zorazhuang

Things were looking grim for the oil & gas industry about two years ago, when I first wrote about an oil major – Exxon Mobil (XOM). A few months later, I also laid out my investment thesis for Chevron (NYSE:CVX) and took a long position in the company.

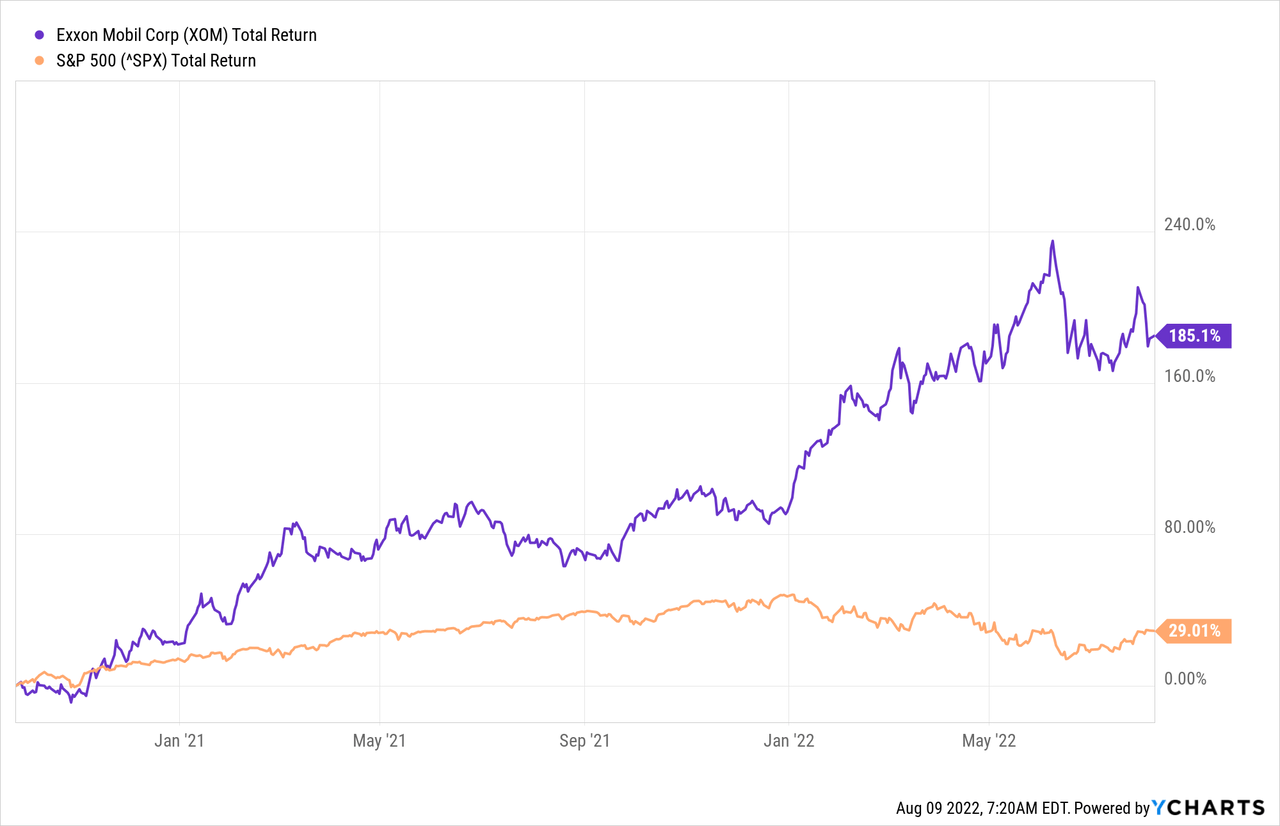

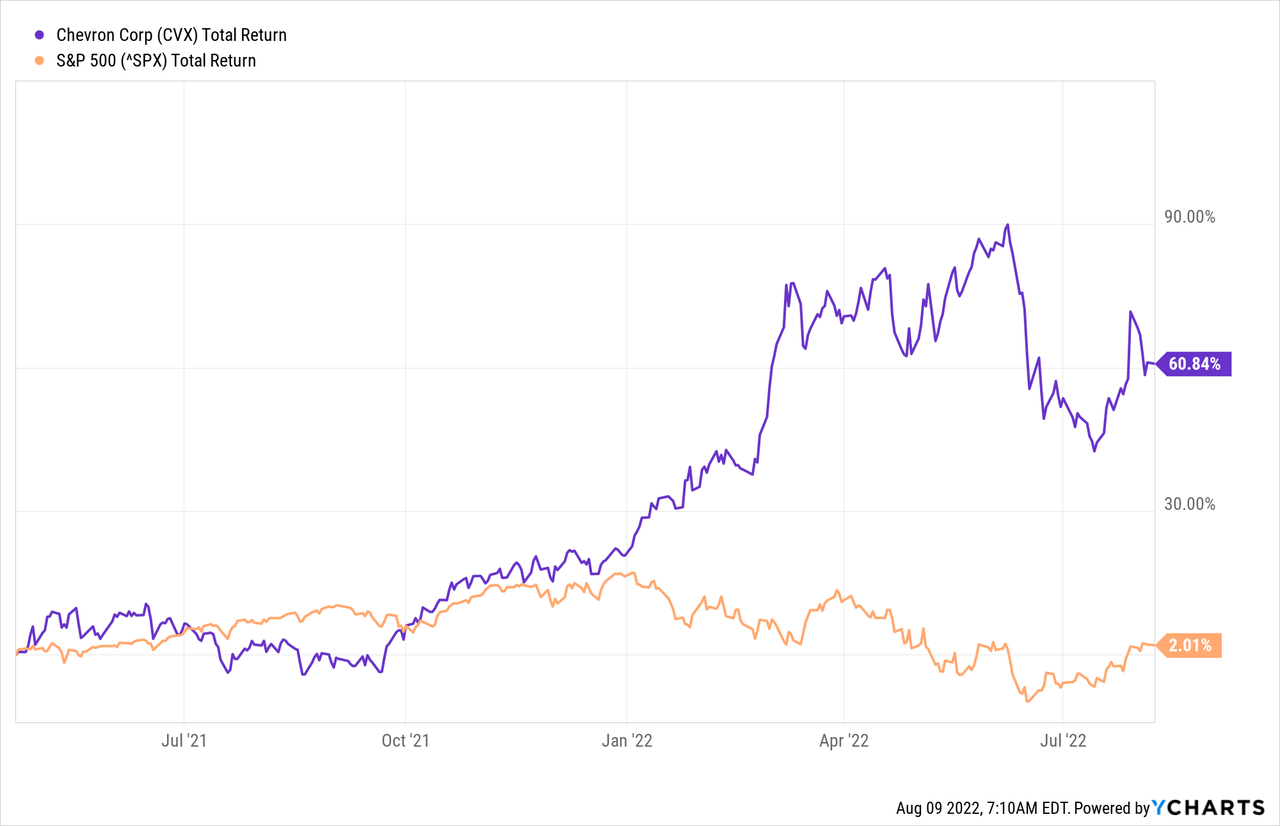

At the time, oil was still trading near historical lows and the narrative of oil & gas companies heading to extinction was going strong. As it often happens in investing, popular narratives start from a reasonable argument and over the years grow to an extreme and with that create an environment that is ripe for a reversal. That is one of the reasons why both CVX and XOM quickly turned from two of the worst performers in the market to what we see down below.

Of course, we humans are very good at creating narratives in our heads and once a narrative falters, we usually resort to excuses in the form of ‘unforeseen events’ or so-called black swans. We then easily construct new narratives to fill in the vacuum created by the previous story that failed to materialize.

In a similar way, it now seems clear that the narrative of oil & gas being displaced overnight by renewables was utterly wrong as we move towards a multipolar world order and deglobalization intensifies. However, there is now a new boogieman in the oil & gas sector – the risk of a prolonged recession. More specifically, it is the notion that the current recession could lead to new lows in oil prices as demand falters.

In the following lines, I will show why these risks are once again exaggerated and why Chevron is still a good long-term investment.

A Strong Quarter And Resilient Earnings

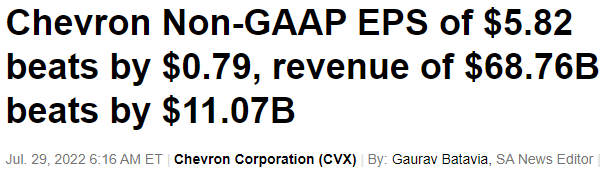

Chevron’s most recent results were exceptionally strong, both in terms of revenue and profitability.

Seeking Alpha

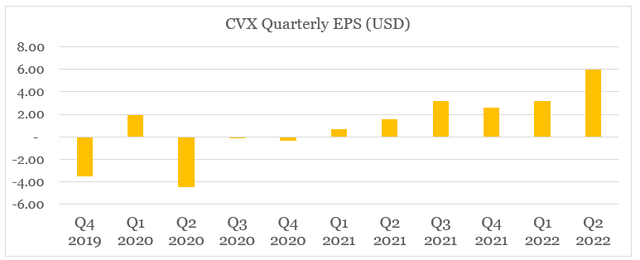

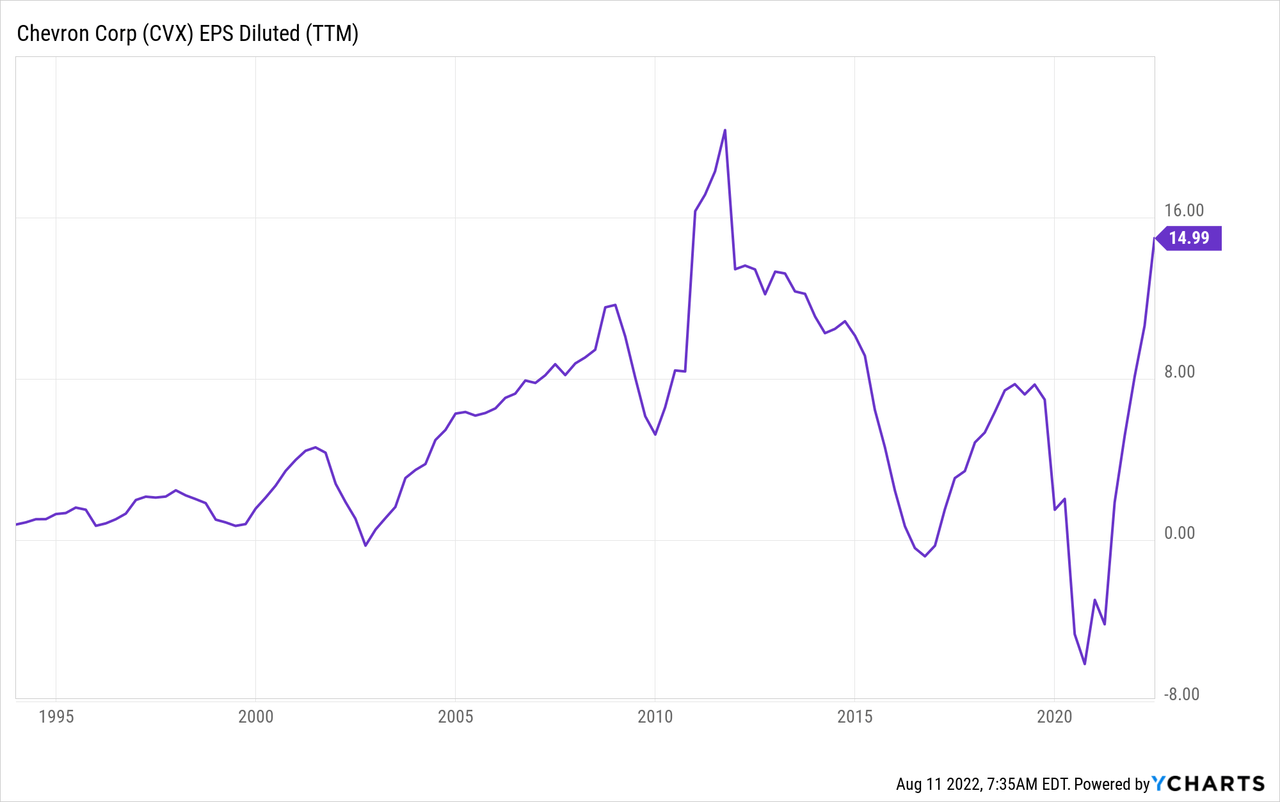

Quarterly earnings per share of nearly $6 were by far the strongest earnings number reported in a very long time (see below) and with that CVX has largely recouped the large losses resulting from the pandemic lockdowns in 2020.

Prepared by the author, using data from Seeking Alpha

Moreover, the company is on track to record one of its best annual results ever, eclipsing the previous highs of the 2011-12 period.

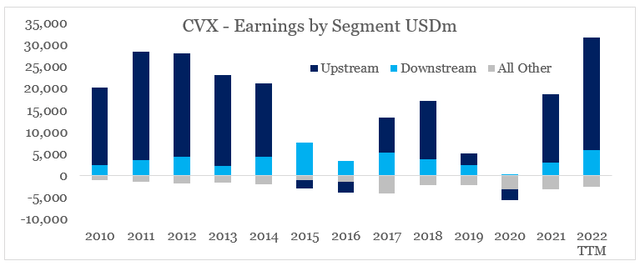

Although the level of integration between upstream, downstream and petrochemical operations is a major competitive advantage for Chevron, the recent increase in earnings was largely driven by the outstanding profitability of the upstream segment.

Prepared by the author, using data from SEC Filings

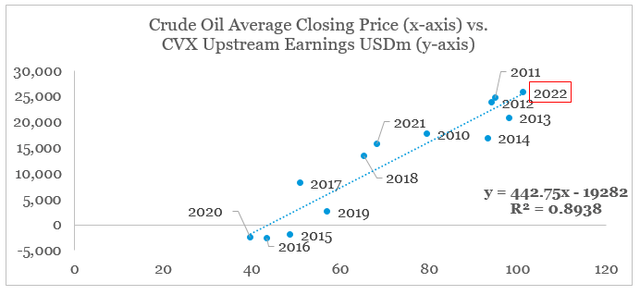

Even though the current recession has already wreaked havoc in the equity markets, crude oil currently trades just shy of the $100 mark, which is also in line with the 2022 average (January to August). Therefore, Chevron’s upstream earnings for the past twelve months are a good indication of the company’s profitability, if oil prices stay at current levels.

Prepared by the author, using data from Seeking Alpha and macrotrends.net

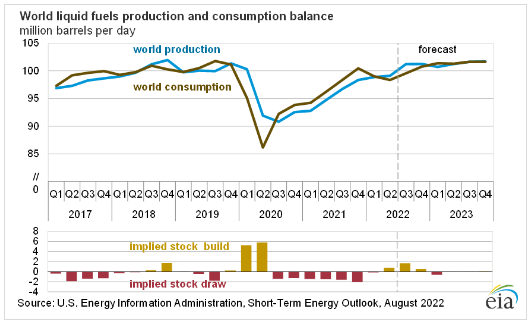

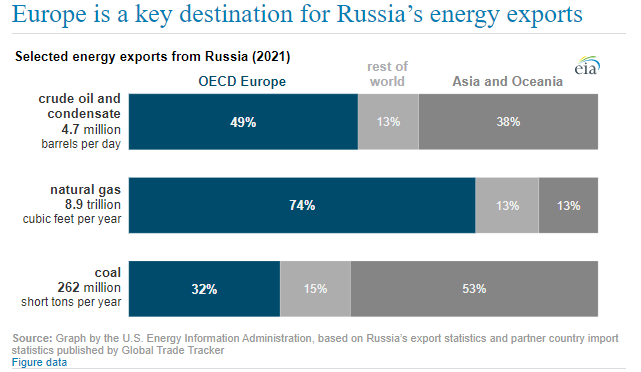

What this clearly illustrates is that even though we are already in a recession (based on the traditional definition), the oil market has not responded as it used to during previous recessions. The reason for that is twofold, on one hand, overall supply has adjusted accordingly (see below) and on the other is the geopolitical risk associated with large export nations, such as Russia and Iran.

U.S. Energy Information Administration

Europe, in particular, is vulnerable from an energy security point of view and recent scrambling by governments across the old continent to find substitutes to Russian exports has also contributed to keeping prices high.

U.S. Energy Information Administration

Is Chevron’s Valuation An Issue?

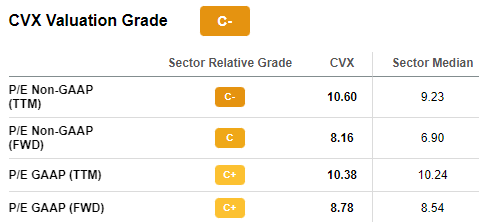

Based on Chevron’s most recent results and overall macroeconomic and geopolitical setup, the company is still in a good position to continue to outperform the broader market. This leads us to yet another misunderstanding of the sector that is largely driven by emotional biases – the perception of overvaluation.

A rather simple overview could lead us to believe that Chevron is ‘overvalued’ relative to peers, even as it currently trades at single-digit forward earnings.

Seeking Alpha

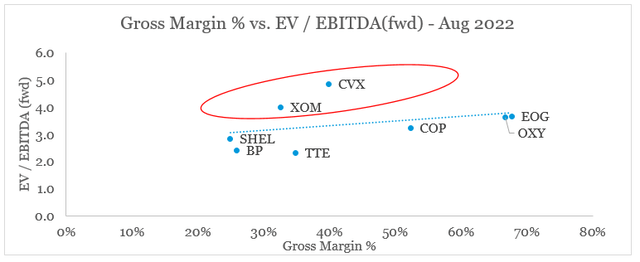

If we plot gross margins versus EV/EBITDA multiples of integrated oil majors alongside a number of large upstream players, we could also be led to a conclusion that Chevron and Exxon Mobil are both overvalued.

Prepared by the author, using data from Seeking Alpha

This, of course, is a rather simplistic view, and it does not take into account a number of risks. As I highlighted in one of my previous analyses, integration within the sector creates significant long-term competitive advantages, which gives integrated majors a premium multiple.

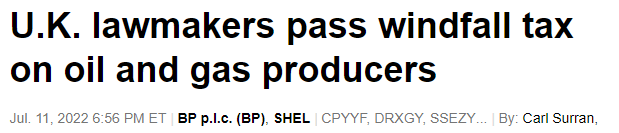

On the other hand, the European majors have a higher political risk, given the more fragmented nature of their business and the inclination of European governments to nationalize profits.

Seeking Alpha

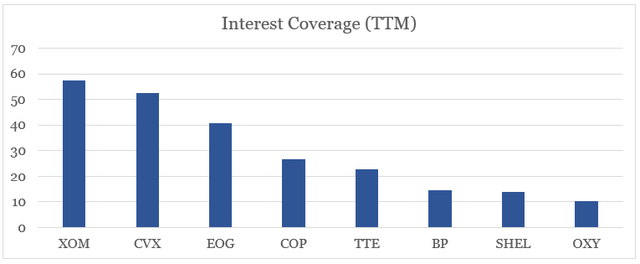

More importantly, however, Chevron and Exxon Mobil have a lower interest burden and as such are now in a much better position to reinvest more heavily during the market downturn.

Prepared by the author, using data from Seeking Alpha

The Free Cash Flow Perspective

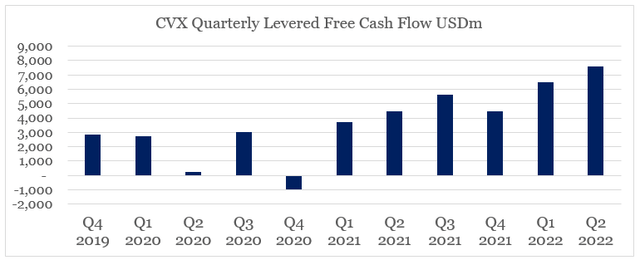

Even as oil prices have somehow cooled off in recent months, Chevron continued to earn a record-high free cash flow.

Prepared by the author, using data from Seeking Alpha

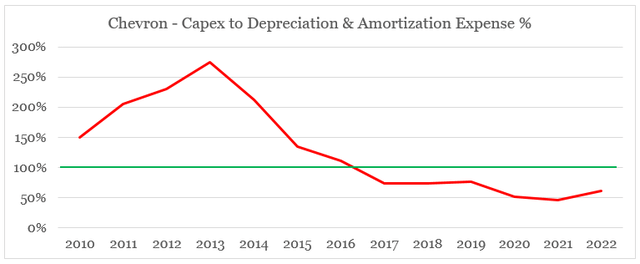

To an extent, this was largely due to significantly lower capital expenditure, which for a number of years has been lower than the company’s depreciation and amortization expense.

Prepared by the author, using data from SEC Filings

This, however, is changing rapidly as higher oil & gas prices and less competition in the industry are both creating significant opportunities for profitable future investments. I have covered that in further detail in here.

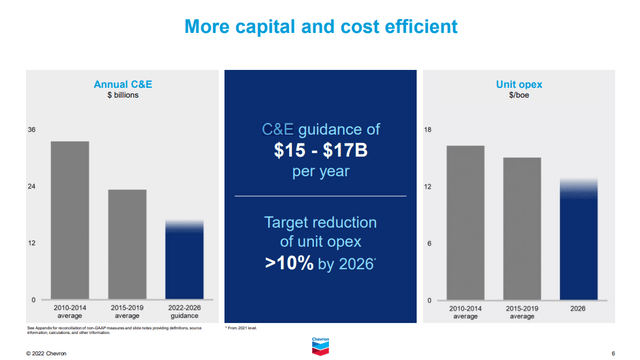

As a result, Chevron is going to slowly dial-up its capex over the coming years to reach a range of $15bn to $17bn, compared to roughly $10bn over the past 12-month period.

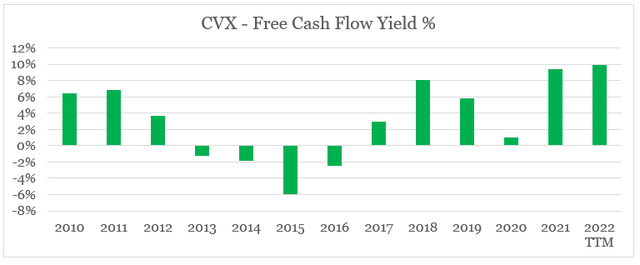

Even in that case, however, Chevron would trade at a free cash flow yield of almost 8% (assuming constant cash flow from operations). As we see in the graph below, this would still be one of the highest yields Chevron has traded at since 2010.

Prepared by the author, using data from Seeking Alpha and SEC Filings

Conclusion

Since I first covered Chevron, the company’s share price had a total return of more than 60% at a time when the broader market returned a mere 2%. As before, some market commentators are once again raising the alarm that the company has become overvalued and that it faces significant risks associated with lower oil prices due to the recession. Such speculations, however, are of no use to anyone trying to judge the real value of the business and stay invested over the long run. Even though market conditions will likely remain challenging in the short term and volatility is to be expected, Chevron remains a solid long-term investment and I intend to continue adding to my position during market-wide sell-offs.

Be the first to comment