Feng Li/Getty Images News

Overview

Here I analyze the evolution of the Chinese domestic new-energy vehicle (“NEV”) market, with a focus on vehicle segments (size and SUV/sedan). Next, I dig deeper to highlight the players in the expanding compact vehicle “A” segments, particularly BYD Company Limited (BYDDF, OTCPK:BYDDY) (“BYD”) and the Guangzhou Auto Group’s (OTCPK:GNZUF, GNZUY) Aion brand. XPENG (XPEV, XPNGF) and VW (OTCPK:VWAGY, VLKAF, VWAPY) also have a good presence there.

This contrasts with the declining A00 (GM via GM Wuling) and “B” midsized segments (Tesla [TSLA] and Nio [NIO]). The “C” full-size segment has 3 significant players, BYD (as always!), Li Auto (LI), and VW.

I then consolidate this at the firm, highlighting the broad coverage of BYD and Geely (OTCPK:GELYF, GELYY) and the emerging strength of VW.

I conclude with cautions based on short-run and long-run headwinds faced by the Chinese motor vehicle industry.

Note my focus is on sales, not on financial health or stock valuation, and I don’t look at automotive suppliers (which has been my research focus as an academic economist and consultant). My reading is that the market is driven by growth expectations, so this analysis is crucial background for anyone following one or another. Oh, and as should be obvious, I read Chinese, and followed / taught about the Chinese economy for 30 years.

Segment Trends

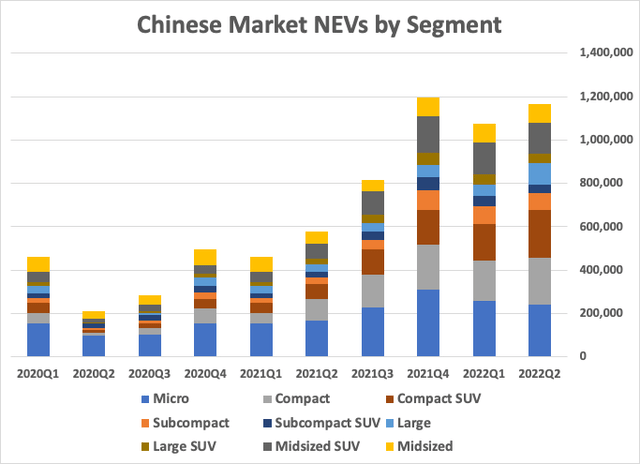

Well, let’s dive into it. First, here’s the market evolution by segment, in absolute terms. The main visual takeaway is overall market growth, peaking in 2021Q1, and the absolute decline of the A00 minicar segment on the bottom.

Author’s database and calculations.

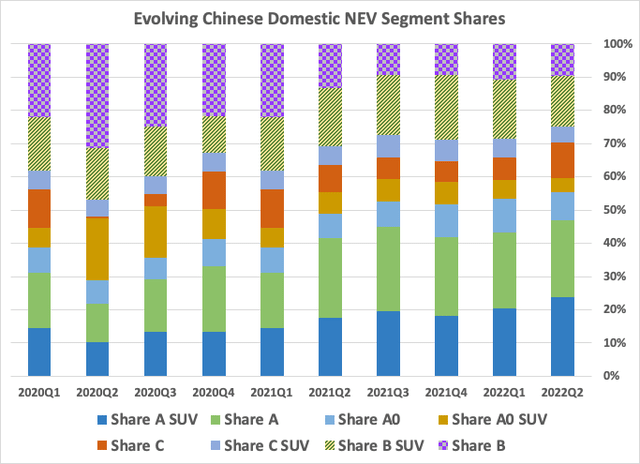

To make it easier to digest, here is the same chart turned into market shares. To lessen visual overload, I removed the declining minicar segment.

Author’s database and calculations.

Compact vehicles

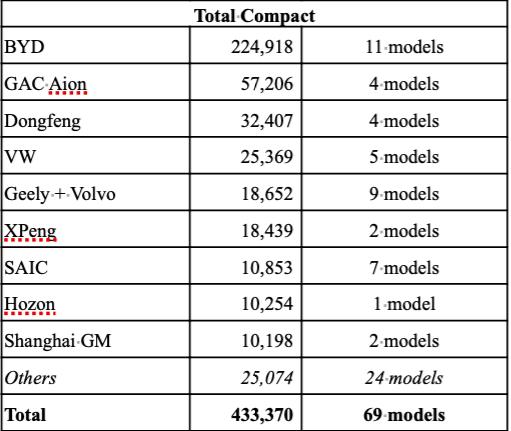

The takeaway here is the growth of the compact “A” segments, and the shrinking of the midsized “B” segments. So let’s break those down in more detail. Rather than provide a list of all models, I consolidated into firms with over 10,000 segment sales in 2022Q2. (I can share spreadsheets with any reader who really wants added detail.)

Author’s database and calculations.

While the segment has lots of available products, average sales are 6,500 per model; if we drop all the minor sellers, average volume rises to 9,250. Now quarterly sales of 50,000 are needed to keep a standard 240,000 a year assembly plant operating at a profitable level. So most players are still far from that level, though they can potentially make NEVs and internal combustion engine vehicles (“ICEs”) in the same plant That’s not enough to keep capacity utilization at an assembly plant at a profitable level,

The standout is BYD, with a broad array of models, some new, some being phased out; GAC’s Aion NEV-only brand also stands out. Both Dongfeng (OTCPK:DNFGF, DNFGY) and SAIC earn the majority of the profits from joint ventures, and have long rested on those laurels. I wouldn’t suggest investors look deeper. Xpeng, of course, is a new venture with shares listed in the U.S. I, however, have liked Geely/Volvo product, and believe they have brand value that permits healthy pricing, even if I am put off by the complexity of the Geely group. Finally, the VW group is rapidly expanding EV offerings in China, and have product well-placed given the expansion of the compact segment.

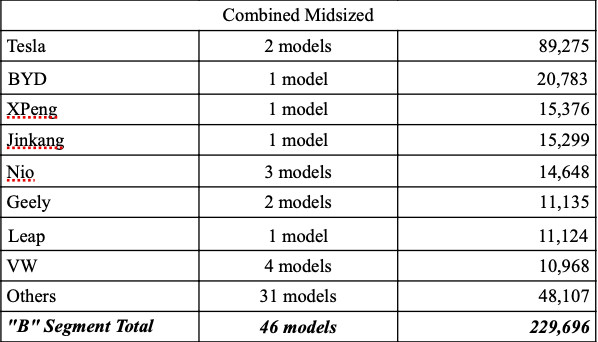

Mid-sized “B” vehicles

The mid-sized market is smaller, but has a lot of models; sales average only 5,000 per model. Drop the bottom 31 models, and that rises to 12,000 per model. That is somewhat better than the compact segment, but it still imposes a challenge for any firm running an EV-only factory.

The bigger challenge is that things have not been improving. Because of lower incomes and more congested roads, the market in China is for less expensive with smaller vehicles. A compact model suffices to put parents in front and a son and a pair of grandparents in the rear. (Despite the end of formal fertility restrictions, the urban norm has been one child since 1970, and that remains the norm in China’s now-majority urban population.) From another direction, cars in the Tesla price segment are only about 10% of the market. So (with hindsight) it should be no surprise the “B” segment isn’t expanding.

Now to the data:

Author’s database and calculations.

As well known, Tesla dominates the segment. However, going forward (as I argued on SA in January), the market is shifting to sedans. Adding two quarters of data to my earlier analysis reinforces the challenges that the Model 3 faces. BYD doesn’t offer a mid-sized sedan, only one good-selling SUV. Xpeng has a sedan that has been on sale since June 2020, but is still doing OK. Nio, however, has all its eggs in this one, limited, basket. For startups, expanding sales is critical, and the “B” segment is not the place to be. Note Geely and VW are both present; theirs is a broad product portfolio that insulates them from a single segment facing excess competition or falling out of favor with consumers.

Other Segments

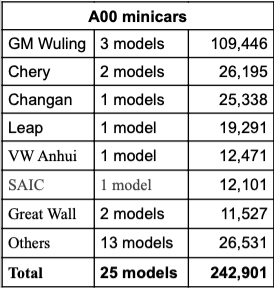

Briefly, the A00 segment is shrinking, but volumes are high. For the segment as a whole, 2022Q2 per model sales averaged 9,700, and excluding the bottom 13, the average rose to almost 19,000. That’s enough to keep capacity at a profitable level, but small cars mean small profits. With the segment shrinking, it’s not a great place to launch new models.

Author’s database and calculations.

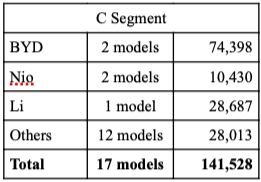

Now the “C” segment tends to luxury vehicles, with different pricing and hence lower economies of scale. BYD does well, one reason that the firm overall earns money; Li One’s only model is in the segment, and is now generating a reasonable annual volume for a higher-end vehicle. Geely and VW fall below my 10,000 unit threshold; what matters is that they are covering multiple market segments.

Author’s database and calculations.

Summary

Segment Analysis

Cars are a highly differentiated, durable consumer good. Style matters, so launching new products on a regular basis. (BMW (OTCPK:BMWYY), for example has built its factory and marketing cadence around 3 launches a year, year in and year out.) A broad portfolio matters, both because consumers are fickle, but also because it provides more opportunity to convert a shopper into a purchaser, with the potential to move up or down a segment, or offer an SUV instead of a sedan.

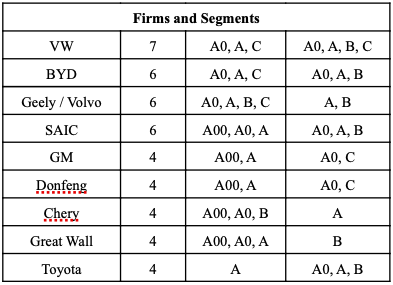

So, who are the strong players? – I only focus on the firms in a large number of NEV segments, and ignore ICE’s, which after all remain the majority of the market.

Author’s database and calculations.

I have 3 takeaways from this. First, global OEMs have a steady stream of new product under development, and a global sales base to cover the overhead. BMW, Mercedes, Honda and Hyundai/Kia will all leverage that for the Chinese market.

Second, the old state-owned enterprises have been overly dependent on joint venture partners for profits, and are at last being proactive if not entrepreneurial. They bring to the table scale and longstanding experience developing new vehicles, and years of experience running modern assembly plants.

What remains to be seen is whether they also have the ability to market and not just make vehicles, and to do so profitably. Part of this is expanding outside their home base – GAC Aion sells very well in Guangzhou and surrounding provinces, but fares poorly in Beijing and Shanghai. (BAIC, GAC, and SAIC are owned respectively by the municipal governments of Beijing, Guangzhou and Shanghai.)

The other firms – Geely, BYD, Great Wall – are private and must make money to survive; none run joint ventures. Geely purchased Volvo from Ford, turned it into a profitable company, and leveraged Volvo’s development team and supply base to move their product upscale. BYD began as a battery manufacturer and only later moved into automotive, with a focus from the start on electric buses and then passenger vehicles; branding is a weakness. Great Wall was a commercial vehicle firm that made an off-road utility vehicle. They spotted the move to SUVs in China ahead of both domestic and global rivals, and have developed from that base. These are the three domestic firms to watch, not the startups.

Headwinds

Today’s news trumpeted a new record for NEV sales of 565,000. So NEVs are on a roll, right? Maybe not.

Long-run trends

China’s auto market peaked in 2017: economic growth is slowing, the working-age population is falling, and countryside-to-city migration has ended. In this, China is following in the footsteps of Japan, which today has a falling population, slow GDP growth, an empty countryside, and a declining domestic auto market.

For those following NEV players – which now means most of the motor vehicle industry – future gains thus come from “conquest” sales of NEVs relative to ICEs. My next article will examine the unusual geography of the auto industry, where sales differ across regions. (That is said from an American perspective, as the European car market maintains a distinct national and regional characters.)

NEVs are primarily urban vehicles; those markets are becoming saturated. As elsewhere, only a limited, more prosperous segment of the population buys new vehicles. China is now a replacement demand market, so car owners need to sell their existing one to buy their next set of wheels. That segment is also more likely to live in a higher-end condominium with dedicated parking. The rest of the population – excepting much poorer rural residents – is far less likely to have access to overnight charging. That will limit the used car market and feed back into slowing the expansion of NEVs.

Battery prices will also be a limiting factor through the end of the decade. Mines take a long time to develop – hard-rock mines a full decade and often much more – but car companies have ignored this, and only now is the mining sector gaining access to funding. Using LFP batteries only partially offsets this.

So, relative prices for NEVs will remain high. Very large indirect subsidies – free license plates in Shanghai that are worth $14,000 and give access to the urban center – obscure this. (See the section “Who buys an EV, and why?” in China’s Electric Vehicle Market: Many Losers, No Big Winners | Seeking Alpha.) With 50% or more of sales now EVs, Shanghai will need to pare back such freebies to ease congestion, while NEV sales will cease to grow faster than the overall market – which is not expanding. Sooner rather than later, the long-run stagnation of the Chinese market will rear its ugly head.

Short-run trends

The economy faces numerous headwinds in the next 2 years. First, the real estate market is imploding. In an economy where household investment options were limited, a disproportionate amount of savings flowed into the purchase of condominiums. The largest player Evergrande (OTCPK:EGRNF) has collapsed, and numbers of small banks have gone belly-up. Unlike in the U.S. Savings-and-Loan debacle, depositors are frozen out. Furthermore, local government finance relies upon land sales (through LGFVs). Their financial straits mean that, unlike in 2008-2010, public works expenditures won’t pick up the slack. The central government in Beijing is not turning on the spigots, either, as it has its hands full trying to bail out financial markets.

Then there’s COVID-19, or more properly SARS-CoV-2, as China also was hit by a SARS-CoV-1 outbreak in 2002-2004. Now, in 2003-4, a combination of contact tracing and targeted quarantines quelled the SARS outbreak. The same measures were effective in spring 2020 against the initial strains of COVID-19. That led to a perception that the pandemic could be stopped, but current strains (BA.5 variants) are far more transmissible. In the meantime, the Chinese population is under-vaccinated, particularly among the 185 million who are age 65 and over. China also has high rates of smoking and diabetes. Even with lower morbidity than the initial COVID-19 strains, a wave of infections would overwhelm an already strained healthcare system, leading to a surge of excess mortality from the pandemic and from “ordinary” health issues that would go untreated. Oh, and panic.

So the government has painted itself into a corner. With Xi’s pending coronation this fall, local government officials will continue to err on the side of political caution. Lockdowns will continue.

Given the ongoing economic downturn, the government is pushing car sales. It’s not clear yet what that will mean in practice, and whether it will be enough to offset lower incomes and much lower wealth.

Finally, China has not been immune from chip shortages; Chinese drivers want vehicles with airbags, and automatic emergency braking, and other sensor- and processor-intensive features. As elsewhere, this has boosted profits by dinting supply. That’s been a short-run positive for the industry, but won’t continue. Firms not currently profitable, in these best of times, face a grim future.

Afterword

This being Seeking Alpha, I need to point out the absence of Tesla in much of the above discussion. They’re trapped in the strategically weak but competitive “B” segment, and as new competition enters their niche and chip supplies improve, they will be forced to trim margins. They have a thin product lineup, with only 2 vehicles able to sell in enough volume to be relevant to their top and bottom line. They have no new vehicle for the China market; the California-oriented Cybertruck is a non-starter. Going forward, Tesla will need to rely on exports to keep the Shanghai plant profitable. That means Europe. I’ll leave to others the prognosis for continued strong MIC sales there. What is clear is that the domestic Chinese market is not enough to support their growth story.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment