skynesher/E+ via Getty Images

Investment Thesis

Celsius Holdings (NASDAQ:CELH) is a public company that markets and sells functional energy/fitness drinks as well as their FAST brand of protein bars, and a powdered version of their main product. The company has hit another major milestone, with Nielsen scan data as of April 9th, 2022 showing that sales of Celsius were up 216% year over year in North America. The fitness drink is now the second largest selling energy drink on Amazon with 18% share in the entire category. There is still room for massive scaling up in physical stores, and the stock has been beat down unnecessarily.

With the recent news about a crypto lending network of the same name blowing up, Celsius shares have been hit hard in the past week. The broad market is having one of the worst weeks since 2020, and confusion over Celsius’ involvement in cryptocurrency is adding to the panic for investors. As the news gets digested, Celsius Holdings stock could present with a buying opportunity as speculators move out of the name and long-term holders capitalize on the obvious chance to accumulate more shares.

Introduction

Cryptocurrency will be somewhat of a focus in this article, as it is necessary to explain what has happened with the stock market in the past week. First off, I will begin by addressing the UST and Luna collapse, as I believe that this is integral to understanding the shift in mindset of many crypto investors and can somewhat explain the recent price action in Bitcoin and Ethereum.

More importantly, I will shed some light on the crypto lending network, Celsius Network, which shares the same name as Celsius Holdings but is not affiliated with the company in any way. Confusion over this recent development in the market has caused Celsius investors to panic, and speculators to try and capitalize on the short-selling opportunity created by the negative news stories. This indeed will pass, and as the market digests what is currently happening with crypto, the company’s stock will likely benefit from short-covering.

Lastly, I will share some updates which investors may have missed regarding Celsius Holdings, the beverage company, and what the recent quarter can tell us about the future prospects of the company.

Celsius Network And Crypto Debacle: What Happened?

A little over a year ago, I was invited to join a video call with several people regarding cryptocurrency, specifically a complex system with Luna and Tether. At the time, I was aware of the cryptocurrency phenomenon, and was somewhat curious to hear what the person had to say. From what I understood, the explanation was that you could put money into UST, or Terra, which was an algorithmic stablecoin, and stake your coins and mine a cryptocurrency called Luna. This Luna coin was rapidly appreciating in value, causing early adopters to see outsized gains after only a short amount of time. I listened to the idea intently, and only had one question for the presenter: Where does this money come from?

The answer was that you could get paid interest just for converting your US dollars into UST and staking it in the system connected to Luna; the money came from new additions to the system, building the liquidity pool and expanding the profit potential. My red flags shot up in my head, and I said, “Okay, that is all I need to hear. Thank you for the educational opportunity!”

Needless to say, I did not download any software, mine any cryptocurrencies, or stake anything as part of the system with Luna. The system chugged along, and actually became one of the largest cryptocurrency projects until May of this year, when one of the most epic crashes I have ever witnessed occurred.

The price of Luna went from just a few dollars to a high of over $100 in a year, then down to a fraction of a cent in about a month and a half. This crash coincided with a drop in the price of Bitcoin, with the mother of all cryptocurrencies losing around 48% of its value since the high set on May 4th, 2022.

What does this have to do with Celsius, you may ask? I believe that this Luna crash was a massive wake-up call to many adopters of cryptocurrency, and caused a lot of people to rethink their thesis on why investing in crypto is a good idea. The correlation between this crash, the drop in the price of Bitcoin, as well as Ethereum (which many crypto projects such as NFTs are built on), and other cryptocurrencies has had crypto lenders like Celsius Network skating on thin ice.

Celsius Network is one of the largest crypto lenders, with about 1.7 million customers. There have reportedly been questions about Celsius’ high yields, its connections to the failed stablecoin UST, and its reserves. The similarities between this platform and the system with Terra and Luna are uncanny. Celsius Network operates much the same as a traditional bank, only for cryptocurrency. Allegedly, the company was offering an over 18% annual percentage yield on crypto deposits, causing many people to abandon their savings account at their local bank and switch to crypto banking. The only difference is that Celsius Network is not FDIC Insured, meaning that there is no protection in a case of bank failure. Over a billion dollars flowed out of the Celsius Network system between March and May of this year.

The crypto company said on June 7th that it had the reserves to more than meet the obligations. Just days later, on June 12th, Celsius Network stated:

“Due to extreme market conditions, today we are announcing that Celsius is pausing all withdrawals, Swap, and transfers between accounts. We are taking this action today to put Celsius in a better position to honor, over time, its withdrawal obligations.”

Source: Email to Celsius Network Customers

This announcement created huge panic among crypto enthusiasts, and cryptocurrencies began to decline almost immediately, wiping another $200 billion off of the total market over the weekend and into Monday. This development created massive volatility in risk assets, and sent the broad equities market into a tailspin along with the crypto markets.

Adding to panic for investors was the Fed meeting on Wednesday, where the funds rate was upped by 75 basis points. This caused one of the worst weeks in the stock market since 2020, and in all the confusion with Celsius Network, CELH stock dropped by 11% in a single session and continued to decline by about 15% within a five day period. The worst may be over, as the company’s stock is recovering as of this time of writing, up by around 2.5% on Friday, June 17th, 2022.

Celsius Holdings: Volatility Is The Best Opportunity

As a shareholder of Celsius Holdings, I am in awe of the markets and the complete stupidity and willingness of investors to sell on any bit of news. Only a few simple online searches would have led market participants to realize that Celsius Network is not a public company listed on the Nasdaq. Although, on a day where the broad market is down multiple percentage points, it is somewhat expected that stocks which make up the indexes would be down even more than the broad market itself. Still, it seems that short-sellers have pounced on the opportunity to beat down Celsius as much as possible, given the negative press that the eponymous company has gone through in the past week.

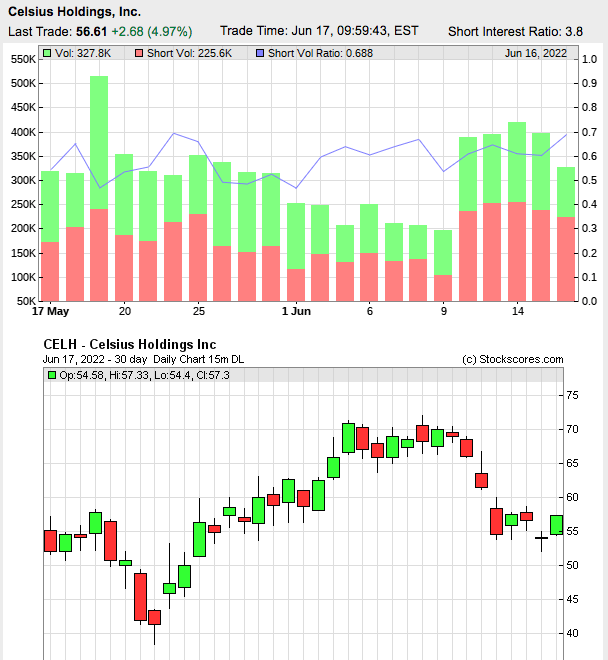

CELH Short Volume (shortvolume.com)

As you can see in the above chart, taken from shortvolume.com, the volume of shares of CELH sold short rose substantially in the past five sessions. As of now, the chart is hitting an important support level around $54 and rebounding, with a potential rally back to $65 possible and a breakout over $70 in the coming months. Looking at a longer term chart of CELH, and you can see that the stock is still in a raging bull market with momentum building as the company continues to set sales records and take online market share.

Recent Wins For Celsius: Extrapolating Into The Future

The recent quarter for Celsius Holdings was a massive one, with many insights to be gained from the data. April 2022 was a record level for sales, with Nielsen scan data showing a 216% increase in sales year over year for 2 weeks, 215% for the 4 weeks, and 230% for the 12 weeks.

Celsius also saw a 17% price increase on cans sold, showing that the company has pricing power in the face of inflation without curbing demand for their fitness/energy drinks. Celsius is also the second largest energy drink on Amazon now, with 18% share of the market and second only to Monster Energy. Compare this to just a couple years ago, when Celsius was a virtually unheard of product with low single digit online market share. Red Bull has around 11.6% market share on Amazon. Celsius eclipsing Red Bull in terms of online Amazon sales is a major milestone for the company, and the market share growth is likely to continue in physical locations where the product is sold, such as gyms, gas stations, and other brick and mortar retailers.

Celsius has passed up Red Bull in terms of Amazon sales, but still lags in terms of the physical placements. Rockstar Energy drink is lagging behind, while Celsius has jumped into the top three brands. The trend of physical locations is growing exponentially, with US door count now exceeding 140,000 locations nationally. This is growth of over 49,000 locations or 53% from the first quarter of 2021.

Extrapolating this data into the future, it seems as though the massive sales growth Celsius is experiencing has reached a point of supercharged growth. While the sales growth is reaching over 200% year over year, this may indeed slow down in the next two years, but not likely in 2023. Sales growth will continue to be explosive, but the physical placement growth and exponential adoption of these physical locations will begin to slow down in coming quarters. While there are still many physical locations that do not carry Celsius yet, the company will likely start to hit a huge percent of the US population in terms of reach within the next year or two. If the company does not have to worry about expanding inventories and distribution, they can focus on operating efficiencies maximizing profit margins. However, the company is at this point nowhere close to being done in terms of scaling up.

Celsius Holdings just launched their Amazon EU operations beginning with Great Britain, so the online European market remains largely untapped. With a good foothold in Sweden, Norway, and Finland already, Celsius is poised to take over not just the North American energy drink market, but also the European market as well.

Conclusion

With the recent cryptocurrency collapse, Celsius Holdings has become caught in the crossfire with an unjustified sell-off due to a company of the same name getting negative press. After the crypto debacle surrounding UST and Luna, many crypto investors have begun to wake-up and reconsider their positions in not just Bitcoin and Ethereum, but other “alt-coins” and the platforms that support this type of high-yield interest and related systems with crypto. Short interest on CELH remains elevated, and as the cryptocurrency collapse washes out, market speculators will likely begin to cover their positions as the facts behind Celsius Holdings and Celsius Network show themselves. As for potential risks, the rising interest rate environment will continue to produce volatility in high growth stocks such as Celsius Holdings, but these massive sharp drops will more than likely be long-term buying opportunities as the company continues to scale up and take market share away from competitors. I currently see the shares of CELH as a Strong Buy on weakness, with shares under the $60 price level.

Be the first to comment