BlackJack3D

Thesis

CEL-SCI Corporation’s (NYSE:CVM) share price is near a 2 year low. Their Phase III missed the primary endpoint, but objective tumor responses were shown in the overall ITT at a significant rate. More importantly, these tumor responses were shown to be predictive of a large survival improvement, cutting the death rate by more than half. Driven by these objective responses, one of the two treatment arms demonstrated a 14.1% Overall Survival Improvement (OSI) for Low Risk (LR) Head & Neck Cancer (HNC) patients exceeding the 10% improvement goal vs. Standard of Care (SOC). The other treatment group saw a disadvantage because those patients could not tolerate the extra three weeks before surgery needed to receive Multikine. Cel-Sci does not intend to include this other group in the indication for use.

We believe Multikine, if approved, will result in a paradigm shift in treating all solid tumor cancers. This results in a disconnect b/w the current share price and the intrinsic value of the company.

CEL-SCI Background

CEL-SCI is a clinical stage biotech. The company was founded in 1983 and was an early adopter of using cytokines for immunotherapy. The company just completed a 9.5 year, 24 country, 928 patient Phase III trial evaluating their flagship drug, Multikine, on HNC patients.

CEL-SCI has a rocky history, to say the least. Since starting its Phase III trial in Dec 2010, they endured 2 reverse splits, multiple capital raises, a lawsuit, a counter-suit, an FDA hold (with eventual release) and more. But management did not give up. They persevered to the trial’s end and it might pay off handsomely for shareholders, and more importantly, HNC patients. (The official name for HNC is SCCHN, but we will use HNC throughout this article.)

The Novel Approach of Multikine

Before we can understand the potential of the HNC market, as well as other markets, we need to understand how Multikine works. As you will see it is very different from current immunotherapies.

Multikine is a mixture of naturally derived cytokines that boosts the immune system to fight the cancer before SOC treatment. Your immune system produces cytokines in response to antigens to fight diseases. Cancer cells essentially ‘hide’ from your immune system.

For HNC patients, surgeons perform wide-margin surgery. The goal is to remove the visible tumor and any smaller, possibly unseen tumors around the primary tumor. This is followed by chemo and radiation to get any very small tumors (i.e. micrometastasis) that might be remaining.

If any micrometastasis somehow survives chemo and radiation, these cells can lay dormant until they start to divide and grow. It is well known that if the cancer returns, your chances of survival are worse than after the initial diagnosis.

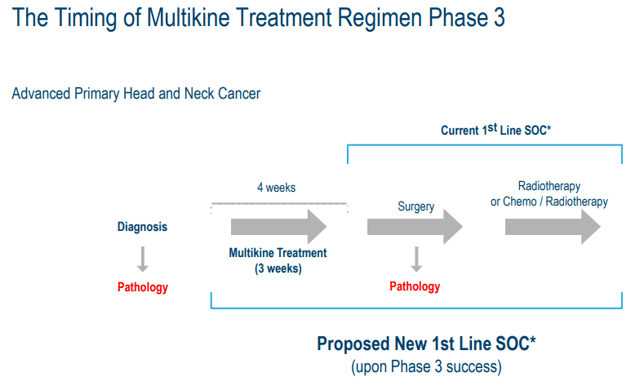

It is not the visible tumor that kills patients. Some people live with tumors and lead relatively normal lives. It is the remaining micrometastasis that does the real damage. If your immune system is enhanced to see and destroy the micrometastasis, survival improves significantly. Multikine proposes to accomplish this task when the immune system is still healthy (i.e. before it is damaged by surgery, radiation and/or chemo). Almost all other cancer immunotherapy drugs (e.g. Keytruda, Opdivo, Bavencio) are given after traditional cancer treatments have failed. They are typically for recurrent cancers.

For newly diagnosed patients with HNC, the FDA allowed a 3-week window between diagnosis and surgery in the Phase III trial. Multikine is administered during this 3-week span. It is injected around the tumor (peritumoral) and around the lymph nodes (perilymphatic) for 5-days a week for 3-weeks. Half of the drug is injected around the tumor and half is injected around the lymph node. Injection near the lymph node is very important b/c this is a critical part of your immune system. Multikine aims to enhance the immune system to seek out the cancer cells and destroy them. Note that Multikine is not delivered via IV as that might induce a cytokine storm. It is only given locally, near the tumor and lymph nodes. After the 15 injections, SOC is administered which involves surgery followed by radiation or chemo-radiotherapy.

While surgery is designed to remove any visible tumor it also destroys the tissue (and biological systems) around the tumor. Surgeons employ wide-margin surgery to ensure they get as much of the cancer as possible. They are essentially destroying part of the immune system that delivers cytokines and white blood cells.

This is why Multikine is given BEFORE surgery & radiotherapy/chemo-radiotherapy. It is a first line treatment (i.e. given first before other treatments). The immune system is essentially intact, albeit not 100% since cancer is present, so Multikine can boost the immune system to recognize and destroy the tumor. It is a radically different approach than most immunotherapy drugs. And based on the Phase III results, it appears to work.

To repeat, most currently approved immunotherapy drugs are given when the cancer has returned. We are not aware of any immunotherapy drug that can be given before surgery or chemoradiotherapy when the cancer is first discovered. Multikine’s approach is truly unique and could open the door to other types of cancer, if approved.

Phase III Results Review

Phase III results have been contentious, and confusing for some, so we will review them.

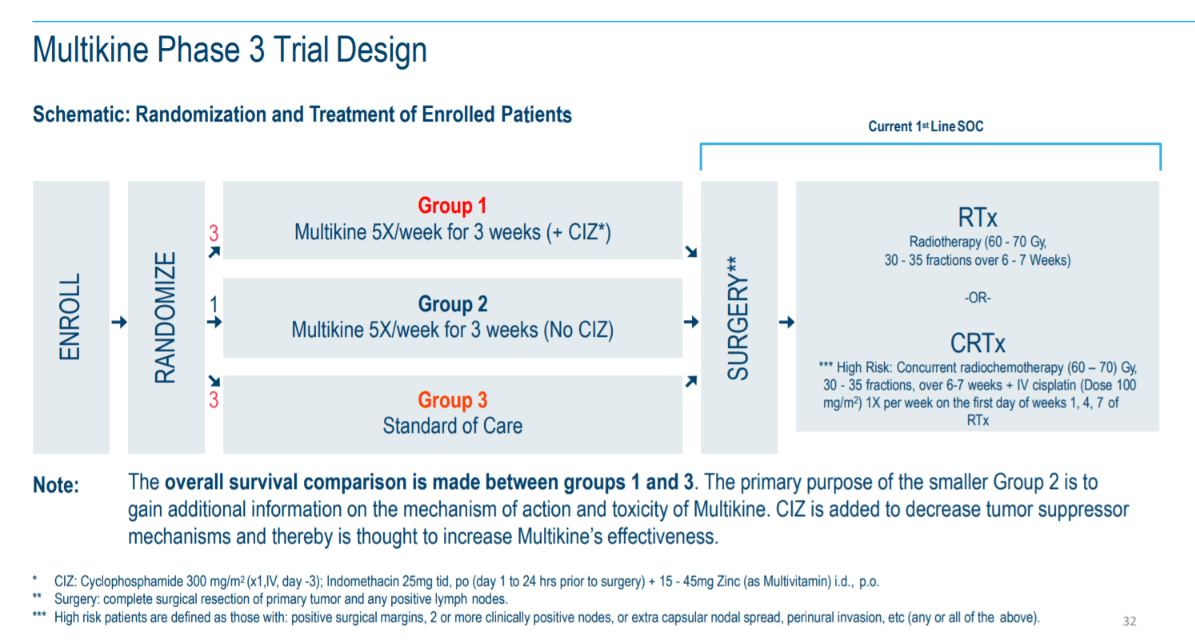

On June 28, 2021 the company announced that it missed the primary endpoint for the Phase III trial. However, the company also stated that it had exceeded the 10% OSI goal for the Low Risk treatment arm. This created some confusion as it was the first time many CEL-SCI followers were not aware there was more than one treatment arm. But looking at the trial protocol below, we can see the 2 treatment arms. Notice the word “OR” b/w the RTx and CRTx treatment treatments.

Figure 1 – Phase 3 Trial Design (Cel-Sci)

On the right side you will see after surgery the patients can receive either RTx or CRTx. RTx is used when the patient is considered Low Risk (LR) for recurrence, and CRTx for the patient when their cancer is considered High Risk (HR) for recurrence. After surgery patients will get one or the other as part of the SOC.

Why 2 treatment arms?

The reason is because HNC patients exhibit tumors in varying stages of progression. Less advanced cases can receive only radiation therapy as their final treatment. And remember that chemotherapy is highly toxic so if a doctor doesn’t have to give it as per the treatment protocol, they will willingly oblige. The more advanced HNC cases require a more intense treatment and therefore, chemotherapy is added to the radiation treatment.

The results first released in the June 28, 2021 press release, for the LR group, were the following:

-

The 5-year overall survival benefit was 14.1% in absolute terms exceeding the protocol required 10% or better

-

p-value was 0.0236 exceeding the protocol required p-value of <0.05

-

Hazard Ratio was 0.68 exceeding the protocol required 0.721

-

No safety issues involving the whole study population

They exceeded the 10% goal with a 14.1% improvement over SOC, which is impressive for an indication that has not seen an FDA approved drug in over 50 years.

Their secondary outcomes were local regional control (i.e. did the tumor spread?), progression free survival (i.e. patient lives and disease does not get worse), and quality of life. These are not known since those results have not been released, but we hope 1 or more have been met.

Additional Phase III Info Released

On May 27, CEL-SCI released an Abstract to be presented at the June 2022 ASCO meeting.

Snapshot of ASCO Abstract (Cel-Sci)

There is new information in this abstract so we will highlight a few of the details. Note that “LI” stands for Leukocyte Interleukin, which is the scientific term for Multikine.

The abstract stated:

Pre-surgery responders (PSR; CR/PR) in ITT LI treated (+/- CIZ) groups were 8.5% (45/529; overall LI) and 16% (34/212; LR LI) vs no SOC PSRs.

Pre-surgery responders (PSR) are defined as patients who had a cancerous tumor that exhibited either a complete response (CR) or partial response (PR). A CR is the cancerous part of the tumor disappears, and a PR is at least 30% of the cancerous tumor disappeared.

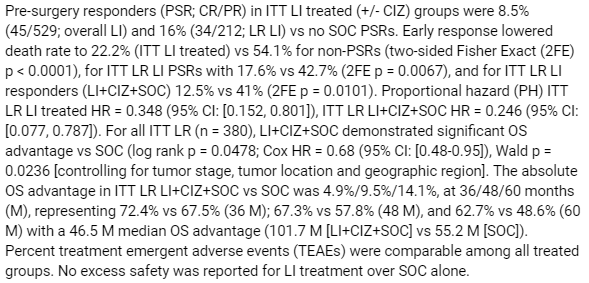

Here is the above data organized into a chart. (Thanks to cvmresearch.com for this chart.)

Figure 2 (www.cvmresearch.com)

The takeaway is that 16% of the target population (LR group who receives only radiation after surgery) for Multikine showed a response. Almost 1 out of every 6 patients given Multikine showed some sort of tumor shrinkage or disappearance within 3 weeks. Not a single person in the RTx control group saw a tumor response.

For the CRTx group, which includes dropouts, only 3.5% saw a tumor response. And again not a single person in the CRTx control group saw a response in their tumor before starting SOC.

Seeing part of the cancerous tumor either partially disappear, or completely disappear, within 3 weeks is incredible. It’s even more astounding when the drug causing this shrinkage appears to be non-toxic.

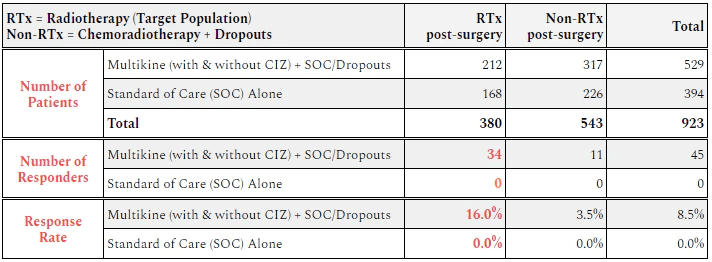

Here is a chart provided at ASCO showing the Response Rate b/w the different patient risk groups.

Figure 3 – Early Response Rates (Cel-Sci)

CEL-SCI provides in the poster one p-value for the early responses in the total population: “the difference between LI (MK) treated and SOC early response rate, for all patients as randomized, was highly significant (two-sided Fisher Exact test p=0.00000000001 [one in 100 billion]).” That means there is a 99.9999999% chance that the tumor response did not occur by chance.

But the FDA isn’t too focused on tumor response as a primary endpoint, per se. They want to see patients living longer. Longer life is a sign of a potential cure.

Improved Overall Survival – Is it real?

One question is whether the tumor responses mean the patients live longer. Tumor response doesn’t always mean better survival. But CEL-SCI appears to show a very strong correlation (almost unmistakable) b/w tumor response and improved survivability.

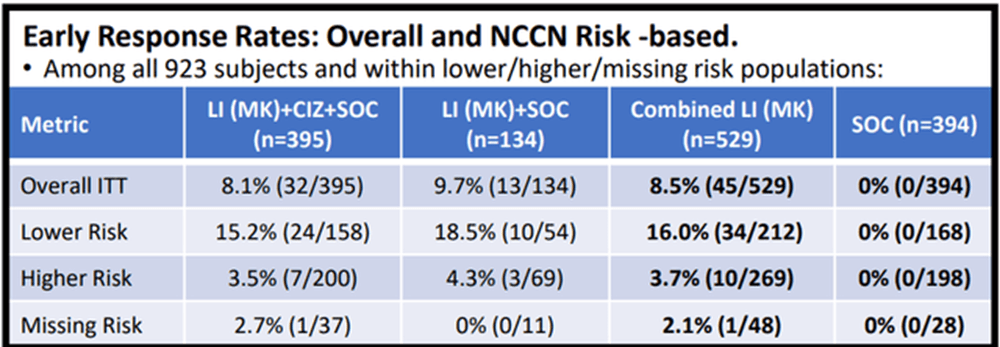

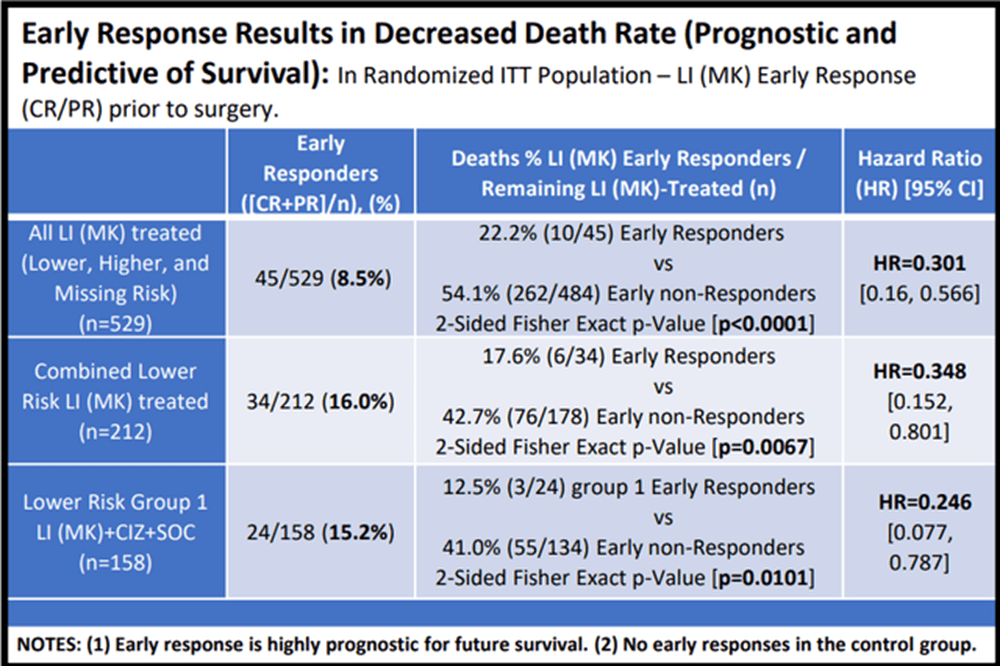

Here is a table for survival in the ASCO poster:

Figure 4 – Early Response Results in Decreased Death Rate (Cel-Sci)

The importance of this chart data cannot be overstated.

For the total population (top row), MK patients who had pre-surgery responses had only ~22% death rate compared to ~54% death rate for those who did not respond to Multikine. That means the survival increased from 46% to 78% if you had a pre-surgery response. The probability of this happening by chance was less than 1 in 10,000, the company reported, so that is very statistically significant.

In the RTx category (middle row), the death rate fell from 43% for the people without responses to 18% for people who had responses. This means the survival rate went from 57% to 82%. This is a major improvement for the RTx group. CEL-SCI also reported a p-value for this as being 0.0067, which basically means that the chance of it being by chance is less than 7 out of one thousand, which is much better than the 5 in 100 (i.e. p-value of 0.05) requirement for statistical significance.

In the comparator treatment arm where patients received a “CIZ” supplement to help Multikine work (bottom row), the death rate went down from 41% to only 12.5%, which means survival went from 59% to 87.5%. Even though this is a smaller group (with a small sample size), the p-value is still 0.0101, which means about 1 out of 100, and this is still much better than the 5% requirement.

The data seems to suggest a very strong correlation b/w tumor response and improve survivability. And the results are statistically significant which is a high hurdle to cross with the FDA.

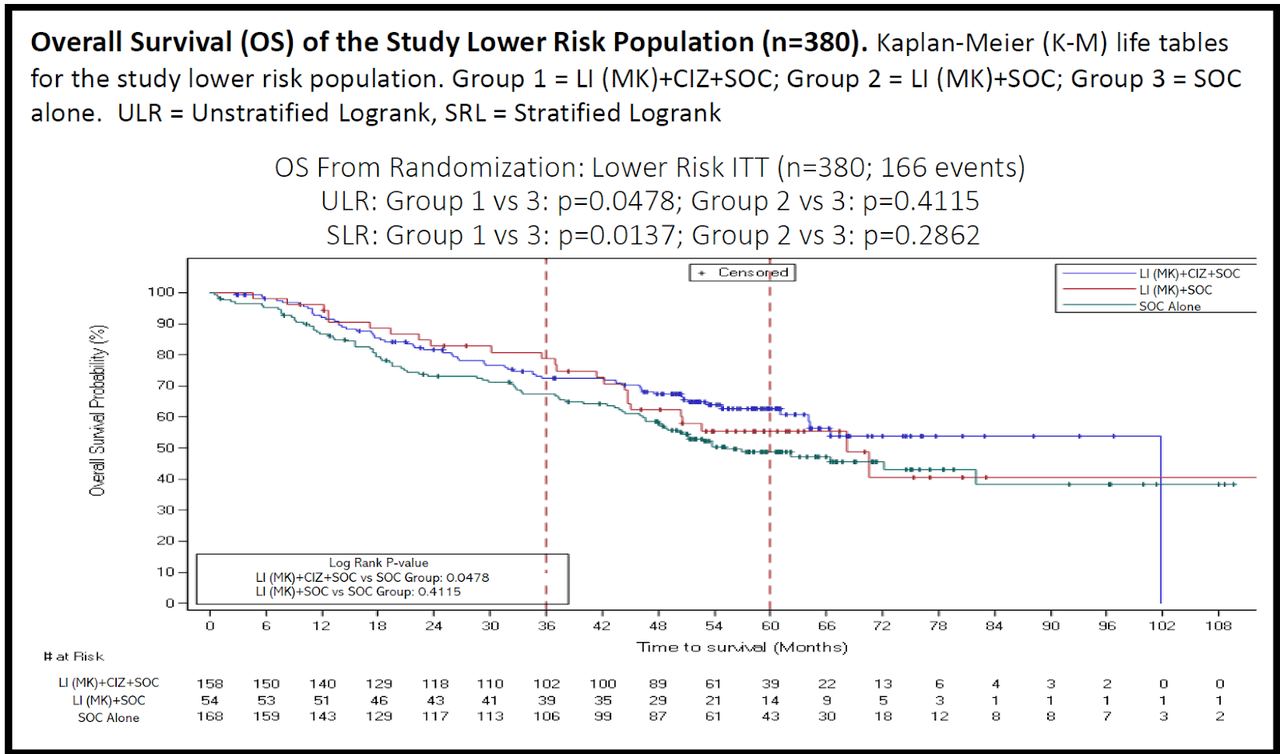

For those interested in the OS of the LR treatment arm, here is the overall survival curve.

Figure 5 – OS of the Low Risk Population (Cel-Sci)

Again, only the blue and green curves are used for OS comparison. Blue is the MK + CIZ group and green is the SOC. You can see the effect of the MK + CIZ treatment is robust and durable, meaning it is statistically significant and the survival improvement does not recede over time.

The Takeaway

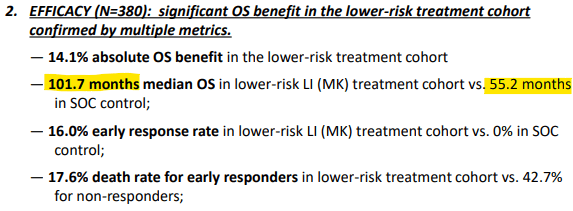

The new piece of data from the recent ASCO conference is that MK showed an astounding 46.5 month median OS advantage. See the ASCO poster snapshot below (highlighted section).

Snapshot of OS Benefit (Cel-Sci)

This is almost 4 years of additional life from just a 3 week outpatient injection! This is an impressive feat by a small biotech. Even Big Pharma can’t achieve this, as we will see.

Comparing Multikine to Keytruda

The current king of cancer drugs is Keytruda. Specifically to HNC, but with also many other diseases, this drug can only be given when the cancer is recurrent, or metastatic. And it only gives an additional 2.1 months of life for HNC. According to Axios Keytruda is close to becoming the world’s best selling drug of all time. Keytruda sales are so significant (2021 sales of $17.2B), it would be a Fortune 200 company all on its own.

Multikine beats Keytruda by a massive 22x for additional life expectancy for HNC. Granted, the indications are different with Multikine being for first line (i.e. newly diagnosed) therapy and Keytruda for second line therapy. Multikine & Keytruda will not compete against each other. With approval Multikine will be given before surgery and Keytruda can be given if the cancer returns.

ASCO Poster Presentation

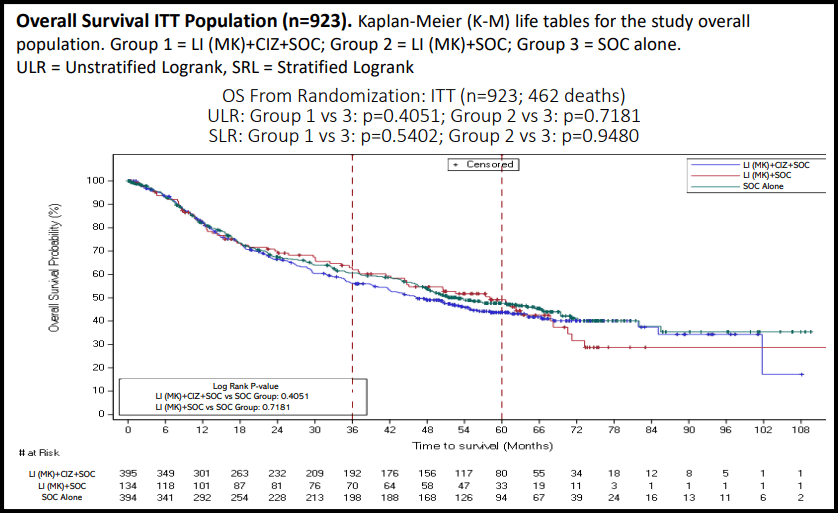

CEL-SCI provided additional transparency in its poster presentation of the Phase III results. One of them was a chart showing OS in the ITT population of all (923) patients. The chart is below.

Figure 6 – Overall Survival ITT Population (Cel-Sci)

You can see the data points are broken up into the 3 arms of the trial. Only the blue and green curves are the comparator arms for determining OS. Starting from 0 months until about 18 months, the 3 arms are essentially identical. But at around 18 months the MK+ CIZ+SOC arm starts to separate from the SOC arm. At this point SOC beats the MK + CIZ arm. This seems to last until about 72 months where the arms meet up again.

For the period b/w 18-72 months the MK + CIZ + SOC arm is lagging behind the SOC arm in terms of OS. This is truly bizarre as MK has never shown any serious side effects. On top of that but MK has an extremely short half- life. Almost all of it would disappear by the time the surgery commenced at the start of the SOC. Many of the drug’s components have a half-life around a few hours. This is part of the reason MK must be given every day, 5x a week for 3 weeks.

But can we definitively conclude that Multikine reduced survival? It doesn’t seem like it. CEL-SCI provided p-values for the survival curve shown above and these are very high: p=0.4051 or p=0.5402. This means the curves are not statistically different. They are basically the same because any differences are at least 40% due to random chance. You can’t say from these curves that Multikine is any worse or better in the total overall population.

So what is happening here? The short half-life of Multikine would ensure it is completely gone by the time chemoradiotherapy is administered. What is causing the control group to outperform the Multikine group?

The most recent shareholder letter provided the possible reason. The letter stated:

Patients in the chemoradiation group did not benefit from Multikine. In fact, these patients did less well than the control. This is believed to be because these patients needed their tumors removed quickly and could not delay surgery for an extra three weeks to receive Multikine.

We wanted clarification on this lack of surgery delay so we reached out to the company. They confirmed that ALL patients in the control groups (LR & HR) did not have to wait 3 weeks for surgery. Surgery could start immediately after diagnosis. The company said that trial enrollment would have been very difficult had they forced the control group to wait 3 weeks for surgery.

So it appears there was an additional variable (3-week delay) between the control group and Multikine-treated group. Remember that patients who require chemoradiation have a more advanced stage of cancer. Timing is of the essence and the tumor needs to be removed asap, and chemoradiation started.

For the HR treatment arm, the results show that Multikine was not able to overcome the detriment caused by waiting an additional 3 weeks. It is important to note that there may be other reasons why the control group did better than the treated group, which are not known, or the company has not divulged.

The fact that the LR control group didn’t have to wait for surgery seems to bode well for MK in the LR treatment arm. MK was able to show a significant benefit in this group even though this group retained their tumor for 3 additional weeks vs. the control. MK plus a 3 week delay before surgery attains much better outcomes than removing the tumor immediately without MK injections.

Phase III Detractors Claims

CEL-SCI’s detractors claim that the LR treatment arm was actually a subgroup and the company performed subgroup analysis. CEL-SCI claimed the benefit was seen in a specified treatment arm and the results were compiled before unblinding. Who is right? Subgroup analysis is a serious red flag to the FDA and typically requires an additional Phase III trial. To sort this out, some definitions are required.

First, a subgroup is a group of patients who exhibit biological characteristics (eg. sex, race, biomarker/gene expression, etc.) within a larger group of the clinical study population. For subgroups all patients received the same treatment, but certain groups exhibited better performance than the mean.

A treatment arm is a group of patients who receive different treatments due to progression of the disease, in this case. There is no consideration for biological characteristics of the patient.

One can see from Figure 1 above that the treatment groups in the Phase III trial fit squarely under the definition of treatment arm.

The next dart thrown by the detractors is that CEL-SCI did subgroup analysis after they knew the trial had missed their primary endpoint. This is preposterous considering CEL-SCI makes no distinction in the results as it relates to biological characteristics. The only differentiation highlighted in the results is between the RTx arm and the CRTx arm. The former met its primary endpoint, and the latter missed it. In addition CEL-SCI repeatedly stated they were blinded while the data was being analyzed. Geert Kersten, the CEO, has never wavered from this claim or stated anything contradictory during the data-lock or analysis period.

The final dart thrown is that CEL-SCI will need to redo their entire Phase III trial on just the patient population requiring RTx since they missed the primary endpoint. It doesn’t take long to realize there are several problems with this argument.

Remember that Multikine must be administered for 3 weeks before surgery. However, with the current SOC, the doctor makes an assessment as to which treatment is needed after surgery. He will then assign the patient to receive either RTx or CRTx. The current SOC only makes a distinction on who receives RTx or CRTx after the surgery is completed. But Multikine can only be administered before surgery since that is the only window of opportunity that is available. You cannot delay any other treatments that are part of the SOC.

So who do we give Multikine to when we don’t know who is going to be in the RTx treatment arm? With the current SOC, we are forced to give it to everyone, just to ensure the RTx treatment arm receives the drug. But that would just be a repeat of the recently completed 9.5-yr Phase III trial. However, there is a larger issue. It is unethical to administer a drug (even in a clinical trial) when you know the drug has no benefit. (There is an exception when ruling out a placebo effect.) We know from the recently compiled data that Multikine does not benefit the CRTx treatment arm so it cannot be given to them. We don’t see any method as to how the FDA could mandate CEL-SCI to do another Phase III trial, even if it was for just the LR group.

It is for this reason that CEL-SCI has developed an algorithm to determine who is likely to receive RTx at the time of diagnosis, which is the group that will benefit from Multikine.

New Algorithm for Treatment Arm Assignment

The data shows the CRTx treatment arm exhibited no benefit from Multikine administration. In fact, that arm did worse. This doesn’t appear to be from Multikine being harmful, but the 3 week delay needed to administer Multikine. This would make sense since the higher risk group has a more advanced form of cancer that is starting to spread. Timing is of the essence for this HR group and waiting an additional 3 weeks seems to make their outcome worse.

Therefore, the company needs to have a way to accurately identify who is in the LR group. This group will be given Multikine and needs to endure a 3 week delay before surgery. CEL-SCI claims to have an algorithm for this.

In a second 2022 ASCO abstract the company stated they can identify the LR group (RTX) with 91.8% accuracy. Simultaneously it excluded 60.4% of the CRTx patients who were not supposed to receive Multikine. This means that about 40% of the CRTx patients would still have received Multikine, even though they should not have. Overall the algorithm selected 74.5% accurately with a p-value of 0.0376, which shows that it is statistically significant (a 96.6% chance that it did not occur by chance).

This algorithm will receive intense scrutiny from the FDA. Let’s look at possible scenarios how the FDA might respond to this algorithm. Note that all 3 scenarios assume the FDA is okay with the stated 74.5% overall assignment accuracy.

Scenario 1 is the FDA accepts the algorithm, as is, without requesting any follow up. We don’t see this as very likely.

Scenario 2 is the FDA accepts it on the condition the company must do a followup with all patients to ensure the algorithm is as accurate as claimed. But for this to occur the drug must be approved. This is not too different from companies who must follow up their patients for years after a drug is approved to ensure it is safe long term.

Scenario 3 is the FDA requires another trial to determine the accuracy of the algorithm before they approve Multikine. This scenario would devastate the share price, but it would not be another 9 year trial.

The only part requiring validation is the algorithm. The step in the SOC which determines LR, or HR, for recurrence is the surgery, which occurs 3 weeks after diagnosis. This is essentially at the very beginning of the treatment. So another trial would not take several years, but it would take b/w 1-2 years to set up and complete.

Of the scenarios outlined above, we see the 2nd as most likely. This is because HNC is an unmet medical need with approved therapies in over 50 years, and Multikine shows a clear benefit for the LR patient group. Simultaneously, the FDA wants to be sure the algorithm is correctly placing people in the right risk classification.

Over time the classification algorithm will improve. A lot of work is being done with biomarkers, artificial intelligence and scanning to better predict which type of treatment a HNC patient will need. CEL-SCI will be able to use all available medical data to improve their algorithm.

What about misclassified patients?

There are 2 broad scenarios with using the algorithm that can misplace patients into the wrong treatment arm.

One is that a LR patient is identified as a HR patient. This means they would not get Multikine and would proceed straight to surgery. This is no different than the current standard of care, and would not be a concern from the FDA’s standpoint.

The other is that a HR patient is identified as LR. The FDA is concerned about this scenario b/c people would be given Multikine injections over a 3 week period when they should be heading straight to surgery to remove the tumor. CEL-SCI admitted that these patients did worse than the control despite the fact they were administered Multikine.

Safety

Multikine so far has been demonstrated to be safe for HNC when monitored through the various Phase 1 & Phase 2 trials and the large 928 patient Phase III trial. Note that only the FDA can make the final determination if a drug is safe. Also note the official name for HNC is SCCHN, but we will use HNC throughout this article.

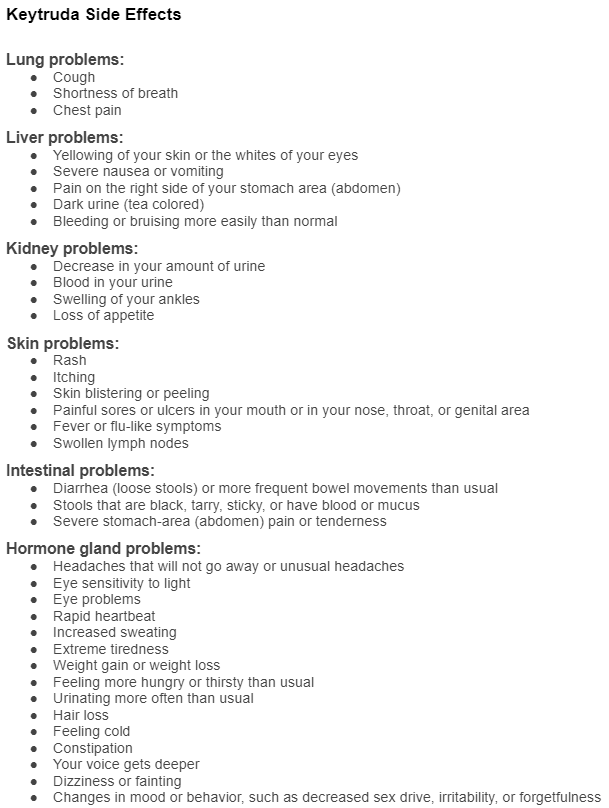

During the trials the most commonly reported Adverse Events (i.e. side effects) associated with the administration of Multikine were:

-

Pain at the injection site

-

Local minor bleeding at the injection site

-

Edema at the injection site

-

Diarrhea

-

Headache

-

Nausea

-

Constipation

This is truly spectacular for a cancer drug, or any injectable drug for that matter. Just for a simple comparison, vaccine injections often have more side effects. When looking at currently approved cancer drugs, all of them have side effects far worse than those listed above.

In addition there were no Serious Adverse Events (SAE) directly associated with Multikine during any of the trials. This adverse events profile is spectacular when knowing the drug is used for cancer treatment.

For comparison, here is the adverse events profile for Merck’s Keytruda directly from their website.

Keytruda Side Effects (Merck)

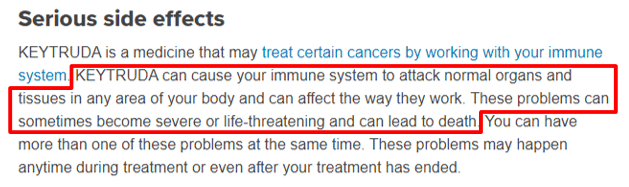

And here is what their website says about serious side effects. Take note of the statements inside the red line.

Keytruda Serious Side Effects (Merck)

Keytruda has been proven to extend life expectancy by a few months in many types of cancers so doctors will try Keytruda in hopes of extending the patient’s life. However, once a serious side effect is presented, immediate discontinuation is a near certainty. This stops any potential benefit for the patient, and ends the income stream for Merck.

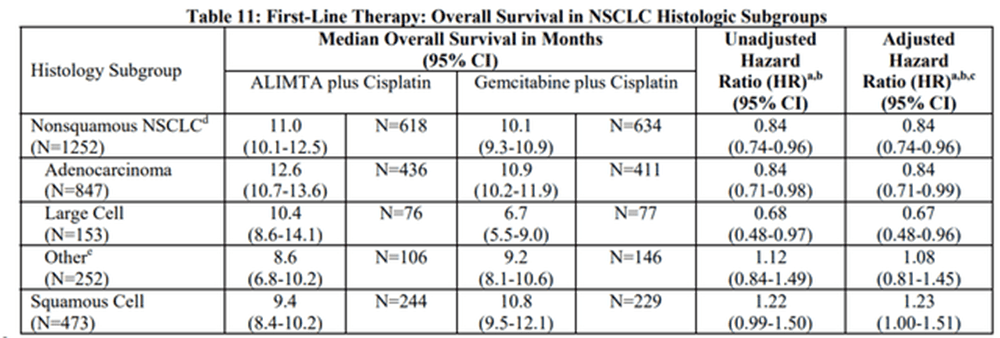

For those feeling ambitious, here is a link to Bristol Myers Squibb Opdivo side effects.

And for good measure, below is their statement on Serious Side Effects. They are virtually identical to Keytruda.

Opdivo Serious Side Effects (Bristol Myers Squibb)

Multikine’s Phase III data showed it improved survival in the LR treatment arm by 29% vs. SOC alone. Note that the 14.1% OS improvement is an absolute improvement over SOC, and the 29% improvement is a relative improvement over SOC.

And it achieves this result without any serious side effects. The potential Multikine’s benefits still has yet to be realized in the medical community as there has not been a lot of public discourse. If the FDA approves Multikine and deems it safe, it can potentially be marketed as a non-toxic cure for cancer. If granted this would be the first such claim ever for a cancer drug.

Note that only the FDA can approve the final labeling of MK, should it be approved. It is possible that the label might include more ominous side effect warnings than what is known at this time.

Does the FDA ever approve drugs that fail their primary endpoint?

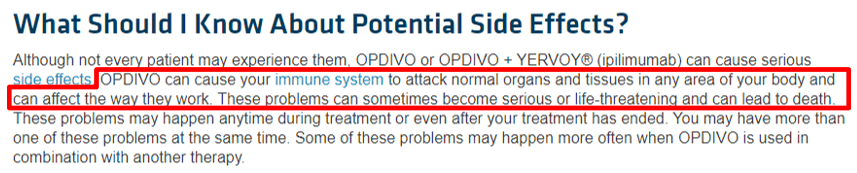

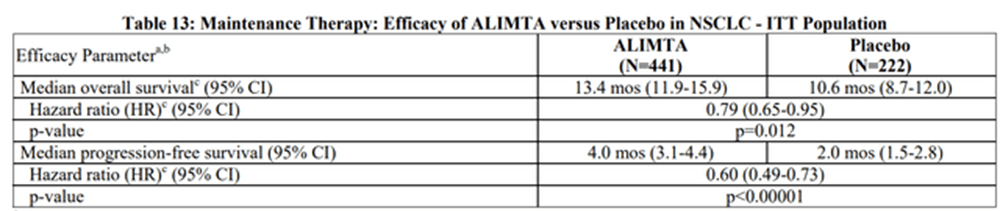

Yes, they do. The approval of Alimta gives an example of an approval of a drug that did not meet the primary endpoint in the overall study. This article states that “Neither superiority nor noninferiority for overall survival could be demonstrated.” According to the product label, the primary endpoint was overall survival but this was exactly the same as the control arm, so it was not proven to be any more effective than the control. There was a 0% survival advantage. However, for one “prespecified analysis” of a subgroup of non-small cell type cancers, there was a small benefit seen:

Alimta table of non-small cell group (Eli Lilly)

Alimta also showed a better safety profile than the control in the non-small cell group. The FDA then granted accelerated approval as long as there was a confirmatory study to see the results in the non-small cell type group. That study ended up showing a positive survival benefit:

Alimta confirmatory study survival benefit (Eli Lilly)

Remember that it is the FDA’s job to bring safe and effective drugs to the market. In this case the FDA worked with the manufacturer to help bring Alimta to market since there was a group of patients that could benefit.

Approval Likelihood for Multikine

While CEL-SCI achieved their objectives in one of the treatment arms, they still need to get FDA approval. Not only that, but they also have to change the SOC for the LR treatment arm to receive the MK injections for 3 weeks before surgery occurs. We believe the likelihood of approval is warranted, but challenges remain.

CEL-SCI designed their Phase III trial with OS as the primary endpoint. The NIH considers OS the gold standard of endpoints. This is a high bar to pass and the FDA should see it extremely favorable. In addition, there hasn’t been a new FDA approved drug for HNC for over 50 years. Multikine has also received orphan drug status. The FDA recognizes the lack of options in the HNC space.

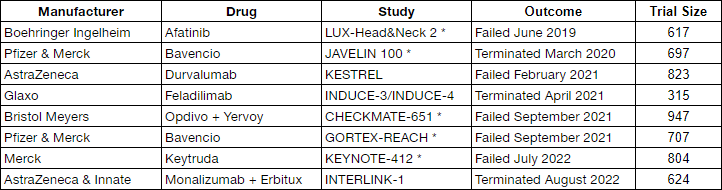

Here is a chart showing the most recent failed trials in the HNC space. This is a list of 8 failed trails within the last 3.5 years.

Failed HNC Trials (Cel-Sci)

The above companies all had survival (i.e. overall survival, progression free survival, disease free survival, or event free survival) as their primary endpoint. Also note that these trials are all large with hundreds of patients in the trial. Companies are throwing a massive amount of resources at HNC in an attempt to improve the outcome. But all have ended in failure.

The companies with an asterisk by their study indicate their trial was a first line treatment similar to CEL-SCI’s. The study without the asterisk means the trial was for recurrent cancer. Five companies, ranging from Pfizer, Merk, Bristol Meyers, to AstraZeneca all failed in the head and neck cancer trial as a first-line treatment. Yet they didn’t succeed. But a small, relatively unknown, clinical biotech managed to show their drug demonstrates significant improvement for LR patients.

Expanded the Team of Experts

CEL-SCI is a clinical biotech with no FDA approved drugs. This is new territory for the company. Fortunately they have not been shy about bringing on experts to help them get MK across the finish line. CEO Kersten stated this in his recent shareholder letter:

We have added incredibly experienced people to our team, including scientists, biostatisticians, regulatory counsel who worked at FDA, an oncologist who worked at FDA as a clinical reviewer, and more than half a dozen independent oncologists on our Scientific Advisory Board, including key opinion leaders from major U.S. medical centers. One of our team members has helped bring over 80 drugs to market. We are in very capable hands.

It is hard to know the true value of the team members, but many companies get complacent after finishing their Phase III trial with positive results. Hubris sets in and after submitting the BLA, they find themselves on the receiving end of a CRL. While a CRL is still a possibility, having the right team in place is crucial to avoiding any unnecessary missteps.

Where is the Pre-BLA meeting?

It has been over 14 months since the disclosed results and there has not been a pre-BLA meeting with the FDA.

On July 1, 2021 (3 days after Phase III results), John Cipriano, CEL-SCI Sr. VP of Regulatory Affairs stated the following on an investor call:

…we will be in contact to line up a pre-BLA meeting at which we will present all the data and seek their approval to submit an application.

Based on this statement it appeared CEL-SCI had the intention of scheduling a pre-BLA meeting fairly quickly. Usually most companies will schedule the meeting within a few months of receiving positive Phase III data. For example Citius Pharmaceuticals announced positive Phase III results on April 6 and by July 12 (3 months later) had already announced it held a pre-BLA meeting with the FDA.

This lack of pre-BLA meeting is a factor that has us slightly concerned. Is there something in the data that the FDA might not like and the company needs time to research an answer? Is there another reason besides the 3 week delay why the HR control group did better than the test group? These are questions we cannot answer. Had they scheduled the pre-BLA meeting months ago, our buy recommendation would have been higher.

In a recent Reddit AMA the CEO stated their goal is to have a pre-BLA meeting with the FDA by the end of this year. For investors and, more importantly, patients let’s hope that goal becomes a reality.

Pre-BLA meeting aside, the company has been meeting with the FDA. In the most recent shareholder letter, CEO Kersten said this:

We have met with FDA and have received their questions and comments. This is normal. We plan to submit a major follow-up package to FDA soon that will address those questions and comments. At about the same time, we plan to file the Clinical Study Report, which is typically filed with a biologics license application (BLA).

Things are moving forward, but at a very slow pace

While the FDA backlog due to Covid may be part of the reason for a delay, it doesn’t account for all of it. Assuming the data doesn’t have something ominous, additional reasons for the delay could include compiling a massive amount of information for the FDA.

For example CEL-SCI needs to compile information for 1) why the HR treatment arm did better than the control, 2) the algorithm to determine LR/HR classification, 3) changing the SOC for the LR treatment arm, 4) a new class of drug, and 5) compiling information to approve MK for use in the LR treatment arm. Most companies only need to address one, or maybe 2, but CEL-SCI needs to address all 5 simultaneously in their BLA.

The Anticipated BLA Timeline

Once the pre-BLA meeting occurs (hopefully by year’s end), we expect it will be another 3-6 months before they file the BLA. After the BLA is filed, we expect it to be at least 12 months before approval. This puts final approval sometime around mid-2024.

A Formidable Moat

Multikine has filed for Multikine patents in several countries (US, Canada, Japan, China, The EU and more). However, we do not assess much value to the patents since many of them were filed over a decade ago – the US patent expires in 2024. A positive is that CEL-SCI has been granted orphan drug status, which grants 7 years of US market exclusivity. This is nice, but not the real reason for the moat around their business.

The real value of Multikine is that it is a complex biologic. It is a collection of large molecules which is quite difficult, if not impossible, to duplicate. The process to make it is as critical as its components, both of which are top secret.

In 2007 CEL-SCI decided to build a $22M facility capable of mass-producing Multikine before they started their Phase III trial. Since Multikine is a complex biologic, the FDA could not be certain the Multikine used for the Phase III trial (potentially produced by a 3rd party) would be the same Multikine used for mass production. Therefore, CEL-SCI de-risked FDA approval by constructing the facility. Zacks recently wrote about their facility tour in mid-2019. Despite the technical advances in the 21st century, duplicating complex biologics is a herculean task with no guarantee of success.

There is also no competition for Multikine when used for HNC. No one else can put their drug in place of Multikine because it is not part of the SOC. See graphic below.

Proposed Multikine New SOC (Cel-Sci)

A competitor would need to do Phase I, Phase II and Phase III trials. This is a 10-12 year process, under ideal circumstances. If Multikine is successful, it becomes part of the new SOC. Therefore, any new drug would have to show a statistically improved benefit over Multikine + SOC. This is a huge moat to traverse.

Potential Sales

Geert Kersten put a price for Multikine of around $100K per treatment regimen back in 2015. This is low, so we will use $150K for our calculations. Note that Keytruda costs ~$150,000 for a year of treatment (2017 price) and it doesn’t cure the patient – it permits just an additional 2-3 months of survival, on average. Opdivo (a Keytruda competitor) costs ~$170,000 (2018 price) -and only extends life by ~4 months, on average.

If Multikine is approved, it will become part of the new SOC for LR patients. This is because it statistically demonstrated a clinical improvement over the prior SOC. Doctors must now use it, or at least inform the patient about the MK injections. If they don’t, they open themselves up to lawsuits.

The CEL-SCI manufacturing facility can make 20,000 dosing regimens per year, but is expandable to 60,000 per year. If we figure the manufacturing facility makes 60,000 treatment regimens per year, this results in $150,000 x 60,000 = $9 Billion in sales just for HNC. Using an average market capitalization value of 1.5-2X sales (a low multiple for a biotech) would put CEL-SCI at a $13.5B-18B market cap. This is around $245-327/share (We used 55M outstanding shares – this includes all options and warrants). Note that it will take several years to achieve these sales numbers. Regardless of the timeline, one can see that the potential sales of Multikine are impressive.

Keep in mind this value is only based on the treatment of 60,000 cases of HNC – only about 30% of the global need. Up to 210,000 new LR cases of Head & Neck Cancers are diagnosed every year.

Additional Markets

Any drug that is approved can be given off-label for other types of cancers. It is premature to guess on these numbers. But you can be sure that, if approved, the drug will be offered if the doctor thinks it will improve the patient’s outcome. Considering the administration of MK is an outpatient procedure, it is not an intensive process to receive it. We believe most patients, if given the option, will proceed with using the drug.

Cash

As of the most recent 10Q in June 2022, CEL-SCI has 28M of cash available. They are consuming cash at a rate of $1.5M per month. At the current burn rate this gives them 18 months of liquidity. We expect a slightly higher burn rate over these next several months as CEL-SCI indicated in their last shareholder letter they have added additional expertise to help with filing the BLA. We expect an offering sometime around the 2H of 2023, at the latest.

Risks

Despite the fact there is solid data in one of the treatment arms, there are still risks. The FDA is now involved in this process and it could be a bumpy ride.

CEL-SCI has a new class of drug (with no usage history), and a control in the HR treatment arm that did better than the MK arm, which will result in additional scrutiny. There is also a new algorithm that proposes to assign recurrence risk to patients before surgery, something that has not been done before in the HNC space. The FDA might not consider the 74.5% overall assignment accuracy acceptable and reject the drug outright. It is the FDA’s job to question everything to ensure the drug is safe and effective.

There could be another factor (besides the additional 3 week surgery delay) related directly to why the HR control group performed better than the Multikine group. If it exists, the FDA will thoroughly investigate.

The company has cash until 2H 2023, but this BLA process will take a year or more after filing. They will need to raise cash before they hear back from the FDA on the BLA. A cash raise will most likely depress the share price when that occurs.

Conclusion

CEL-SCI’s data suggests it might have the first non-toxic cure for cancer in newly diagnosed Low Risk for recurrence HNC patients. The LR treatment arm did very well with the HR treatment arm performing worse than the control, though not statistically significant. The algorithm for LR or HR assignment is a significant hurdle related to BLA approval. Regardless, the resulting share price contrasted against a possible BLA approval means CEL-SCI is undervalued. The current share price presents a compelling risk/reward scenario for a small part of one’s portfolio.

Be the first to comment