TrongNguyen/iStock Editorial via Getty Images

Broker-dealer Charles Schwab (NYSE:SCHW) traded down after a mixed post-earnings winter business update which saw guidance for an elevated expense run-rate and further balance sheet contraction in FY23 amid client cash sorting headwinds (i.e., clients reallocating excess cash into higher-yielding alternatives). The deck isn’t entirely cleared, though – lingering uncertainties remain around the persistence of higher interest rates this cycle and where balance sheet contraction and net interest margins (NIMs) will bottom out.

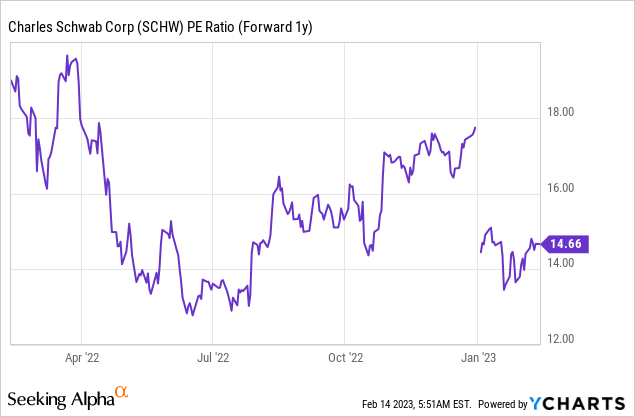

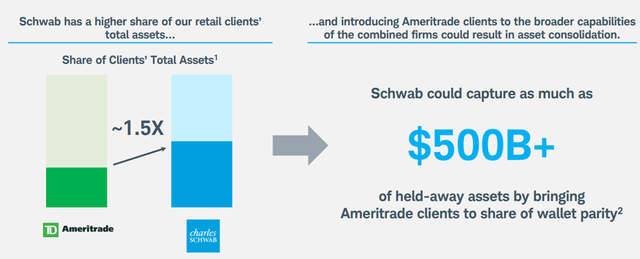

But these are near-term concerns; over the long run, the SCHW outlook is as bright as ever now that the Ameritrade (AMTD-OLD) integration is underway. Key long-term growth levers cited at the update include increasing SCHW’s share of the Ameritrade customer wallet and reducing attrition (a ~$500bn asset opportunity), as well as revenue/cost synergies from platform consolidation and upselling the SCHW full-service offering. Execution will be key; unlocking further deal synergies from the Ameritrade consolidation should drive upside to earnings and capital returns in the coming quarters. Net, at ~15x fwd earnings for a retail financial services leader poised to grow organically through the cycles, SCHW stock is worth a look.

Shrinking Balance Sheet Weighs on the Near-Term P&L Outlook

SCHW’s rate-sensitive income stream has allowed it to emerge as a major beneficiary of higher rates over the past year – mainly due to clients’ excess being swept into higher-yielding securities. That said, the pace of Fed hikes has resulted in SCHW also suffering from a contracting balance sheet as client cash also moved off-platform into higher-yielding alternatives. With the Fed also slowing down on rate increases, the tailwind from rising short-term rates may not be enough to offset the balance sheet headwinds, driving guidance for a P&L deceleration in 2023. The only silver lining offered by management at the winter update was that the client cash sorting cycle is likely in its later innings (based on prior rate cycles), so while FY23 will bear the brunt of the headwinds, things should improve post-FY23.

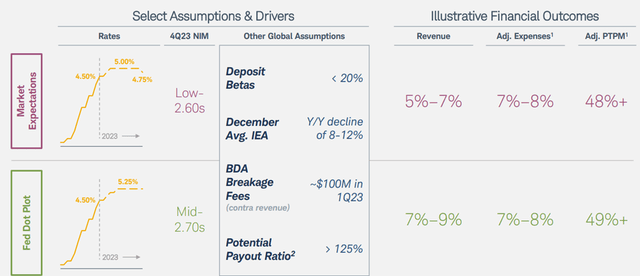

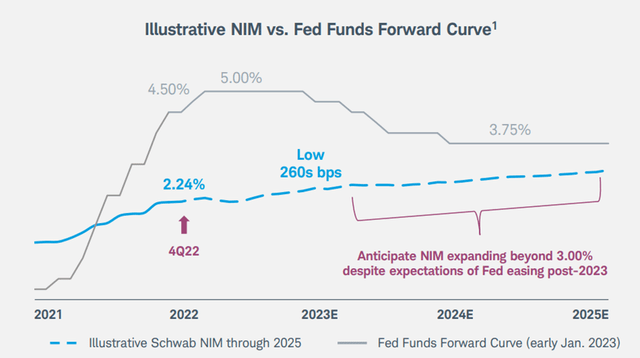

Navigating the next year or so will be tricky. Using the Fed ‘dot plot’ (i.e., rate projections by Fed members) and market-based curves, SCHW is guiding for deposit growth to resume in FY23 but also for an 8-12% YoY decline in average interest-earning assets throughout the year. Based on the strong jobs report last month, rates could well remain elevated for longer (note market curves are pricing in rate cuts in late 2023 to early 2024), potentially driving downward revisions to the post-FY23 balance sheet size. Depending on reinvestment rates, though, higher Fed Funds could still translate into higher net interest margins. Case in point – management is guiding to a >300bps NIM by Q4 2025, which, if achieved, would be a major positive for the P&L.

Ameritrade Integration Paves the Way for Long-Term Upside

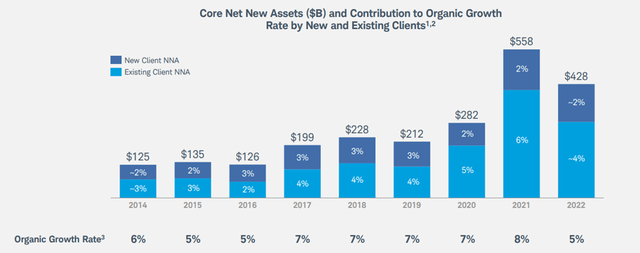

Having established a track record of mid to high-single-digits % net new assets growth per year (new and existing clients), SCHW is looking to extend its runway by integrating Ameritrade’s client base. In addition to reducing attrition levels post-integration, management also sees an opportunity to grow its wallet share of Ameritrade clients to unlock more growth via upselling its full-service brokerage offering. As it stands, legacy SCHW clients park >50% of their assets on the platform (1.5x the share of client assets at Ameritrade), so just getting to wallet parity would entail a massive >$500bn opportunity. Additional growth levers like advice solutions ($125-200m/year of incremental revenue per % penetration) and lending ($1.5-2bn incremental revenue per year from narrowing the peer gap) are coming off a low base and should drive long-term P&L upside as well.

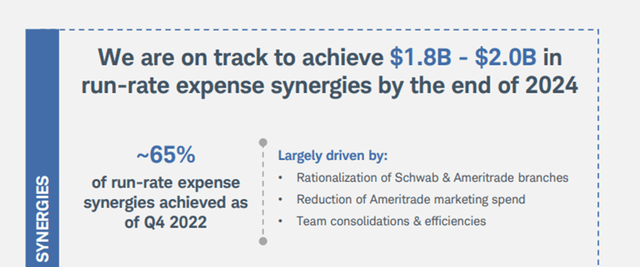

In the meantime, SCHW’s latest update indicates good progress on the integration of Ameritrade – per management, the initial migration phase (~500k accounts) is set to be complete this month. The next migration phases will take place over the next few quarters, with the vast majority set to move over by the end of the year; after this, the final phase (involving the most active accounts) will be completed in H1 2024. Thus far, the updated guidance calls for a cumulative $1.8-2bn of run-rate synergies on the cost side, out of which ~65% have already been realized as of Q4 2022.

As the remaining contribution is tied to consolidating the platforms, expect a full realization sometime in FY24. Of note, revenue synergies haven’t been fully incorporated in the guidance, leaving ample top-line opportunities for SCHW to tap into for incremental upside. Given the levers available, maintaining the 5-7% organic earnings growth algorithm should be well within reach; all that’s left is the execution.

Near-Term Expense Headwinds to Fall Off Eventually

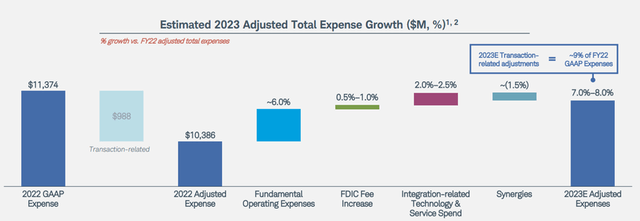

Further weighing on the near-term P&L outlook is management’s guidance for adj opex to grow at 7-8% for the year. Most of that will go toward funding organic growth, with the remaining 2-3%pts coming from integration-related expenses such as increased FDIC fees and incremental customer service hiring. The latter is set to normalize lower as soon as FY24, though, as the account migration process is completed.

Also helping will be the reversal of one-offs related to portfolio management – this includes the ~$100m of investment breakage fees incurred in FY23 as SCHW rotates its lower-yielding bond holdings into higher-yielding areas. So the more material guide, in my view, is management’s 4-5% expense growth outlook for FY24/FY25, with the key to a lower run-rate being SCHW’s execution on the expense synergies front. Upside here could cushion any adverse swings relative to the >3% NIM guide through FY25, which is based on forward curve expectations that will fluctuate alongside upcoming economic data releases.

Look Past the Mixed Winter Business Update

SCHW stock has understandably traded lower following its latest business update – higher expenses and a longer runway for balance sheet contraction imply incremental downside to current earnings estimates for the year. All eyes will be on the interest rate path from here and the impact on client cash sorting, but a bottom will be found eventually, and timing the inflection shouldn’t concern long-term investors.

Instead, I’d point to the upbeat commentary on the Ameritrade integration, as well as the various incremental growth drivers (e.g., advice solutions and an expansion into lending) available to drive further earnings upside over time. For a company with a proven track record of through-cycle growth, the current ~15x fwd earnings valuation seems undemanding and should re-rate alongside continued organic growth, as well as further deal synergies.

Be the first to comment