Geber86/E+ via Getty Images

REITs, in general, have seen a decent run so far this year. This is especially notable in the shopping center arena with some REITs such as Kimco Realty (KIM) now trading well above its pre-2020 levels. The hotel segment, however, appears to be the last to recover, as a number of names are still lowly priced.

This includes Chatham Lodging Trust (NYSE:CLDT), which is well on its way to recovery and yet remains attractively valued. In this article, I highlight what makes CLDT a worthy buy at the current price to participate in potentially strong gains, so let’s get started.

Why CLDT?

CLDT is a REIT that invests in upscale extended stay, premium-branded hotels. It has 39 properties across 16 states and Washington D.C., totaling approximately 5,900 rooms.

What sets CLDT apart from traditional hotel owners is its focus on extended stay properties which cater to business customers. This is an advantage for the REIT, as this model comes with lower operating costs than full-service hotels, resulting in higher margins and profitability at the property level.

What’s more, with business travel expected to continue to rebound in the coming months, CLDT is well-positioned to capitalize on this trend. The company has already started to see an increase in bookings for the second half of the year, which is a positive sign for the future.

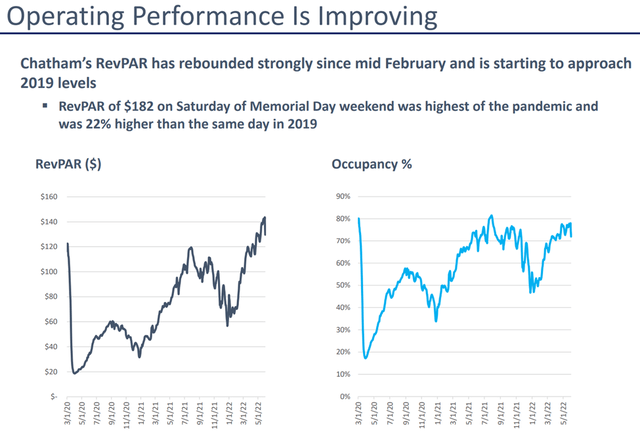

CLDT is seeing its operating performance improve rapidly as intense cost control is being combined with a continued recovery in RevPAR (revenue per available room). This is reflected by the fact that management now expects for full year margins to exceed 2019 levels as RevPAR recovers. As shown below, RevPAR now sits above where it was at the start of the pandemic, and occupancy has recovered to the 70%-80% range.

CLDT RevPAR and Occupancy (Investor Presentation)

Moreover, CLDT is regaining its profitability with generated margins for all owned hotels sitting at 49.2% at the end of the second quarter, up significantly from 43.1% in the prior-year period, and just slightly below the 49.5% during Q2 of 2019. Also encouraging, CLDT has solidly returned to profitability at the corporate level, generating AFFO per share of $0.41 during Q2, which is slightly more than four times that of $0.10 in the prior-year quarter.

Looking forward, I remain optimistic as business travel is expected to continue to grow in the coming months, with CLDT being well-positioned to capitalize on this trend. The company has already started to see an increase in bookings for the second half of the year, which is a positive sign for the future. Management sees continued strong margins ahead along with encouraging news on business travel, as noted on the recent conference call:

The second quarter operating margins would be our third highest second quarter margin, since our IPO 12 years ago. We know there is even more margin upside in the portfolio, particularly as ADR continues to increase. And it’s encouraging that we are within earshot of an all-time high set seven years ago, given all the incremental costs we’ve absorbed over the years from a labor and benefits perspective.

We’re seeing increased demand in many of our primary business travel driven markets such as Washington D.C., the Northeastern U.S. Dallas and especially in Austin all posting sizable gains again this quarter. But for us, as we’ve said many times, it’s the resurgence in Silicon Valley in Bellevue Washington that really helps pop our performance and increases our confidence for our promising outlook going forward.

Looking past the summer, we’re encouraged by what we’re hearing from our teams in these five hotels. Our key accounts continue to reach out for blocks of rooms in the fall. And that list includes common names known by everybody and our long-term customers Samsung (OTCPK:SSNLF), Google (GOOGL), Apple (AAPL), Applied Materials (AMAT), Amazon (AMZN) and the rest.

Meanwhile, CLDT has made strong progress in boosting its balance sheet, with long-term debt now sitting at its lowest level since 2013, and a debt to gross assets ratio of just 29%. Given these strengths and the aforementioned AFFO per share of $0.41 generated last quarter, I see potential for the return of the monthly dividend in the near term.

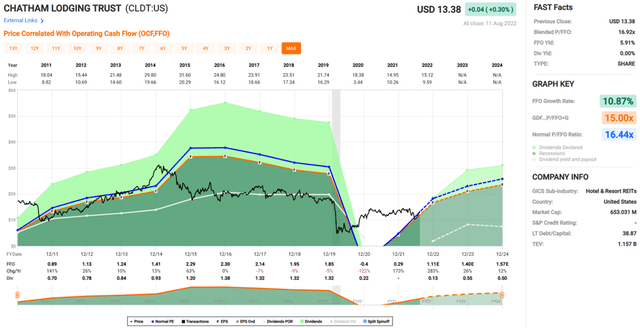

I also see value in the stock at the current price of $13.68 with a forward P/FFO of 12.7, sitting well below its normal P/FFO of 16.4. Sell-side analysts have a consensus Buy rating on the stock with an average price target of $16.30, translating to a potential one-year 19% total return, and that’s not factoring in any potential dividends.

Investor Takeaway

CLDT is a high-quality hotel REIT that is well-positioned to capitalize on the rebound in business travel. The company has made significant progress in improving its balance sheet, and I believe there is potential for the return of the monthly dividend in the near term. CLDT also looks attractively valued at the current price for potentially strong capital appreciation.

Be the first to comment