Rob Daly/OJO Images via Getty Images

An Ominous Sign Emerges From Recent Money Stock Changes

Apple’s (NASDAQ:AAPL) profitability seems to respond to changes in the Real M2 Money Stock. With that data series moving steadily lower over the last seven months, I find myself wondering if Apple’s business is close to a decline as well. It’s hard to recommend outright shorting Apple, given their track record, but investors might consider reducing their positions if they are currently holding AAPL shares.

Apple Seems Sensitive To The Money Supply

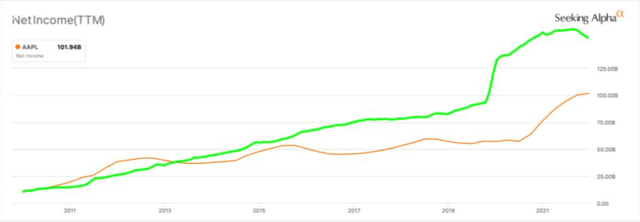

Below, in orange, is a line that charts Apple’s net income from 2010 to the present time. The overlaid green line shows the change in Real M2 Money Stock over the same twelve-year timeframe.

Seeking Alpha, Federal Reserve Bank of St. Louis, Real M2 Money Stock [M2REAL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2REAL, July 9, 2022.

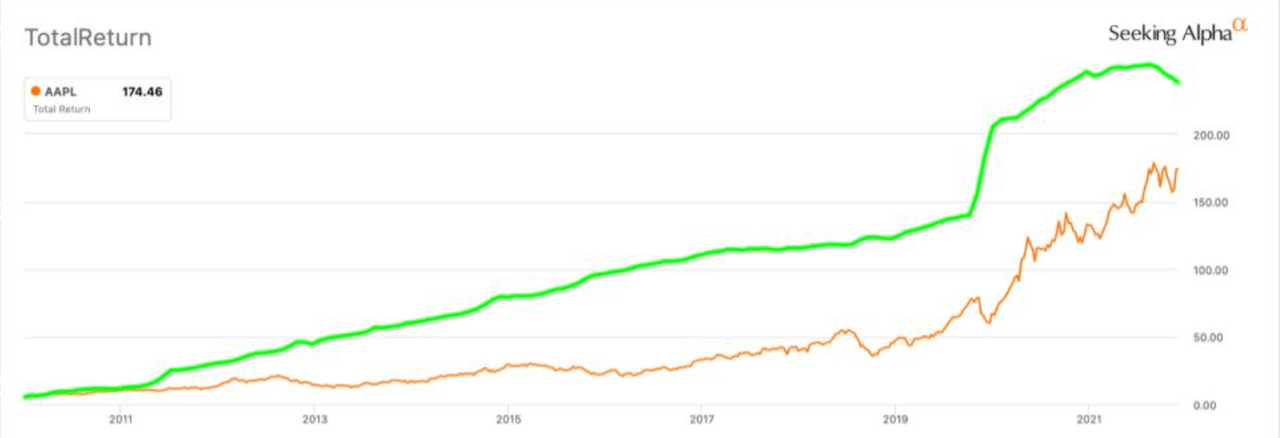

Comparing Apple’s total return to the same Real M2 Money Stock change over the last twelve years shows a similar trend. That isn’t a surprising thing to observe: Apple has used profits to aggressively buy back shares starting in 2013.

Seeking Alpha, Federal Reserve Bank of St. Louis, Real M2 Money Stock [M2REAL], retrieved from FRED, Federal Reserve Bank of St. Louis; Real M2 Money Stock, July 9, 2022.

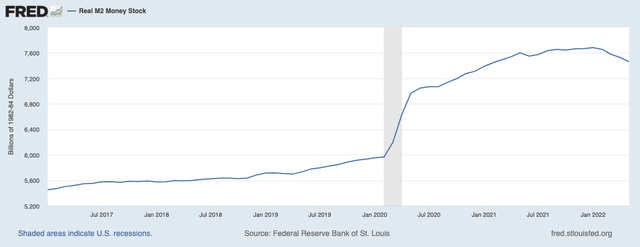

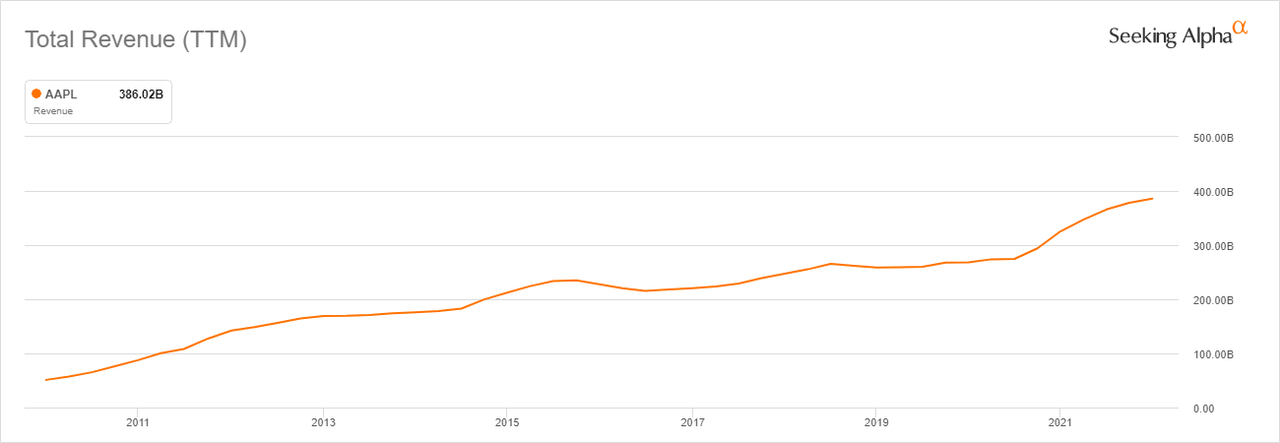

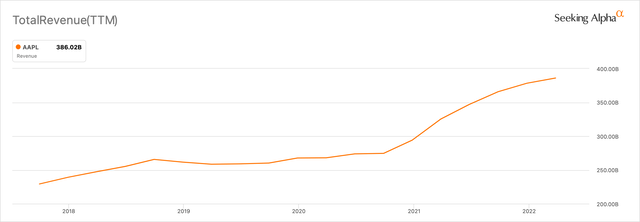

Below is a chart of Apple’s revenue over the last five years, followed by the money stock over the same period.

Federal Reserve Bank of St. Louis, Real M2 Money Stock [M2REAL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2REAL, July 11, 2022.

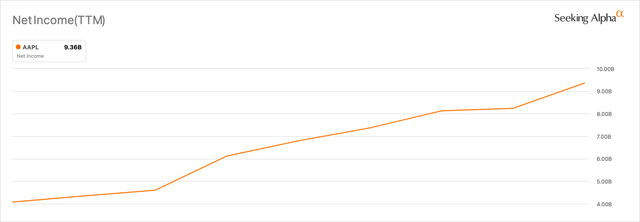

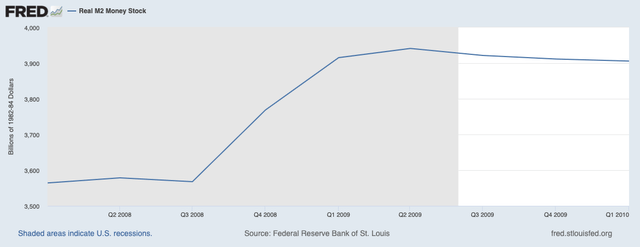

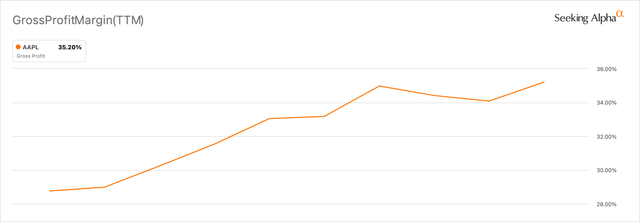

Before 2020, the last time the money stock jumped sharply higher was in the fall of 2008. Below is a graph that shows Apple’s gross profit margin in 2008 and 2009 and one that shows net income in the same stretch, followed by the Real M2 Money Stock across the same timeframe.

Seeking Alpha Federal Reserve Bank of St. Louis, Real M2 Money Stock [M2REAL], retrieved from FRED, Federal Reserve Bank of St. Louis; Real M2 Money Stock, July 11, 2022.

The money stock jumped by about 10.5% from Q3 2008 to Q2 2009. Apple’s net income grew about 21% per quarter in that span. In the two years leading up to Q3 2008, Apple grew net income by about 12% per quarter while the money stock increased less than 5% over that stretch.

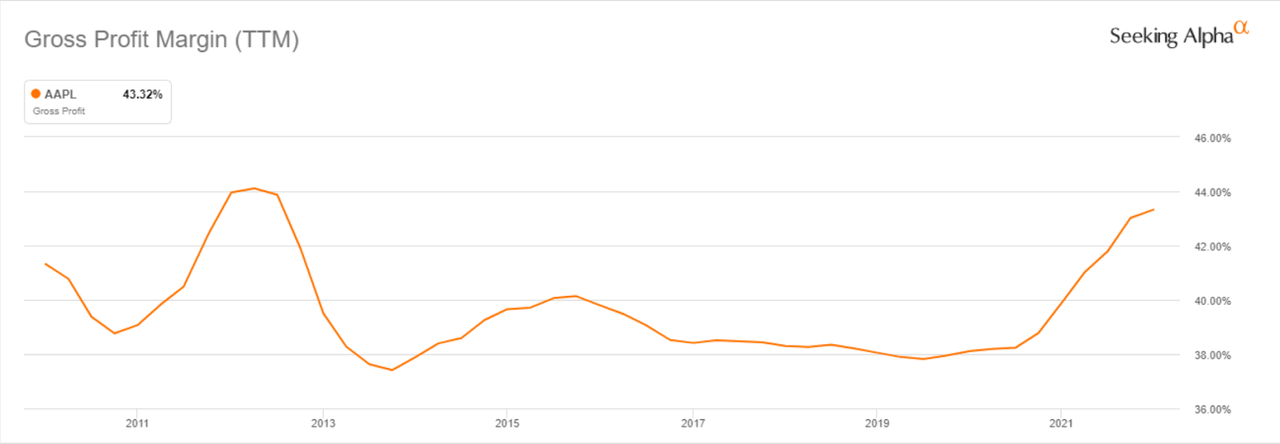

Apple’s Profit Margin Could Retreat From The Recent High Watermark

Seeking Alpha

Discussing recent high profit margins, an article posted to Forbes.com on February 3rd, 2021 suggested 1) that high revenues (at the time) helped Apple minimize the fixed costs that go into making an iPhone, 2) that Apple was more successful in convincing customers to buy the pro version of their devices, and 3) that growth in services revenue further absorbed fixed costs. I wanted to dig deeper into those suggestions.

Apple’s total revenue over the last twelve years, charted below, moves somewhat sympathetically to gross profit margin at times but, to my eye, that relationship is hard to see with confidence.

Seeking Alpha

According to backlinko.com, the iPhone 12 outsold the second most popular model, however, if you combine iPhone Pro Max and iPhone Pro sales numbers, the high-end phones outsold the iPhone 12 by 50%. Information sourced from 9to5mac.com confirms that the dynamic of buying the more expensive model was a change compared to the iPhone 11 launch, where the baseline model outsold the pro models.

Higher services hit a record in Q1 2021. It’s intuitive to recognize that services revenue growth diminishes the fixed cost of designing the systems that support that arm of Apple’s business. It doesn’t cost Apple anything to sell an additional digital book, mp3, or app subscription. With a burst of new customers introduced to the Apple ecosystem during the pandemic, it logically follows that services would see a boost.

My independent checks of the claims made in the Forbes article lead me to believe that higher margins in 2020 and early 2021 were mostly a function of 1) selling pro versions of the devices Apple released and 2) growing services revenue. According to macrumors.com the iPhone 13 is currently outselling the pro models, similar to the sales dynamic of the iPhone 11 launch. Although services revenue growth may offset the hit to margins that could come from cheaper models regaining popularity, this dynamic suggests to me that Apple’s gross profit margins are likely to move lower.

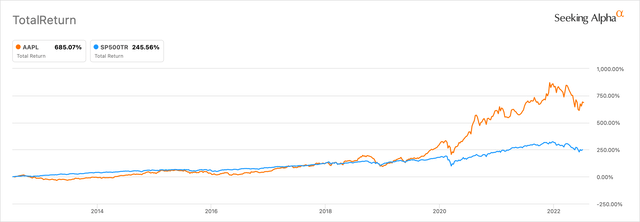

Apple Stock Jumped When Interest Rates Started Dropping

An article by Hunkar Ozyasar on Zacks.com notes, “Stock prices tend to move higher when the money supply in an economy is high. Plenty of money circulating in the economy both makes more money available to invest in stocks and also makes alternative investment instruments, such as bonds less attractive.” From my perspective, Apple has become especially sensitive to money supply changes. Below is a graph that compares the total return for Apple against that of the S&P 500. Apple struggled to keep pace for years, and then began jumping higher, just as interest rates started to be lowered in August 2019 and the money supply started to accelerate upward.

The Money Supply Is Contracting

Since January, the money stock has declined by almost 3%. That might not seem like a lot but in the last twelve years, outside of the last seven months, the money stock has hardly ever decreased at all. You have to go all the way back to 1995, 27 years ago, to find a decrease of at least 3% in the Real M2 Money Stock. If some part of Apple’s ability to grow net income is tied to money supply growth, I would expect a contraction in net income to start showing up on Apple’s books sometime soon.

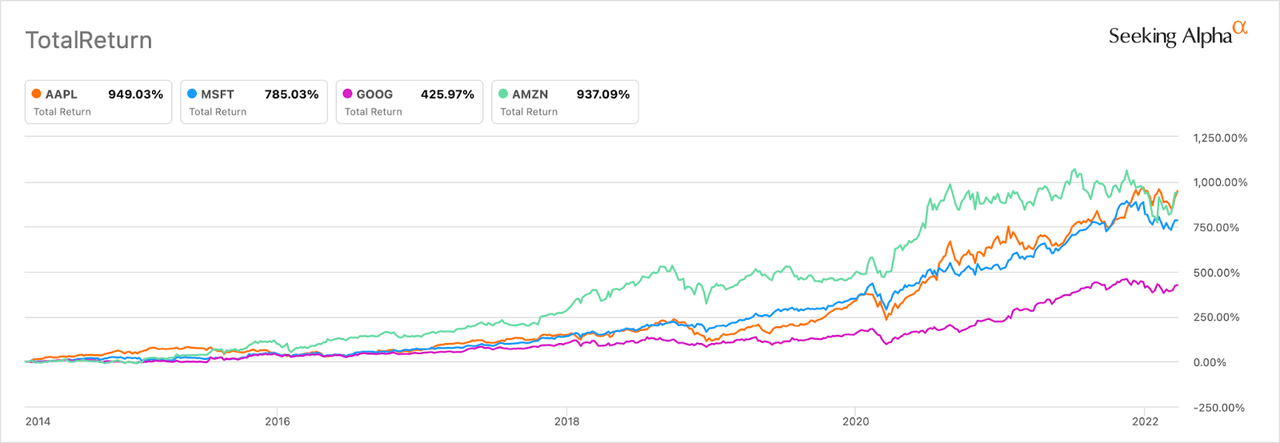

Peer Stocks Aren’t Waiting For Apple

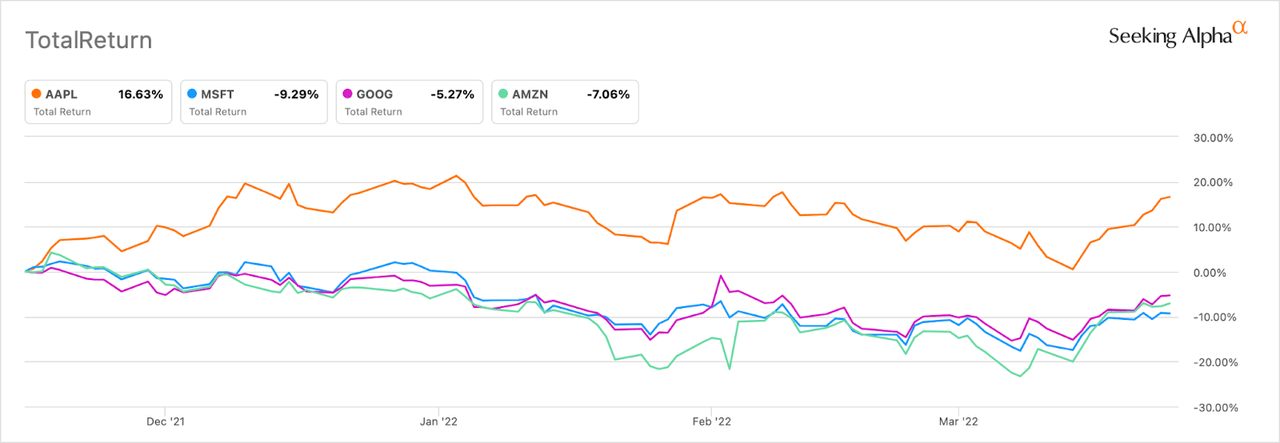

Comparing total return over the last eight years for the four American companies that have a market cap north of a trillion dollars, Apple, Microsoft, Google, and Amazon, reveals that all of these behemoths may respond, to some degree, to a change in the real money stock. Although some of the companies compared below might outperform others over time, they tend to move in roughly the same direction.

Seeking Alpha

Charted below is a comparison of the total return, as a percent change, for those big four companies, AAPL, MSFT, GOOG, and AMZN, over the last eight months. While three of the four companies have closely tracked lower, Apple seems determined to go its own way. Are investors wrong about three companies and right about one, or wrong about one company and right about the other three? Or is Apple actually in the process of differentiating itself from its peers?

Seeking Alpha

Macro Considerations

Chairman of the Federal Reserve, Jerome Powell, recently suggested that the Fed is deeply committed to fighting the high inflation we are currently experiencing in the US. To do this, I think they will have to continue to bring the money stock lower. Based on the research presented in this article, I believe that possibility poses a risk to Apple’s profitability.

Modeling Growth

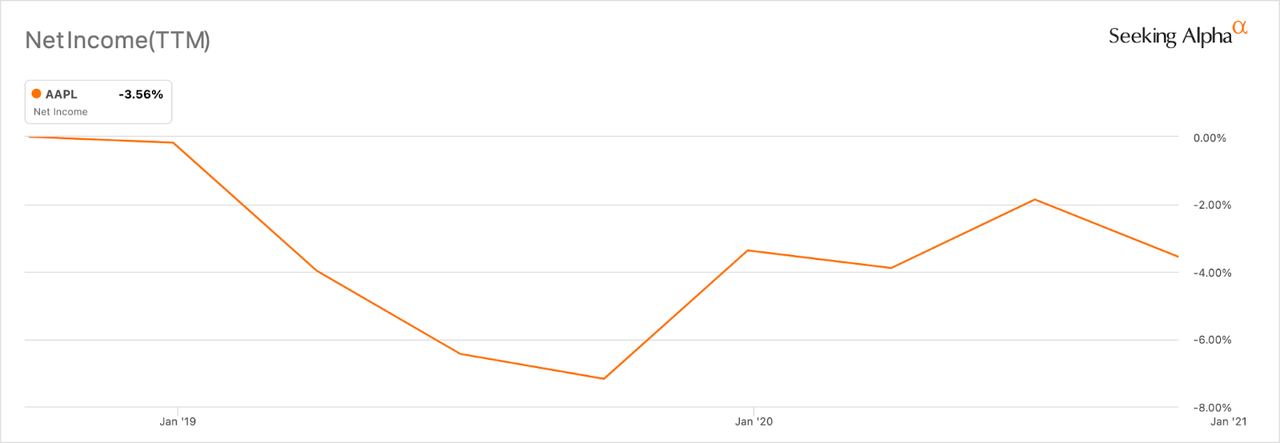

Consider the two-year period of time leading up to 9/26/2020. Net income in that stretch actually contracted 3.56%, despite three separate iPhone model launches contributing to Apple’s revenue, each offering a variety of device versions with diverse features and across a range of price points.

Seeking Alpha

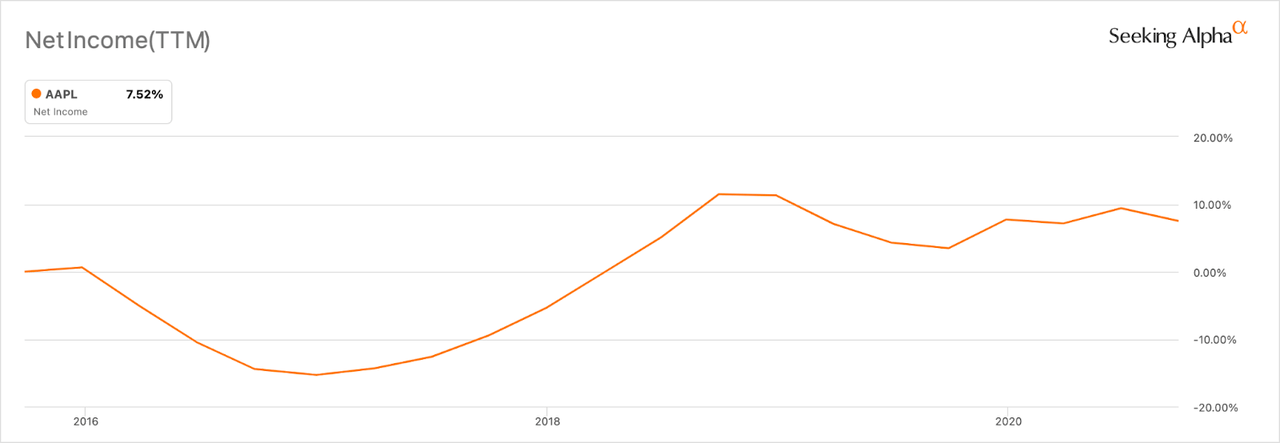

And if you look further back, at the five years preceding 9/26/2020, net income only grew a paltry 7.52%. Remember, this is Apple we’re talking about across a five-year window. If you thought Apple would grow net income by 7.52% over the coming five years, would you be excited about buying shares at the current P/E GAAP of almost 24?

Seeking Alpha

I think Apple could easily return to a period of net income growth that was similar to what it realized leading up to the pandemic. Given high inflation and the Fed’s stated resolve to fight it, I just don’t think Apple is likely to enjoy any time soon the kinds of conditions that facilitated an enormous 77.55% rise in net income over just a year and a half. In addition to a contracting money supply, I suspect that Apple’s large market cap and general declining smartphone demand will act to suppress growth.

Risks

If services growth continues to climb higher, it could support Apple’s profit margins and give the company the flexibility to lower prices on their devices. That, in turn, might allow Apple to better compete for a broader customer demographic and adapt to changing economic conditions that grow out of a shrinking money supply. If you hold shares of AAPL in a stock account that isn’t tax-advantaged, it’s possible that whatever risk you might be able to offload by selling AAPL won’t make up for what is lost when you have to pay capital gains on your sale.

It’s also worth noting that Warren Buffett really likes Apple, which comprises around 42% of Berkshire Hathaway’s (BRK.A) (BRK.B) portfolio. Buffett likes to hold onto companies for a long time, and even added to his already lopsided AAPL bet in Q1 2022.

Conclusion

Companies can’t grow infinitely larger. With a market cap near 2.4 trillion dollars, there is a lot that has to go right for Apple to continue growing at a meaningful rate. There are only so many people in the world with enough cash, enough internet access, enough electricity, and enough interest to buy the next iPhone. Google search trends for the term “iPhone” reveal a long and steady decline in interest, and shows a similar trend measuring searches for “iPad”. If the recent burst in profitability was tied to a rare bump in the money stock, Apple could be in danger of returning to a slower growth, lower margin, and lower net income environment. Share buybacks, it would follow, could dry up or slow down considerably.

I’m not outright recommending that investors short Apple stock, but if you’re holding AAPL shares and the logic for the company’s near-term (or longer) decline outlined in this article resonates with you, you might consider taking some of your apple chips off the table.

Be the first to comment