DNY59/iStock via Getty Images

Covered call writing is a defensive, low(er) beta, strategy. When the markets rise, you get a nice return. That return will probably be lower than the return of the equity markets itself, but that’s something you know in advance.

When the equity markets fall, you outperform thanks to the collected option premiums. Thanks to the combination of dividends and collected option premiums, covered call writing ETFs are very popular with income oriented investors.

Two of the most popular ETFs are the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) and the Amplify CWP Enhanced Dividend Income ETF (NYSEARCA:DIVO). Let’s compare them.

Performance

Covered call writing is a conservative strategy with only two possible outcomes. If the stock is sold at a higher price on the expiration date of the call option, the call writer keeps the option premium and also the appreciation of the underlying stock up to the strike price.

On the other hand, if the stock never exceeds the strike price during the period up to expiration, the call writer keeps the option premium and also keeps the stock in portfolio. A negative total return cannot be excluded in this case.

In both cases, the collected option premium is a source of income.

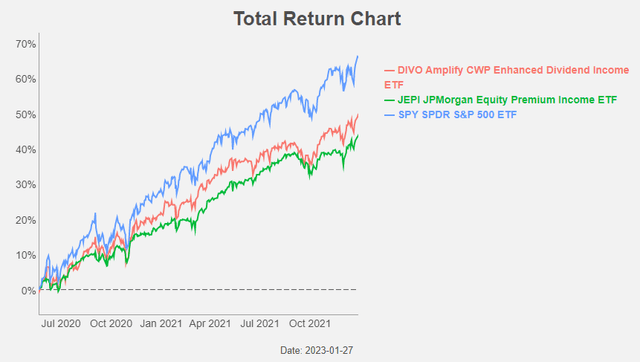

When we take a look over a longer period, we do see indeed that covered call ETFs underperform when the stock market is rising.

Figure 1: Total Return Chart (Yahoo! Finance, Author)

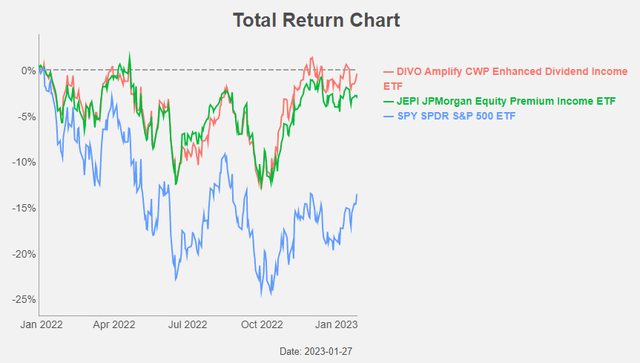

Equities are in a down market since the start of 2022 and the covered call ETFs are indeed outperforming over this period.

Figure 2: Total Return Chart (Yahoo! Finance, Author)

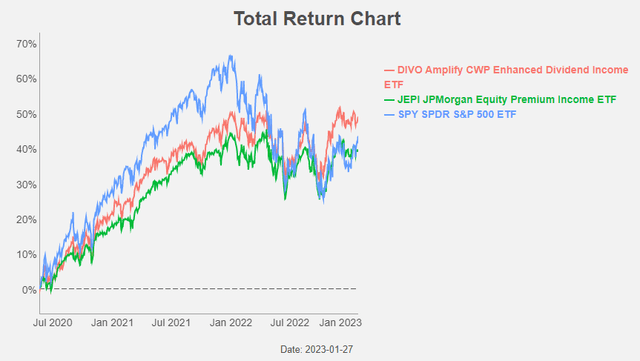

But while the stock market is up in the period from the depths of the covid-crisis until now, DIVO is outperforming the S&P 500 over that period! JEPI on the other hand is slightly underperforming the S&P 500. Despite a higher expense ratio (0.55% vs 0.35%) DIVO is outperforming JEPI.

Figure 3: Total Return Chart (Yahoo! Finance, Author)

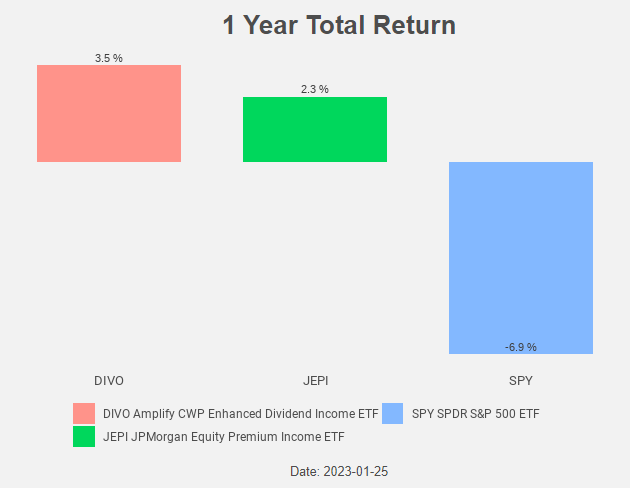

Over the past 12 months, the S&P 500 was down almost 7%. When the stock market falls almost 10%, you would expect a covered call ETF to outperform on the one hand but on the other hand to have also a negative return.

Figure 4: Total Return Chart (Yahoo! Finance, Author)

But both DIVO and JEPI posted a positive return over the past 12 months! They are not only popular because of their dividends, but also for the alpha they create by their stock selection.

Alpha

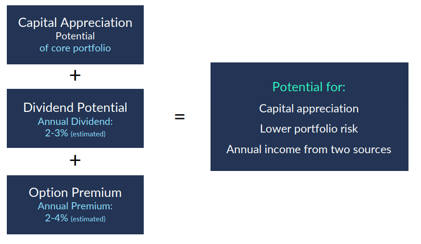

DIVO buys 20 to 25 high-quality large-caps with a history of dividend growth. This portfolio should deliver a 2% to 3% dividend potential.

Figure 5: DIVO Sources of return (Amplify ETFs)

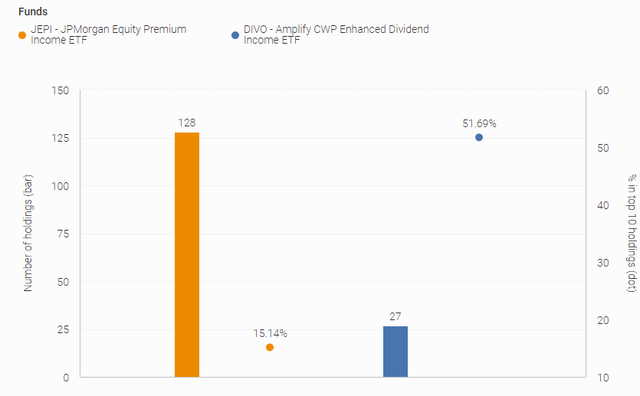

JEPI has a less concentrated defensive equity portfolio that employs a bottom-up fundamental stock selection. JEPI considers also financially material Environmental, Social and Governance (ESG) factors in investment analysis and investment decisions.

Figure 6: Concentration (JPMorgan)

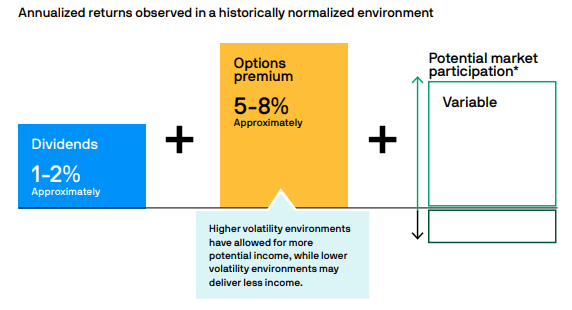

JEPI counts on a slightly lower dividend income of 1% to 2%. The expected options premiums are higher for JEPI (5% to 8%) compared to DIVO (2% to 4%).

Figure 7: JEPI Sources of return (JPMorgan)

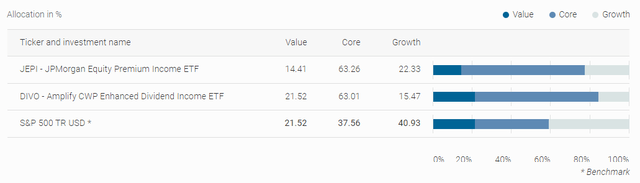

DIVO has a little bit more value-exposure and JEPI some more growth-exposure, but the difference is small. Both clearly have much less growth stocks in their portfolios compared to the S&P 500.

Figure 8: Value & Growth allocation (JPMorgan)

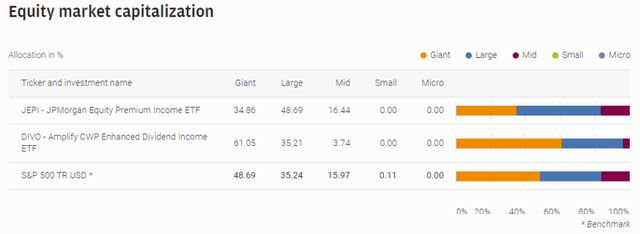

DIVO focuses more on large caps, while the market cap allocation of JEPI is more in line with that of the S&P 500.

Figure 9: Market cap allocation (JPMorgan)

All-in-all we can say that there are no real big differences in both portfolios. DIVO is more concentrated and focuses a bit more on big stable dividend paying companies.

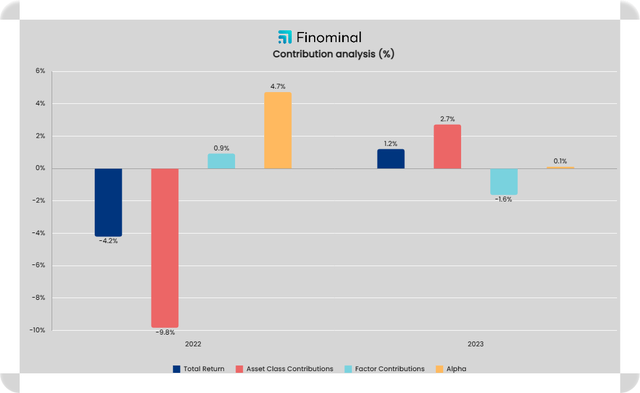

Does the portfolio construction lead to alpha creation for DIVO and JEPI?

When we look at the contribution analysis, we see that JEPI created an (enormous) alpha of 4.7% in 2022.

Figure 10: JEPI Contribution analysis (Finominal)

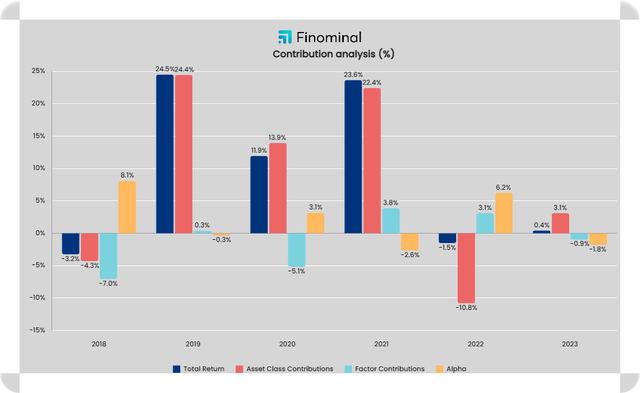

DIVO did even better! Their alpha was 6.2% in 2022!

Figure 11: DIVO Contribution analysis (Finominal)

Call writing

DIVO is actively managed, not only regarding the stock selection but also concerning its call writing strategy. It uses a tactical covered call strategy on individual stocks. Based on market observations and income targets, the portfolio managers use a rules-based set of triggers to identify the best covered call opportunities on the stocks in their portfolio. They look for opportunities to write covered calls when the VIX is at 15 or higher. And the higher the implied volatility, the higher the premiums you can collect when writing options. DIVO aims for call premiums that will yield them 2 to 4% on an annual basis.

JEPI on the other hand uses an options overlay that implements written out-of-the-money S&P 500 Index call options to generate distributable monthly income. It does this through so-called equity-linked notes (ELNs). These are “derivative instruments that are specially designed to combine the economic characteristics of the S&P 500 Index and written call options in a single note form” and are not traded on an exchange. This approach exposes JEPI to counterparty risk if any of the counterparties would go bankrupt. Those counterparties are diversified and well-known names like Barclays, BNP Paribas, Citigroup, Credit Suisse, Goldman Sachs and Royal Bank of Canada.

All-in-all we can say that there are some but no real big differences in the way both portfolios approach their call writing strategy. JEPI uses the calls more systematically and this allows them to pay out higher dividends while it limits at the same time a bit more of the upside potential of the underlying portfolio.

The VIX is currently at 18.5, allowing both ETFs to write calls at attractive premiums.

Outlook

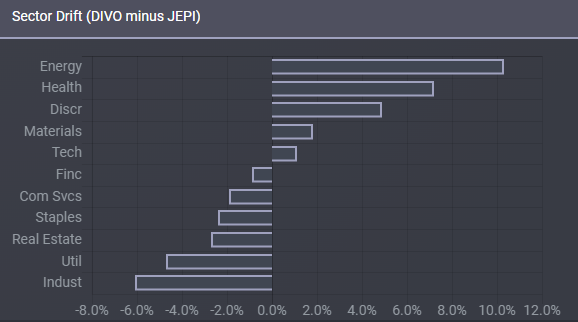

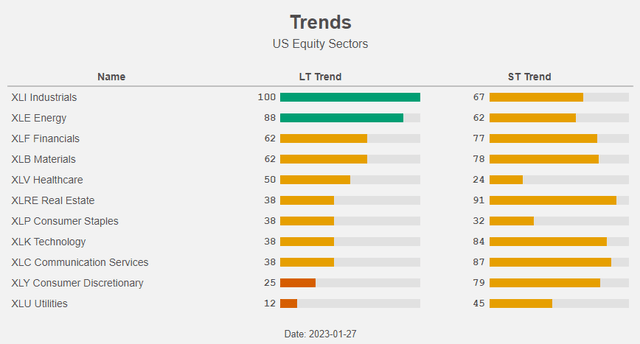

We didn’t yet look at the sector allocation of both ETFs. This might give us a clue about the outlook for both ETFs. DIVO is more exposed to the Energy, Healthcare and Consumer Discretionary sectors, while JEPI focuses more on Industrials and Utilities.

Figure 12: Sector allocation comparison (ETF Research Center)

So both ETFs focus both on sectors that are in a long term uptrend (Industrials and Energy) and in a long term downtrend (Utilities and Consumer Discretionary).

Figure 13: Trends (Yahoo! Finance, Author)

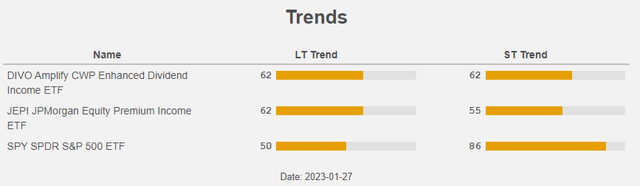

So here again, there’s not much difference between the two ETFs.

Figure 14: Trends (Yahoo! Finance, Author)

Conclusion

JEPI uses the calls more systematically and this allows them to pay out higher dividends while at the same time it limits a bit more of the upside potential of the underlying portfolio.

This translates into a better (total return) performance and a higher alpha for DIVO.

Both ETFs are great and it depends on how important a higher dividend is for you: if a high dividend is most important you go for JEPI. If the dividend is less important, you could go for DIVO.

If we have to make a call, we can only write that it’s a close call. Given the better past performance and the higher alpha, we would opt for DIVO.

Be the first to comment