Klaus Vedfelt

This is my first look at Chimerix (NASDAQ:CMRX) which drew my attention after its recent 11/2022 Q3, 2022 earnings call (the”Call“).

Chimerix’s TEMBEXA deal has been virtuosic.

TEMBEXA (Brincidofovir, CMX001) has had an extended and occasionally painful birthing over the years. It has been in 22 clinical trials recorded on clinicaltrials.gov since its initial 2008 24 participant trial assessing its bioavailability in tablet form.

As reported in Chimerix’s latest (Q3, 2022) 10-Q, it secured an initial BARDA development award in 2011. BARDA’s interest in TEMBEXA remains in force to this day as I will discuss.

Those with long memories may remember the brouhaha in 2014 surrounding Chimerix’s maladroit handling of pleas from the parents of a dying child for access to the drug. Later in 12/2015, it was back in the “bad” news for therapeutic challenges in treatment of hematopoietic cell transplantation patients.

As the years passed Chimerix righted the ship. In 04/2020 it received FDA clearance to pursue a rolling submission of its New Drug Application [NDA] for the approval of brincidofovir as a medical countermeasure for smallpox. It promptly completed the rolling submission later in 2020.

It filed its NDA in 10/2020 with a major amendment in 01/2021; these filings were duly accepted. Its initial PDUFA was set for 04/07/2021 which was delayed by the major amendment to 07/07/2021. On 06/04/2021 it received FDA approval for TEMBEXA in the treatment of smallpox.

Allowing little time to pass from its approval, Chimerix announced a major disposition deal in 06/2022 with Emergent (EBS); the deal was nominally valued at $337.5 million plus royalties. It called for $225 million out front. It was predicated on:

- an anticipated procurement contract between BARDA and Chimerix,

- as well as receipt of any required consent from BARDA to a pre-novation agreement to be entered into with Emergent.

The deal closed in short order on 09/26/2022. As described in the Call, Chimerix was able to negotiate an increase in the out front payment to $238 million based on late-stage negotiations with BARDA.

With TEMBEXA closed, Chimerix is ready to focus on final development of its lead therapy.

ONC201, being investigated in treatment of H3 K27M-mutant glioma, as shown on Chimerix’s Q3, 2022 pipeline presentation (the Presentation”) (slide 4), is its lead therapy. It acquired ONC201 with its 2021 $78 million acquisition of Oncoceutics, Inc.

Its release describing the deal noted that ONC201 was expecting data in 2021 to support a clinical trial in a filing of a $500 million opportunity. It also noted that it had acquired the following indications from the FDA:

- Fast Track Designation for the treatment of adult recurrent H3 K27M-mutant high-grade glioma;

- Rare Pediatric Disease Designation for treatment of H3 K27M-mutant glioma, and

- Orphan Drug Designations for the treatment of both glioblastoma and malignant glioma.

It described the following development path for the drug:

The current Phase 2 clinical program for ONC201 includes a 50 subject registration cohort comprised of patients greater than 2 years of age with recurrent diffuse midline glioma that harbor the H3 K27M mutation, that have measurable disease, received radiation at least 90 days prior to enrollment and displayed evidence of progressive disease, and certain other criteria. This registration cohort is comprised of patients from multiple clinical trials and has completed enrollment. A BICR analysis is expected to take place in 2021 which, if favorable, may form the basis for regulatory approval of ONC201 in the United States. A BICR of the first 30 patients was completed and presented at the Society of Neuro-Oncology meeting held in November 2020.

It noted that an ONC201 database of over 350 treated patients had demonstrated a favorable safety profile. It has been generally well tolerated during extended periods of administration with nausea/vomiting, fatigue and decreased lymphocyte counts as the most commonly reported.

Chimerix is now readying ONC201 for its final development. As stated in the Call, it is working with the FDA on the design of its pivotal ACTION study. It will be:

…launching the Phase 3 ACTION study at the Annual Society for Neuro-Oncology or SNO Conference taking place later this month in Tampa Florida. This is an ideal form to enhance engagement in this study with an audience of the world’s leading neurooncologists.

This is a small tight-knit community of key opinion leaders who are already aware of ONC201 and its potential and already creating momentum for the study’s launch. We collaborated with many of these physicians to design a trial with a high probability of success and multiple paths to achieve success quickly.

CEO Sherman noted that ONC201’s chances for success in this trial were higher than was typical. Its phase 2 trial had succeeded in the challenging task of showing single-agent durable responses in the relapsed setting. The Phase 2 results were compelling with strong data on both primary and secondary endpoints.

In the phase 2 trial response rates were highest in those with less advanced disease burden. The ACTION trial is being designed to focus on these patients. Additionally with its favorable safety profile, ACTION will be able to have more frequent dosing.

Even better is the potential for FDA action based on the existing phase 2 data. Chimerix has scheduled a meeting with the FDA to discuss this. Chimerix has monitored recent Oncologic Drugs Advisory Committee Meeting (ODAC) meetings. It believes that ONC201 phase 2 meets all key concerns including:

- clarity of unmet need – H3 K27M-mutant glioma is considered Grade four by W.H.O. and all post-radiation therapies are considered palliative. Post-relapse survival is less than six months;

- drug safety – ONC201 is very well-tolerated backed up by 211 patient safety analyses;

- the need to isolate single-agent activity unconfounded by combination drugs or insufficient washout periods – ONC201’s inclusion criteria were designed with the FDA to assure this, and

- dose optimization – ONC201’s phase 1 focused on this.

Supplemental information on this lead indication is available at the Presentation, slides 5-23, including efficacy analysis at slides 6-17, ACTION study design, slides 19-21 and market opportunity slide 23.

Just when it looked like Chimerix had mapped its future, Rubric tossed a grenade.

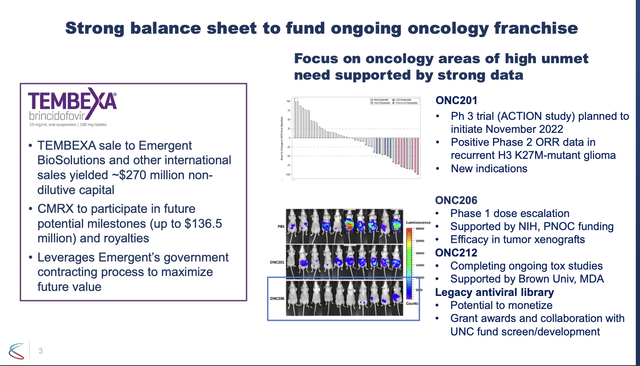

Chimerix has an attractive simple profile as mapped out by slide 3 below from the Presentation:

Chimerix has three components of interest to investors:

- Its TEMBEXA deal which provide its financial engine;

- its 0NC201 lead therapy as discussed;

- the balance of its early stage pipeline.

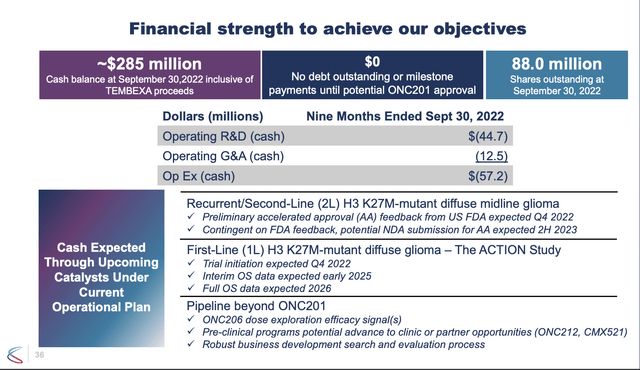

Slide 36 from its Presentation sets out potential timelines and financial details:

A best case scenario for ONC201 would be for it to submit its NDA in H2, 2023 based on its phase 2 data, if FDA feedback supports it. In that case we might see an approval, and possibly a launch, in 2024. If that fails data will not be available until 2026 with a launch no earlier than 2027.

With annual cash needs of ~$76 million based on projected 2022 expenses, Chimerix is set through 2025. If it has been unable to file based on phase 2 data, in 2025 its fate will likely be heavily dependent on its interim ACTION readout expected in early 2025.

Of course if it qualifies for maximum TEMBEXA milestones, its cash situation will benefit by up to an additional $136.5 million (Presentation slide 35). I expect management would have been well satisfied with its finances at that point, but for a series of conversations it has been having with Rubric Capital Management since 05/2022.

On 11/10/2022, Rubric sent Chimerix a fascinating letter in which it urged Chimerix to consider alternatives to its current ONC201 development plans. It urged that shareholders would be better served by liquidating the company. It accused management of being frivolous with shareholders’ value.

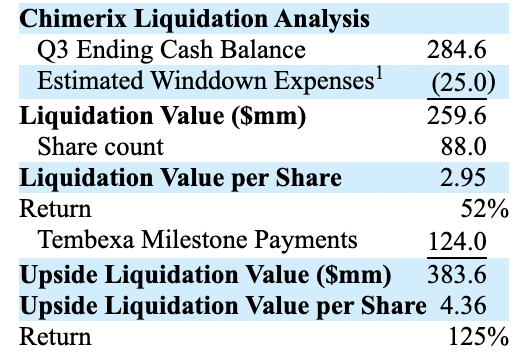

It set out a liquidation value for the company as:

businesswire.com

Of course the return is a moving target. As I write on 11/12/2022 Chimerix is $2.13.

In any case management responded as one might expect, stating:

We do not believe a liquidation of Chimerix is in the best interests of all of our shareholders as it would deprive them of the significant upside potential of ONC201 and our other assets. It would also be irresponsible to patients with this deadly disease as it would halt critical progress on ONC201 simply as a means to appease a shareholder making such demands. While we are confident that the continued successful execution of our strategy will drive significant shareholder value, our Board and leadership team regularly consider all opportunities to create or enhance value.

The next move is up to Rubric.

Conclusion

As a newcomer to this situation, I am sympathetic with management. I think they have struck solid deals:

- by acquiring ONC203 from Oncoceutics

- by selling TEMBEXA to Emergent

As I write on 11/12/2022, I am not a shareholder. It is beginning to look like Chimerix is going to be consumed with extraneous issues, likely at considerable cost in legal fees and management attention. Regardless of Rubric’s future action, other shareholder class action suits are potentially in the offing.

Before Rubric muddied the water, I was considering Chimerix as an attractive speculation. Until this current standoff is resolved, I plan to steer clear.

Be the first to comment