Joe Raedle

One of the largest and most successful energy companies in the history of the world is none other than Chevron (NYSE:CVX). Historically speaking, the company has done very well from a fundamental perspective. But of course, considering that you need strong financial results over an extended period of time to get to a market capitalization of nearly $350 billion, this goes without saying. Recently though, performance achieved by the company has been exceedingly impressive, with revenue and profitability soaring through the roof. Add on top of this how affordable shares look, even if we assume financial performance reverts back to what it was last year, and I cannot help but to rate it a ‘buy’, reflective of my belief that it should generate returns to outperform the broader market for the foreseeable future.

A great update

Not since July of 2020 have I written an article dedicated specifically to Chevron. In that article, I talked about the company’s plans to acquire Noble Energy at what was initially a $5 billion transaction. At that time, I felt as though Chevron was getting a really great deal on the enterprise based on the cash flows Noble generated. Add on top of that how shares of Chevron were priced at that time, and I ended up rating it a ‘buy’. So far, that call has been very successful. While the S&P 500 is up by 19.2%, shares of the integrated energy business have risen by 121.5%.

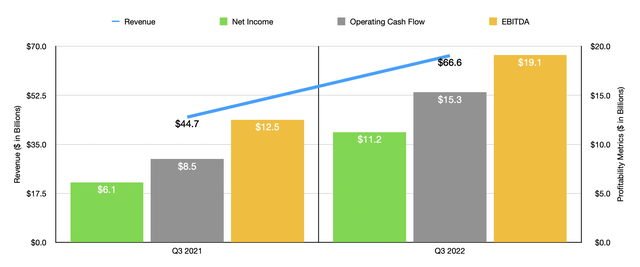

Most recently, the company benefited from financial results covering the third quarter of its 2022 fiscal year. These results were released on October 28th. For the headline news, it’s important to note that the company reported sales of $66.6 billion. In addition to beating analysts’ expectations by $5.2 billion, this amount of revenue came in 49.1% higher than the $44.7 billion generated in the third quarter of 2021. Although it’s nice to see revenue increase, I generally view revenue as fairly insignificant in this space. After all, a lot more of the success centers around the margins they can generate from the products they produce.

Speaking of earnings, during the quarter, the company reported net income of $11.2 billion. This was up from the $6.1 billion the company generated in profits the same time one year ago. On a non-GAAP per-share basis, the company reported earnings of $5.56. That beat expectations by $0.71 per share. Actual GAAP earnings came out to $5.78, crushing the $3.19 in earnings per share generated in the third quarter of 2021. Of course, we should pay attention to other profitability metrics as well. During the quarter, the company reported operating cash flow of $15.3 billion. That’s almost double the $8.5 billion generated one year earlier. Meanwhile, EBITDA for the enterprise rose from $12.5 billion in the third quarter of 2021 to $19.1 billion the same time this year.

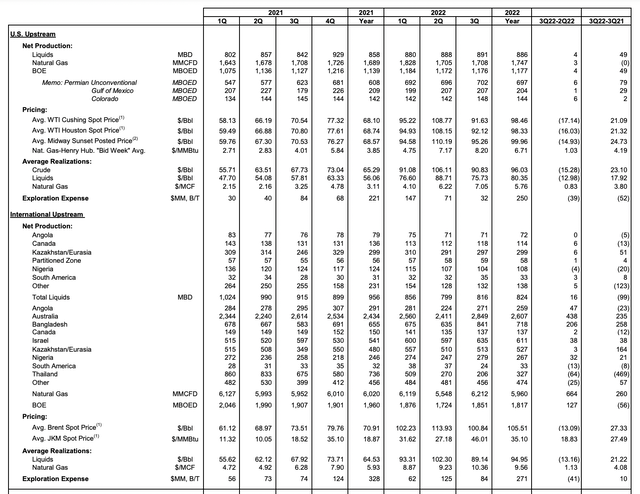

It would be helpful to dig into the numbers and see exactly why profitability improved so much from year to year. Into the US upstream operations of the company, we saw profits rise from nearly $2 billion in the third quarter of 2021 to $3.4 billion the same time this year. Interestingly, the company benefited only marginally from a rise in production. Total output from these operations grew 4.3% year over year, climbing from 1.127 million boe (barrels of oil equivalent) per day to 1.176 million boe per day. The big driver for this segment then was improved product pricing. For instance, for crude oil, the company realized a price of $90.83 per barrel. That stacks up against the $67.73 per barrel reported just one year earlier. For natural gas, meanwhile, pricing rose from $3.25 per boe to $7.05 per boe. Price changes like this can have a massive impact on the company’s bottom line. Because with the exception of taxes that must be paid, 100% of every penny in increased pricing flows directly to the company’s bottom line.

In the international upstream operations of the company, overall production totaled 1.851 million boe per day during the quarter. One year earlier, it was actually higher at 1.907 million boe per day. The increase, then, for profits from $3.2 billion to $5.9 billion can be attributed to realized prices rising from $67.92 per barrel for oil to $89.14 per barrel, while natural gas prices rose from $6.28 per Mcf to $10.36 per Mcf. The company also sides downstream operations improve year over year, with profits soaring from $1.3 billion to $2.5 billion. The vast majority of this came from the company’s international operations, with profits climbing from $227 million to $1.2 billion in response to a mixture of higher pricing and higher volume.

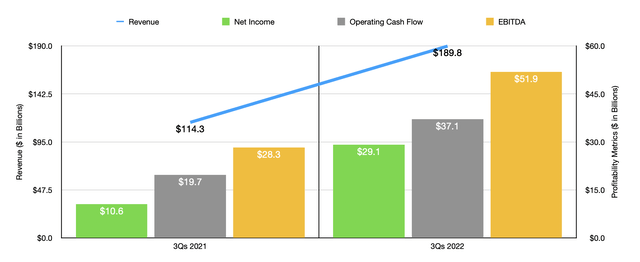

The third quarter was not the only good quarter for the company. For the first three quarters of 2022 as a whole, revenue came in at $189.8 billion. That compares to the $114.3 billion reported one year ago. Net income nearly tripled from $10.6 billion to $20.1 billion. Operating cash flow jumped from $19.7 billion to $37.1 billion. And EBITDA shot up from $28.3 billion to $51.9 billion. Management has made it a priority to reward shareholders with these profits and cash flows. In the third quarter alone, for instance, the company paid out $2.7 billion in dividends, a 6% increase over what they were one year ago. And the firm also repurchased $3.75 billion worth of shares. None of this has stopped the company from making sure that its balance sheet is stable. At the end of the latest quarter, net debt was only $8.2 billion. And on top of that, management continues to invest in growth initiatives. In the incredibly valuable Permian Basin, unconventional production is up over 12% from the same quarter one year earlier. And in total, management has increased its investments by over 50% year over year.

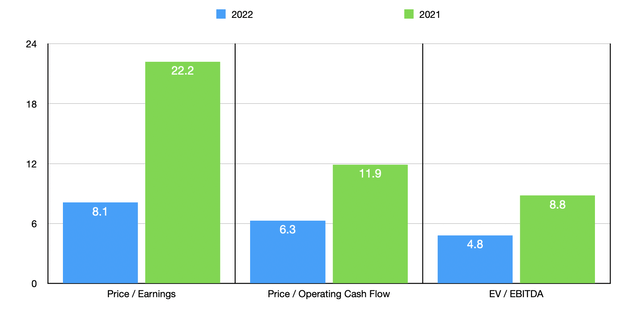

We don’t really know what to expect for the rest of the 2022 fiscal year. But if we annualize results experienced so far, we would expect net income of $43 billion, operating cash flow of $55 billion, and EBITDA of $73.9 billion. These numbers would imply a price-to-earnings multiple of 8.1, a price to operating cash flow multiple of 6.3, and an EV to EBITDA multiple of 4.8. If we assume that financial performance will eventually revert back to what it was in 2021, we would end up with multiples of 22.2, 11.9, and 8.8, respectively. Also, as part of my analysis, I compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 5.9 to a high of 13.5. Two of the three were cheaper than Chevron. Using the price to operating cash flow approach, the range was between 3.5 and 4.9. In this case, our prospect was the most expensive of the group. And when it comes to the EV to EBITDA approach, the range was between 3 and 7.8, with two of the three being cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Chevron | 8.1 | 6.3 | 4.8 |

| Exxon Mobil (XOM) | 6.4 | 4.9 | 4.0 |

| Shell plc (SHEL) | 5.9 | 3.7 | 3.0 |

| BP plc (BP) | 13.5 | 3.5 | 7.8 |

Takeaway

The data we have today suggests to me that Chevron continues to be a great prospect for long-term investors. The company’s financial performance has been robust and shares are looking cheap on an absolute basis, even as they might be more or less fairly valued compared to similar firms. Given these factors, I feel comfortable rating it a ‘buy’ just like when I last wrote about it over two years ago.

Be the first to comment