Chesky_W/iStock via Getty Images

A writer who is afraid to overreach himself is as useless as a general who is afraid to be wrong. – Raymond Chandler

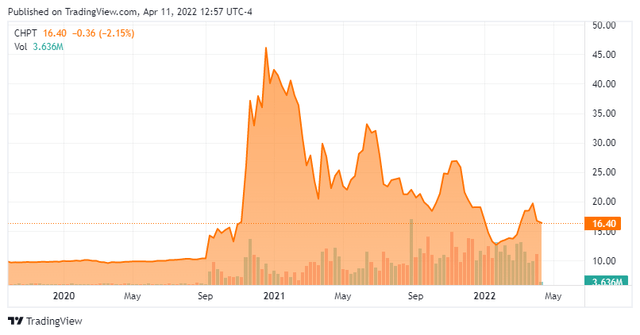

Another day, and another in-depth look at an EV-related concern whose stock has crashed in recent quarters as a good portion of the hyperbole has come out of the sector. Especially in shares that conveniently IPO’d in the midst of investor enthusiasm for the sector via a SPAC from mid 2020 to late last year. So, does this now “Busted IPO” have better prospects on the horizon? We attempt to answer that question via the analysis below.

CHPT – Stock Chart (Seeking Alpha)

Company Overview:

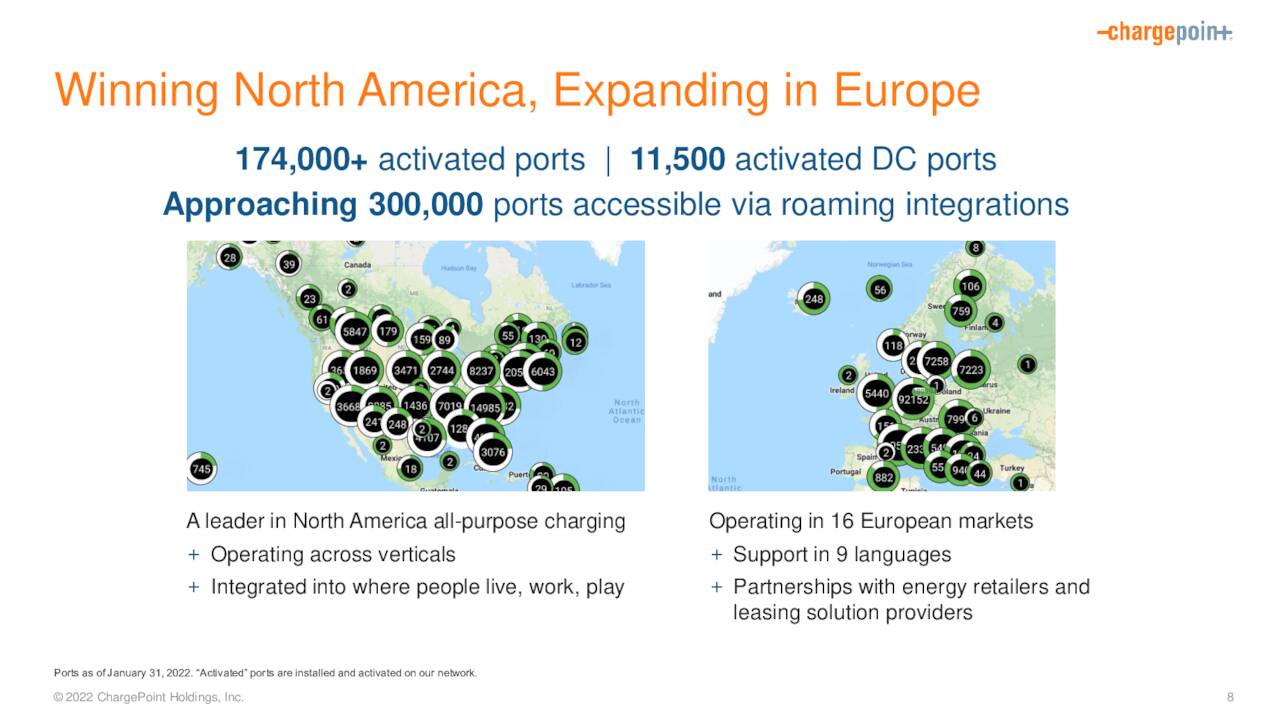

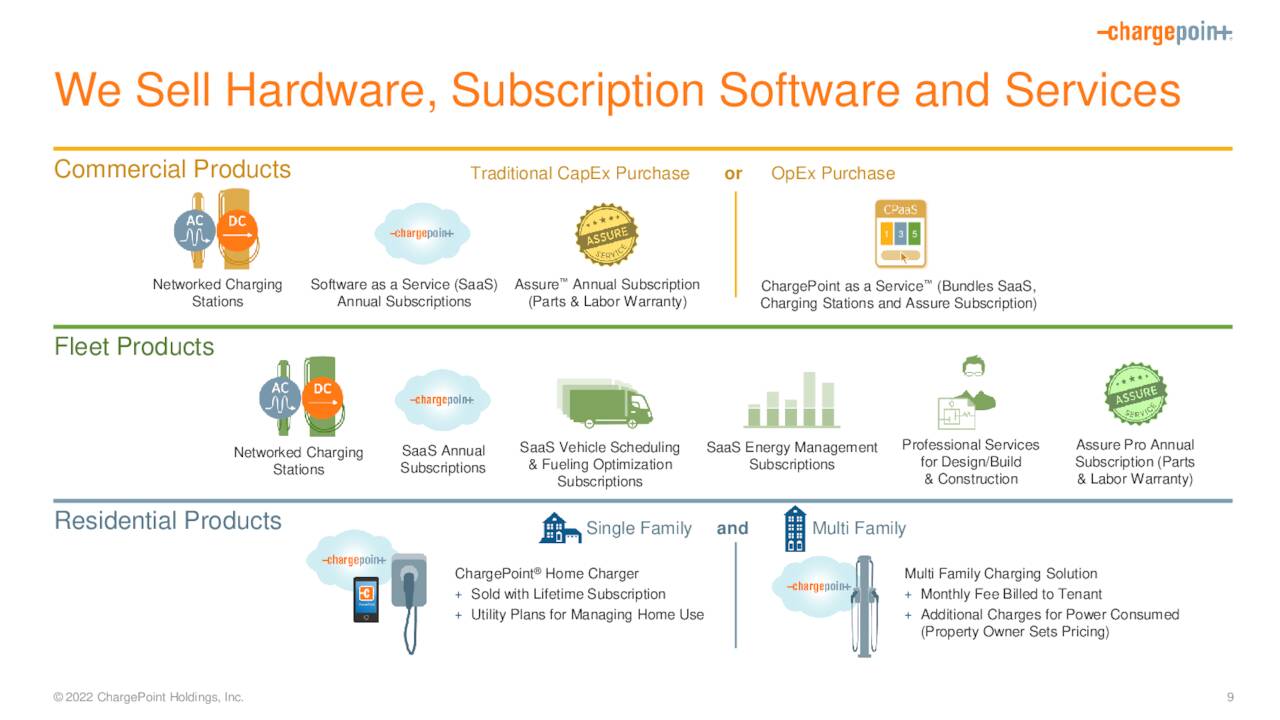

ChargePoint Holdings, Inc. (NYSE:CHPT) is headquartered just outside of San Jose, CA. The company has a portfolio of hardware, software, and services for commercial, fleet, and residential customers, and provides electric vehicle (EV) charging networks and charging solutions. Currently, over 50% of the Fortune 500 currently uses one of the company’s products/services.

CHPT – Company Footprint (April Company Presentation)

The company was founded in 2007 and came public via a business combination with Switchback Energy SPAC. The company debuted with an approximate $14 Billion Pro Forma valuation. Currently, the company has an approximate market capitalization of $5.6 billion and trades right around $16.50 a share.

CHPT – Services/Products (April Company Presentation)

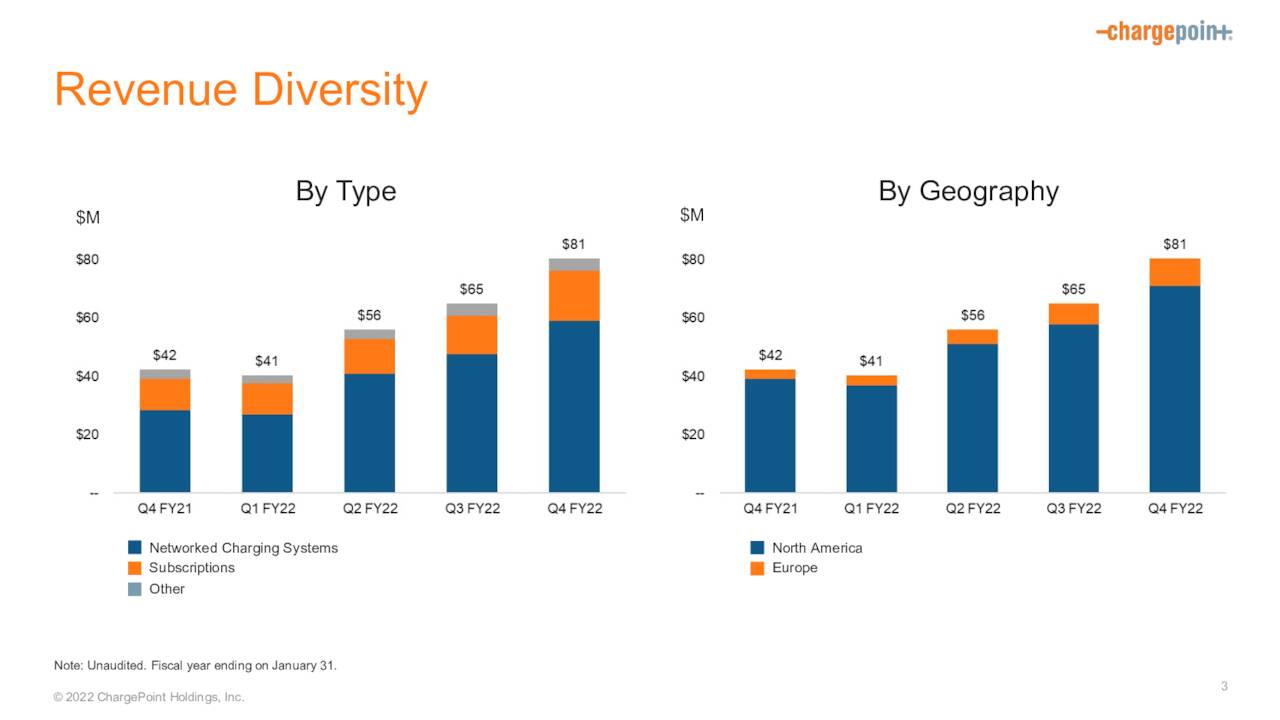

Fourth Quarter Results

On March 2nd, ChargePoint Holdings reported fourth quarter numbers. The company had a GAAP net loss of 23 cents a share, a nickel a share lower than the consensus. Revenues rose some 80% from the same quarter a year ago to a bit north of $80 million, nicely above expectations. As of yearend 2021, the company had 174,000 activated ports globally including 51,000 in Europe.

Management provided the following guidance for the current fiscal year:

- Full year revenue of $450 million to $500 million. At the midpoint of this range, this would result in a sales increase of 96% from the previous year;

- Non-GAAP gross margin of 22% to 26%;

- Non-GAAP operating expenses of $350 million to $370 million. At the midpoint, this represents an anticipated increase of 50% as compared to the prior year.

It should be noted that, at the time, the analyst consensus expected the company to post some $380 million in revenue for the coming fiscal year. Below are some other tidbits from the fourth quarter earnings report and the conference call that followed it.

CHPT – Revenue Breakdown (March Company Presentation)

- Networked charging systems revenue for the fourth quarter was $59.2 million. This was an increase of 109% from $28.3 million in the prior year’s same quarter.

- Subscription revenue was $17.2 million, up 57% from $11.0 million in the prior year’s same quarter.

- Fourth quarter GAAP gross margin was 22%, up from 21% in the prior year’s same quarter primarily due to the impact of acquisitions.

Analyst Commentary & Balance Sheet

The analyst community has mixed views on ChargePoint. So far, in 2022, four analyst firms, including Citigroup and Bank of America, have reissued Hold or Neutral ratings on the stock, with price targets proffered in the $16 to $21 a share range. Seven analyst firms, including Needham and Cowen & Co., have also maintained Buy or Outperform ratings, albeit a few with downward price target revisions. Current price targets among these optimists range from $22 to $32 a share. Oppenheimer is probably one of most bullish analyst firms on the company, as its analyst issued these comments immediately after fourth quarter results came out.

Given the early stage of the market, we believe CHPT’s ability to maintain/ grow market share is critical to the long-term model of driving recurring revenue per port. We believe the company is executing well on port growth and is gaining traction in the EU with the aid of its recent acquisitions. As we raise OpEx spend estimates, we believe the company is pursuing a sound strategy bringing several new products to market in FY23 and expect CHPT to enjoy incremental operating leverage going forward and could substantially outpace our revenue estimates through FY26. We remain bullish on shares.

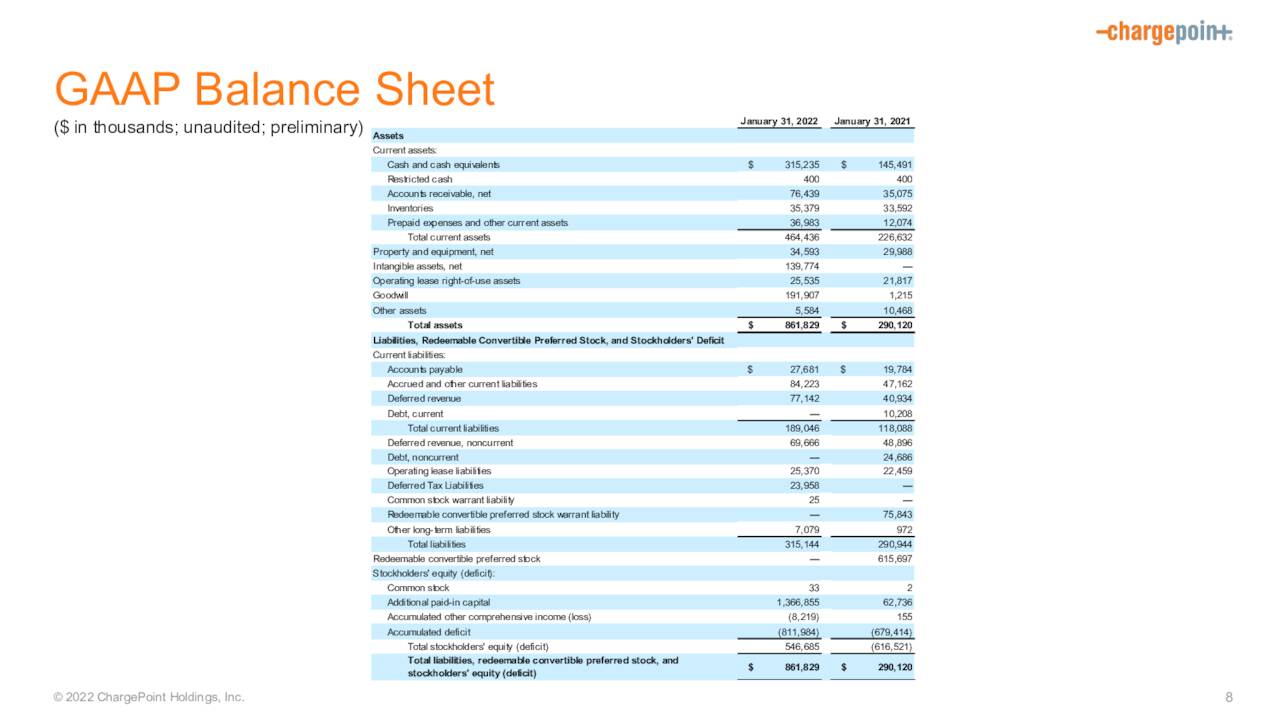

The company ended FY2021 with approximately $315 million in cash and marketable securities on its balance sheet after posting a GAAP net loss of $60.5 million for the fourth quarter.

CHPT – Balance Sheet (March Company Presentation)

In early April, the company announced that Antara Capital will invest $300 million in the company through the purchase of convertible senior notes to support ChargePoint’s growth initiatives.

Insiders are not signaling the shares are oversold yet. Several have disposed of approximately $3 million worth of stock in aggregate so far in 2022, after disposing of tens of millions of dollars’ worth of equity throughout 2021. The only insider buy came on December 10th of last year, when a director purchased nearly $250,000 worth of shares. Approximately 14% of the outstanding share are currently sold short as well.

Verdict

The current analyst consensus for this fiscal year has the company losing around 70 cents a share as revenues nearly double to just south of $475 million, in line with the midpoint of recent management guidance. When CHPT first made their debut on the public markets, they were valued at approximately 100 times revenues. Thanks to sales growth and the pullback in the stock, it goes for “only” approximately 12 times forward sales.

That said, the company is likely many years towards profitability and will continue to post quarterly net losses over the near-term horizon. There are also concerns on margin pressure, which were captured in this recent article. Finally, the shutdown in Shanghai could spread to other regions in China. This would put additional pressure on a good portion of the EV supply chain.

Therefore, until sentiment improves on the EV space, and the company can significant lower its quarterly net losses, I am staying on the sidelines around this name despite some impressive revenue growth projected in the year ahead.

Truthful hyperbole’ is a contradiction in terms. It’s a way of saying, ‘It’s a lie, but who cares?‘ ” – Tony Schwartz

Be the first to comment