JHVEPhoto

Introduction & Purpose

Aritzia Inc. (OTCPK:ATZAF) reported earnings that exceeded analysts’ expectations and provided a bright light amid the dreary retail outlook. The company’s high growth brands continued to generate momentum throughout the quarter, and their U.S. focused expansion generated dividends with a beat and raise quarter. My recent article on ATZAF showcased a bull view, and this quarter proved that those trends remain intact. While the macro environment will remain a bit challenged as rates rise and supply chain woes drag on, ATZAF remains one of a few true growth names in retail and I re-iterate my “Buy” rating with a $60 ($46 USD) price target with an 18-month view.

Q1 Review

ATZAF announced earnings on July 7, 2022 that positively shocked investors, sending the stock up 10% between July 7-July 8. Net revenue hit $407MM, up 66% year over year. The company’s profit rose to $33MM, sporting an 8.2% net income margin, a 900 basis point improvement from the prior year quarter. The revenue jump was fueled by continued retail expansion and e-commerce growth. The company saw U.S. e-commerce grow by almost 50% from last year and re-opened stores in Eastern Canada. ATZAF also opened new retail locations in Las Vegas and Miami, their first stores in these cities. U.S. revenue grew 81%, and ATZAF’s spring and summer lines were well received by customers. New CEO Jennifer Wong noted that client demand remained exceedingly strong throughout the quarter and that their customer base continues to grow. Adjusted EBITDA increased by 70.3% from Q1 2022, while retail store revenue increased by 101.3% to $287.8 million from the prior year. Margins also remained steady in the face of a difficult supply chain environment. ATZAF reported $0.35 earnings per share, which outpaced last years $0.19 earnings per share.

The company raised their guidance for both next quarter and year end results. ATZAF now anticipates year end revenue between $1.875B-$1.9B, an increase from last earnings call. The company also forecasted 26-31% revenue growth in Q2. ATZAF noted that SG&A would rise 50-100 basis points for the full year, given the new store openings. The company also noted that profit margins would shrink throughout the year given the supply chain crises, and expect gross margins to dip about 100 basis points. ATZAF also re-iterated that CAPEX would be $110-120MM this year. The company also showcased high inventory of $299MM at the end of the first quarter, up 81% from last year. However, they emphasized that this increase includes higher in-transit inventory due to the strategic decision to order and ship fall product earlier.

ATZAF also provided business updates in the quarter reflecting the culture of the company. While the company prides its retail touchpoints, they have continued to emphasize e-commerce growth and provided digital updates. To maintain momentum, ATZAF added new features to the company website. A key highlight mentioned in the earnings conference call included a note about launching a sustainable styles offering. The company pushed customers to shop from certified, recycled and organic materials, and achieved ~63% of sales from these sources. The company also made data intelligence a key pillar in their growth strategy to make informed data-driven decisions. In Q1, ATZAF confirmed that their data and analytics team headcount reached 50 members. They also further developed data warehouse capabilities and expanded their previous partnership arrangement with Tableau. The company also confirmed on the analyst call that pricing has not been adjusted given inflation concerns. Their offerings fit in the Everyday Luxury space and they feel that they are differentiated enough to not battle on pricing with competitors at this time. ATZAF continues to grow at a strong clip and their profitability and revenue expansion are envious among the industry.

ATZAF Investor Presentation May 2022

Upside & Areas for Improvement

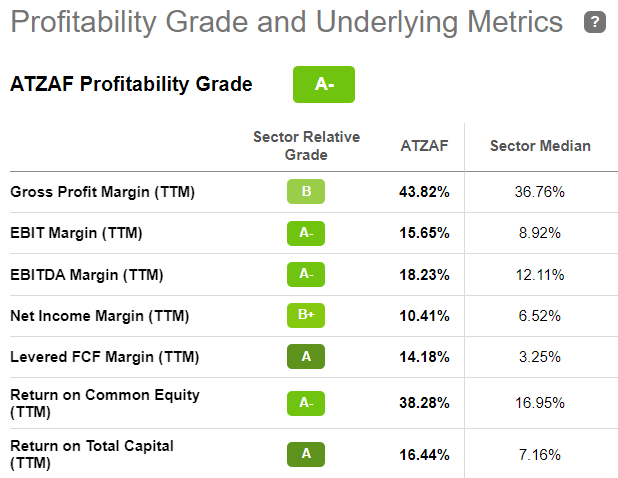

After seeing several retailers miss on earnings over the past month, ATZAF’s beat and raise was a breath of fresh air. New CEO Jennifer Wong led the company through choppy waters and delivered an impressive quarter that showcased the company’s growth story. I was impressed that even despite the beat and raise, CAPEX remains forecasted at $110-$120MM, which implies that ATZAF is confident in their growth profile. New boutique openings remain on schedule and the company continues to push the needle on retail touchpoints while peers reduce or cap stores. Showcasing margin strength similar to prior year totals provides comfort for investors during a sluggish supply chain environment and proves that ATZAF’s quality and brand strength are strong. This has led to earnings metrics that are the envy of the industry.

Seeking Alpha – Profitability Measure

While inventory jumped significantly to $299MM, I will take ATZAF’s explanation at face value until there’s reason to believe otherwise. Given the lag in shipping times and increase in freight costs, I believe that inventory will slowly subside over time as fall wear sells through and global ports run at full capacity again. The company is also reliant on in-store revenue, which could be adversely affected by future government shutdowns. However, I believe they are better positioned now to mitigate these risks, with an e-commerce platform that is growing (and is the company’s #1 focus) and a strong brand that has succeeded before and through the pandemic. While their net profit and net revenue marks are slightly down from Q4, I attribute much of that to seasonality given the strong comparisons year over year.

Model Continues to Show Upside

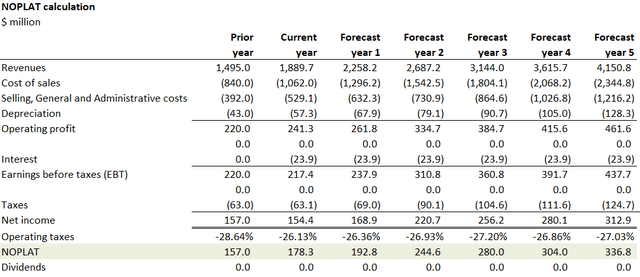

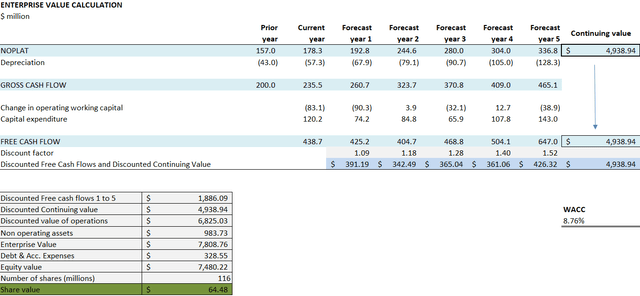

If ATZAF can continue to deliver to their forecasted growth, its stock price is poised to bounce back even in the current environment. The stock popped ~5% after earnings were public which proves investors are still interested in true growth stories. I don’t change much from my prior article, though make adjustments given the company’s refreshed forecast. I increase forecasted revenues this year by $100MM, while also increasing SG&A by 100 basis points, and reducing gross margin slightly, per company discussion. This leads a terminal value of almost $5B. While the model can now support $64/share, up from $63/share in May, given the macro investor environment, I keep my price forecast at $60/share ($46 USD) with an 18-month view.

Author Net Profit Forecast Author EV Calculation

Conclusion

ATZAF continues to impress with outsized growth. The company delivered strong revenue and profit numbers, while continuing their expansion both via e-commerce and in the U.S. with new targeted boutique openings. New CEO Jennifer Wong has settled in quickly and hasn’t missed a beat. While high inventory will be something to keep an eye on, ATZAF remains one of just a few high growth stories in retail. I re-iterate my previous Buy recommendation with a $60 ($46 USD) price target.

Be the first to comment