wundervisuals/E+ via Getty Images

Timing the market is a tricky endeavor, and I don’t know of anyone who can do it consistently. The best way to ensure success in investing is to have a long-term perspective and focus on building a diversified portfolio of quality investments. In other words, time is on your side when it comes to buying above average investments at below average prices.

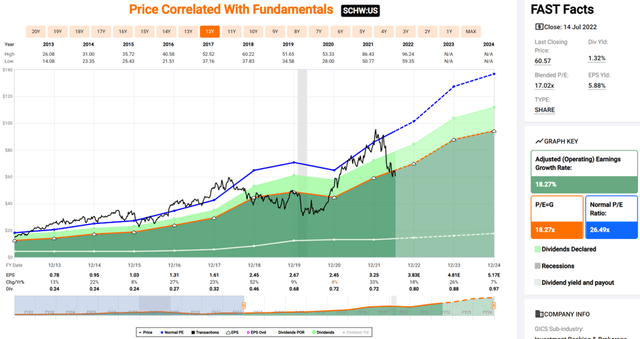

This brings me to Charles Schwab (NYSE:SCHW), which is now trading well below its 52-week high, and is looking attractive. In this article, I highlight why SCHW appears to be a bargain for long-term investors, so let’s get started.

Why SCHW?

Charles Schwab is a leading retail brokerage and financial services firm. It’s shown robust growth over the years, and has become an industry juggernaut since acquiring the TD Ameritrade franchise. At present, it has over 33 million active brokerage accounts, 2.2 million corporate retirement plan participants, 1.6 million bank accounts, and a staggering $7.9 trillion in client assets.

Scale matters in the retail brokerage industry, and SCHW has a formidable presence with both a strong online presence and a wide-reaching physical retail network of brokerage offices. This omnichannel model gives the company valuable access to both digital savvy Millennials and older generations that prefer the ability to visit a physical location.

This scale has only further been enhanced by the acquisition of TD Ameritrade, which comes with revenue synergies that should benefit the bottom line for time to come, as noted by Morningstar in its recent analyst report:

We assess that a combined Charles Schwab-TD Ameritrade is a financial sector powerhouse that will be able to compete in an environment where traditional industry lines have increasingly blurred. The combined firm had over $7 trillion of client assets as of the end of May 2022, which compares favorably with the largest wealth managers, asset managers, and banks.

In addition to its pure scale and efficient business model, both companies have a history of adapting to new sector trends, so we are confident that together they will be a key financial sector player over the next decade. With expense synergies to be realized over the next two years and much of the revenue synergies tied to the gradual movement of client cash from Toronto-Dominion Bank to Charles Schwab, the combined firm should experience a prolonged earnings tailwind.

Meanwhile, SCHW is seeing robust growth, with total client assets up 11% YoY to $7.86 trillion at the end of its first quarter. It’s also generating a strong return on tangible equity of 26%, up 200 basis points from 24% in the prior year period. Also encouraging, SCHW is seeing high client engagement with trading activity that averaged more than 6.5 million per day, a level exceeded only by the re-opening surge of activity in the prior year period.

SCHW is also benefiting from rising rates, as net interest revenue improved by 14% YoY. Interest rates are expected to continue rising in response to the hot 9.1% inflation during the month of June, and many on Wall Street now expects a 1% rate hike by the Federal Reserve at its next meeting. This should lift short-term rates, with which about 40% of Schwab’s interest earnings assets are tied to, resulting in potentially significant earnings growth on Schwab’s $400 billion of deposits.

Looking forward, management seeks to stay a step ahead of the game with innovative product offerings such as Schwab Personalized Indexing, as noted by management during a recent press release:

We announced Schwab Personalized Indexing, a proprietary direct indexing solution designed to bring tax efficient personalized portfolio management capabilities – along with a highly competitive account minimum and fee schedule – to a wider spectrum of both registered investment advisors and retail investors.

SPI includes daily monitoring of client portfolios and tax-loss harvesting technology that is managed by a team of investment professionals. Additionally, we introduced our initial thematic stock lists, which are built using a proprietary algorithm and designed to help self-directed investors pick stocks aligned with their interests and values.

Clients can view potential investments from a list of 45 different categories and approximately 900 companies representing a range of themes including data advancement, medical breakthroughs, and environmental innovation.

SCHW also maintains a strong A rated balance sheet. While the 1.3% dividend yield is low, it’s very well covered by a low payout ratio of 23%, comes with a high 20% 5-year CAGR, and 7 years of consecutive growth.

Factors that could drive down the stock price include market volatility, the unpredictable nature of interest rates, which affects Schwab’s bottom line, and increased competition for client assets from competing brokerage firms.

I see value in the stock at the current price of $62, with a forward PE of 16.1, sitting well below its normal PE of 26.5 over the past decade. This is also considering the quality of the enterprise and the 26-47% EPS growth that analysts expect over the next 4 quarters. Sell side analysts have an average price target of $86, implying a potential one-year 40% total return including dividends.

Investor Takeaway

Charles Schwab today is a wealth management powerhouse with significant scale, a broad product suite, and diversified revenue stream. It’s set to continue its growth trajectory with strong client engagement, new product offerings, and higher interest rates. At current prices, I believe the stock is a bargain with significant upside potential.

Be the first to comment