sestovic/E+ via Getty Images

Cenovus Energy (NYSE:CVE) (TSX:CVE:CA) is one of many oil stocks that have done well this year. In fact, it has done better than most. Year-to-date, it’s up 67%, which is about 7% better than the Energy Select SPDR Fund (XLE) in the same period.

Cenovus’ success comes down to two main factors:

-

A large increase in earnings.

-

A dividend hike.

-

Strength in the broader sector.

Cenovus Energy’s earnings have been rising rapidly this year. In its most recent quarter, earnings were up 200%, and cash from operations was up 91%. The growth was not as good as in the previous quarter, and those same metrics were down sequentially, but it was solid year-over-year growth.

On the strength of this growth, Cenovus Energy hiked its dividend. After delivering a blowout first quarter earnings release, it tripled its dividend, for a cumulative 400% dividend increase since the start of 2021.

Finally, the broader energy sector has been rallying this year due to high oil prices, leading to a lot of investors buying energy stocks. CVE, like others in the sector, has benefitted from this phenomenon.

One of the most appealing things about Cenovus Energy is its rapidly growing dividend. The stock doesn’t have an exceptionally high yield right now, but it’s growing its payout dramatically. Additionally, it has a low (11%) payout ratio. When you consider the fact that oil prices are once again rising like they were at the start of the year, along with the fact that Cenovus’ payout ratio is low, you can make a compelling case that CVE’s yield is likely to go higher. In this article I will make the case that Cenovus Energy is a quality stock for investors seeking dividend growth.

Cenovus – a Bet on the Canadian Energy Industry

When you buy Cenovus Energy you’re betting on the Canadian energy industry as a whole. This is even more the case with Cenovus than other Canadian oil and gas stocks, because CVE not only extracts oil in the oil sands, it also sells fuel directly to Canadian companies. Cenovus Energy owns Husky Energy, an oil company that once owned a gas station chain. The retail fuels business was sold but Cenovus retains a commercial fuels business serving commercial trucks, travel centres and other buyers.

So, when you buy Cenovus, you’re not only investing in a Canadian energy producer, but the Canadian energy sector as a whole. This makes Cenovus an interesting bet for U.S. investors because it increases the geographic diversification in one’s portfolio. We’ve all heard about the importance of diversification and “spreading our eggs across many baskets.” However, what’s often forgotten is that there are many different types of diversification; geographic diversification is an important one. Diversification is maximized when assets aren’t correlated with one another. Cenovus’ share price is correlated with that of U.S. oil stocks, but its business won’t necessarily always be. The Canadian oil industry has unique characteristics. For example, the country has 168 billion barrels of proven reserves, behind only Venezuela and Saudi Arabia. Reserves of that size will likely last a long time, so there’s a case to be made for buying Canadian oil companies for longevity; these companies are likely to last.

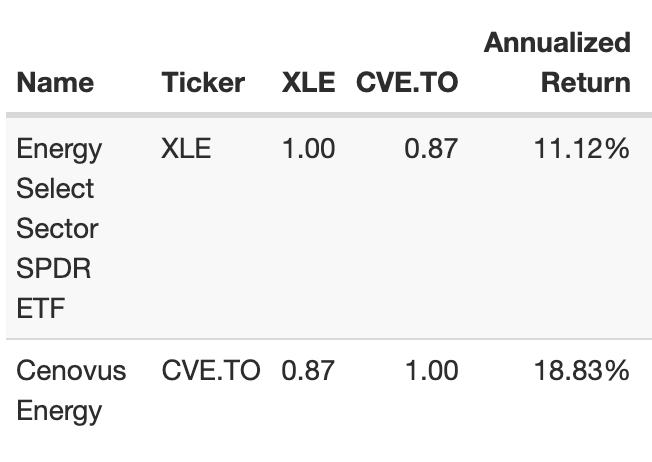

Additionally, the price correlation between CVE and the U.S. Energy sector, while high, is not 1.0. Below I’ve attached a correlation analysis between CVE and XLE (U.S. oil stocks) over five years. The correlation is 0.87, which is high, but not as high as the correlation between the Canadian energy index and the U.S. energy index. So, CVE offers a reasonable amount of variance with the U.S. energy sector when compared to a Canadian sector fund.

CVE/XLE correlation (portfoliovisualizer)

Cenovus vs. the Competition

As we’ve seen, the Canadian oil industry has a lot of things going for it. Canada’s reserves are likely to last a long time so the Canadian energy sector will be around for as long as petroleum products are a thing. That’s a positive, but Cenovus has advantages over its Canadian competitors too.

First, its output is rising. This year we’ve seen the majority of oil stocks rally on high oil prices, but it’s easy to forget there’s more than just prices in this picture. Output is also a big contributor to revenue, and Cenovus’ production increased significantly in Q3. So, there’s reason to think that Cenovus can grow its earnings even if oil futures trade flat from here.

Second, its business is running relatively smoothly, without issues. This year we saw Suncor Energy (SU)(SU:CA) underperform the Canadian oil sector due to activist reports and safety issues. In Suncor’s most recent quarter, the safety thing finally became material, as it contributed to a $3.3 billion impairment charge. Cenovus has been free from such issues this year, and that has helped its earnings (and its stock price) immensely.

Third and finally, Cenovus Energy is paying off its debt. Other Canadian oil companies are doing this, too, but the sheer amount by which CVE is paying off its creditors is massive. Cenovus has paid off a staggering $8.4 billion in debt this year. Not only does this improve the balance sheet, it also makes it easier to achieve future earnings growth, because it reduces interest expenses. So, Cenovus could edge ahead of its competitors that haven’t paid off as much debt.

Valuation

Having looked at the conceptual factors that Cenovus has going for it, we can now proceed to a valuation. A discounted cash flow valuation of CVE would be difficult given the stock’s rapid growth, but we can come up with a tentative price target by using a range of different growth assumptions.

First, though, let’s look at the multiples. According to Seeking Alpha Quant, Cenovus Energy trades at:

-

11.5 times earnings.

-

0.88 times sales.

-

2 times book value.

-

5.3 times cash flow.

As you can see, these are very low multiples. The one that is a little high by the standards of oil stocks is the price/book multiple. For comparison, Suncor’s price/book multiple is only 1.76, although that company took a big impairment charge last quarter. I’d overall say that Cenovus is cheaper than average going by multiples.

Now, as I said, it’s pretty much impossible to predict the future earnings of a company growing as rapidly as CVE is. In some quarters this year, its earnings were up as much as 900%. We know that growth that fast can’t last forever-if you start with a billion dollars and grow it at 900% per year you end up with a sum greater than the world’s money supply in under a decade. CVE’s growth will decelerate from this year’s rapid growth rates, the challenge is figuring out by how much. Given this, I decided that, rather than doing one DCF model, I’d present a series of fair value outcomes with different 5 year growth estimates and an 8% discount rate. This discount rate is double the 10 year treasury yield so it takes into account a lot of risk. The results were:

-

0% growth: $32.5.

-

5% growth: $40.

-

10% growth: $49.

-

20% growth: $73.

As you can see, the entire range from 0% to 20% growth gives significant upside to today’s prices. It certainly looks encouraging. Just remember that this is a commodity producer we’re talking about here. When commodity prices go down, commodity producers’ earnings growth often becomes negative. That is to say, worse than 0%.

Risks and Challenges

As we’ve seen, Cenovus Energy is a pretty cheap stock with explosive growth. It certainly looks like a buy based on what we’ve covered here. However, it is exposed to considerable risk. Stock market history is full of examples of oil investors going bust after periods of high returns when supply gluts hit the market. So, Cenovus investors will want to watch out for:

-

Lower oil prices. A big part of this year’s oil price rally was low supply. The Russia/Ukraine war disrupted supply chains, OPEC cut by 2 million barrels a day, etc. These kinds of political factors can turn on a dime, as they ultimately come down to decisions by a few key individuals. So, the risk of oil prices coming down is significant.

-

ESG issues. Oil companies are often excluded from ESG portfolios, which reduces demand for their shares. Not all ESG fund managers exclude oil companies altogether, but some exclude oil companies viewed as particularly toxic. This is part of the reason why Cenovus sold its gas stations: the gas station business is viewed as one of the more “problematic” in the oil sector, because it involves encouraging consumers to gas up. Cenovus thought that if it ditched the gas stations it would attract more investment. Maybe it did, maybe it didn’t, the point is that there’s nothing stopping ESG funds from deciding that other areas of the oil industry are “problematic” in the future.

The Bottom Line

The bottom line on Cenovus Energy stock is that it’s a dirt cheap energy name with stratospheric growth. It has avoided the safety issues that have plagued its competitors and it is ramping up production and lowering debt. This is a classic example of an oil company that can produce growing earnings even with oil futures just trading flat. Overall, if you want exposure to non-US oil stocks, Cenovus is a name to consider.

Be the first to comment