Justin Sullivan

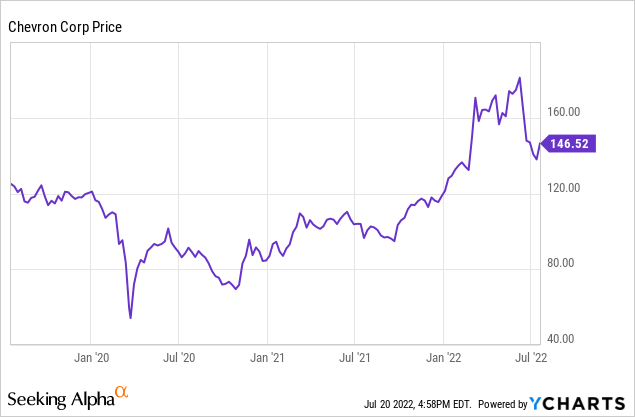

Major multinational energy company Chevron Corporation (NYSE:CVX) remains a staple for energy investors. While the stock price is up 40% from my last review, it is off recent highs.

The company offers investors a 3.9% dividend, coupled with a stock buyback program that flexes between $5 billion and $10 billion per year, depending on oil prices.

Chevron’s low-royalty Permian acreage is a bigger competitive advantage that many realize. However, given today’s huge need for natural gas overseas, Chevron’s international operations are also a sometimes-overlooked boon, e.g. Chevron has an interest in an Angolan LNG venture.

Value investor Warren Buffett increased his stake in the company from 2.5% in early 2020 to 8.1% at March 31, 2022.

I recommend Chevron to dividend-seeking and growth investors interested in energy.

Chevron First Quarter 2022 Results and Guidance

In the first quarter of 2022, Chevron earned $6.3 billion, or $3.22/share, in contrast to earnings of $1.4 billion or $0.72/share in 1Q21.

Quarterly cash flow from operations was $8.1 billion, in contrast to cash flow of $4.2 billion for 1Q21. Free cash flow was $6.1 billion. Capital expenditures were $2.8 billion.

Earnings by major operating area:

|

$MM |

1Q22 |

1Q21 |

|

Upstream |

6934 |

2350 |

|

Downstream |

331 |

5 |

|

All Other |

-1006 |

-978 |

|

6259 |

1377 |

Upstream is US and international exploration and production; downstream is US and international refining and chemicals. “Other” comprises worldwide cash management and debt financing, corporate administrative functions, insurance operations, real estate activities, and technology companies.

Total worldwide production was 3.06 million barrels of oil equivalent (BOE)/day, 39% in the U.S. and 61% international. Of the total, 56.7% was liquids (oil, condensate, and natural gas liquids).

In the U.S. production was just above that of a year ago at 1.18 million BOE/D. Liquids (oil, condensate, and natural gas liquids) were significant at 880,000 BPD.

U.S. production included a record 692,000 BOE/D from the Permian Basin, or 59% of the company’s US total.

Refinery inputs were 1.5 million barrels per day (BPD), about 60% of which were in the U.S. and the rest international. Refined product sales were larger at 2.55 million BPD, over half international.

Critically, the company paid $2.7 billion in dividends and repurchased $1.3 billion of stock during 1Q22.

In 1Q22 Chevron announced the acquisition of Renewable Energy Group, a company with 34,000 BPD of biodiesel and renewable diesel production for $3.15 billion. The acquisition is expected to close in the second half of the year.

Chevron provided 2Q22 guidance:

*share repurchases of $2.5 billion

*turnarounds and downtime will subtract about 160,000 BOE/D from production

*expiration of Thailand concessions will subtract about 50,000 BOE/D

*refinery turnarounds will cost $250-$350 million

The company’s Indonesian contract is also due to expire in 2022.

On a growth note, it raised 2022 Permian Basin production guidance to 700,000-750,000 BOE/D, a 15% increase from 2021. It also expects to realize $250 million-$350 million in capital returns from its Angolan LNG project. The 2022 capital expenditure budget is $15.3 billion.

Results for 2Q22 will be released July 29, 2022.

Macro Environment

It is no exaggeration to say the energy environment has flipflopped (again) in the last two years, particularly after major energy producer Russia’s invasion of Ukraine and the follow-on reactions. Prior to the invasion, Russia accounted for about 10% of the world’s oil production and 40% of Europe’s natural gas consumption.

However, Europe—now desperately short of affordable natural gas—had already been experiencing difficulties before the invasion due to over-reliance on intermittent renewables that had no backstops.

Indeed, ESG proponents have pushed global government and banking officials—as in Sri Lanka–to stop investing in or using hydrocarbons, a restriction that impoverishes people worldwide.

Some countries have limited or reduced purchases of Russian energy. Russia has retaliated by cutting natural gas flows. Russian oil IS being sold at a discount to China and India. Indeed, Chevron’s CEO, Mike Wirth has said Russia’s oil production will likely fall due to the departure of Western oil companies with their technology and capital.

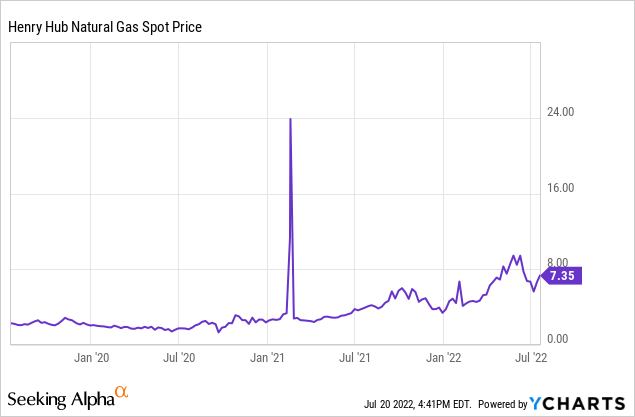

Most alarmingly, high liquefied natural gas (LNG) costs in Europe may lead to mandatory consumption cuts and industrial constraints on (for example) fertilizer—which would have a follow-on effect on food production. (Chevron produces natural gas in the U.S., Angola, Australia, and the eastern Mediterranean.)

Other problems are the Biden administration anti-hydrocarbon government policies that discourage U.S. oil and gas production.

Oil and Gas Prices

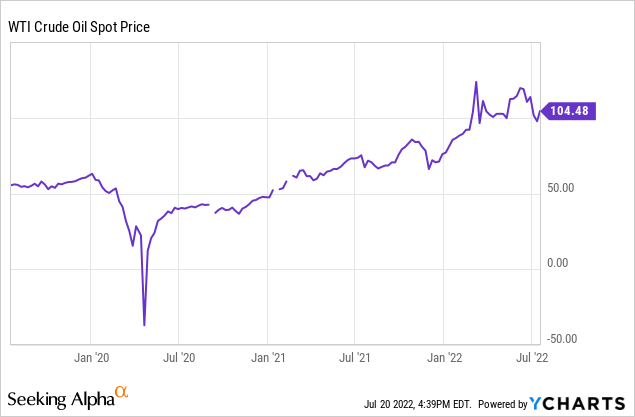

The July 20, 2022, NYMEX oil price was $102.26/barrel for August 2022 delivery of West Texas Intermediate (WTI) crude oil. Henry Hub natural gas, also for August 2022 delivery, was $7.87/MMBTU. Dutch Title Transfer LNG for August 2022 delivery was more than five times as high at $46.51/MMBTU.

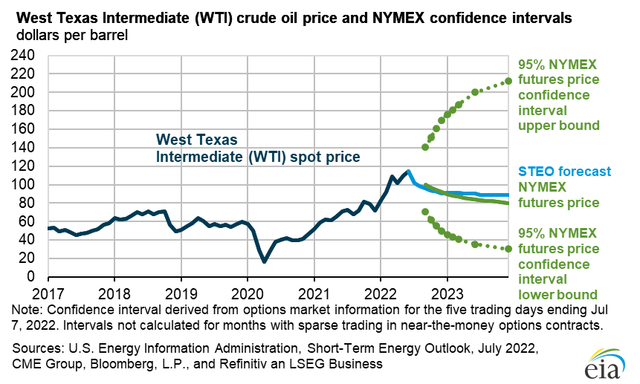

The U.S. Energy Information Agency (EIA) shows a 5-95 confidence interval of about $30/bbl to $210/bbl for WTI prices at year-end 2023.

US Energy Information Administration

Chevron’s Worldwide and US Reserves

At year-end 2021, Chevron’s SEC PV-10 reserves were valued at $52.7 billion for the US, $103.9 billion for its consolidated companies (including US and international consolidated companies), and $128.9 billion for its consolidated and affiliated companies. At December 31, 2021, 34 percent of the company’s net proved reserves in the United States, 19 percent were in Australia and 16 percent were in Kazakhstan.

This is well over twice the 2020 year-end total of $58.5 billion, a benefit of 2021’s much higher oil and gas prices.

The company’s proved (developed and undeveloped) reserves total 11.3 billion BOE.

These proved reserves includes the U.S., international operations, and affiliated operations. Proved developed reserves are 7.4 billion BOE.

Just under half, or 5.1 billion barrels, are liquids: oil, condensate, and synthetic oil.

U.S. proved (developed and undeveloped) reserves are 3.86 billion BOE. U.S. proved developed reserves are 2.12 billion BOE.

Competitors

As noted, Chevron operates in the upstream and downstream sectors in the U.S. and internationally. The company is headquartered in San Ramon, California, however it plans to move to a new headquarters building in California and—notably—is encouraging California employees interested in doing so to move to Houston, Texas.

Competitors in the Midland and Delaware sub-basins of the Permian are numerous, including small companies, private companies, as well as other medium, large, and very large public companies like ConocoPhillips (COP), EOG Resources (EOG), Diamondback Energy (FANG), EOG Resources (EOG), Occidental (OXY), and Exxon Mobil (XOM).

Different from its competitors, Chevron has considerable legacy, low-royalty-cost Permian production and acreage.

International competitors include BP (BP), Equinor (EQNR), ExxonMobil, Shell (SHEL), plus all non-OPEC and OPEC+ (such as Saudi Aramco and Gazprom) national oil and gas companies.

Governance

At July 1, 2022, Institutional Shareholder Services ranked Chevron’s overall governance as a 7, with sub-scores of audit (7), board (6), shareholder rights (1), and compensation (9). In this ranking a 1 indicates lower governance risk and a 10 indicates higher governance risk.

As of May 2022, Chevron’s ESG ratings from Sustainalytics were severe (below-average) with a total risk score of 43 (92nd percentile). Component parts are environmental risk 22.4, social 10.6, and governance 9.9. The only problematic area noted is animal testing.

Controversy level is 3 on a scale of 0-5, with 5 as the worst.

On June 30, 2022, shorts are 0.91% of floated shares. Insiders own only 0.07% of shares.

The company’s beta is 1.13, as one might expect for a large multinational with both upstream and downstream operations and thus only slightly above the overall market level of volatility.

The company announced a major structural reorganization, effective October 1, 2022. Upstream, midstream, and downstream will be combined into one organization and overseen by one executive vice president. Multi-regional upstream operations will also be consolidated into just two regions: Americas and International. The goal of the reorganization is capital optimization.

At March 30, 2022, the four largest institutional stockholders, some of which represent index fund investments that match the overall market, are Vanguard (8.5%), Berkshire Hathaway (BRK.A, BRK.B) (8.1%), State Street (7.0%), and Blackrock (6.5%).

There are two points of interest. First, Berkshire Hathaway’s holdings of Chevron, along with its significant position in Occidental (OXY) of nearly 20%, suggests a Berkshire/Buffett assessment that both companies are undervalued.

Separately, Vanguard, Blackrock, and State Street are signatories to the Glasgow Financial Alliance for Net Zero, a group that, as of May 31, 2022, manages $61.3 trillion in assets worldwide and which (despite high-cost energy-all energy—due in part to hydrocarbon energy supply constraints) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

Financial and CVX Stock Highlights

Chevron’s market capitalization is $288 billion at a July 20, 2022, stock closing price of $146.52/share.

Trailing twelve months’ EPS was $10.64/share for a price/earnings ratio of 13.8. Analysts’ average estimates for 2022 and 2023 EPS are $17.68 and $15.79, respectively, for a forward price-earnings ratio range of 8.3 to 9.3.

With a 52-week price range of $92.86-$182.40 per share, the July 20, 2022, closing price is 80% of its one-year high. The company’s one-year target price is $176.27/share putting its closing price at 83% of that level.

At March 31, 2022, the company had $101.9 billion in liabilities and $249.0 billion in assets giving Chevron a liability-to-asset ratio of 41%. Of the liabilities, debt totals $29.3 billion (29.0 billion of which is long-term debt), or 11.8% of assets.

The company’s ratio of debt to market capitalization is a small 10%. The debt-to-EBITDA ratio is comfortable at 0.76.

Chevron’s dividend of $5.68/share represents a 3.9% yield at its current price. As noted, depending on oil prices, the company plans to repurchase several billion dollars’ worth of stock annually.

Mean analyst rating is a 2.1, or “buy,” from the 24 analysts who follow it.

Notes on CVX Stock Valuation

Book value per share at $74.42 is well below market price, implying positive investor sentiment.

Its ratio of enterprise value to EBITDA is in the bargain (sub-10.0) range at 7.5.

Chevron’s current market capitalization is $288 billion. SEC PV-10 reserve value at year-end 2021 was $128.9 billion. As of March 31, 2022, assets are $249 billion and liabilities are $102 billion for balance-sheet equity of $147 billion.

The company’s market capitalization/flowing BOE is $94,100 and its market capitalization/flowing barrel of liquids is $166,000. These are similar to the current metrics for ExxonMobil.

Positive and Negative Risks

Investors should consider their oil and natural gas price expectations as the factor most likely to affect Chevron’s operations.

International operations in the eastern Mediterranean, Kazakhstan, Australia, and elsewhere carry country-specific risks, but so do operations in the U.S. given the current administration’s anti-hydrocarbon stance. Indeed, the company’s international diversification is (again) a significant benefit that layers on top of its competitive low-royalty advantage in the Permian basin.

Recommendations for Chevron

Despite the stock price increase, I recommend buying Chevron stock now since it is off the 52-week high. Oil and natural gas prices remain constructive for the near future. Chevron is returning to cash to shareholders in the form of a 3.9% dividend and a share buyback program of $5-$10 billion/year, depending on oil prices.

The company has plenty of flexibility in its balance sheet with a relatively small debt percentage as well as an investor-friendly forward price-earnings ratio of 8.3-9.3 and an attractive enterprise value-to-EBITDA ratio of 7.5.

In December 2020, value-oriented Warren Buffett’s Berkshire Hathaway had a 2.5% equity stake in Chevron. He has increased his stake to over 8%, presumably for long-term upside.

Other favorable factors include Chevron’s strong Permian position, globally diversified operations, and good cash flow.

chevron.com

Be the first to comment