ArtistGNDphotography/E+ via Getty Images

Chewy, Inc. (NYSE:NYSE:CHWY) stock, once a Wall Street favorite, is down close to 40% this year. This lackluster performance does not come as much of a surprise given that high-growth tech stocks including e-commerce companies have lost some love from investors this year amid challenging macroeconomic conditions. E-commerce stocks soared in 2020 because of pandemic-related restrictions and in the first half of 2021, stimulus checks boosted spending on e-commerce platforms. With the relaxation of mobility restrictions, the withdrawal of relief checks, and soaring inflation, e-commerce companies are finding it difficult to maintain the stellar growth rates seen at the height of the pandemic. In addition to this, geopolitical conflicts and supply chain challenges are proving to be massive obstacles for companies of every size and scale.

Given the current economic situation, it is not surprising that investors are looking for profit-making companies that are cheaply valued instead of high-growth companies. When interest rates rise, so does the cost of capital. This means that future cash flows will be discounted at a higher rate, which results in lower present values. From a valuation perspective, therefore, growth companies seem less attractive in a situation where interest rates are expected to rise further.

Investing in stocks, however, is not about deriving numbers from a valuation model. Therefore, ignoring growth stocks in fear of rising interest rates does not sound prudent to me, which is why we, at Leads From Gurus, continue to hold on to high-growth names we believe in. In this article, I will revisit Chewy to determine whether the company is finally investable after losing more than half of its market value in the last 12 months.

Chewy’s Excellent Business Model Deserves Some Love

Fellow Seeking Alpha contributor Alessio Pace recently claimed that Chewy is still too pricey despite the drop, and I want to agree with this remark. From a valuation perspective, Chewy may not be appealing just yet, and this is one of the main reasons why Chewy stock is left behind by value and growth investors alike. Although Chewy might not be attractive from a valuation viewpoint, the company certainly has a scalable, unique business model that could help the company grow exponentially in the coming years.

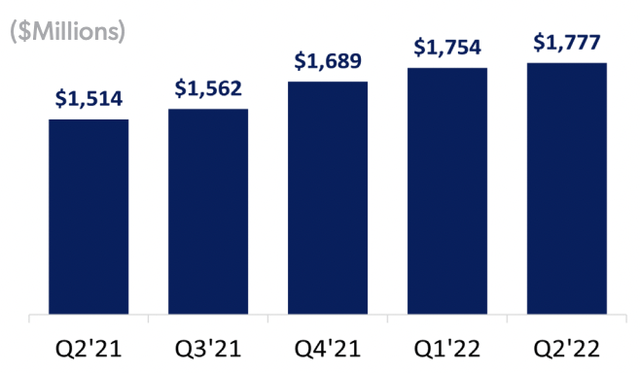

Chewy is an online retailer of pet products and services. Chewy’s business has grown since pet ownership increased in 2020. Although there is no slowdown in pet ownership, the reopening of the economy has brought significant challenges for the company as pet owners seek out-of-home experiences with their pooches. As a result, the pet supply e-commerce giant reported a slowdown in growth and an increase in net losses in the last three quarters of 2021. However, Chewy’s net sales per active customer reached a new high of $462 in the second quarter of 2022. The food and healthcare categories, as well as Autoship, an automated fulfillment facility, are driving the company’s sales growth. Chewy reported increased Autoship penetration, with Autoship customer sales reaching a new high of 73.1% of net sales in Q2. Autoship is a subscription service that offers pet owners timely and customizable auto-reordering and deliveries.

Exhibit 1: Autoship Customer Sales

Q2 shareholder letter

Source: Q2 shareholder letter

Autoship’s consistent growth demonstrates how Chewy is winning the trust of an increasing number of high-value customers with predictable purchasing patterns. Subscription programs are very profitable for e-commerce businesses and increase customer lifetime value. The success of a subscription program is determined by the customer’s trust in the company and the type of product or service offered. Subscription models will assist companies that already have customers who see and believe in the value they provide in turning those customers into loyal customers. This means higher customer retention, lower acquisition costs, and more predictable growth. Chewy’s early adoption of a subscription model and its success demonstrate the company’s ability to stay ahead of the competition, and the model’s success also suggests the company is building brand equity. A growth company that is on the right track to enjoying long-lasting competitive advantages will always get my attention, which is why I continue to monitor Chewy closely.

Automation facilities are handling a larger share of Chewy’s outbound shipment volume at lower variable costs per package. In the second quarter, nearly a quarter of the company’s outbound network volume was shipped from its two automated fulfillment centers at a variable cost per unit that was about 15% lower than the legacy network. As Autoship continues to provide significant benefits, the company opened its third automated fulfillment center in Reno, Nevada, in July. Based on these trends, the company is confident in meeting its target of 40 to 60 basis points of annual run rate SG&A leverage from its three existing automated fulfillment centers over time.

Additionally, Chewy Freight Services, a linehaul initiative that operates a portion of the company’s own middle-mile network, grew in the second quarter, carrying three times the volume it did the previous quarter, resulting in lower costs and better delivery performance. These facilities allow the company to meet customer orders on time despite supply-chain issues, save money per package, and improve delivery performance and customer experience. Chewy’s focus on automation and streamlining shipping, in my opinion, will serve as important drivers of the company’s brand value in the long run through enhanced relationships with its customers.

As the demand for pet healthcare products remains robust, Chewy expanded CarePlus, its wellness and insurance program, to 31 states in Q2. The company anticipates completing the nationwide rollout of CarePlus by the end of the year. However, Chewy does not expect CarePlus to have a significant financial impact in 2022 but believes it will provide an opportunity to help grow the historically under-penetrated pet insurance market and gain market share in this high-margin business. This initiative will also continue to enhance customer experience, engagement, and retention.

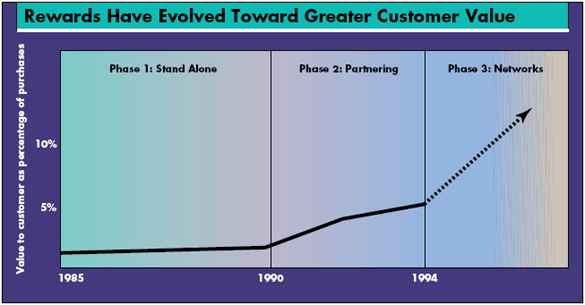

To diversify its revenue streams and improve margins, the company plans to launch Chewy Loyalty, a customer loyalty program, and Sponsored Ads on Chewy.com in 2023. Loyalty programs, similar to subscription models, are another effective customer retention strategy. Most retailers now use loyalty or reward programs to boost customer satisfaction because these programs are designed to make customers feel more valued by providing special services and attention. Building loyalty could save millions of dollars in customer acquisition costs in the long run. According to a recent report published by the Harvard Business Review, loyal customers become more profitable over time as they are likely to purchase more, pay premium prices, and bring new customers through referrals and recommendations.

Exhibit 2: Rewards have evolved toward greater customer value

Harvard Business Review

Source: Harvard Business Review

According to Incentive Solutions, adding a loyalty program to an e-commerce platform can increase average order quantity by 319%. Furthermore, sponsored ads are an excellent way to gain market share, and this model has a proven track record of profitability. Although the advertising market has taken a hit this year due to uncontrollable macroeconomic challenges, it remains a viable revenue diversifier. Chewy already has a dominant position in a niche market, and the sponsored ad segment will strengthen that position. Chewy has a large customer base with a high customer retention rate, which will entice more suppliers to run advertisements on Chewy’s website in the future.

What Could Make CHWY Stock Move Higher?

As things stand today, I do not believe the Fed’s upcoming policy decisions will have a durable positive impact on Chewy and other high-growth companies. Chewy is unlikely to benefit from any favorable developments from the macroeconomic front as well, and I believe Chewy shareholders should brace themselves for an extended period of sideways stock movement at best. For Chewy stock to move higher, I believe either of these two things should happen.

- The global economy entering a recession.

- The global economy making a surprise comeback.

I know, these two events lie at the extreme end of things, but this makes a lot of sense when you look at some stats.

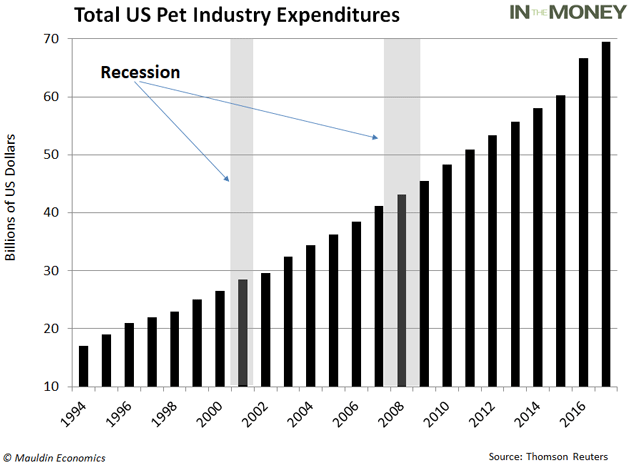

The pet care industry has historically been resilient to external shocks such as recessions. As illustrated below, the U.S. pet care industry registered positive growth in each of the last two recessions.

Exhibit 3: Total U.S. pet industry expenditures

MarketWatch

Source: MarketWatch

Although consumer spending will take a hit in the coming quarters in a recessionary environment, history is likely to repeat when it comes to pet care spending. Empirical evidence also suggests spending on medications for pets will be very resilient at any given phase of the global economy. These findings are good news for Chewy, and the company could jump into the spotlight in a recessionary environment as a resilient business that continues to grow regardless of macroeconomic challenges. Such a phenomenon is likely to lift Chewy shares higher.

On the other hand, if supply-chain challenges ease and the economy enters a growth phase, Chewy stock could still move higher aided by improved market sentiment toward growth stocks.

Takeaway

Chewy is constantly working to improve margins, but the company still has some work to do in order to stabilize operating margins. The company is developing new features and products to provide more value to its customers and attract new customers, which I believe is the right strategy going forward. Chewy is a one-stop shop for everything pet-related, and while the hard goods and treats segment is affected by inflation, the food and healthcare segments remain strong. Pet ownership will continue to rise, and easy access to pet care resources will continue to drive spending on pet care products and services. Although growth will be slow in the short run, the excellent business model of the company has positioned Chewy to grow exponentially in the long run. Chewy is not cheaply valued in the market but I am considering adding CHWY stock to my portfolio with a long-term view.

Be the first to comment