dan_prat

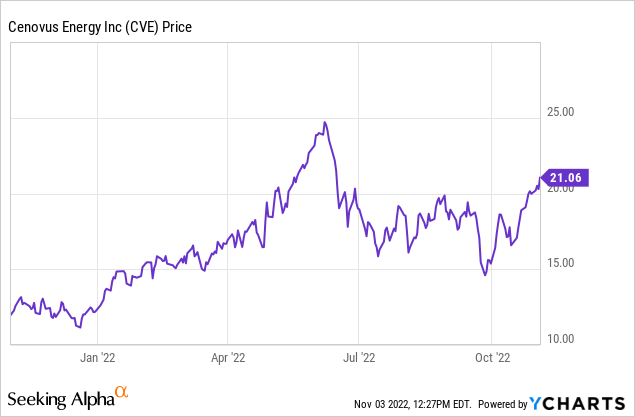

Cenovus Energy’s (NYSE:CVE) Q3 earnings are out and a day later, the stock has jumped 3% while the broader market has given back 4% – a nice outperformance.

Overall, it was a good quarter and the thesis is still on track. I remain bullish on oil prices and still believe Cenovus is a great way to capitalize on them.

Here are my key takeaways from the report.

The Good

Long Term Debt Reduced to $8.8 billion. Net debt down to $5.3 billion.

I’d call this one Great, not just good. Due to both ongoing operating cash flows and a working capital release, Cenovus has rapidly delevered, with net debt down to $5.3 billion. In the last nine months, they have repurchased $4.3 billion worth of debt in a series of tenders.

What remains carries low interest rates, and at this point I would rather see Cenovus build a cash buffer over further debt repurchases.

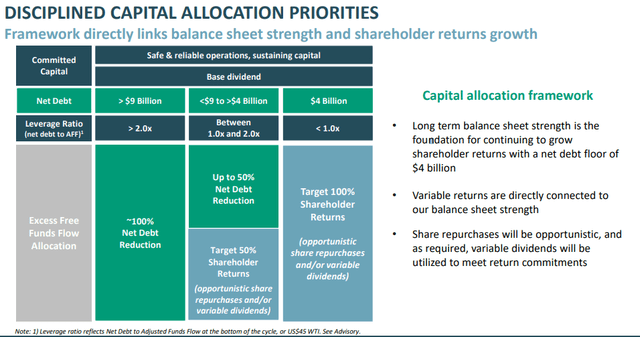

Cenovus November Corporate Presentation

At $5.3 billion, Cenovus is within striking distance of the $4 billion debt floor where it returns all cash to shareholders, which they have guided to reach by the end of this year.

Additional projects are all on-track

With the exception of the Toledo Refinery accident (which Cenovus is not currently the operator of) all of the new Cenovus projects remain on track.

- Sunrise: Cenovus recently closed the purchase of the additional 50% interest, which immediately adds 25kbpd per day of production. Cenovus started reporting 100% of Sunrise volumes since August 31st. Management commented that it had just begun a redrill and redevelopment program at Sunrise and just drilled two of the longest wells to date, and guided for additional redevelopment, noting that Sunrise hasn’t had a new well pad since 2017.

- Spruce Lake North, also came online in August, has recently achieved daily rates “well above” its nameplate capacity of 10kpd.

- Superior Refinery. The refinery rebuild, which will add 50kbpd of refining capacity, was noted as on track and “imminently getting ready to commission the crude unit and start that up.” This will add back a significant percentage of the refining capacity lost from the Toledo fire in Q1.

- Terra Nova coming back online (+10kbpd per day production.)

Net Interest Expense has been cut in half from this time last year

Cenovus paid $356 million in net interest expense in Q3-2021. This quarter, they paid $186 million.

Husky Integration Costs are decreasing as promised.

Husky Integration costs were $302 million through the nine months ended September 30th, 2021. So far this year, they total just $79 million.

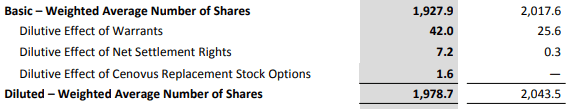

NCIB (aka, share buyback) having real impact

We are finally seeing real reduction in outstanding shares through the NCIB.

Cenovus Q3 2022 Financials

The Cenovus board has approved the application for another NCIB program after the current one expires in November, with capacity to repurchase 136 million additional common shares over the next year.

The Bad

Toledo refinery remains offline with no timetable to repair or reopen

Cenovus currently has a 50% working interest in the Toledo refinery, which was slated to move to 100% after purchasing the other half from BP. This purchase has not yet closed. Toledo is a large refinery with 160 Mbbls/day capacity, and it being offline at a time when crack spreads are at historic levels is not good for Cenovus or American consumers. Neither Cenovus or operator BP (BP) provided much additional information or timetable for repair and reopen of this facility. They are still in the investigation phase. Cenovus did comment that “aerial and drone footage suggests the damage is localized to a small area of the refinery.” I hope that they learn the root cause and can apply the learnings so tragic accidents like this can be better avoided in the future.

Western Canadian Select differential to stay wide into 2023

Per CEO Alex Pourbaix, Western Canadian Select (WCS) differential remain very high and this may persist well into 2023. As Cenovus production is greater than their refining capacity, this is a negative for them. There is a potential for this differential to narrow now that the SPR releases are winding down.

Maintenance CapEx likely higher in 2023

Cenovus now expects maintenance capital to be up in the $2.7-2.9 billion range, up from $2.4 billion due to cost inflation.

Conclusion

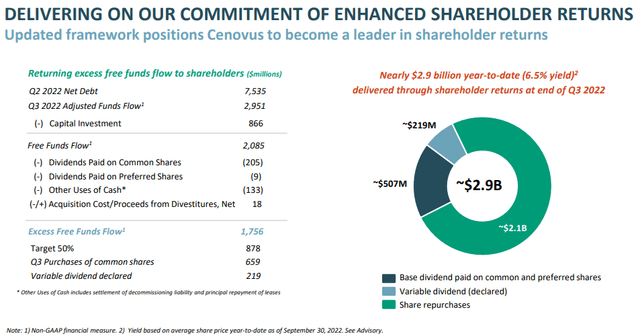

Cenovus is roughly two months away from hitting their debt floor of $4 billion, at which point they will return 100% of free cash to shareholders through share repurchases and variable dividends.

Cenovus has had a fantastic October and is up nearly 40% from the dead low. Is it too expensive to buy now?

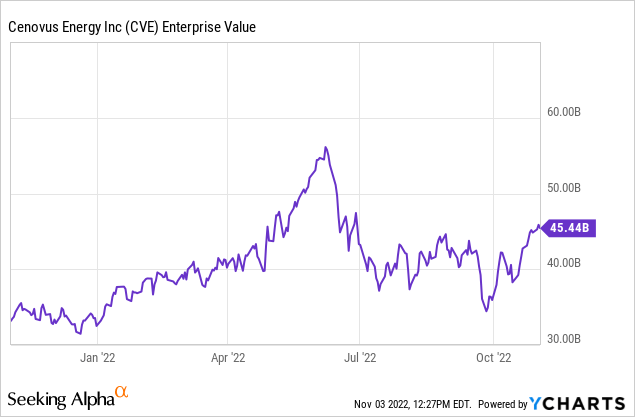

Instead of looking at share price, I focus on Enterprise value. Since Cenovus has been using the majority of its cash flow to retire debt and repurchase shares, the Enterprise Value is only a touch higher than levels hit back in April, and 20% below the high hit in June.

I continue to find Cenovus management as top notch and credible, delivering on the promises they’ve made to shareholders.

Cenovus November Corporate Presentation

We are only a few months away from Cenovus going from a debt reduction story to a capital return story. Further showing how transparent management is, Alex Pourbaix has even provided a playbook on what shareholders should expect:

If that share price is looking like $30, people should expect a lot of variable dividends. And conversely, if that share price is trending below $20. They should expect share buybacks. That’s really directionally how we think about it.

At current commodity prices, Cenovus should be able to generate enough cash to fund the share buyback and pay a dividend of around 10%, with significant upside torque if oil continues to move higher. It remains my favorite investment in the current environment.

Be the first to comment