LordRunar/iStock Unreleased via Getty Images

Chevron (NYSE:CVX) is a company we’ve consistently recommended before. However, with the company up almost 40% YTD, we see other better opportunities in the oil market. As we’ll see throughout this article, Chevron’s ability to continue generating substantial shareholder returns is muted in the current environment.

Chevron Cost Improvement

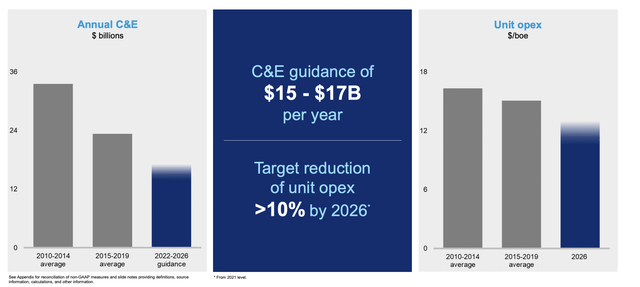

Chevron is focused on consistent cost improvements across its business.

Chevron is lowering its capital expenditures, focusing less on the massive capital projects that defined the company over the past decade. The company expects costs to reduce by >10% by 2026 with lower capital guidance of $16 billion / year continuing through 2026. The result of this is the company taking minimal advantage of higher prices and instead focusing on performance.

The company expects at $60 Brent, by 2026, the company’s ROCE will move into the double-digits. That shows the company’s financial strength. The company expects strong CFFO / share will continue.

Chevron Financial Priorities

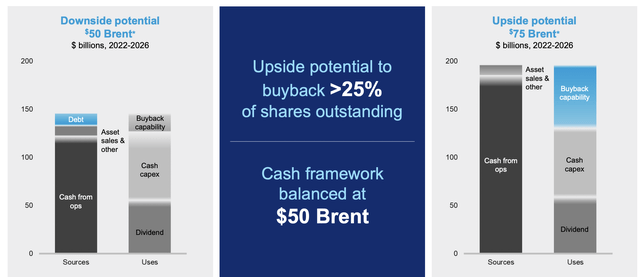

The company is focused on maintaining its financial priorities with consistent growth and shareholder rewards.

Current Brent crude prices are $100 / barrel, with some decrease of stress caused by the Russian-Ukrainian war. At $75 / barrel Brent over the next 5 years, the company expects to have roughly $200 billion in cash flow. The company sees itself as having roughly $70 billion in buyback capability and $50 billion in dividends.

The remainder of the cash flow from operations will be spent on cash capital expenditures. With some asset sales, we expect the cash capital expenditures will keep the company’s production mostly constant. Taking the $120 billion in shareholder rewards, for a $320 billion company, points to roughly 7.5% annualized returns.

At $100 / barrel Brent, that number becomes almost 11% (assuming the $50-75 barrel Brent improvement continues). These are strong returns, however, in an environment where crude prices remain at $100 / barrel for the next 5 years, we expect better in terms of returns.

Chevron Asset Portfolio

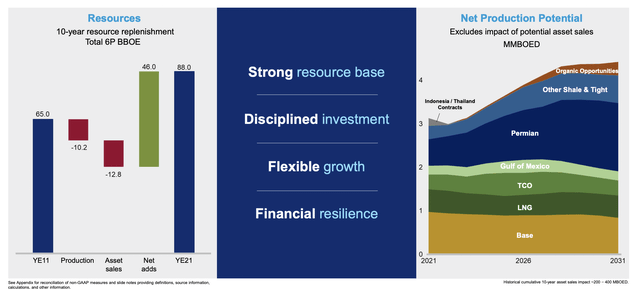

Chevron has an impressive asset portfolio and has continued to focus on developing it.

Chevron has done an impressive job, despite massive asset sales, of maintaining its overall reserves. The company’s reserves are decades long versus its production of just over 1 billion barrels / year. The company sees production potentially growing by 2031 towards 4 million, although most of that growth will start towards the middle of the decade.

Additionally, there’s no guarantee, especially with the company’s Permian goals, that it manages to achieve the growth its targeting. Still, it’s worth noting that we think the company’s assets are incredibly strong and won’t present a shortfall for the company’s performance anytime soon.

Our View

Chevron is a valuable company. The company has an impressive portfolio of assets and we expect it to continue generating its 8% returns at $75 Brent. At $100 Brent, that becomes more than 10%.

However, there’s numerous other opportunities in the market. Chevron always had a premium because of its reliable cash flow, and in our view, with current prices, that premium isn’t worth paying anymore. The company is above its mid-2014 prices, and historically, oil prices haven’t spent a substantial amount of time above $100 / barrel.

As a result, we recommend investors sell their investments in Chevron.

Alternative Investments

For those looking for alternative investments, we see numerous opportunities, especially in the double-digit return scenario for Chevron where Brent prices need to remain at $100+ / barrel.

Hess Corporation (HES), which we discuss in more detail here, could see a FCF yield of more than 30% at current Brent prices. By 2026, even at $60 / barrel, the FCF yield is expected to hit 10%. The company is rapidly ramping up production, and has a massive asset in Guyana, with significant growth potential.

Western Midstream (WES) is another name we’ve discussed. The company is pushing its dividend yield to more than 8% and is focused on continued rewards on top of that dividend. The company’s fee-based cash flow means its returns are much stronger, even in an environment where oil prices fluctuate.

We view both companies as a strong replacement for an investment in Chevron.

Thesis Risk

Time in the market is better than timing the market. The largest risk, in our view, is selling your position and leaving it in cash. There’s plenty of other opportunity available in the market, and we recommend taking the opportunity to reinvest your capital if you’re going to sell the position.

The second risk is Chevron has normally received a higher premium because of its execution strength. At current prices, the company does still have the ability to generate substantial shareholder rewards. Those rewards help highlight the company as a viable investment.

Conclusion

The oil markets are on a roll, and Chevron, as a well-run company, is performing better than most. The company has managed to pass its mid-2014 share price, and we think that the company could continue to generate strong cash flow with Brent at more than $100 / barrel. However, despite that, there are more opportunities in the market.

Assuming that prices remain at their current level, at more than $100 / barrel, the company will generate 11% annualized returns from 2022-2026. Even with those returns, we see numerous other opportunities in the market. That risk means we recommend investors sell their investments in Chevron at the current time.

Be the first to comment