Sky_Blue

Due to hiked natural gas and energy prices in 2022, especially in Europe (as a result of the war in Ukraine and plunged flows from Russia), Cheniere (NYSE:LNG) reported strong financial results in the third quarter of 2022. The war in Ukraine is still going on. U.S. LNG export is expected to increase in 2023. Also, after the recent JKM price decrease (after hitting a new high in the summer of 2022), JKM price is expected to increase in 2023. 70% of Cheniere LNG volumes produced in 2022, were delivered to Europe. Amid Russian supply cuts, LNG flows to Europe jumped 106% YoY. Russian flows to Europe dropped 72% YoY while U.S. LNG deliveries surged over 200% YoY. Due to record LNG imports from the U.S., European Union storage levels surpassed 90% in early October. On the other hand, Asia LNG imports decreased by 7% YoY as a result of lower imports from China. Cheniere is well-positioned to benefit from the market condition in the upcoming quarters. I expect Cheniere to report strong 4Q 2022 and 1Q 2023 results. The stock is a buy.

Q3 2022 results

In its 3Q 2022 financial results, LNG reported revenues of $8852 million, compared with 3Q 2021 financial results of $3200 million, up 177% YoY. The company’s adjusted EBITDA increased from $1053 million in 3Q 2021 to $2782 million in 3Q 2022. The company’s LNG volumes exported increased from 500 TBtu in 3Q 2021 to 558 TBtu in 3Q 2022, up 12%. LNG’s cost of sales increased from $4868 million in 3Q 2021 to $1107 million in 3Q 2022. Cost of sales includes a $5.5 billion change in the fair value of commodity derivatives prior to contractual delivery or termination during the three months ended 30 September 2022, compared with $2.4 billion of losses during the three months ended 30 September 2021. Thus, LNG’s net loss attributable to common stockholders of $1084 million in 3Q 2021, increased to $2385 million in 3Q 2022. The company’s derivative losses are related to the use of commodity derivative instruments (indexed to international gas and LNG prices), which relates to its long-term integrated production marketing (IPM) agreements. Because of accounting requirements the company has to recognize these long-term gas supply agreements at fair value. However, the company cannot recognize the associated sale of LNG.

The company reconfirmed full-year 2022 consolidated adjusted EBITDA guidance of $11 to $11.5 billion and full-year 2022 distributable cash flow guidance of $8.1 to $8.6 billion. In the third quarter of 2022, LNG prepaid over $1.3 billion of consolidated long-term indebtedness. Moreover, the company repurchased an aggregate of approximately 0.6 million shares of common stock for approximately $75 million and paid a quarterly dividend on its common stock of $0.33 per share.

“The Cheniere team continued to fire on all cylinders throughout the third quarter, as evidenced by our strong quarterly earnings, confirmation of our recently revised 2022 guidance, and the implementation of our ‘20/20 Vision’ long-term capital allocation plan,” the CEO commented. “Our confidence in a strong finish to 2022 and optimism looking ahead to 2023 is underpinned by our achievements across the Cheniere organization,” he continued.

The market outlook

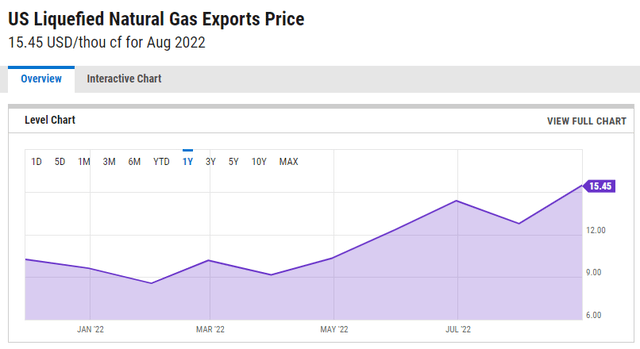

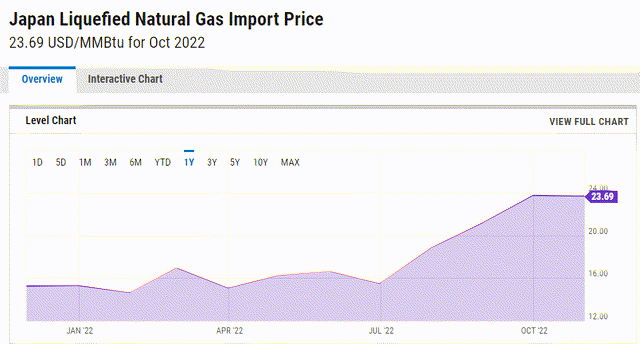

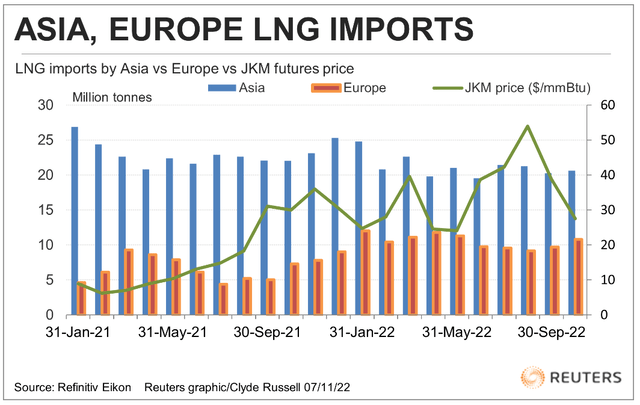

Figure 1 shows U.S. liquefied natural gas export price increased from $8.56 per thousand cubic feet on 31 January 2022 to $15.45 per thousand cubic feet on 31 August 2022. Figure 2 shows that Japan’s liquefied natural gas import price increased from $14.69 per thousand cubic feet on 31 January 2022 to $21.21 per thousand cubic feet on 31 August 2022 and to $23.69 per thousand cubic feet on 31 October 2022. According to Figure 3, JKM’s price decreased from more than $50 in August 2022 to below $30 in September 2022. Meanwhile, Europe’s LNG imports increased in the past two months. Also, Asian LNG imports increased to more than 20 million tonnes in September 2022.

Figure 1 – U.S. LNG export price

Figure 2 – Japan LNG import price

Figure 3 – LNG imports by Asia vs Europe vs JKM futures price

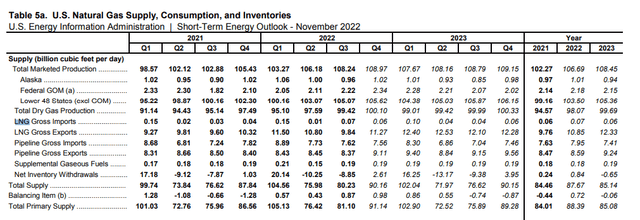

According to EIA, U.S. LNG gross exports are expected to increase from 1.08 billion cubic feet per day in 22022 to 12.3 billion cubic feet per day in 2023. Compared with the first ten months of 2021, Russian natural gas pipelines to European Union decreased by 50% in the first ten months of 2022 and will decrease further until the end of the year. As European Union was able to import 30 Bcm of Russian gas supply in the summer of 2022 and due to China’s COVID-19 restrictions that decreased its LNG imports, EU gas storage sites are now 95% full. However, Russian gas pipelines to the EU could cease completely and China’s COVID- lockdowns will eventually finish. Thus, the EU will need to increase its natural gas imports from the United States.

“We expect inventory draws in December and January to outpace the five-year average, driven by a seasonal decline in natural gas production, rising demand for space heating, and increases in liquefied natural gas exports that largely result from the return of Freeport LNG. Although any delay in the return of Freeport LNG could contribute to some downward price pressures in the near term, these factors will likely limit any downward price pressures this winter, and the possibility for price spikes and volatility in the case of extremely cold weather is high,” IEA explained.

Altogether, according to the LNG prices and LNG demand outlook in 2023 and due to the company’s IPM agreement, the company is well-positioned to make huge profits in the near future.

Figure 4 – U.S. LNG gross exports

LNG performance outlook

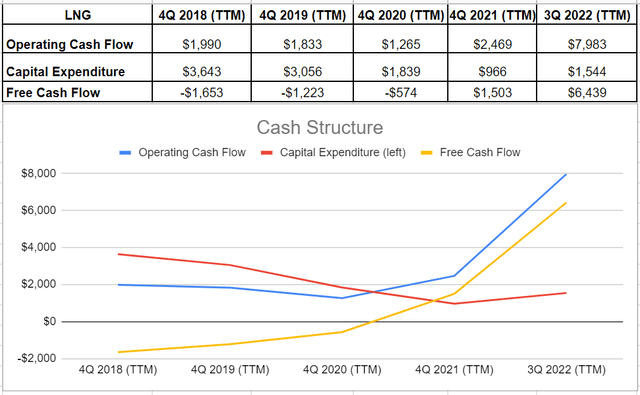

Analyzing the cash and capital structures of Cheniere Energy indicates that the company’s operating cash flow has recovered amazingly after a downturn in 2020 and reached a peak of $7983 million in 2022. It is observable that the company’s cash conditions have improved considerably since 2020. In minutiae, LNG’s cash in operation surged by 97% and set a new record of $1265 million in 2021 compared with its previous level of $1265 million at the end of 2020. About its capital expenditure, we can see that after a decrease to $966 million in 2021 versus its previous amount of $1839 million at the end of 2020, increased back to $1544 million in 2022. When all was said and done, Cheniere Energy ultimately catered an ample amount of free cash flow and sat at $6439 million in 2022, which is the highest record for the company, while its free cash flow was $1503 million at the end of 2021. As a result, the cash structure of Cheniere Energy how successfully the company is able to bring benefits to its shareholders (see Figure 5).

Figure 5 – LNG’s cash structure (in millions)

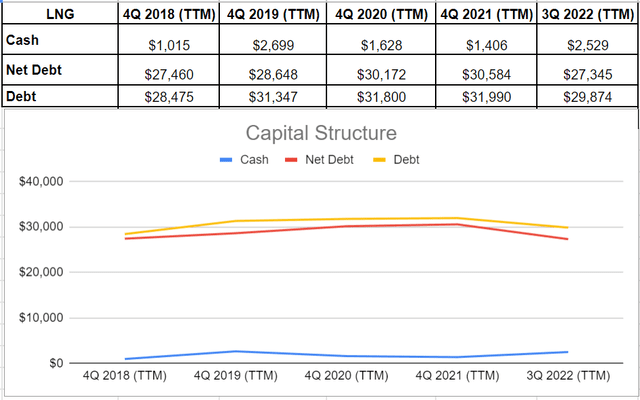

After their cash balance waned to $1628 and $1406 million in 2020 and 2021 respectively, LNG could improve its cash balance considerably by 79% to $2529 million in 2022. Also, the impressive increase in Cheniere Energy’s cash balance, combined with a 6% decline in total debt to $29874 million in 2022 versus its previous amount of $31990 million in 2021, led to a decrease in the company’s net debt. LNG’s net debt had a fall to $27345 million in 2022, while it was $30584 million at the end of 2021. All in all, the capital structure of Cheniere Energy indicates the company’s well-performance and will likely improve further in the future (see Figure 6).

Figure 6 – LNG’s capital structure (in millions)

Summary

In terms of the market outlook, Cheniere will continue benefiting from hiked LNG prices and U.S. increasing LNG exports to Europe. In terms of the performance outlook, due to the company’s recent developments and agreements, Cheniere’s capital structure and cash structure will improve further. I am bullish on LNG.

Be the first to comment