Mikhail Mishunin

The European gas crisis continues to shock us all – even those of us who have been preparing for some time. Living in the UK, European gas stocks are about the best hedge one can have against soaring utility bills over the winter, and very few people have any significant exposure, not helped by ESG mandates underweighting fossil fuels in portfolios.

In June to July, I switched from Tellurian (TELL), an LNG company which is building an export terminal, to Vermilion Energy (NYSE:VET) (TSX:VET:CA), when I saw how well-positioned it was to cash in on today’s nosebleed prices and how it compared on valuation. I continued loading up on shares throughout the June-July dip and also bough January calls. A somewhat under-the-radar company, Vermilion is an internationally diversified Canadian oil and gas producer with assets in North America, Europe and Australia. European gas accounts for ~23% of 2022 production. It has a ~C$6.3bn market cap and ~C$1.6bn in net debt.

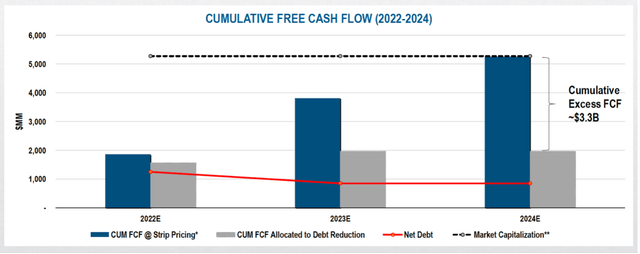

The case for the stock is its free cash flow (FCF) yield. The company’s beginning-of-August estimate was that it could make its entire market cap in FCF between 2022 and 2024.

Vermilion investor presentation

Believe it or not, my numbers suggest this was actually under-selling it somewhat, and, since then, European gas (TTF) is up by some ~50%. Despite the recent run-up of the stock, it is arguably even better value now that it was before. The stock price appreciation does not fully reflect the move in TTF.

At forward strip commodity pricing, a buyer of the whole company today could be left with his/her investment in cash and a debt-free company by the end of 2024. Due to the margin of safety that I see, the stock is my highest conviction holding and largest position. I believe it has a value of C$95 per share at forward strip commodity pricing.

Asset overview

Vermilion owns a rather unusual collection of assets – across North America, Europe and Australia – making the company quite complex (AKA unpopular!).

I’ve had people contact me on Vermilion asking about the reported “low reserve life” of only seven years. I’m not sure where this came from, but as of 31 December 2021 it had 481 million barrels of oil equivalent (BOE) giving the company 9.7 years and 15.4 years of gross proved and probable reserves (1P and 2P) on 2021 production of ~85,400 boe/d. This doesn’t include 2022’s acquisitions.

The Leucrotta acquisition closed in May 2022 and adds ~70 million boe of 1P and 2P reserves in the Montney, Canada. The company, however, estimates this to be a fraction of the total recoverable resource as it plans to increase production from these assets to 28,000 boe/d for a life of 20+ years.

The Corrib acquisition is expected to close in Q4 2022 and adds ~7,700 boe/d of European gas production, with end of field life estimated at 2034.

Vermilion investor presentation

Over half of the production is in Canada (~52,000 boe/d) with assets in West Pembina, SE Saskatchewan and the Montney. In the US, the company operates in the Powder River Basin in north-eastern Wyoming.

Off the coast of Australia, Vermilion owns the Wandoo oilfield whose products fetch a premium to Brent.

In Europe, the company owns assets in:

- France – operates two-thirds of the country’s domestic oil production.

- The Netherlands – Vermilion is the number 2 onshore gas producer.

- Ireland – owns a 20% operated interest in the Corrib Natural Gas Project. (Following the closure of the partner acquisition in Q4 2022, the company will own a 56.5% operated interest.)

- Germany – owns production and an exploratory land position in the North German Basin.

- Central and Eastern Europe – ~2 million acres of undeveloped land in the Pannonian Basin across Croatia, Hungary and Slovakia.

Corrib acquisition

In November 2021, Vermilion announced an agreement to acquire an additional 36.5% working interest in the Corrib Natural Gas Project, off the coast of Ireland, an acquisition that will add ~7,700 boe/d of European natural gas production. The gas field provides ~60% of Ireland’s natural gas consumption and 100% of its production following the decommissioning of the Kinsale Head Gas Field.

Buying out partner Equinor for approximately C$600m, operator Vermilion is increasing its ownership from 20% to 56.5%. The remaining stake is owned by Canada Pension Plan Investment Board.

The deal has an effective date of 1 January 2022, after which all the FCF will accrue to Vermilion and be netted off the purchase when the deal closes, which Vermilion anticipates will be in Q4 2022. The company has forecast the acquisition to produce C$450-500m FCF in 2022 alone (expected net purchase price of C$100-150m). The 2022 FCF will now be even more based on the recent run-up in strip gas prices.

They have essentially bought the asset with its own 2022 FCF, and it will then be capable of funding shareholder returns into 2023.

Production

Following Q2 production of 84,868 boe/d, 2022 annual production guidance is 86,000 to 88,000 boe/d, excluding Corrib acquisition volumes. Vermilion is forecasting 2022 exit production of 95,000 to 100,000 boe/d (including Corrib and increased production from the Leucrotta acquisition that closed in May).

The company comments that its intention is to “maintain the production base in this range for the foreseeable future”. The 10-year plan delivers flat production and, thus, the once growthy Vermilion is moving to a capital return model.

Hedges

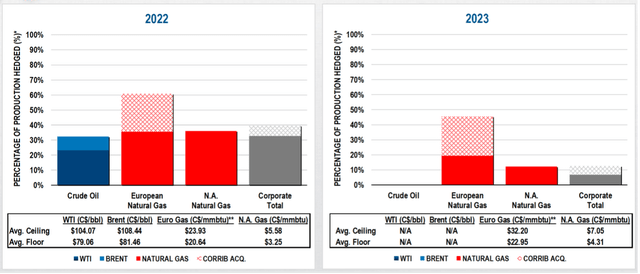

Pro forma the Corrib acquisition, ~40% of total production in 2022 is hedged, which is moving to ~12% hedged in 2023.

European gas production (including Corrib) is ~60% hedged in 2022, moving to ~45% in 2023. A large part of the 2023 hedging, as you can see in the graphic below, is the Corrib acquisition, which was hedged as part of the deal.

However, Euro gas hedging for 2023 was just increased since the beginning of July from 32% to 45%, locking in the high prices since the recent run-up in TTF. The average ceiling on Euro gas hedges is increasing in 2023 from C$24/mmbtu to C$32/mmbtu.

Vermilion investor presentation

Free cash flow

With ~23% of 2022 production being European gas, Vermilion has substantial leverage to the current stratospheric TTF prices.

Pro forma Corrib, FCF was C$920 in H1 2022. In its August investor presentation, the company estimates full-year 2022 FCF of ~C$1.8bn or C$11.10/share.

High earnings yield as it is, this was a little conservative even before August’s parabolic TTF move. The TTF strip pricing now averages $96/mmbtu for September to December (as at 26 August) compared with ~$30 in Q2.

I’m now getting ~C$2.4bn FCF, or $14.70/share, for the full year of 2022 by modelling with actual July and August prices and TTF strip prices for the remaining months.

For 2023, using the 2023 strip pricing, the updated hedging and the company’s forecast production, I’m getting C$4.2bn FCF, or C$25.40/share.

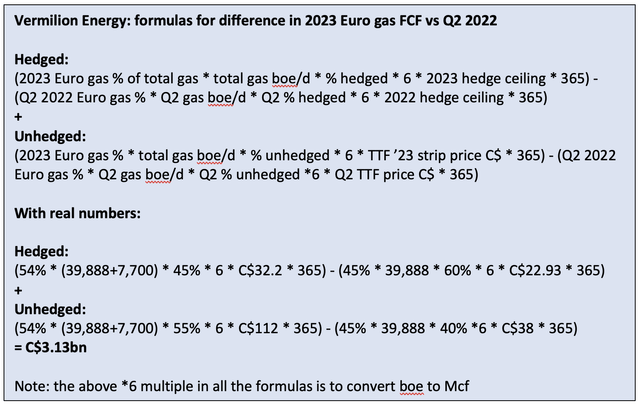

These results are modelled out using formulas for each commodity to estimate the difference between future FCF and Q2 reported FCF (C$340m). The difference on each commodity is then added to Q2 FCF annualised to arrive at a total future FCF number.

This C$3.13bn is the number for Euro gas to add to the annualised Q2 2022 FCF. Similar calculations for oil, NGLs and AECO gas also should be added. The increased capex (C$50m) can be subtracted.

The result is a projected FCF for 2023 of C$4.2bn, or C$25.40/share.

Shareholder returns

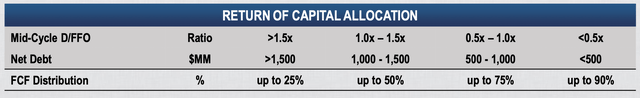

Vermilion released a capital return framework in its Q2 report, and the result is better than I was expecting. The plan is essentially to reduce net debt from C$1.6bn to C$1.2bn by the end of 2022 and to work towards returning the majority of capital to shareholders.

In July, Vermilion announced a share buyback programme for ~16 million shares, ~10% of the float. By 11 August, the company had purchased 1.25 million shares for C$35 million.

In August, Vermilion increased its quarterly base dividend by 33% to C$0.08/share, equating to a ~1% yield. Management aims to provide shareholders with a resilient, growing base dividend by limiting the base dividend to 10% of mid-cycle free funds flow (FFO).

However, the company intends to “return an increasing amount of capital to shareholders as debt levels decrease using a debt grid”.

Vermilion investor presentation

Management anticipates returning up to 25% of FCF in H2 2022 and up to 50-75% in 2023 while reducing debt to $850 million by the end of 2023.

The company announced in the Q2 report that it will consider a variety of capital return options: share buybacks, variable and special dividends, and “a potential substantial issuer bid”. Based on its “review of a number of valuation data points”, however, it expects the majority of the capital return to be in the form of share buybacks initially.

Acquisition strategy

Shareholders may have been relieved to learn Vermilion is pivoting from its debt pay-down and acquisition strategy to a capital return model (although, frankly, if the recent acquisitions are anything to go by, there should be no complaints!)

Vermilion announced in its Q2 releases that future acquisitions will focus on European gas, mentioning potential German gas bolt-on acquisitions. The company says it will “continue to evaluate small tuck-in acquisitions to further strengthen our core areas”.

It seems Vermilion is going smaller with the acquisitions, aiming to maintain production at the 95,000-100,000 boe/d level after the end of 2022, while increasing European gas volumes as a percentage of production.

Management

There is some perception in the market that the management is poor with its Executive Committee structure, that they are serial acquirers and can’t be trusted to return capital. Cancelling the dividend in 2020 left a sour taste!

Yet, despite the poor stock performance since 2014 along with the broad sector, the long-term performance of Vermilion stock has been very good. The stock has gone from C$1.75 in 1996 to C$38 in 2022, and they have paid ~C$40 in dividends over that time.

The recent messaging from the company and the new capital return framework should change the perception of management being serial acquirers. While it remains a risk that, following two good acquisitions, they could plough into a poor acquisition at the top of the Euro gas market and destroy capital, this goes against what they’ve just announced: a disciplined capital return framework via a debt grid, aiming to return up to 90% of FCF to shareholders.

The question is then, do we trust the management?

Vermilion has an Executive Committee structure which fills the role of CEO. Executive Chairman Lorenzo Donadeo, a co-founder of Vermilion in 1994, has confirmed his plan to retire from his role, effective 1 September 2022. President Dion Hatcher, who has been with Vermilion since 2006, will lead the Executive Committee going forward.

I was in a Twitter Spaces with management in June, including President Dion Hatcher and CFO Lars Glemser. They came across to me as very capable managers, Euro gas bulls who understand the macro and were excited about capital returns. Judging by this and recent events (the accretive acquisitions, the capital return framework, the buybacks and dividend increase), I see no reason not to trust them to deliver on capital allocation.

Valuation

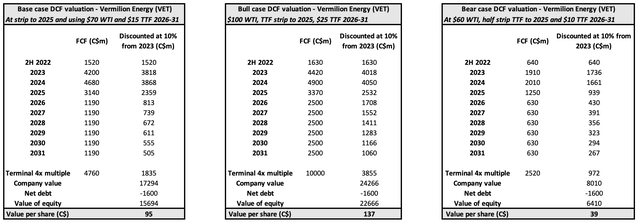

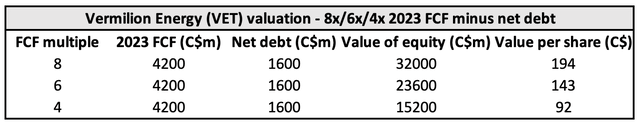

Vermilion is not easy to value accurately due to its sensitivity to Euro gas prices. A standard valuation model of a multiple of FCF minus net debt could be misleading as the cash flows are expected to be so front-loaded. I have therefore approached the valuation primarily with discounted cash flow (DCF) models, making a range of assumptions about commodity prices.

- I see the stock at full value at around C$95/share as a base case valuation with commodity prices similar to forward strip prices (at strip to 2025 and using $70 WTI and $15 TTF from 2026-31).

- My bull case is C$137/share, using $100 WTI, TTF strip prices to 2025 and $25 TTF from 2026-31.

- My bear case valuation is C$39/share, using $60 WTI, half of the strip Euro gas prices to 2025 and $10 TTF 2026-31.

You might see in the above tables that I’ve got 2024 as the peak of earnings despite lower TTF prices that year. This is because of hedges rolling off from the beginning of 2024.

The bear case valuation illustrates what would have to happen for the stock to be worth its current price: the strip TTF prices from today to 2025 would have to be cut in half and be $10 thereafter, along with $60 oil for the next decade. Can that happen? Possibly – particularly the halving of TTF strip prices to 2025 were there to be a resolution of the Ukraine war and resumption of gas flows from Russia. Yet, it seems unlikely for all three to occur – and the company now has the option to hedge at the forward strip which it appears to be doing. The point is, we have a big margin of safety.

To use the ‘X times FCF minus net debt’ valuation just to compare with the DCF, a 4x multiple of (near) peak earnings is probably reasonable for this cyclical, and this ties in with the base case DCF.

Risks

Commodity prices

The key risk is a fall in commodity prices. Vermilion’s earnings can rise with lower oil prices due to high European gas. However, if both commodities were to suffer a significant, prolonged decline, the stock would be vulnerable. I estimate FCF would turn negative around $45 WTI and $7 TTF. At $70 WTI and $10 TTF, the company can make ~C$660m in FCF.

Delay to closure of the Corrib acquisition

The closure of the Corrib acquisition being delayed past the end of 2022 could have a negative effect on the stock price.

Change of administration in Russia

The end of Putin along with the war in Ukraine, the installation of a more pro-Western government in Russia and the resumption of natural gas supply to Europe would bring TTF prices down.

Capital allocation

There is some risk of the company doing a poor gas acquisition at the peak and destroying capital.

Catalysts

- Q3 earnings should be a blowout based on TTF pricing.

- The Corrib gas acquisition is expected to close in Q4, which could get some news coverage considering the gas crisis in Europe. Following that, the Corrib earnings will appear on the financial statements.

- 2023 FCF numbers are looking far better than 2022, which is not yet appreciated by analyst consensus. The company should be valued increasingly on 2023 numbers as we approach the end of the year.

- Buybacks are forecast to increase from up to 25% of FCF in 2022 to up to 50% in 2023. Based on our 2023 FCF numbers, that’s a lot of buybacks on the cards, which should support the stock price in addition to meaningfully increasing our ownership of the business.

- The end of the US Strategic Petroleum Reserve (SPR) release in October could be a catalyst for oil prices which would be bullish for the sector.

Conclusion

The case for Vermilion Energy is that it’s possible for it to make its entire market cap in FCF within the next two years at strip commodity prices (from now to end Q2 2024). The company has a great opportunity to lock in the current forward strip TTF prices until the end of 2024 (it has been increasing hedges since July). If the company were to do this, a buyer of the whole business would be left with his/her investment in cash and a debt-free company by the end of 2024. I believe management will be gradually increasing hedges opportunistically over this autumn and winter.

According to the company’s capital return framework, a substantial amount of the FCF will be returned to shareholders, initially through buybacks. I see front-running the 2023 buybacks as likely to be rewarded with a rerating of the stock in addition to the share count reduction. A C$55-60 share price by January 2023 would not surprise me – and I am long January calls in addition to the stock. Even if it doesn’t rerate, the stock presents a compelling long-term investment opportunity with value of ~C95/share.

Be the first to comment