CHUNYIP WONG/E+ via Getty Images

The first US company to export liquified natural gas, Cheniere Energy Partners (NYSE: CQP), is based in Houston, Texas. In its early days, Cheniere Energy was an oil and gas exploration company. However, as the market landscape changed in the early 2000s, the decision was made to invest in the development of liquified natural gas re-gas terminals. The company hit a low point in the mid-2000s as international competition on the (LNG) front stalled the domestic market. In 2010 however, the company rose to prominence as natural gas production in the U.S. intensified. In 2016, Cheniere Energy began exporting LNG to other countries – a first for LNG companies in America. The company has rebuilt its foundation on that model, using it to build value and expand. In 2018 Cheniere Energy reached a $25 billion agreement with CPC Corp, a Taiwanese company, to supply them with LNG for 25 years.

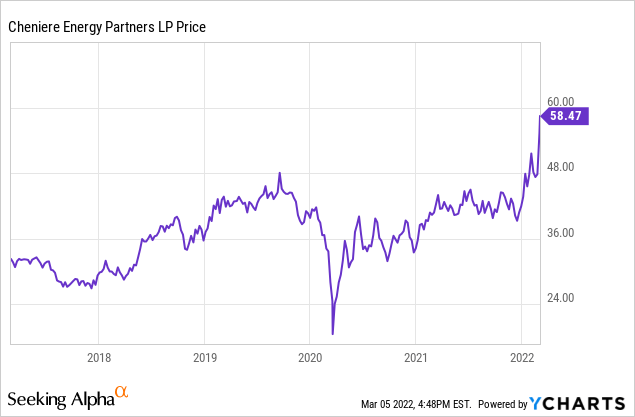

YCharts

In this article, I will show that despite some analysts listing Cheniere Energy Partners as a hold or sell, I have it listed as a buy. The long-term futures of the company have changed drastically with the political landscape and the war between Russia and Ukraine, which is sure to raise market prices. The company’s completion of the Train 6 terminal at Sabine Pass is also flying under the radar, as it will offer a nice boost in production. With demand outpacing supply, the LNG industry is still highly lucrative, and Cheniere’s ability to export their LNG to other countries puts them in the driver’s seat for success.

Effects of the Ukraine-Russian War

War is terrible on all fronts. Despite this war being fought far away from the United States, the economic consequences and fallout will be felt globally. Several factors lead to this. The first is that Russia is the second leading nation globally in terms of oil and natural gas production. In 2020, Russia produced 10.1 million barrels of crude oil and natural gas condensate per day. With Russia being in a state of war, those numbers are sure to drop. This will directly affect nations with a high oil consumption rate. The leader in that category is the United States which consumes a staggering 11.3 million barrels per day. With the Russian market likely to underperform, it will cause a shortage on the market, which will drive the cost of those barrels way up.

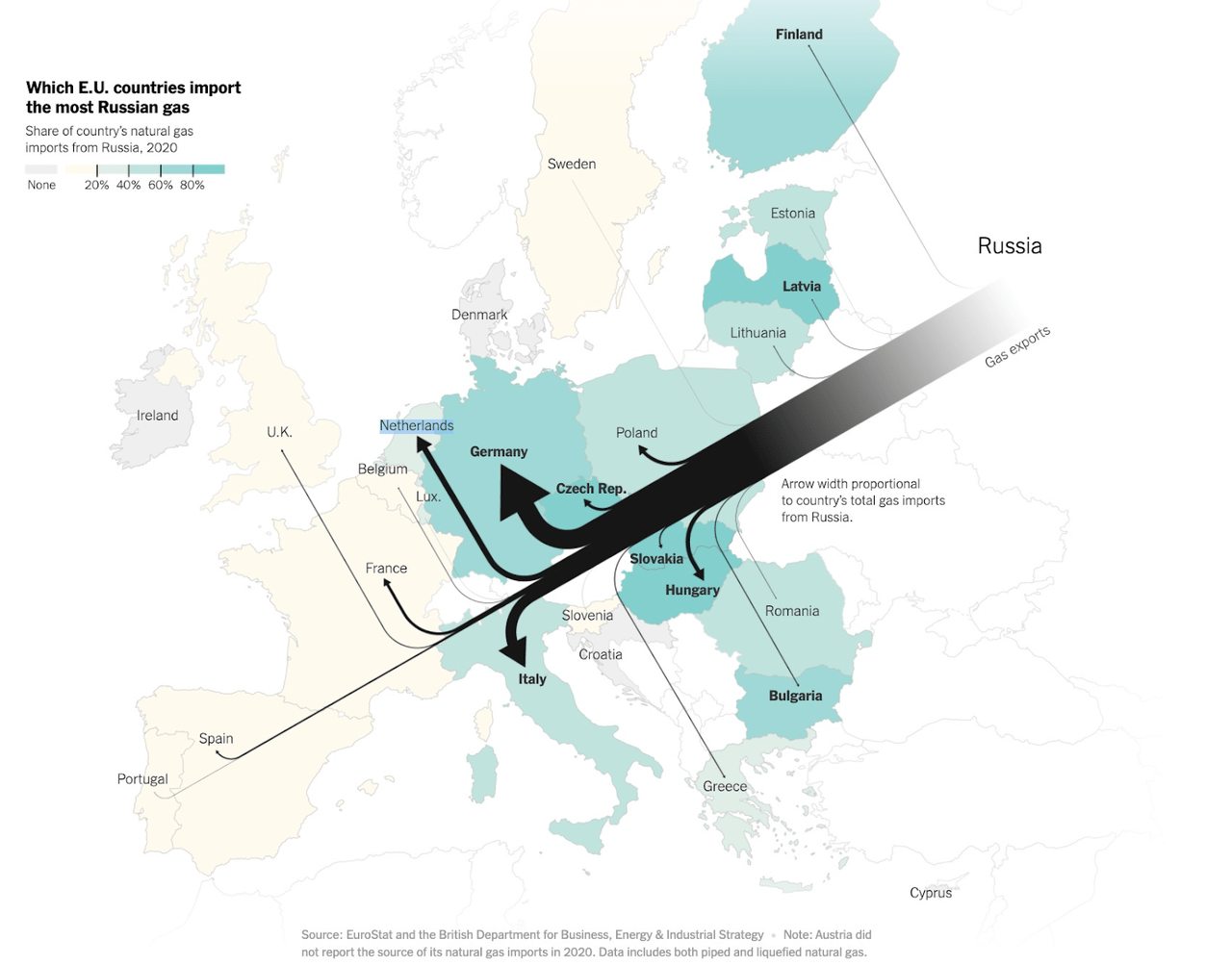

The New York Times

Another issue flying under the radar is Ukraine’s role in the natural gas market. Specifically in regard to the natural gas pipelines used by Russian industries. 20% of the natural gas pipelines used by Russian enterprises flow through Ukraine. With rampant bombings and the perils of war, the risk of damage to these pipelines is astronomically high. Another issue is that Russia may declare force majeure on those pipelines, releasing the Russians from any liabilities on the delivery of their contracted natural gas supply. This would directly impact the EU financially, and they would be scrambling to find alternative imports for their LNG supply.

Future Opportunities

Despite the horror of the war overall, it does provide some unique opportunities for a company like Cheniere Energy Partners. Because they are the first American LNG company to export their product to other countries, they could be called upon to pick up some of the slack on the international market that is likely to be caused by this war. With a lucrative contract with Taiwan already in hand, Cheniere Energy could look to other LNG starved countries that risk being cut off from Russian supply through sanctions or pipeline delivery issues. Countries in the EU could look to generally stable American companies as a short-term bridge gap. At the same time, they navigate the fallout from Putin’s invasion of Ukraine, which could further boost profits.

With this potential uptick in demand, Cheniere would have to have the capacity to produce excess supply. With the company’s recent completion of Train 6 at Sabine Pass, such an increase in supply is entirely possible. The company declares that with all six trains running, Sabine Pass can produce 30 million tons per annum (MTPA) of LNG. The opening of train six increased the MTPA rate by 6, from 24 MTPA to 30. This will increase sales, increasing the company’s future financial outlook. While this amount would not supply all international markets, it will give Cheniere Energy the ability to pick and choose its deals.

Financial Overview

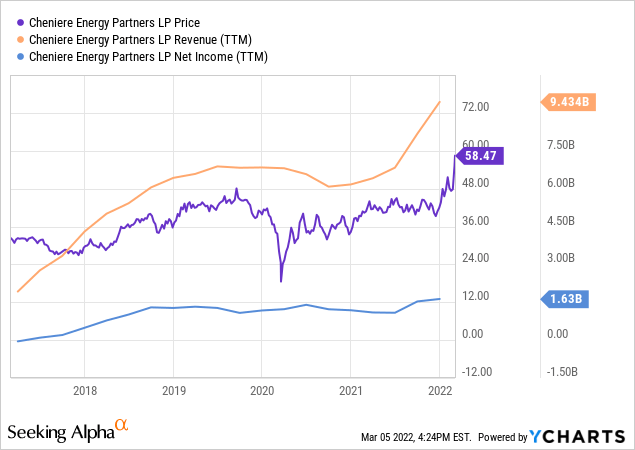

YCharts

Cheniere Energy enjoyed a tremendous jump in revenue in 2021, from $6.1 billion to $9.4 billion. This $3.4 billion increase is significant, representing a revenue growth rate of 54%. However, this jump does come with a cost. The cost of revenue between 2020 and 2021 nearly doubled. In 2020 the COR was reported at $3.3 billion, while in 2021, that number rose to $6.2 billion, which impacted profits. The $3.3 billion jump in revenue led to a profit increase of just under $400 million. With that being said, it still represents an increase in profits, which means that the company has increased its profits in three of the last four years.

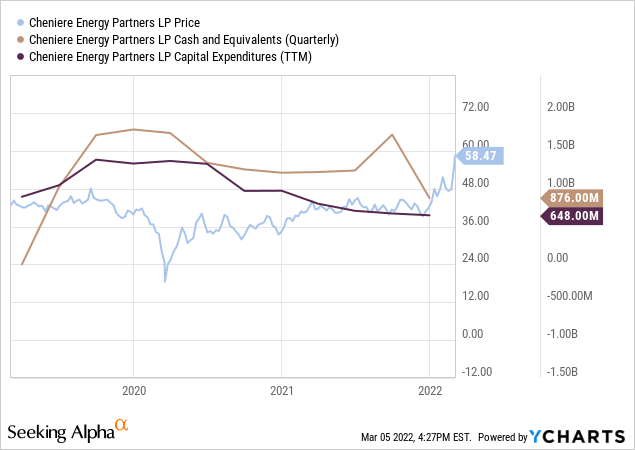

YCharts

In terms of the balance sheet, cash and cash equivalents remain largely the same. Overall they are down about $900 million from 2019, dropping from nearly $1.9 billion to $876 million. However, their recent opening of Train 6 at Sabine Pass likely accounts for a sizable portion of that. Company CapEx has increased, from $972 million to $648 million. Since CapEx tends to serve as a leading indicator of a company’s expansion, the fact that this number has risen puts my analysis in line with several other analysts; no company growth is imminent. However, they do not need expansion to have a bright outlook when market opportunity has been brought directly to their doorstep.

YCharts

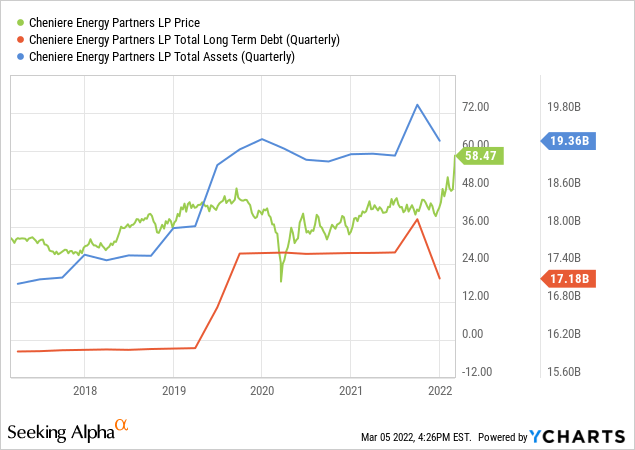

Long-term debt is somewhat of a cause for concern. It has continually risen, although minimally, across 3 of the last four years. Starting in 2018, long-term debt sat at $16 billion. In 2019 that number rose to $17.5 billion. In 2020, it rose again, this time to $17.6 billion. In 2021, the company was able to reverse this trend, but again, only minimally, decreasing their total long-term debt to $17.1 billion. However, this number is drastically mitigated compared to the valuation of the company’s total assets. In 2021 the company reported a robust $19.3 billion in total assets. This shows that the company likely acquired most of its debt in acquiring its assets. So long as those assets are valued higher than the total debt, the company is stable financially.

Conclusion

Everything that many other analysts have said regarding Cheniere Energy Partners, L.P., and the lack of future growth and expansion can be mitigated by changing market conditions due to the political and economic fallout from the war. While many companies could decline in the face of this war, Cheniere Energy Partners stands to benefit. With Russia being one of the world leaders in oil and natural gas, and with their ability to produce threatened by war along with their ability to sell threatened by sanctions, the world may look to other companies to fill the void. Cheniere Energy is one of the more likely names of American companies that will fill that market void internationally. The fact that these events coincided with the expansion of their Sabine Pass facility, which increased their supply capabilities, puts them in the category of “right time right place” companies. This company appears to have a very bright short-term future, and long-term prospects should improve pending the company’s ability to access expanding international markets.

Be the first to comment