krblokhin

Though the reports have been surprisingly strong, more than halfway through earnings season, we have had our fill of hearing about all the headwinds REITs face in our inflationary, rapidly rising interest rates, post-COVID economy. Looking for good news, it was encouraging to hear management at American Airlines (AAL), Delta, United, and others describe that travel demand is holding strong this fall and into 2023. Smith Travel Resources, a Costar Group (CSGP) company, recently reported that hotel RevPAR came in the week of Oct. 9-15 at 12.8% above the comparable week of 2019. Maybe it’s time to take a fresh look at potential opportunities in the hospitality sector.

For a laundry list of reasons, we have struggled to stay enthused about investment in hotel REITs. Since the pandemic shutdown of the whole travel industry and its gradual recovery, the biggest obstacles to profitability for hotel operators have been too much debt and a sustaining labor shortage in the sector. Though demand and revenues are rising, so are costs. One company, however, might be faring better in this environment; consider Chatham Lodging Trust (NYSE:CLDT).

One avenue around the labor shortage in the lodging sector is to operate hotels that require less labor. Extended stay hotels accomplish this effectively in that they offer very limited food and beverage service and housekeeping is usually offered on a weekly rather than daily basis. Hotel owners like extended stay because they offer profit margins of about 50% of revenue which is almost double the whole hotel sector. 24 of CLDT’s 39 hotels (61.5%) are extended stay and that drives their profitability coming out of the pandemic. At least that is what management says.

Chatham Lodging Trust Announces Huge Second Quarter 2022 Results

The headline is not my creation, it is actually the immodest title of CLDT’s August 3rd press release announcing their 2Q results. The earnings report and conference call provide significant detail about what management is seeing in the business and leisure travel economy and how they are trying to position themselves to optimize results.

Chatham has a strong focus on the resurgence of business travel in the work from home/work from anywhere post-COVID world. Their extended stay and all suite hotels target markets that they expect will benefit most from this trend. In the second quarter they saw many locations trend back to pre-pandemic occupancy levels at higher room rates.

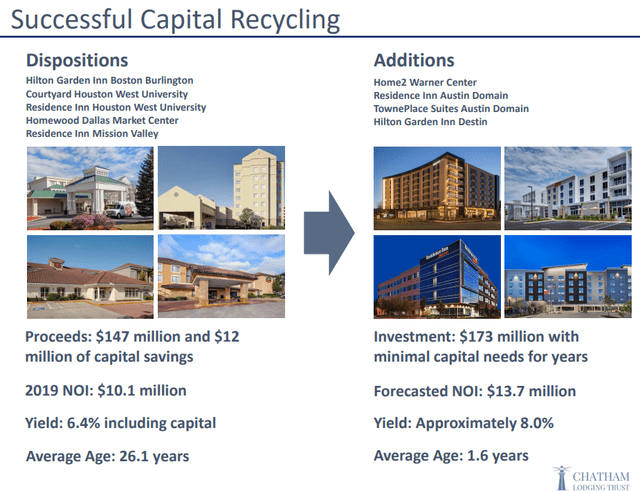

CLDT is actively pursuing market share in the return of business travel through a capital recycling program. They have made dispositions of older properties at low cap rates and redeployed proceeds into new assets at more attractive yields.

When I travel for business, clean and modern is always more appealing than run down and Chatham seems to believe that is what their guests prefer as well.

CLDT will release its 3Q22 results on November 8th so we will soon have an update on their performance and expectations. In the interim you might do well to consider the options available to invest in Chatham.

CLDT

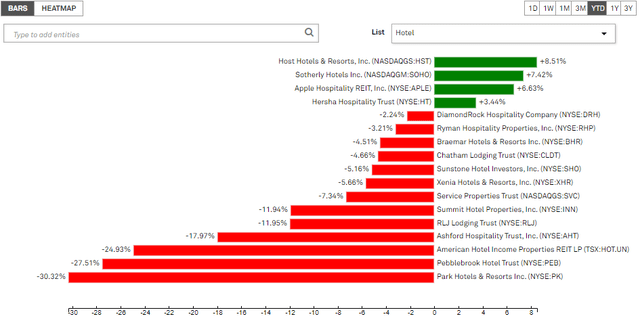

Year-to-date hotels as a sub-sector have performed a little better than REITs as a whole and within the sector Chatham falls into the top half.

Source: 2MCAC as of 11/01/22

Hersha Hospitality (HT) and Apple Hospitality (APLE) are nicely in the green, possibly as a result of reinstating common dividends that were suspended at the start of the pandemic (APLE has raised its dividend three times this year!). CLDT has not yet reinstated its dividend, but shares might get a lift if they do with next week’s report.

CLDT is currently trading at 10.14x next 12 months FFO consensus and at 84% of consensus NAV. Those metrics are roughly in line with sector peers.

CLDT PA

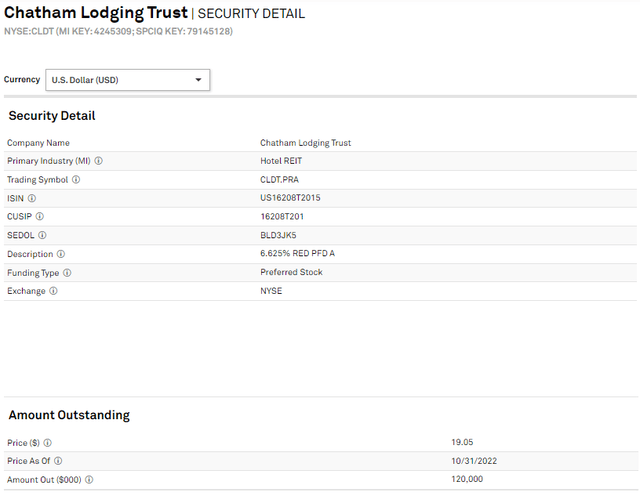

To shore up its equity capitalization in the pandemic, Chatham, like many other hotel REITs, elected to issue preferred shares (CLDT PA).

A 6.625% preferred share wouldn’t be very compelling except for the turmoil of 2022’s financial markets. Anxious holders have been off-loading CLDT-A and other low liquidity preferreds with the single minded objective to get to cash. As a result the shares issued for $25 in June 2021 have traded down to as low as $18; at today’s prices that translates to an 8.8% yield with 33% upside to call. Opportunity often accompanies panic.

A Potential Catalyst

We have repeatedly expressed a lack of enthusiasm for investing in hotel REITs, but there has been one sustaining exception to that sentiment; extended stay hotels. When the pandemic shuttered the whole hospitality industry, extended stay properties remained open to house essential workers. When economies reopened, extended stay posted the earliest and strongest recovery. We were paying attention and took a position in Extended Stay America (STAY).

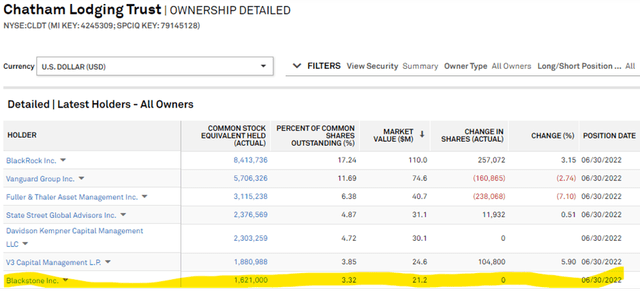

People with a lot more money had the same idea and in March of 2021 Blackstone(BX) and Starwood Capital partnered to buy STAY at a market premium price of $6 Billion. Since that time they have paired up to make other portfolio purchases and last year BX purchased the extended stay portfolio of Condor Hospitality (CDOR).

We haven’t been able to find a new, pure-play extended stay portfolio, but CLDT is more than 60% extended stay. At the same time, BX and Starwood have raised more than $100 Billion in their non-traded REITs. It didn’t escape our notice that in Blackstone’s 06/30/22 13-F that they reported ownership of more than 3% of CLDT’s outstanding shares.

We were profitably frustrated when they bought us out before; I guess it wouldn’t be so bad if it happened again.

Be the first to comment