JHVEPhoto/iStock Editorial via Getty Images

The Thesis

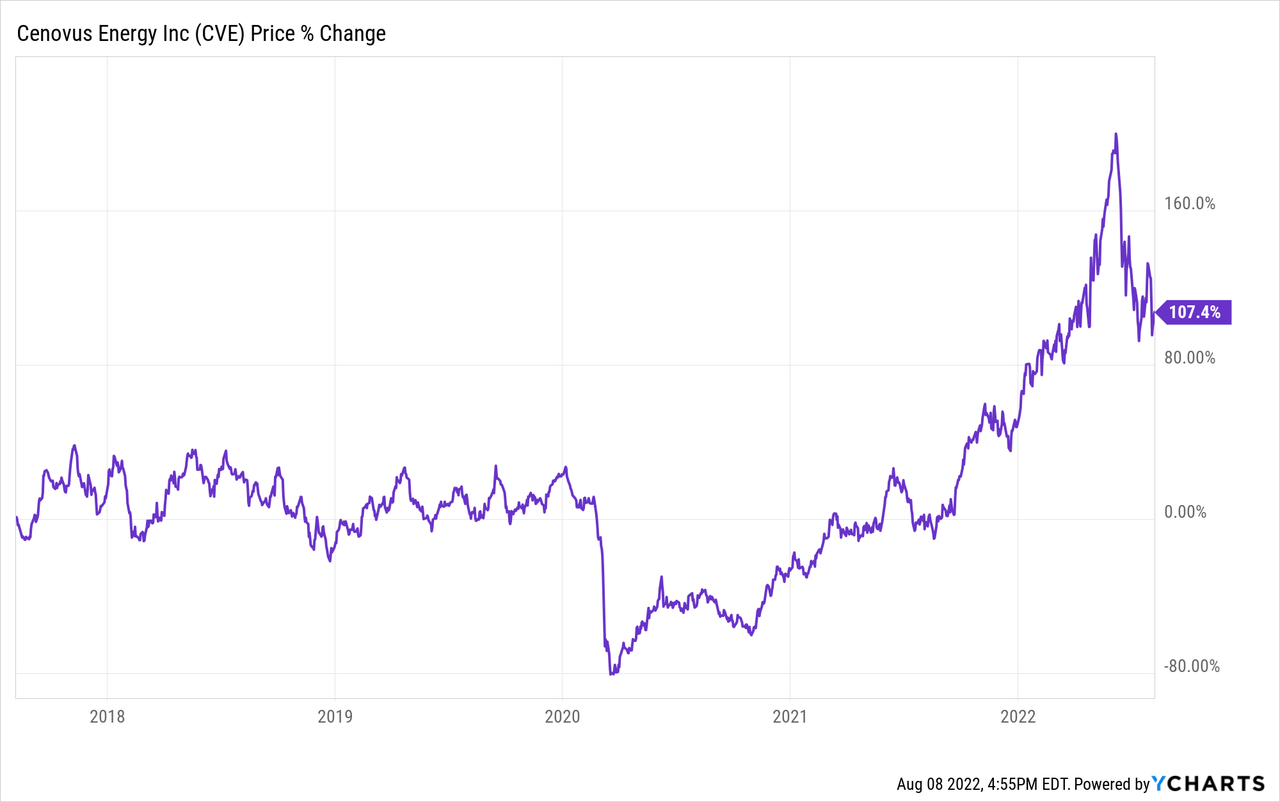

Cenovus Energy’s (NYSE:CVE) CEO did a great job of surviving the pandemic lockdowns of 2020, and shareholders have seen a big surge in returns. Looking forward, it may be time to take some profits. We project returns of just 4% per annum for Cenovus.

A Look At Management

Alex Pourbaix took over as CEO of Cenovus in 2017, and he’s since delivered great returns for shareholders:

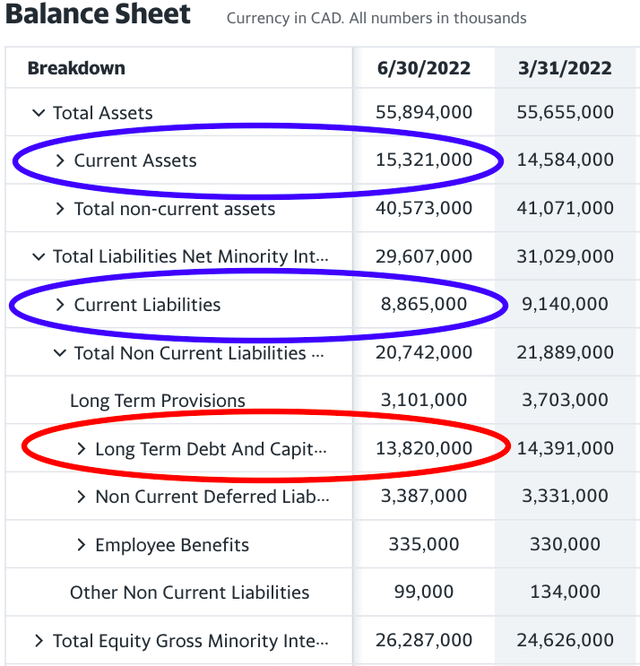

Yes, Pourbaix benefited from booming oil prices over the past year, but he also navigated the 2020 pandemic well. Since then, he’s made a lot of acquisitions and increased the company’s debt levels to do it. Despite this, the company’s balance sheet looks fairly strong:

Cenovus Balance Sheet – Figures In CAD (Yahoo Finance)

Cenovus sits on a comfortable amount of working capital. We’d liked to see the long-term debt reduced. The company has a bond rating of BBB-, which is bordering on the edge of junk bond territory. Thankfully, management has been paying down debt quarter after quarter. We like Pourbaix’s mentality; he recently had this to say about the oil and gas industry:

“The one thing about our industry, it’s so incredibly cyclical that anytime we’re in a good pricing environment, we’re already planning for the next very bad pricing environment.”

Pourbaix went on to explain why oil prices gyrate:

“We’re obviously in a very buoyant price environment. My expectation – at these kind of prices, I think every possible barrel of production is going to come on. And, I also think these prices will do what high prices generally have done throughout history, and they will impact demand. And, I think we’ll find, in a relatively short period, we’re down to a much more modest price environment.”

While this is a message to investors to price in the cyclicality of earnings, it’s also a message that your CEO is preparing the company as such.

Becoming An Integrated Player

Now, back to the acquisitions. Alex Pourbaix wants the company to become an integrated energy player on par with Canadian peers like Suncor (SU) and Imperial Oil (IMO). And, he’s well on his way. Husky Energy was a terrible asset when Cenovus acquired it; its profitability was struggling. At the same time, Husky’s assets had unrealized potential, and the stock was incredibly cheap. Management focused on synergies with this merger, and we’re feeling pretty positive about it. Cenovus recently acquired another downstream asset worth $300 million from BP (BP).

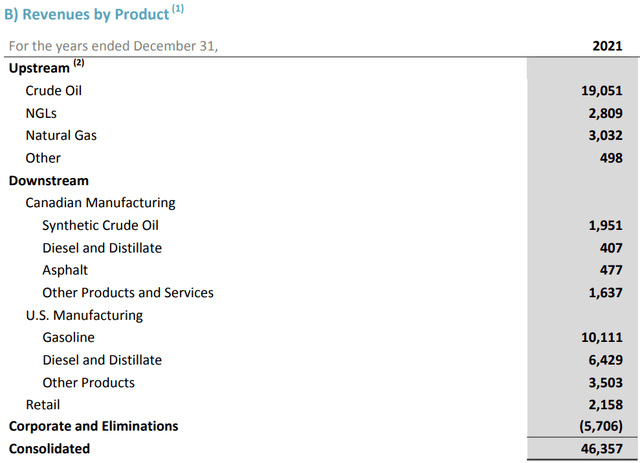

Altogether, Cenovus is building out its refining business, raking in roughly half its revenues from the downstream segment:

Revenue By Segment – Figures In CAD (Cenovus Annual Report)

This downstream integration is exceptionally important as it protects the company from volatile oil prices. When prices fall, Cenovus’ refining business should make up for weakness in the upstream segment, which was not the case in 2020 and 2016. Cenovus has also decreased its breakeven price to $36 per barrel WTI.

Beware The Quant

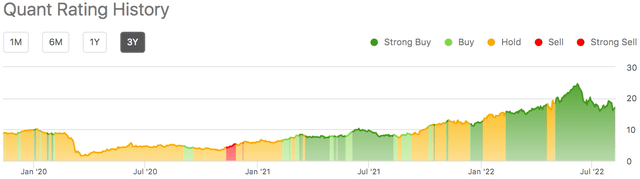

Commodity companies are peculiar because they’re often the best investments when the fundamentals look terrible, which was the case in 2020. Seeking Alpha’s quant system has Cenovus as a “strong buy” at the moment, but in 2020 it was merely a “hold”:

Quant Rating CVE (Seeking Alpha)

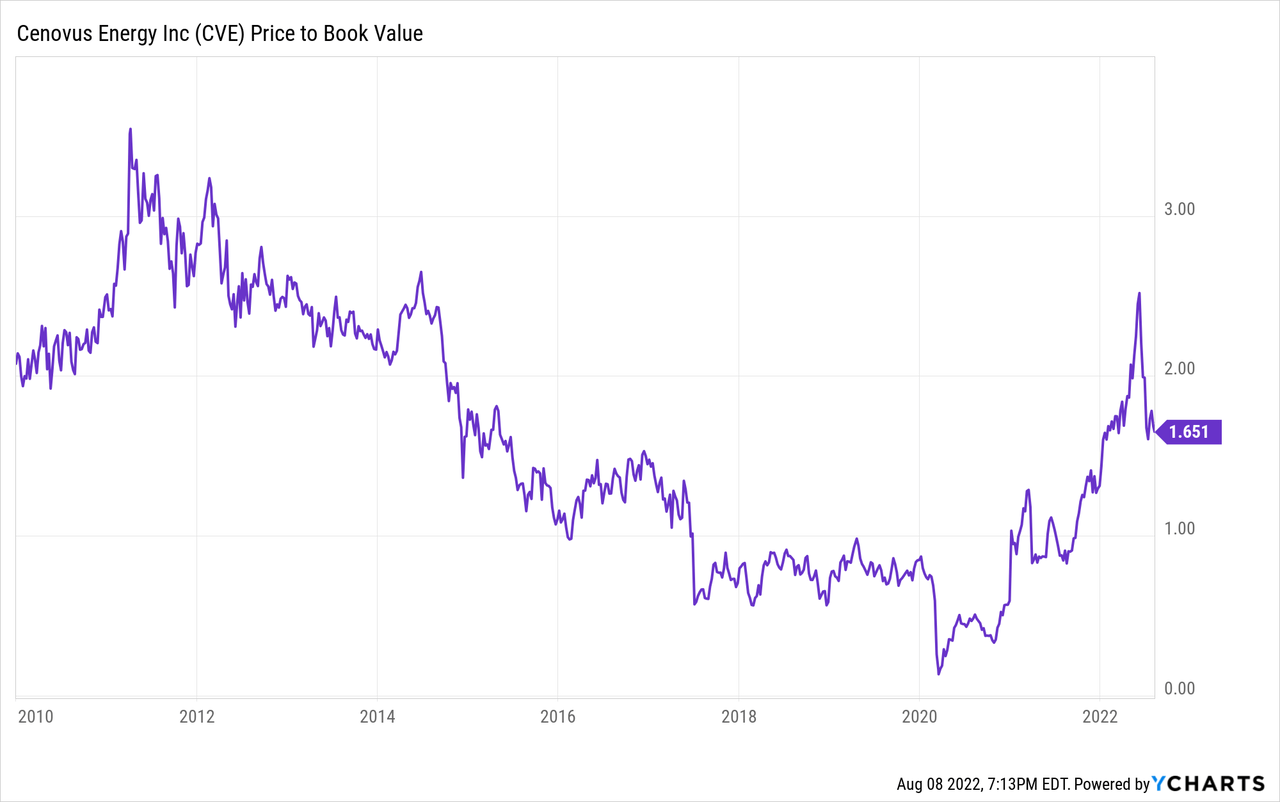

With a cyclical business such as this, it’s probably better to forgot about momentum and earnings revisions, and instead focus on price to book and normalized earnings. Looking at Cenovus’ price to book, we can see that it’s neither cheap nor expensive on a historical basis:

Long-term Returns

Our 2032 price target for Cenovus is $21.40 per share, implying returns of 4% per annum with dividends reinvested.

It’s difficult to calculate normalized earnings for Cenovus given its recent merger with Husky Energy, and the fact that its depreciation and amortization is more than it’s spending on CapEx. Our estimate of normalized earnings is $2 billion USD ($1.04 per share). Assuming management focuses on share buybacks, debt reduction, and occasional acquisitions, Cenovus should be able grow its normalized EPS at 5.5% per annum. In 2032, we’re assuming a price of $95 per barrel of Brent Crude, in-line with The Balance’s estimate. This translates to $1.78 USD per share in 2032. We’ve applied a terminal multiple of 12; the company has 21 years of proven oil reserves. If Cenovus pays larger dividends, you could get less growth, but a similar total return.

Conclusion

While we believe Cenvous’ CEO is doing his best to improve shareholder returns, it seems oil majors have offloaded their least profitable assets on CVE over the years. Acquisitions have increased the company’s depreciation expense and long-term debt. On the plus side, Cenovus is becoming a more integrated player, improving its downstream business. The quant rating can be deceiving when it comes to cyclical commodity companies. We’d take some profits and wait to see how the new integrated model performs during times of industry stress.

Be the first to comment