cemagraphics

It’s been a little over three months since I published my latest cautionary piece on 8×8 Inc. (NYSE:EGHT) and in that time the shares are down about 32% against a loss of ~3.75% for the S&P 500. The company has posted results since, so I thought I’d check on this name to see if it’s now worth buying. After all, a stock trading around $4.75 is, by definition, a less risky investment than the same stock when it was trading at $7. In other words, at some point, the price drop is going to be overdone and it will make sense to pivot on this name. I’ll try to decide whether that time is now by reviewing the latest financial results, and by looking at the current valuations. Additionally, I recommended call options in lieu of shares for those people who insisted on staying long previously. I’m absolutely champing at the bit to write about these, as they offer yet another example of how some calls are preferable to some stocks.

We’re all busy people. I’m assuming that you’ve got very fun and interesting lives to live, and I’ve got hundreds of hours of soap operas and kitten videos to catch up on. Whatever the reason, you may not want to wade through an entire article to get to the “juice” of what I’m thinking, and so I offer you my thoughts up front in a “thesis statement” paragraph. This is yet one more example of the fact that I’m absolutely obsessed with making my readers lives better. While I’m of the view that this company remains troubled, there are some positive signs that have me intrigued. Specifically, net losses are no longer growing as revenue grows, and cash from operations remains positive and is growing. This may not sound like much, but for this company it’s a feat in my view. Additionally, the shares are trading at a decade low. It seems that the market has reached a point of maximal pessimism. For this reason, I’ll be taking a (small and speculative) position in call options. While it’s always possible for the market to grow even more pessimistic, I think shares are closer to a bottom than a top, and I’m willing to “put my money where my mouth is here.” While there are still financial challenges, I’ll remind investors that we’re told to buy when others are fearfully selling. The only way that we can pull off that feat is when those others seem to have good reason to sell. This is the mechanism whereby stocks turn around in price.

Financial Snapshot

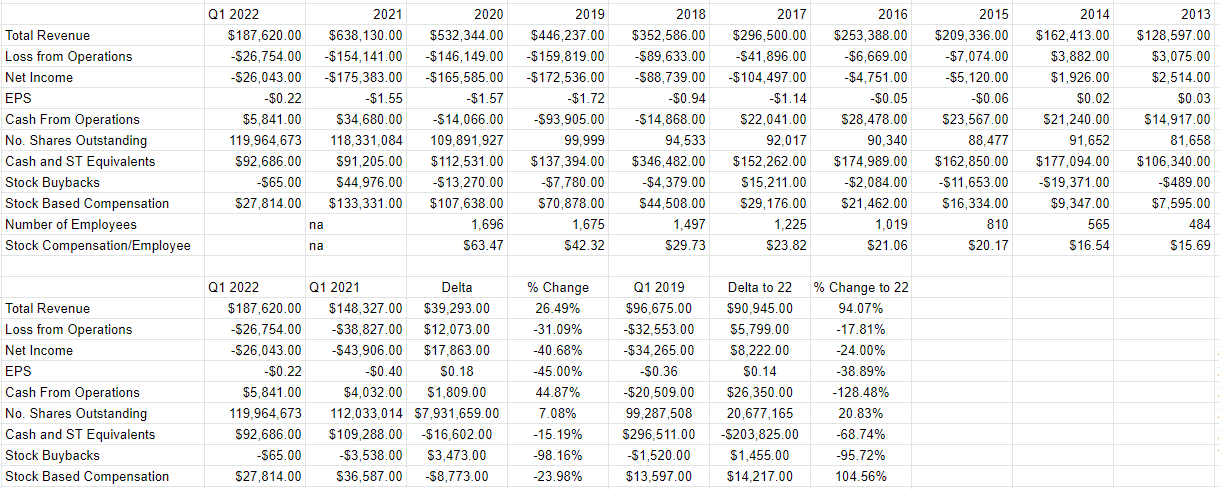

The latest financial results have been “less bad” than previously seen with this name, because there isn’t as strong a negative relationship between revenue and net income. Specifically, while revenue was up by about 26.5% relative to the same period a year ago, net loss is lower by about 40%. Don’t misunderstand me, because I am still of the view that this is poor financial performance, but it’s not as abysmally bad as it has been previously. Put another way, a recurring problem for me with this business has been the fact that the more the company sold, the greater were its losses. It now seems that the company has the capacity to reduce its losses somewhat with higher revenue. Additionally, the company generated about 45% more in cash from operations this year relative to last. This is a significant improvement, and is a downright dramatic improvement over the same period in 2019, when cash from operations clocked in at -$20.5 million.

Now, just in case you were worried that I was “going soft” on 8×8, let me assure you that I’m not. While I’m certainly impressed that losses are lower, the company has still posted losses. This is largely caused by the fact that costs have grown along with revenue. Specifically, cost of service revenue, R&D, and G&A are up 16.4%, 37.7%, and 12% respectively. In order for me to get excited about this business, I’d need to see the company demonstrate the capacity to dramatically lower costs as a percentage of revenue. Alternatively, I might become interested in the stock if it is trading at an absolutely bargain basement price.

8×8 Financials (8×8 investor relations)

The Stock

If you’ve read any of my articles you know that I am of the view that a given business and the stock that supposedly represents it are very different things, and as such, we need to consider each of them separately when making a buy or sell decision. I’m of the view that a reasonably strong company can be a terrible investment at the wrong price, while a struggling company like 8×8 can be a decent investment if you pick it up at a sufficient discount to intrinsic value.

Another way to conceive of this idea is that the business is an organization that buys a number of inputs, like the time of researchers, performs value-adding activities to those by creating embeddable communication APIs for instance, and then selling the results, eventually at a profit hopefully. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company. For instance, the crowd was particularly optimistic about 8×8’s future as the pandemic struck, only to see that optimism evaporate. If you have any experience investing at all, you may have noticed that the crowd can be capricious and has a tendency to drive prices up and down relatively frequently. Added to that is the volatility induced by the crowd’s views about a given sector. A stock can be affected by the pronouncements of some analyst or another. Additionally, a company’s stock can be buffeted by our collective view about “stocks” as an asset class. All of this together adds up to the fact that the stock can be a poor proxy for what’s going on at the firm. This is frustrating in some ways, but it also represents opportunity for us. If we can spot discrepancies between the price and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. The greater the price paid, the worse the returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. In my world, “down in the dumps” means “cheap.” You can tell when the crowd is down in the dumps about a stock when it’s trading at a very low valuation.

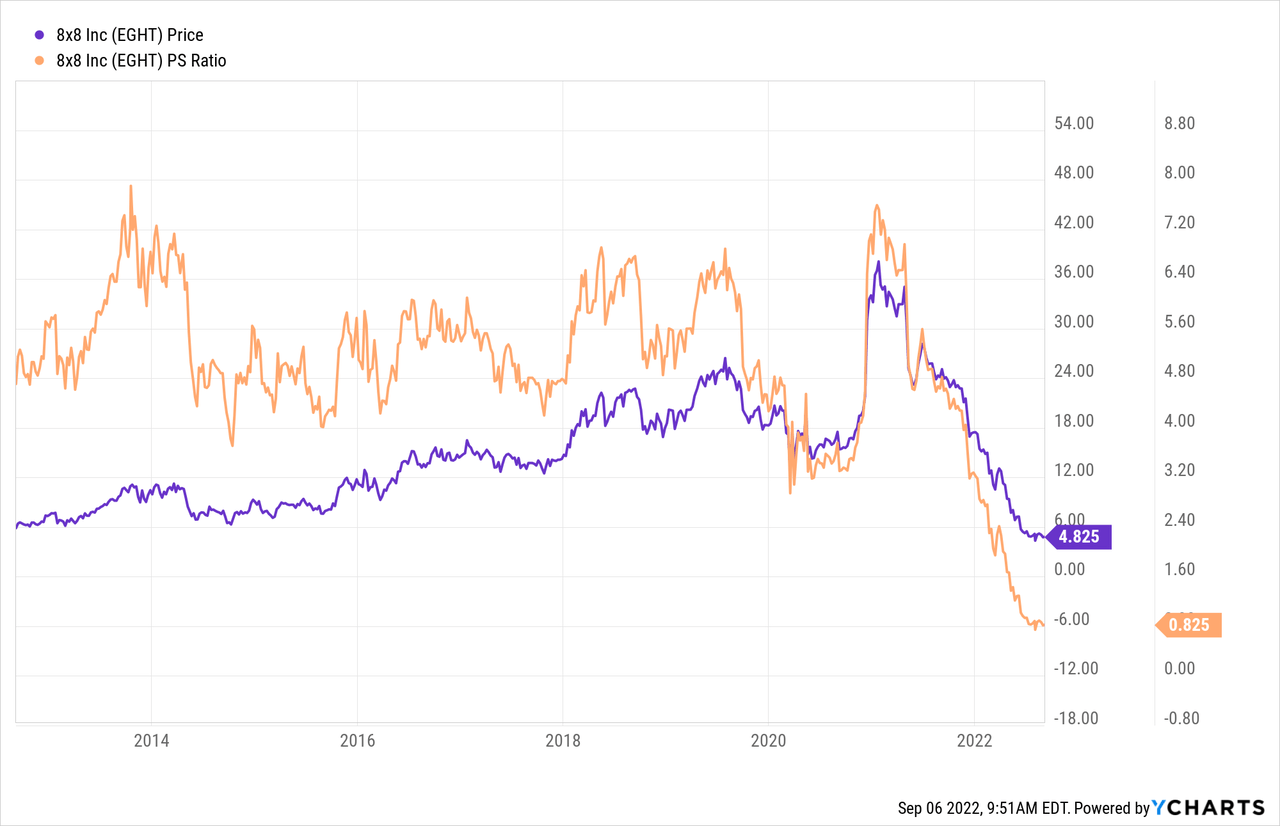

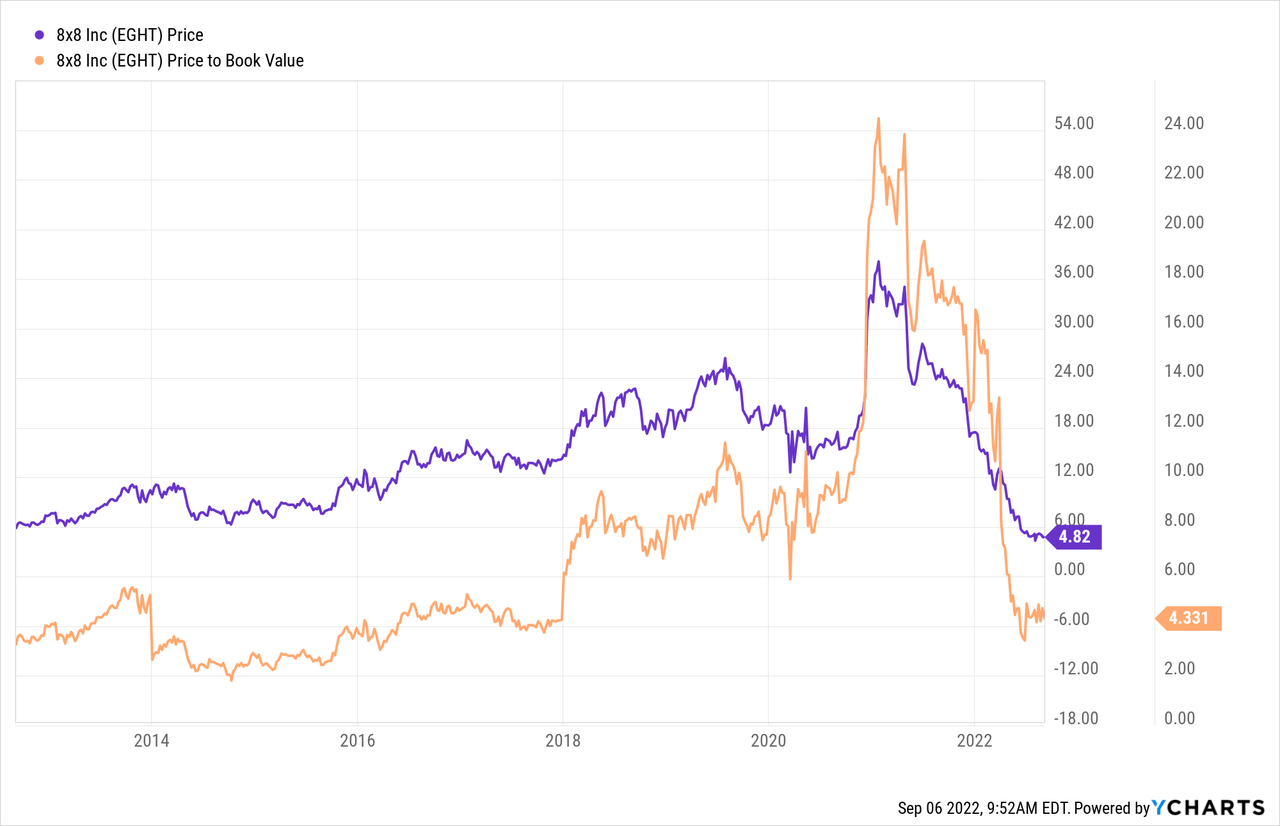

Those who read my stuff regularly also know that I measure the cheapness of a stock in a few ways, ranging from the simple to the more complicated. On the simple side, I track multiples of price to some measure of economic value, like earnings, free cash flow, book value, and the like. Ideally, I want to see a company trading at a discount to both the overall market and its own history. It’s obviously not possible to measure this stock’s price relative to things like earnings, but price to sales can be a reasonably good measure for, uh, “earnings challenged” companies such as this. When I last reviewed 8×8, I wasn’t too impressed by the fact that the price to sales ratio was trading at about 1.22 and the price to book was hovering at 4.5. Fast forward a few months, and the price to sales has reached a decade low of 0.824, per the following:

While the market is paying less for $1 of future sales than it ever has, the shares are not quite at an all-time low on a price to book ratio, but they’re close per the following:

In addition to looking at simple ratios, I actually use a large number of other, more complex valuation measures, one of which involves trying to understand the assumptions currently embedded in price. If you read me regularly, you know that I rely on the work of Professor Stephen Penman, and increasingly Mauboussin and Rappaport to do this. This approach uses stock price itself as a source of information and involves “reverse engineering” the assumptions that cause the current price. When we apply this approach to 8×8, the assumptions for growth are at about 14% at the moment which I consider to be massively optimistic. While I don’t like the assumptions embedded in price, I have to admit that I’m intrigued by the combination of “dropping losses” combined with “decade low valuations.” While I’m not comfortable buying shares, I’ll actually express a speculative long position here via call options. Writing of call options, I absolutely can’t wait to write about the relative performance of the calls that I recommended previously.

Options Update

In this business it is very difficult to “prove” anything, but it is possible to compile ever larger amounts of examples that demonstrate a principle that generally holds. With that as preamble, I will write, yet again, that call options can be preferable to stock ownership because they offer much of the upside at a fraction of the downside. Specifically, in my previous missive I suggested that people who insist on staying long here do so via the January 2023 calls with a strike of $7.50. They were priced at $1.40 at the time, and, after the collapse in share price, they’re currently priced at only $0.15-$0.45. Losing $1.25 per share of value over the past few months obviously isn’t a great outcome. It is “less bad” than the $2.25 per share loss that stockholders have suffered over the same time. This is yet another example of how calls can be a lower risk option for people who insist on staying long.

With that out of the way, I’ll finally put my money where my mouth is and express a bullish take with my own capital. Specifically, I will buy five of the February 8×8 calls with a strike of $5, which are currently priced at $0.85-$1.10.

It may not happen, but if the shares climb from here, I think I’ll do well on my $550 investment. If the shares continue to languish, that won’t be ideal, but I have faith that it’ll be a better outcome than seen by stockholders. If you want to follow me on this trade, understand that this is a very speculative position, and you should only be willing to make this trade if you’re comfortable losing all of this capital. In other words, my long pivot on 8×8 is very much a “flyer.”

Be the first to comment