JackF/iStock via Getty Images

Investment Thesis

Central Garden & Pet Company (NASDAQ:CENT) provides products for lawns and gardens and supplies products for pet animals in the United States. It recently announced its FY22 annual results, and it saw stagnant revenue and income growth. They have provided FY23 revenue guidance expecting the revenue to remain stagnant compared to the FY22 revenue. After analyzing all the parameters in this thesis, I will give my opinion about the company’s future. I expect the sales growth rate to remain slow, so I think CENT has no fresh buying opportunity.

About CENT

CENT operates in two segments Garden and Pet. In the pet segment, they provide supplies of pet animals like toys, pet beds, grooming products, pet containment, cages and habitats, food and supplements, aquariums, pumps, filters, water conditioners, and many more. They offer lawn and garden supplies products like vegetables, live plants, fertilizers, and weeds and grass in the garden segment. It was founded in 1955 and is based in Walnut Creek, California, with over 7000 employees across Europe and North America.

Financial Analysis

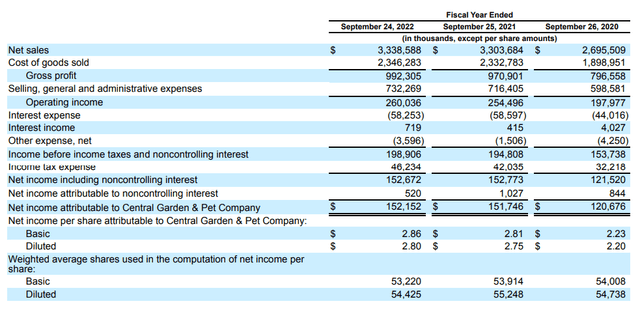

CENT recently announced its FY22 annual and Q4 FY22 results. They missed the Q4 FY22 market EPS & revenue estimates. In my view, the annual result of CENT is quite disappointing. The FY22 revenue and the net income were almost flat compared to the FY21. The reported net sales for FY22 were $3.3 billion, an increase of 1% compared to FY21. I think the primary reason behind the flat revenue is the decrease in the sales of the pet segment. The net income for FY22 was $152 million, in line with FY21. The net income also saw close to no growth.

The FY22 net sales for the pet segment was $1.9 billion, a decrease of 1% compared to FY21. I think the main reason behind this decrease was the company’s decision to exit low-profit private-label product lines. The net sales of the Garden segment for FY22 were $1.5 billion, an increase of 4% compared to FY21. The diluted EPS for FY22 was $2.80, an increase of 1.8% compared to FY21. I believe the main reason behind this increase was the better pricing of products and a favorable product mix. In my opinion, the bad weather, high inflation, and softness across the garden portfolio were the main reasons that impacted the company’s financial performance.

Now talking about Q4 FY22 results. The reported net sales for Q4 FY22 was $707.4 million, a decrease of 4.2% compared to Q4 FY21. I think the main reason behind this decrease was the inflationary headwinds across commodities. The reported diluted loss per share for Q4 FY22 was $0.04, compared to the Q4 FY21 loss per share of $0.06. Overall, the quarterly results are disappointing, and they failed to impress on all parameters.

Technical Analysis

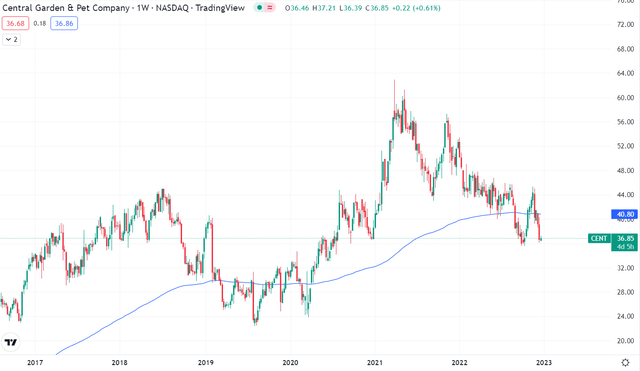

CENT is currently trading at the level of $36.85 and is below its 200 ema, which is at $40.80 in the weekly time frame, which shows that it is currently in a downtrend. Since March 2021, the stock has corrected 42% and continuously forming lower highs and lower lows formation. Now the stock is near the crucial support level of $35, and if it breaks the support level in the weekly time frame, we can expect the stock to fall to $25. The stock looks bearish, and there is no buying opportunity. The only condition in which one can buy is that the stock breaks the lower highs formation and form a higher high or if the stock forms a double bottom pattern at $36 in the weekly time frame. But for now, in my view, one should avoid buying this stock.

Should One Invest In CENT?

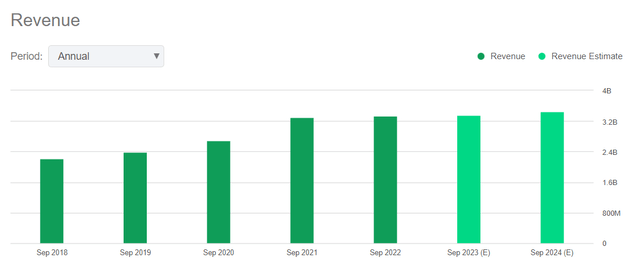

The revenue estimates of CENT for FY23 are $3.3 billion, and the revenue of FY22 was $3.3 billion, which means they expect no growth in revenues in FY23, which is a matter of concern. The revenue growth has been stagnant since FY21, and is expected to remain the same until FY24. They have a poor revenue growth (YOY) of 1% and revenue 3 year (CAGR) of 11.9%. In my opinion, we won’t get any returns from CENT in the next two years, so there is no fresh buying opportunity right now.

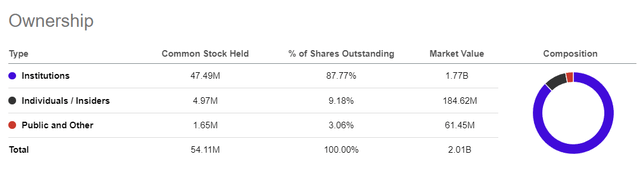

The shareholding pattern of the company looks decent. The institutions own 87.7% of the shares in the company, which is impressive. This shows that institutions trust CENT in the long run. Even though I think it is a safe company, the only problem is the slow growth that the company is witnessing in the last two financial years. The big stake of institutions in the company is the reason we see less volatility in price fluctuations of CENT shares.

CENT has a P/E (TTM) ratio of 13.08x compared to the sector P/E (TTM) ratio of 20.64x, which shows that they are undervalued and can be good for the long term. I think it is only suitable for the long-term investment as I mentioned that they expect stagnant growth for the next two financial years, so we cannot expect it to give returns in the short term.

Risk

High Dependence On Few Customers

Their top 5 customers accounted for 51% of sales in FY22. Their top 5 customers are Walmart, Home Depot, Lowe, Costco, and Amazon. They are expecting it to increase more in the future, which is a serious concern for them. The loss of any of these customers could adversely affect the company’s financial performance. In this highly competitive market, it can become difficult to win new customers and maintain the old ones. They can lose their customers to their competitors, so they have to implement better strategies than their rivals, like better pricing policies, to survive in the market.

Bottom Line

I think there is no fresh buying opportunity right now in CENT. I expect that there will be a very slow revenue growth rate for the next two financial years, and it won’t be able to give any significant returns in the short term. Revenues have been stagnant for the last two financial years, and rising inflation could affect sales in the near future. So after analyzing all the parameters of the company, I assign a hold rating on CENT.

Be the first to comment