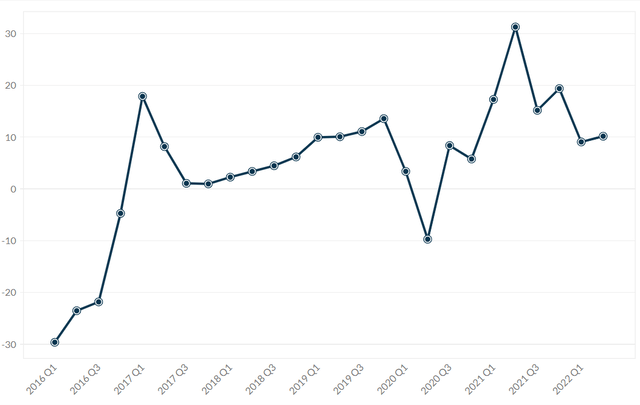

The big talking point surrounding Chipotle’s current financial performance is its impressive comparable store sales. The company’s second-quarter results convey that its comparable sales grew once more, surging by 10.1% year-over-year.

Business Quant

Chipotle’s comparable sales growth is accompanied by a 2.3% year-over-year widening in income from operations, a 3-year sales CAGR (compound annual growth rate) of 16.20%, and a gross profit margin of 38%. Cumulatively these metrics suggest that the company’s formulating a secular growth pattern, providing much reason for investors to keep an eye out for Chipotle stock.

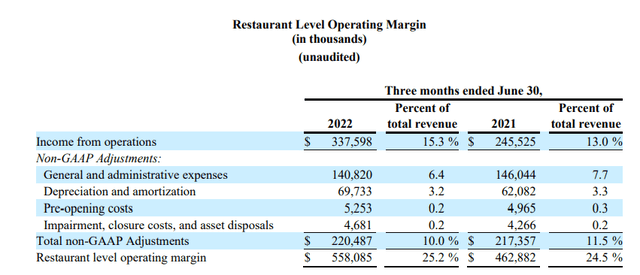

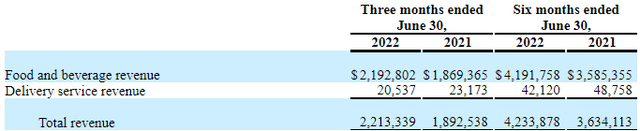

Chipotle

We believe Chipotle’s competitive advantage stems from its ability to offer high-quality food at affordable prices. In addition, the company’s menu is suitable for dine-in and takeaways. As such, Chipotle’s able to leverage its in-store presence and the food delivery space (which is growing at a CAGR of 12%).

Chipotle

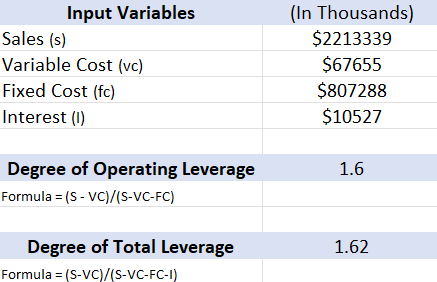

I constructed a spreadsheet containing Chipotle’s operating and total leverage ratios with the view of analyzing the firm’s operational efficiency. The degree of operating leverage ratio paints a picture of a company’s sensitivity to change in revenue, while the degree of total leverage measures the company’s net income sensitivity relative to sales.

Essentially we’re looking at 1) what effect a potential convergence of sales and input costs will have on the company’s income statement and 2) how well the company’s capital structure adapts to changes in sales.

Based on my model, Chipotle’s bottom-line/s isn’t extremely sensitive to changes in its top-line sales. Generally, this conveys a safety net against any macroeconomic headwinds. In addition, the company’s capital structure shows that it’s more than capable of handling a systemic shock.

Pearl Gray Equity and Research; Seeking Alpha

Just a few sidenotes on my computation.

I backed out depreciation & amortization as well as impairments, closures, and asset disposals. Additionally, I split pre-opening costs equally between fixed and variable.

If you’d like to corroborate or do your own computation, see the financial statements here (link).

Valuation

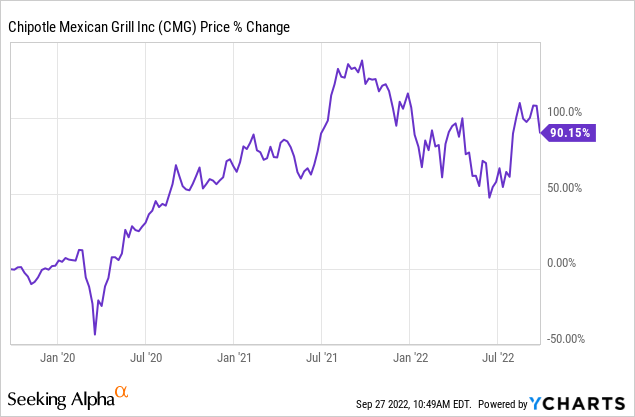

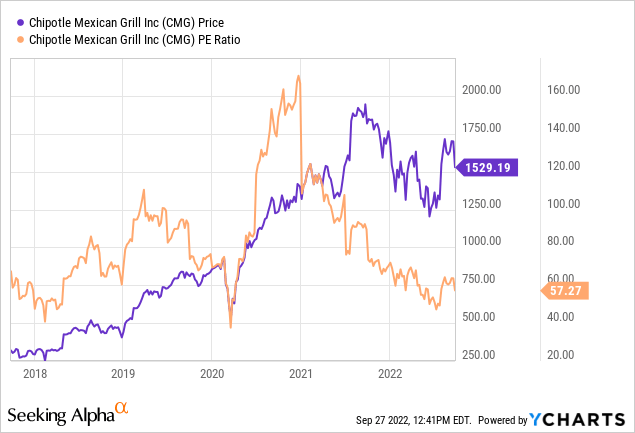

It would be easy to look at a bunch of stationary price multiples and conclude that Chipotle is overvalued at a GAAP price-to-earnings ratio of 57.43. However, the fact of the matter is that Chipotle stock’s performance isn’t well described by its price-multiples (see graph below).

Based on our observations, Chipotle stock’s success is driven by two primary factors, 1) profitability and 2) growth. The company’s key profitability metrics suggest it’s in sublime shape.

The company’s return on invested capital ratio of 17.64% communicates that it monetizes its working capital advantageously. In addition, Chipotle’s return on common equity of 34.94% conveys the company’s knack for delivering extraordinary residual returns to its ordinary investors. Lastly, a 3-year EBITDA CAGR worth 25.45% tells us that Chipotle’s adding to its underlying fundamental value at an exponential rate.

| Return In Invested Capital | 17.64% |

| Return On Common Equity | 34.94% |

| EBITDA 3-year CAGR | 25.45% |

Source: Seeking Alpha; GuruFocus

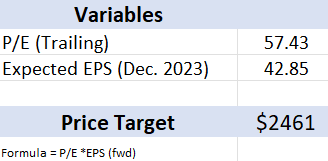

I opted to utilize an earnings-based price target as a means of valuation. The formula might look oversimplified, but it’s a handy trick. By multiplying the trailing P/E with analysts’ expected earnings per share, we’re able to derive an implied price target.

Based on my parsimonious calculation, Chipotle stock could reach a price target of $2461 by December next year. Ideally, you should take this price target with a pinch of salt as numerous other variables need to be considered; however, it’s a valuable indicator.

Pearl Gray Equity and Research; Seeking Alpha

Risks Worth Considering

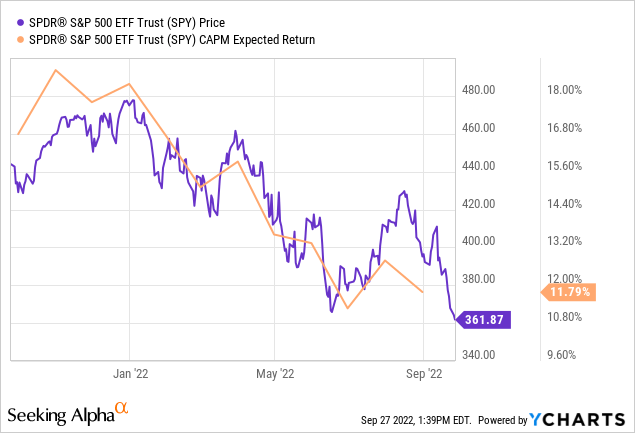

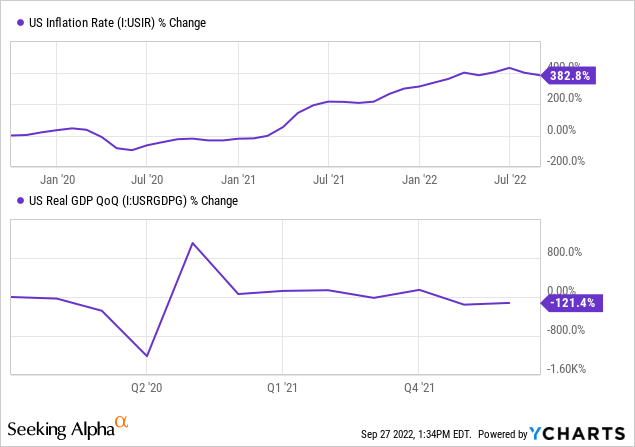

The most prominent risk for Chipotle is the volatile global economy it’s faced with. All enterprises and stocks will inevitably be sensitive to a deep recession and a bear market. Based on key economic variables and the stock market’s risk premiums, all equity securities are at risk for the time being.

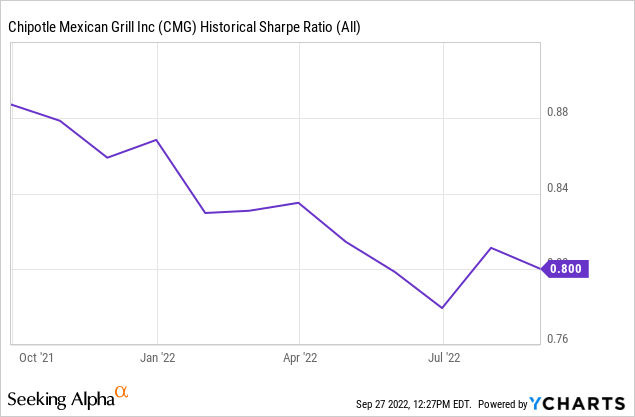

Furthermore, Chipotle exhibits statistical concerns. The stock’s Sharpe Ratio falls below 1, meaning its historical risk-return profile is questionable. Therefore, the stock is at high risk of underperforming in a risk-embedded market.

Final Word

Chipotle seems like an outlier in today’s market. The stock’s trading at a significant discount due to the company’s outstanding operating leverage, comparable store sales growth, and persistent profitability.

After weighing the stock’s risk versus return variables, we assign a strong buy rating to Chipotle.

If you’re interested in more advanced analysis, be sure to keep an eye out for our marketplace program, “The Factor Investing Hub,” which launches soon. FIH is an AI-driven “smart beta/factor investing” portfolio management concept with the goal of balancing long-term portfolios relative to “factors.”

Be the first to comment