IgorSPb

Cheniere Energy, Inc. (NYSE:LNG) shares have sold off since the company reported disappointing third-quarter Adjusted EBITDA of $2.78 billion versus analyst expectations of $2.86 billion. With the shares now trading at $156 – down 14% from their high of $182 – we believe they offer significant long-term upside.

At today’s price, Cheniere’s stock fails to reflect the company’s emergence as a cash flow powerhouse, which was on display in the third quarter. During the third quarter, its free cash flow surged from $363 million in the year-ago quarter to $2.1 billion. Management has allocated all this free cash flow for the benefit of shareholders.

We believe the selloff has gone too far and that Cheniere shares should be bought and held for the long term.

Cheniere’s Operating Environment Remains Bullish

Throughout 2022, Cheniere has benefitted from unprecedented strength in the LNG market. Record LNG demand from Europe and strong demand from Asia allowed it to contract 90% of its capacity over an average term of 17 years.

In the third quarter, free cash flow surged above year-ago levels as the historic rally in LNG prices increased the margins on the LNG cargos Cheniere sells in the spot market. These cargoes are not subject to long-term sales agreements and can therefore capture the huge spread between domestic U.S. natural gas prices and European prices.

So far this year, spot cargo sales have exceeded even the most bullish expectations. This is because Cheniere’s sixth Sabine Pass liquefaction facility entered service before its long-term sales contracts when into effect. The spot cargos it was able to sell have been the primary driver behind the company’s financial outperformance throughout 2022.

Cheniere has benefitted from high U.S. natural gas prices, which boosted LNG lifting margins. It has also managed to profit around the edges of its business. For instance, it took advantage of surging global LNG tanker charter rates by sub-chartering tankers it had contracted at lower rates when it first struck LNG sales agreements.

Capital Allocation is Superb

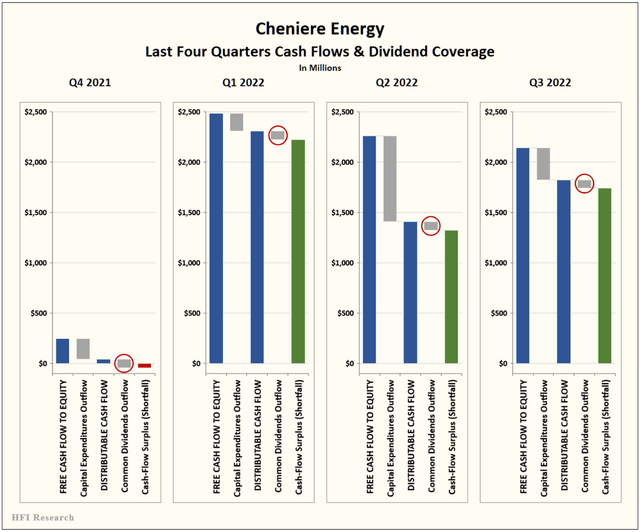

The chart below shows the free cash flow Cheniere generated in each of the last three quarters. It puts into perspective the company’s small dividend burden – circled in red – relative to its total free cash flow. The cash flow that remains after dividends is depicted in green. This cash is allocated at management’s discretion.

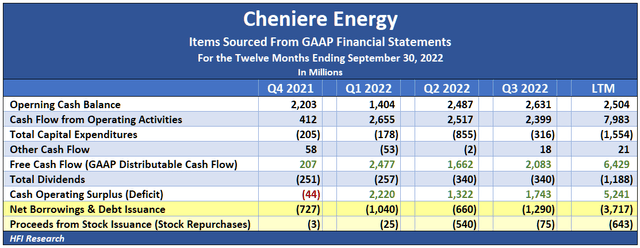

Quarter after quarter, management has allocated cash flow for the benefit of shareholders. The table below illustrates how management has used retained cash flow to aggressively pay down debt and repurchase shares.

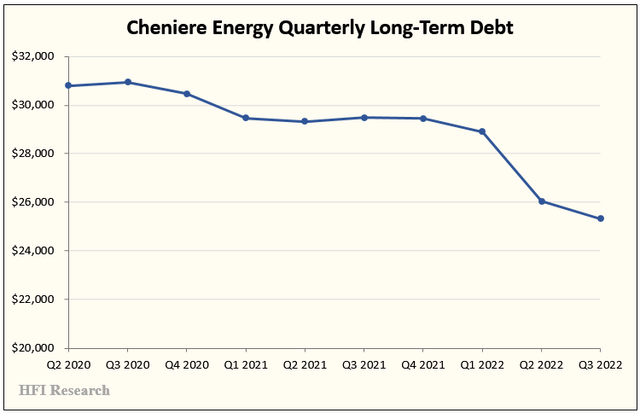

Over the past four quarters, management repurchased $643 million of stock at attractive prices. It also paid down $3.7 billion of debt. Long-term debt has fallen to the lowest levels since 2017.

Cheniere’s lower debt levels and improved cash flow results prompted Moody’s to upgrade Cheniere’s credit rating in September.

Cheniere’s balance sheet is in good shape. Its leverage ratio is already below management’s 4-times target. Meanwhile, interest expense is well covered. The last twelve months operating cash flow covers interest expense by 4.4 times. Over the past three quarters, operating cash flow covers interest expense by more than 6.7 times.

20/20 Vision Set to Benefit Shareholders

During the third quarter, management articulated its “20/20 Vision” long-term capital allocation plan. The plan went into effect in the fourth quarter.

The 20/20 Vision plan starts with the $20 billion of free cash flow management expects Cheniere to generate through 2026. The company should have little trouble generating $20 billion of free cash flow over the next four years. It generated $2.1 billion of free cash flow in the third quarter alone.

The $20 billion of free cash flow will be used, first, to pay down debt and maintain a 4-times debt-to-EBITDA ratio. Second, to repurchase $4 billion of stock. And third, to increase Cheniere’s common dividend by at least a mid-single-digit rate each year.

The plan calls for the company to step up its ratio of share repurchases to debt reduction from 1:4 in previous quarters to 1:1. To accommodate the increased repurchase activity, the company expanded its repurchase authorization from $1 billion to $4 billion.

The 20/20 Vision plan commenced in the fourth quarter. True to form, management wasted no time in executing it. On Cheniere’s third quarter conference call, management disclosed that it repurchased 1 million shares in October alone, double the amount repurchased in the entire third quarter. We expect the repurchases to continue as long as Cheniere’s shares remain undervalued.

Management’s 20/20 Vision plan also calls for increasing Cheniere’s dividend from previous quarters’ $0.33 per share payout rate to $0.395 per share. It also calls for the company to invest $1.5 billion to expand its Corpus Christi LNG facility. This sum is in addition to the $1 billion already spent before reaching a final investment decision.

The higher dividend rate will increase Cheniere’s quarterly dividend obligation by $16.5 million, a tiny amount compared to its current $1.75 billion of quarterly free cash flow after Corpus Christi Stage 3 capex requirements. The new dividend rate provides shareholders with a 1.0% yield on the current stock price.

Cheniere’s Stock: The Downside Versus the Upside

To be sure, Cheniere’s Adjusted EBITDA faces downside risks. For one, LNG prices could collapse if Russian natural gas flows to Europe were to resume. While this scenario wouldn’t adversely impact cargoes subject to long-term sales agreements, it would reduce the margins Cheniere obtains on spot LNG cargoes.

A significant reduction in European natural gas demand is also a risk, whether from economic weakness or continued deindustrialization.

However, these risks have offsetting factors.

First, global LNG demand outlook remains strong. Natural gas will continue to be a favored energy source even if the energy transition stalls or if nuclear is rolled out.

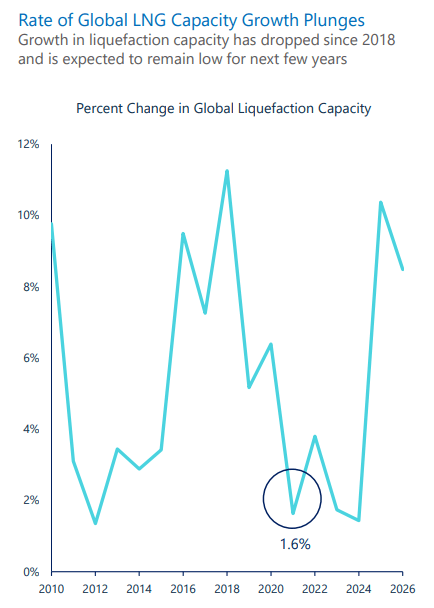

Second, LNG supply is likely to be constrained over at least the next few years. The following chart shows the supply outlook provided by Cheniere’s management.

Cheniere Energy

Constrained LNG supply amid growing demand is likely to keep LNG prices elevated, which would support Cheniere’s cash flow.

Another factor offsetting the risks to Cheniere’s Adjusted EBITDA is the company’s long-term production capacity growth. Altogether, management estimates Cheniere has room to grow capacity by 60% from current levels. Its latest expansion, Corpus Christi Stage 3, is set to add more than 10 million tons per year of LNG capacity, increasing the company’s current 45 million tons per year of capacity by 22% when it enters commercial service in 2026.

There are other attractive features of Cheniere’s economics. For instance, a significant portion of its business is resistant to inflation. The fixed fees its customers pay for contracted LNG volumes are subject to annual inflation escalators tied to the CPI.

Cheniere will also be less dependent on capital markets going forward. This year, the company has transitioned from raising debt to fund construction to using free cash flow to pay down debt. Its credit profile is set to improve over the next few years, which will render its results less exposed to a rising interest rate environment.

We believe these positive factors offset the negatives in Cheniere’s outlook.

Over the next four years, we expect Cheniere’s annual Adjusted EBITDA to remain above $8.5 billion. We believe this estimate is conservative in light of the revenue stability and locked-in margins provided by its long-term sales agreements. It is also conservative relative to the $9.8 billion of Adjusted EBITDA it generated over the past four quarters and management’s full-year 2022 guidance of $11.0 to $11.5 billion.

With Cheniere’s enterprise value at $66 billion, its shares trade at an EV/EBITDA multiple of 7.8 times our assumption of $8.5 billion Adjusted EBITDA over the next four years. Given the company’s prospects for reducing debt, repurchasing shares, increasing its production capacity, and sustaining a high return on capital over that timeframe, we believe a multiple of 9 to 10 is more appropriate. At those multiples, assuming no further debt reduction, no additional share repurchases, and no production capacity growth, the shares have an implied value of $200 to $234, which translates to an upside of 28.2% to 50.0% from today’s stock price of $156.

Conclusion

Cheniere shares are down 14% from their recent high of $182. The selloff provides an attractive entry point for investors looking to profit from the company’s leading position in the booming LNG market. At its current price of $156, we see a low likelihood of fundamental downside risk and significant upside for Cheniere Energy, Inc. over the next few years.

Be the first to comment