JuSun

As an investor in publicly traded companies, I’m generally not a big fan of private equity, given their opaque nature and less liquid nature when it comes to investor capital. Nonetheless, they do serve an important purpose in the marketplace, as competition is good in a capitalist economy, and they also serve as an important backstop for public companies that fall on hard times, providing a potential source of capital during times of need.

This does not appear to be the case, however, for STORE Capital (STOR) a net lease REIT that was not showing any known signs of financial distress. In fact, the deal was opportunistic for the buyers, as higher interest rates have resulted in depressed share prices for perceived slower growing net lease REITs.

Having read comment streams around the buyout of STORE Capital, I get the sense that many buy and hold type investors aren’t happy with the all cash buyout deal for STOR at $32.25 per share. Many investors bought into STOR with the goal of having it be a “forever” investment to generate a steady stream of income. Plus, the all-cash deal will trigger unwelcomed income taxes on realized gains for investors. As such, I view the deal as being a letdown for many income investors.

Nonetheless, the deal appears likely to go ahead, given that the deal pricing implies a P/FFO valuation of 14.7, putting it between the present 15.4x valuation of Realty Income Corp. (O) and 14.3x valuation of National Retail Properties (NNN). Considering this, I view the following 2 opportunities as being good places to deploy proceeds from a STORE Capital sale.

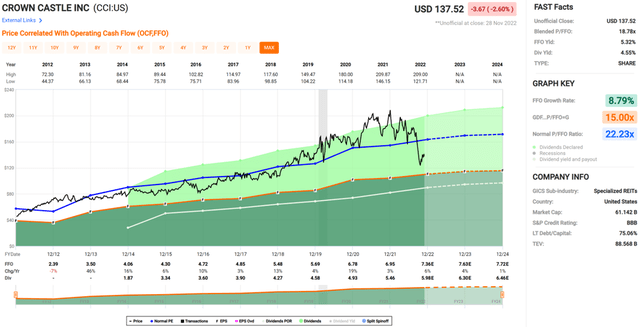

Pick #1: Crown Castle Inc.

Crown Castle (CCI), along with peer American Tower (AMT) are the 2 largest cell tower REITs on the market today. CCI owns and operates 40K+ cell towers and 85K+ miles of fiber, supporting fiber solutions and small cells across every major market in the U.S. Its moat-worthy collection of assets connects populations to essential data, technology, and wireless service.

Perhaps even more so than STOR, CCI enjoys a very steady income stream from its primary telecom tenants, AT&T (T), T-Mobile (TMUS), and Verizon (VZ) in the form of tower leases. Moreover, once a tower is up and running, leasing additional space for hardware equipment requires little to no incremental capex.

CCI is set to grow well over the next decade, given the proliferation of mobile devices and 5G deployment by the cellular carriers. This is reflected by site rental revenue guidance for 10% growth this year.

This translates to potential for continued robust dividend growth, including the 6.5% growth this year (5-year dividend CAGR of 9.1%). The dividend is also covered by an 81% payout ratio, based on forward FFO per share of $7.70. The dividend is also supported by a low net debt to EBITDA ratio of 4.9x. Moreover, 85% of CCI’s debt is fixed rate, with limited debt maturities through 2024, and $4.5 billion in available liquidity.

Lastly, CCI remains attractive at the current price of $137.52 with a forward P/FFO of 17.9, sitting well below its normal P/FFO of 22.2, implying potential for double digit returns after market fears around interest rates ease.

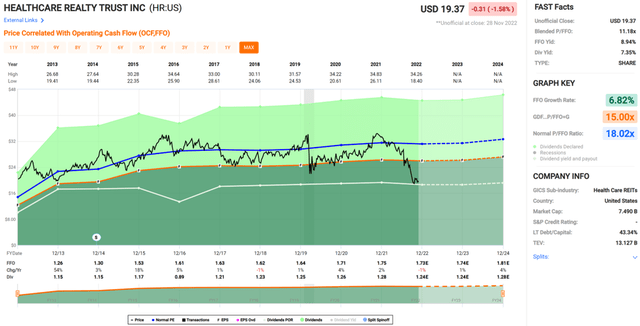

Pick #2 Healthcare Realty Trust

Healthcare Realty Trust (HR) is a large self-managed REIT that grew much larger in size this year, after the closing its acquisition of its rival, Healthcare Trust of America, with its large portfolio of medical office buildings, which comprise 95% of HR’s total properties.

At present, HR’s portfolio consists of 728 properties spread across 35 U.S. states, totaling 45 million square feet of gross leasable space. Moreover, HR has a leasing and property management services arm that serves more than 39 million square feet nationwide. HR’s properties are in major metropolitan cities, with Dallas, Seattle, Houston, Los Angeles, and Atlanta being the top 5 markets.

Medical office buildings is arguably the highest quality property class in the healthcare space. That’s because occupancy is rather steady, and MOBs are not labor intensive like senior housing and hospital properties, which have put pressure on tenant rent coverage in recent years.

HR is also growing nicely, with same store cash NOI growing by 2.8% YoY during the third quarter, driven by contractual rent increases and rent spread on new leases. Tenant retention is also high, at 79%.

Meanwhile, HR maintains reasonable leverage with net debt to EBITDA of 6.3x and pays a well-covered 6.4% dividend yield, supported by a 78% payout ratio. Turning to valuation, HR is attractively valued at present, with a blended P/FFO of 11.2, sitting well below its normal P/FFO of 18.0. While HR’s 5-year dividend CAGR of 3% isn’t particularly high, its high starting yield and stability of cash flow streams makes up for it.

Investor Takeaway

With the anticipation of the STORE Capital buyout deal going through, investors may be well served by deploying capital into Crown Castle Inc. and Healthcare Realty Trust for a mix of growth and safe recurring income streams. The combined dividend yields of CCI and HR is 5.5%, sitting above STOR’s 5.1% dividend yield at the current price. Lastly, both CCI and HR have arguably a higher quality collection of assets, giving STORE investors disappointed by the buyout a silver lining.

Be the first to comment