jetcityimage

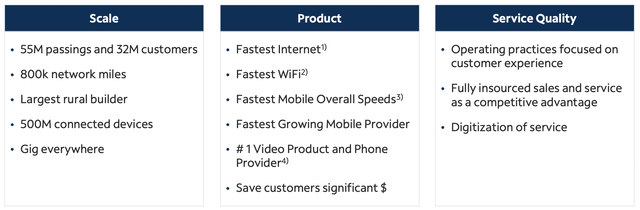

Charter Communications (NASDAQ:CHTR) probably did not expect its common shares to fall by 16.38% after holding its 2022 investor day under new CEO Chris Winfrey. The marked decline compounds a torrid year for the Stamford, Connecticut-based broadband and cable operator whose Spectrum brand serves more than 32 million customers. The company now seems comparatively cheap with its commons down nearly 50% year-to-date for a 12.25x price to forward GAAP earnings multiple. Not only is around 29% lower than its sector median multiple of 17.31x, but its year-over-year trailing 12-month EBITDA growth at 6.97% has also far outpaced the 1.04% growth of its peers.

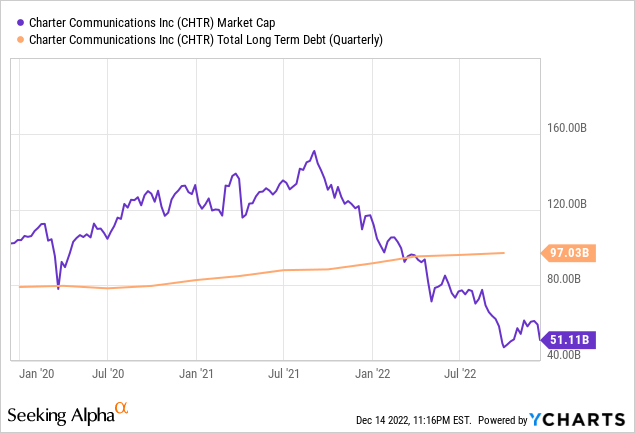

Is this a buying opportunity? It depends. Charter’s investor day reignited angst around the company’s large net debt burden which stood at $96.8 billion as of the end of its last reported fiscal 2022 third quarter, up 8.3% over its year-ago comp and around 190% of its market cap.

This set the backdrop for the growth program set out in the investor day on Tuesday. Planned capex during 2023 will now be $10.65 billion as Chris Winfrey looks to build more scale by enhancing Charter’s coverage and internet speeds. This was higher than consensus estimates with spending being done across two tranches. Firstly, around $5.5B will be spent over the next three years on upgrading the company’s coaxial-based footprint to the latest DOCSIS standard. DOCSIS 4.0 technology should allow Charter to deliver multi-gigabit speeds while supporting high reliability and low latency. The company is gearing up to better compete with fiber overbuilders like AT&T (T) and Frontier Communications (FYBR).

The Buy Pitch Builds On A Mild Recession

The capex plan will also see Charter ramp up line extensions to more rural areas. This will see capex for line extensions jump to around $4 billion next year from its typical annual amount of $1.5 billion. Whilst the rural buildout will support future subscriber growth, it will likely take several years for the company to generate its targeted mid-to-high teen returns and comes with higher construction costs per passing.

Both investment initiatives will take place against the specter of a recession and a rising rate environment and increased competition from fiber overbuilders. It also comes against broader predictions for a recession next year on the back of elevated inflationary pressures and rising Fed fund rates. The Fed fund rate is expected to peak at 5.1% next year and will only start being tapered from 2024. Whilst cablecos are quite defensively positioned during a recession due to the demand for their services being a near necessity, increased competition from fiber overbuilders could mean slower growth in net customer adds or perhaps more promotional pricing.

Bears would be right to flag the company is fully exposed to rising rates with the majority of its debt being floating senior notes rated BBB- by Fitch. This saw interest expenses for its last reported fiscal 2022 third quarter come in at $1.16 billion for an annualized cash interest run rate of $4.8 billion. Management during the third quarter earning call reiterated that they intend to stay at the high end of their net debt to 12-month adjusted EBITDA target leverage range of 4x to 4.5x. This stood at 4.48x as of the end of the third quarter.

Is The Angst A Buying Opportunity?

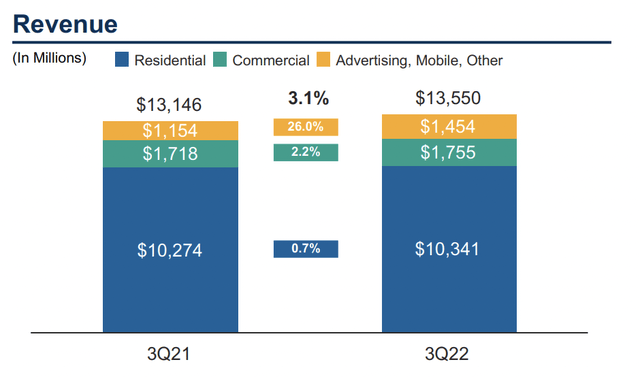

Charter’s third quarter saw revenue come in at $13.55 billion, an increase of 3.1% over the year-ago period but a miss by $70 million on consensus estimates. This was driven by total residential and small and medium-sized business internet customers increasing by 75,000. Mobile line net customer adds reached also 396,000 during the quarter, a new record. The mobile lines business has grown by nearly 50% over the last year and Charter as of the end of the third quarter had nearly 4.7 million mobile lines. This will form a strong avenue for future growth with Charter only having captured 28% of the combined household spend on wireline and mobile connectivity within their current geographic footprint.

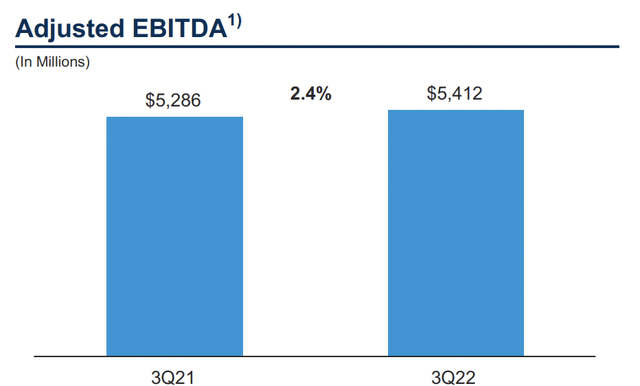

Adjusted EBITDA during the third quarter grew to reach $5.4 billion, an increase of 2.4% over its year-ago comp to drive third quarter free cash flow lower at $1.5 billion. This was a decrease of 39.1% over the year-ago period and was primarily driven by the capex associated with the rural construction initiative. However, even when stripping this capex out, cash flows from operating activities totaled $3.8 billion during the quarter, a decline from $4.3 billion in the year-ago period due to higher cash taxes and the payment of litigation settlements.

Fundamentally, whilst the expanded capex program looks set to dampen FCF in the interim, it will help Charter stay competitive in the long term and help maintain its buyback program. This most recently saw the company buy 5.8 million shares and units for a total of $2.6 billion. The debt burden is also within Charter’s target range as growth initiatives including an ad-supported streaming joint venture with Comcast (CMCSA) named Xumo play out in the years ahead. Whilst the debt profile is too high for my personal tolerance to buy, Charter is a hold for current long-term investors.

Be the first to comment