David McNew

Chevron (NYSE: NYSE:CVX) has seen its share price perform incredibly well, pushing its market capitalization to $360 billion. The company also has seen its equity become one of the largest holdings of renowned investor Berkshire Hathaway’s (NYSE: BRK.A) (NYSE: BRK.B) portfolio, making up 9.2% of his equity portfolio with an 8.8% equity stake in the company.

Chevron Continued Financial Performance

Chevron has continued to perform incredibly well financially, highlighting its strength.

Chevron Investor Presentation

Chevron Financial Performance – Chevron Investor Presentation

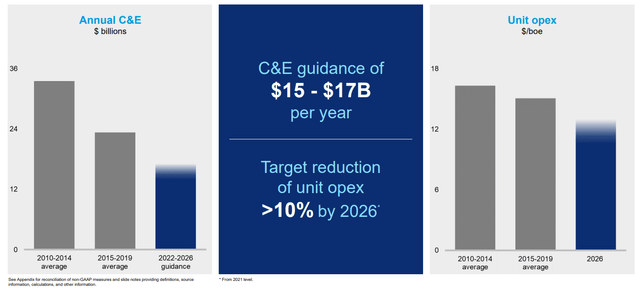

The company has ramped down its capital spending plan substantially, with roughly $15 billion in 2022-2026 guidance. That’s a substantial reduction from the company’s prior capital expenditure range, especially in the early 2010s when that number was more than $30 billion as the company was chasing growth.

The company is targeting continued cost reductions, with >10% reduction in unit opex by 2026. That would put unit opex to just under $12 / barrel, with the potential for continued growth after that point.

Chevron Low Carbon Adjustments

Chevron is continuing to revamp its low carbon business, although being able to switch its business presents a major risk.

Chevron Investor Presentation

Chevron Low Carbon – Chevron Investor Presentation

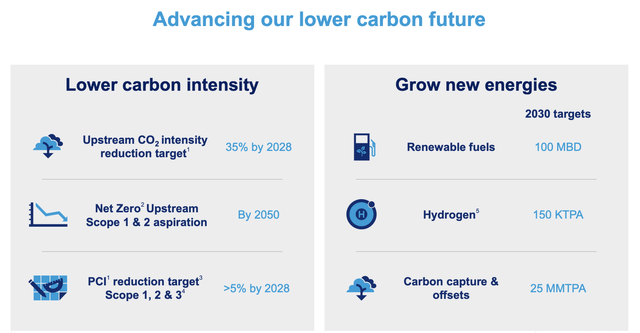

Chevron is continuing to adjust its business for a low carbon environment, but primarily through emission reductions with a 35% CO2 emission reduction by 2028. The company does have new energy targets for 2030 that include 100 thousand barrels / day in renewables fuels, 150 thousand tonnes / annum in hydrogen, and 25 million tonnes per annum in carbon capture. As far as goals go for a new energy environment that’s fairly minimal.

That could substantially hurt the company’s ability to provide continued shareholder returns if the market were to change substantially.

Chevron Growth

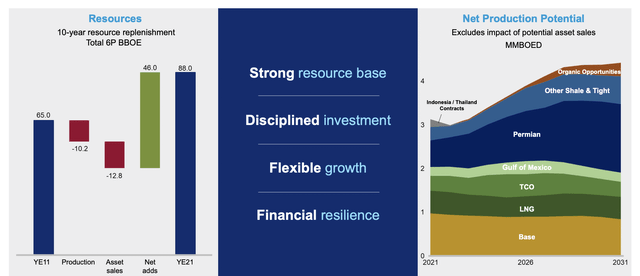

The company’s growth potential lies in its impressive portfolio of assets with 6P resources to the tune of almost 90 billion barrels.

Chevron Investor Presentation

Chevron Growth – Chevron Investor Presentation

The company has roughly 3 million barrels / day of production and by 2030 that’s expected to grow to more than 4 million barrels / day. The majority of that growth is expected to come from the company’s focus on the Permian Basin where production will reach more than 1 million barrels / day. This is low risk production that represents strong margins for the company.

We expect the company’s growth to be able to continue.

Chevron Financial Performance

The company’s financial performance from this cash flow is impressive, but the company still needs to justify its valuation.

Chevron Investor Presentation

Chevron Financial Performance – Chevron Investor Presentation

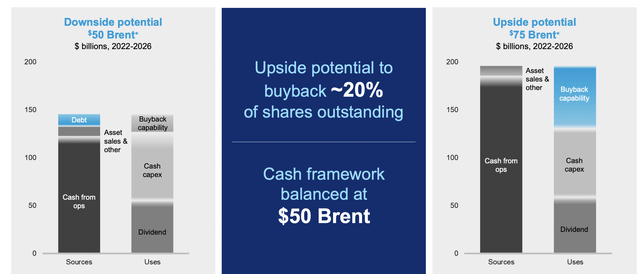

The company at $50 billion expects roughly $70 billion in FCF from 2022-2026 ($14 billion annualized) that can be used for shareholder returns. At $75 / barrel Brent that’s expected to be closer to $120 billion ($24 billion annualized) in cash flow potential. For a $360 billion company neither of those numbers are particularly impressive (4% and 7% annual FCF yield).

The company’s cash flow framework is balanced at $50 Brent, which is nice to see, but the company needs closer to $100 billion Brent average to generate the double-digit shareholder returns that’d make it a valuable separate business. Given the historic trends of the market and the fact that drilling is heavily incentivized at $60-70 / barrel, we find it unlikely that prices remain that high for that long.

Our View

Chevron is an incredibly strong company and there’s no guarantee that the company will continue to outperform. The company is known for making intelligent decisions about capital allocation, and its well-timed hefty 2010-2014 capital program enabled it to whether the oil downturn more than most. Despite that, the company still has substantial risk.

The company is trading at a high valuation. That’s because of its security. But the prices it needs to justify its valuation, especially in the current interest rate environment, are unlikely in our view, making the company a sell at the present time.

Thesis Risk

The largest risk to our thesis is that if long-term crude prices average closer to $100 / barrel, Chevron has more substantial potential, especially if it manages to grow production. The company at this level could comfortably generate double-digit returns. However, even in that case, we see better opportunities in the market for deploying your capital, which makes Chevron a worse use of cash.

Conclusion

Chevron has a unique and exciting portfolio of assets and the company has continued to be incredibly intelligent with its capital program. We expect the company to be able to generate substantial cash flow and use that cash flow to both maintain its dividend and opportunistically repurchase shares. Buybacks are a major part of the company’s plans.

However, the company does have the risk that its valuation has gone up substantially. Its share price has more than doubled from its lows. The company’s ability to generate double-digit share rewards at its current valuation relies on almost $100 / barrel in long-term oil prices, a level we feel the company will be unlikely to meet.

Be the first to comment