After several attempts, it looks like Telecom Italia S.p.A. (OTCPK:TIIAY), hereafter TIM, is finally taking its plan to merge its assets with those of its Italian broadband wholesaler’s peer: Open Fiber, to the final round. This is generally seen by the market as a positive development, as the two companies could eventually develop significant synergies together and effectively act like a monopolist given the lack of other competitors in Italy. However, the details of the plan have not been disclosed and, so far, what we know is rather surprising.

A transformative deal

A few days ago, TIM announced it had signed a non-binding MOU with Cassa Depositi & Prestiti (“CDP”) for the integration of the two companies’ fixed broadband infrastructure. CDP is the main shareholder of Open Fiber, TIM ‘s only competitor in the broadband business in Italy. CDP is a state-controlled company, so the acquisition will return Italy’s broadband infrastructure to the hands of the state: an outcome Italian regulators have sought for decades. In fact, the announcement states that CDP will control all of Italy’s fiber infrastructure at the end of the operation, with the funds KKR (KKR) and Macquarie (MIC) being the minority shareholders.

Interestingly, TIM itself is not mentioned as a shareholder in the new structure, giving rise to a number of speculations. First of all, this is not the first time that TIM and CDP have signed an agreement to combine their broadband cable infrastructures. However, the earlier plan called for TIM to hold a stake in the merged company, and even a majority stake. In addition, TIM had planned to contribute only its primary network, which extends from the exchanges to the distribution boxes in the streets, to the merged company, but not its entire backbone, since the valuation of its whole network far exceeds the value of Open Fiber.

We are talking about 20 billion euros here, while Open Fiber’s enterprise value is estimated at about 5.5 billion euros based on the latest transactions involving the company’s ownership structure. What is interesting is that TIM now wants to withdraw completely from this business (with the probable exception of its non-Italian broadband cable infrastructure) and is trying to carve this 20 billion euros out of its assets. It is quite clear that no one is willing to pay that money for the Italian fiber backbone, which means that TIM (and CDP) are seeking a zero-cost transaction by attaching a large amount of debt to the Italian company’s asset (large enough to value the backbone!).

This can be done in various ways, for example, by creating a new company where assets and liabilities are equal: this company will probably not be profitable after paying the annual interest on the debt, so it could be sold to CDP for a token amount. Such plan (if CDP agrees, but it looks like it has already agreed, at least in principle) would get easily the approval of the Italian authorities, since the fact of transferring a monopoly (or a quasi-monopoly) from a private company to a public entity is certainly welcomed by both Italian and European regulators. Nevertheless, a completely new company would emerge from TIM.

TIM at a glance (without debts)

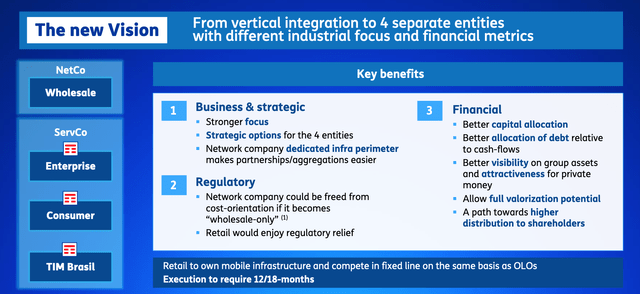

Earlier this year, the new CEO of TIM unveiled his plan to finally turn the Italian telecommunications giant around. In short, it involves splitting the company into two (three) parts: a service company, a wholesaler and TIM Brasil (see figure below).

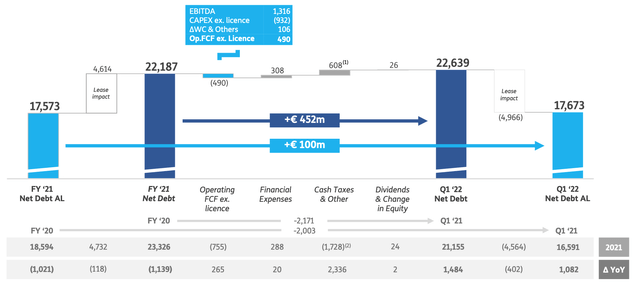

The wholesale part now consists of the Italian backbone fiber network and the international fiber network (Sparkle, which represents about 25% of total wholesale sales): it is a high margin business (EBITDA margin of over 40%) but also higher CAPEX (27% of revenues in this segment VS 17% for the rest of the business). All in all, we are talking about giving up a little more than 4 billion euros in sales per year, or about 27% of the Group’s total sales (if the deal closes on the terms we know). EBITDA will of course shrink, I estimate a drop of about 40%, but the company will basically be debt free.

The math is simple: after a €20 billion debt cut, TIM will have a net debt of less than €3 billion, which includes the company’s leases. However, these are more of an optical charge, calculated according to the IFRS 16 standard: more precisely, they do not bear interest. If we exclude them, TIM would have net liquidity of more than EUR 2 billion, which is unprecedented in its history as a private company. This means that the company that would emerge after the acquisition would be unleveraged and have decent profitability, with the value of equity remaining the same, as the operation is expected to be neutral from an equity perspective. In other words, the current price of TIM, which is about one third of reported equity, makes little sense if the deal actually takes the form the company let us figure out.

Bottom Line

TIM is effectively transforming its business and is seeking a deal with the Italian state-backed: Cassa Depositi & Prestiti to get rid of its backbone fiber infrastructure. This will leave the company with the same equity as today, but virtually no net debt on its balance sheet. TIM will essentially be a service company for both residential and corporate customers in Italy, although it will continue to own valuable business units abroad, such as Sparkle (a fixed-line wholesaler) and the Brazilian telecommunications company TIM Brazil.

The new company will be significantly undervalued at current prices and will trade at a fraction of its unleveraged equity value, while generating significant cash from its operations. Consequently, I view the entire operation as positive for TIM shareholders , although it must be emphasized, of course, that the deal is not yet complete and that TIM and CDP had agreed in the past to merge their wholesale businesses and those plans never materialized. This time, however, it could be different, as the regulatory side of the equation will obviously be much less complicated: indeed, full control of Italy’s fixed-line infrastructure will be reverted to a public entity.

Consequently, TIM is a speculative buy at the moment: a small position could be taken now, followed by further purchases when the overall picture becomes clearer in a few months.

Be the first to comment