Brandon Bell/Getty Images News

Thesis

US oil majors are having an enormously successful year and Q2 confirmed the industry’s exceptional profit windfall due to inflationary pressures in the energy market. Chevron Q2 profit was $11.6 billion, which is the company’s highest quarterly profit ever. Thus, it comes as no surprise that CVX shares have strongly outperformed the broad market. For the past 12 months, Chevron (NYSE:CVX) stock is up by about 50% versus a loss of approximately 6% for the S&P 500.

Seeking Alpha

However, after Chevron’s blockbuster quarter, I am turning more cautious on the company’s stock. I believe investors should take advantage of Chevron’s enormously successful quarter and take profit on stock price strength and peak earning cycle. In my opinion, given the elevated level of positivity the stock has priced in too much optimism and the risk/reward is skewed downwards. In other words, it is time to be fearful when others are greedy.

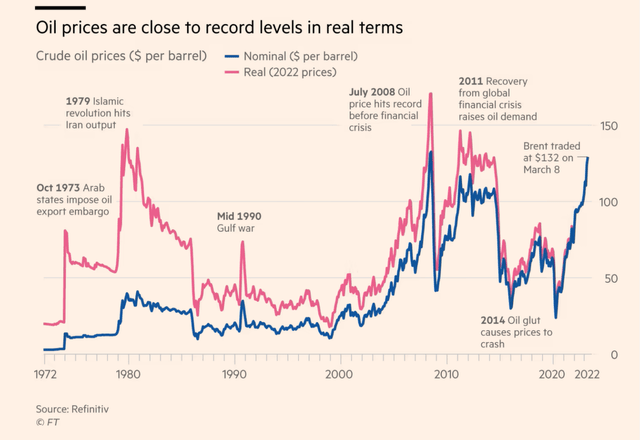

The outlook for the oil industry is slowly but surely darkening, in my opinion. Given the negative economic outlook – pressured by inflation, falling asset prices, rising real yields, a slowing economy in China and decade-low consumer confidence – I argue oil could fall to $60/barrel. Oil has already fallen by some 20% since the March 2022 peak, and I see this not as a materialization of volatility, but as a warning signal of more pain to come. Respectively, I expect downside for US oil & gas majors, where I believe investors are still excessively optimistic.

If investors would like to maintain exposure to the oil and gas industry, perhaps as an inflation hedge, I argue that European peers such as Shell (SHEL), TotalEnergies (TTE) and Equinor (EQNR) provide a much more favorable risk/reward set-up, given their strong relative discount.

Chevron’ Record Quarter

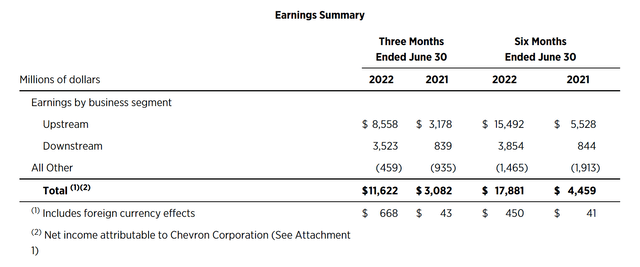

Chevron reported earnings on July 29 and delighted investors with very strong results. For the period April until end of June, the company generated total sales of $68.8 billion, which is an 80% increase as compared to the same period in 2021. Respectively, earnings were recorded at $11.6 billion, or $5.95 per share, which is Chevron’s highest quarterly profit ever. Analyst consensus had expected earnings of $9.9 billion.

Chevron’s cash flow from operations was approximately $21.8 billion, which is almost double the $11.2 billion of cash-flow recorded in 2021. Excluding working capital effects, the cash flow would jump to $22.2 billion, versus $12.2 billion in 2021.

Chevron’s earnings included non-operating and non-recurring losses of about $268 million only (loss of $600 million for early contract termination, a gain on asset sales of $200 million and a gain of $668 million due to favorable currency exchange rates).

Most notably, Chevron’s strong results were driven by both the company’s upstream and downstream business. Downstream more than quadrupled as compared to 2021 and upstream more than doubled. In total, Chevron’s upstream business accounted for slightly more than 75% of the company’s total earnings and downstream accounted for about 25%.

Record Profit Not Sustainable

But how sustainable is Chevron’s profitability? The thesis for investing in oil and gas companies is closely connected to the price of oil. And in my opinion, the oil price is exposed to material downside.

My thesis is based on the observation of a deteriorating global macro-environment. Given falling asset prices, rising interest rates and decade-low consumer confidence, it is hard to argue that the global economy will not enter a sharp recession. And in the context of a global economic slowdown, arguably nothing depreciates commodity prices more than recession-driven demand destruction.

Most notably, Edward Morse, the global head of commodities strategy at Citi with half a century of experience shared the view that oil (WTI benchmark) could fall to $60 per barrel, if the global economy were to slip into a recession. Some readers might argue that a $60/barrel prediction is too pessimistic. I argue that it is very reasonable. For reference, before the financial crisis oil stood at $140 per barrel (July 2008), only to crash to as low as $40 per barrel by the end of the year. And in 2020, lockdown-induced demand destruction crashed the WTI benchmark into deeply negative territory. Notably, during the past recessions oil and oil producing companies always depreciated in value.

Financial Times

Some might argue that valuations have already contracted and thus a recession is priced in. However, in my opinion, the oil depreciation has not yet materialized. True, WTI crude has already fallen from $119/barrel to $95/barrel. But I do not see this as an argument against the thesis. In fact, I view it as a warning sign.

Chevron’s Relative Overvaluation

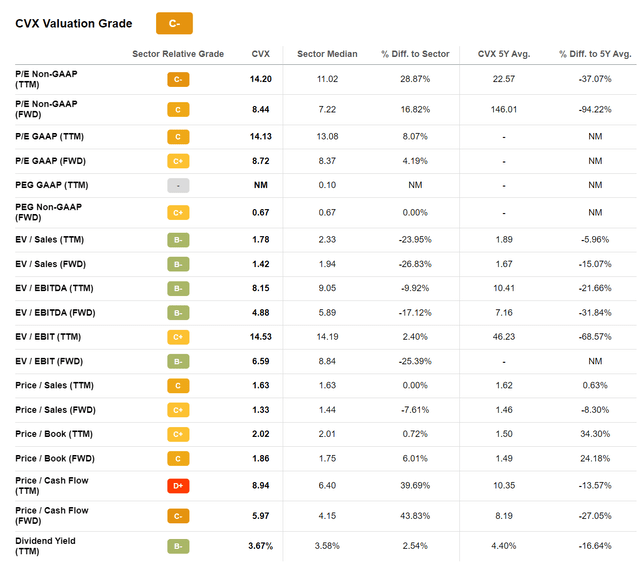

Investors should also consider that Chevron is trading at a relative rich valuation as compared to peers – especially European oil majors.

For reference, Chevron currently trades at a non-GAAP P/E of about x14. This is a 28% premium as compared to industry pears. Respectively, Chevron’s Price-to-Cash Flow ratio is at about x6 versus x4 for industry peers and indicates a 48% overvaluation.

If investors compare Chevron’s valuation against selected European majors such as Shell, Total and Equinor, the overvaluation becomes even more apparent: Shell trades at a PE below x8, Equinor trades at a PE below x6 and TotalEnergies trades at a PE below x5. That said, Chevron’s x14 P/E indicates a 70-100 % premium as compared to European peers. This huge valuation dispersion is not justified, in my opinion. The argument is simple: Both European and US oil majors equally share exposure to oil prices, both on the upside and on the downside.

Risks To My Thesis

My thesis is anchored on the believe that the global economy will enter a recession in the second half 2022/first half 2023. That said, if the economy turns out stronger than expected, energy demand and the oil price might stay at elevated levels – which would invalidate my bearish outlook on Chevron.

Furthermore, the oil price is significantly correlated to the Russian war in the Ukraine. JPMorgan published research that argues oil could jump as high as $190 per barrel – and to a “stratospheric” $380 per barrel as a worst-case scenario. JPMorgan’s thesis is anchored on the assumption that price penalties on Russian oil is retaliated by Russia with output/export cuts. At the same time, however, the situation could also surprise to the upside which would be supportive for my thesis.

In addition, my thesis implies that there are no structural differences between European and US oil majors. This, however, is not necessarily true since the respective regulatory exposure is somewhat different. Arguably, the European Union is slightly more aggressive with regards to the green energy push and US stocks generally trade at a premium. But still, I argue an 80-100% is not justified.

Conclusion

I see downside for the oil price and accordingly I am bearish on Chevron stock. In my opinion, investors are well advised to sell the stock following the bullish quarterly results and thereby take advantage of a favorable exit price.

However, I acknowledge that investors would like to keep exposure to energy companies as a possible inflationary hedge – given the 9.1% inflation print for June. Moreover, the Ukraine war remains unpredictable and energy prices could rally if additional disruption unfolds.

Interestingly, European oil companies such as Shell, TotalEnergies and Equinor are still trading very cheap, not only on a relative basis, but also on an absolute consideration. That said, I personally am selling out my exposure to Chevron (and other US oil majors) and I am accumulating stock of Europe’s energy giants.

My article about European Oil Majors:

Be the first to comment