Darren415

This article was first released to Systematic Income subscribers and free trials on Nov. 5.

Welcome to another installment of our CEF Market Weekly Review where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the first week of November. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

It was a broadly flat week for CEFs as a drop in the average sector NAV was counterbalanced by tightening in discounts. Equity-linked sectors like Covered Call, REITs and others underperformed, reflecting lower stocks on the week.

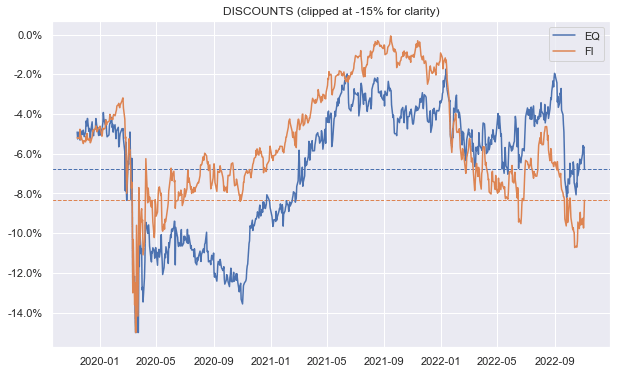

Fixed-income sector discounts bounced off a double-digit discount level but remain attractive historically.

Systematic Income

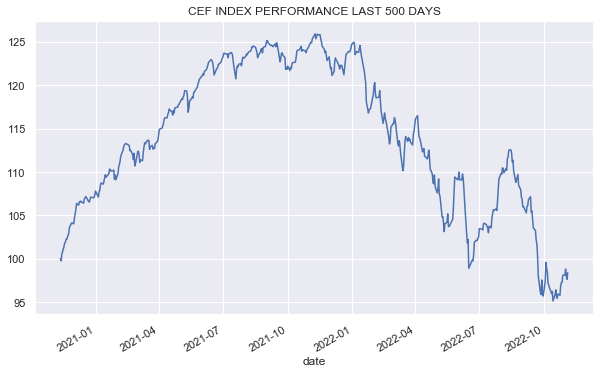

The CEF market has stabilized in the last couple of weeks and is range trading not far from the level it was at two years ago.

Systematic Income

Market Themes

The question of tax-loss rotations came up on the service. In our view, it’s never too early to think about this and it’s a theme we discussed earlier in the year.

A common question is when should investors start executing rotations? There is no need to wait till the last possible minute for three reasons.

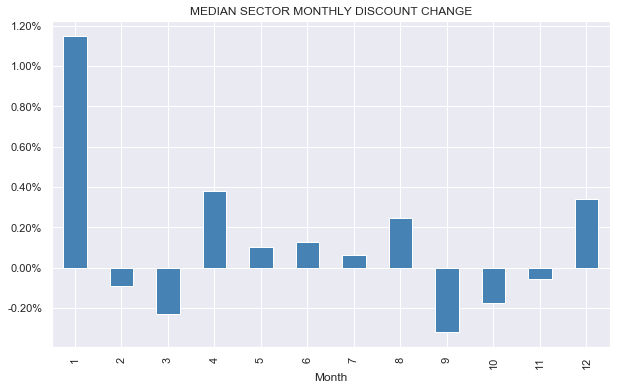

First, it’s impossible to time the optimal point anyway. In fact, the monthly seasonality of CEFs shows that December tends to be a fairly strong month in contrast to the period ranging from September to November. This suggests that statistically, selling earlier in the fall is better than waiting to the last possible minute.

Systematic Income

Two, reduced liquidity towards the end of the year can make it difficult to make all the necessary rotations in the portfolio without incurring excessive bid/offer costs.

Three, the focus of the timing should be as much on the target of the rotation. In other words, waiting till the target position is attractive can be a good trigger to do the rotation. This means it’s as important to decide on new positions to acquire as it is to select which positions to sell.

There are different ways to evaluate rotation ideas.

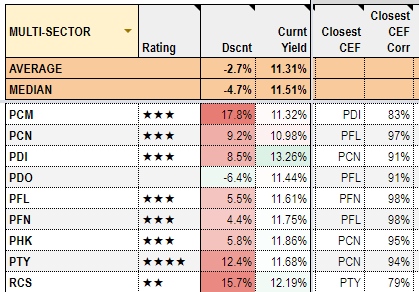

For CEFs, a good place to start is to first identify the CEF that best resembles the position that is to be sold. On the service, we call this the “Closest CEF” as shown below. It is based on the CEF that has the highest pairwise daily total NAV return correlation to a given CEF. The higher the correlation the more similar are the portfolios of the two CEFs.

It’s no surprise that closest CEFs tend to be CEFs from the same manager as the following PIMCO CEF extract shows.

Systematic Income CEF Tool

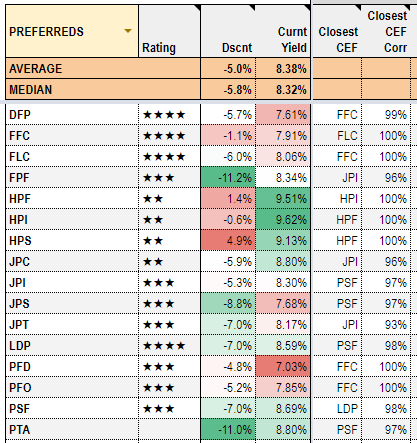

The picture is much the same in the preferreds sector where Nuveen, John Hancock, Flaherty & Crumrine and Cohen & Steers manage multiple funds. As we would expect the most similar CEFs are those from the same manager as they tend to share many positions. This offers a wide array of options for investors who like to maintain broadly the same allocation and strategy but also harvest tax losses.

Systematic Income CEF Tool

Once investors identify good pairs for rotation it is then important to execute when the timing is favorable. Tracking the valuation of the two funds can flag a good time for a rotation.

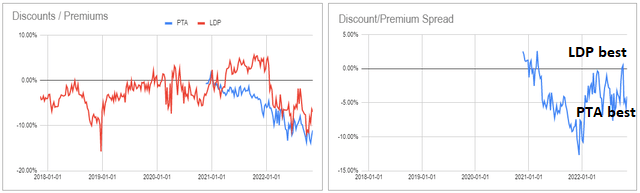

For example, this year we have highlighted a couple of times when the Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund (PTA) could be switched to the Cohen & Steers Limited Duration Preferred and Income Fund (LDP). This happens whenever the discount differential between the two funds approaches zero. This is because LDP has a lower management fee than PTA which means its discount should trade at a tighter level than that of PTA, all else equal. Right now is a less favorable time for moving from PTA to LDP; however, it is a good time to move from LDP to PTA as the PTA discount looks wide relative to LDP.

Systematic Income CEF Tool

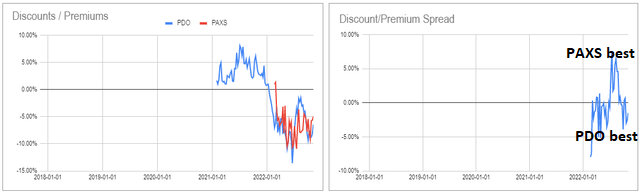

We have also highlighted a couple of times when PIMCO Access Income Fund (PAXS) moved out to a more attractive discount valuation than PIMCO Dynamic Income Opportunities Fund (PDO) – this happened when PAXS traded out to a more than 3% wider discount. At the moment, PDO is trading at a wider discount to PAXS so the PAXS to PDO rotation direction is attractive.

Systematic Income CEF Tool

Market Commentary

We saw another batch of CEF distributions at the start of the month. In Invesco funds, Invesco Bond Fund (VBF) hiked while nearly all Muni CEFs cut. On the face of it there is no good reason for VBF to keep hiking – it’s a nearly fully fixed-rate unleveraged fund. It has a smattering of floating-rate positions but not nearly enough to make a big difference. It was underdistributing at a $0.052 level but now at $0.0655 it is overdistributing relative to its income.

What seems to be happening is that the fund is mirroring what is happening with its yield. For example, at its new distribution it has a NAV yield of 5.1%. That’s not a million miles away from the broader investment-grade bond yield (A-rated bond yield is at 5.7%) net of the management fee. This adjustment to better reflect the underlying level of yield rather than income makes a lot of sense but it can be counterintuitive since the fund’s actual income has not risen at all.

Across Nuveen CEFs, all loan funds hiked as did Nuveen Mortgage and Income Fund (JLS) which holds a lot of securitized assets, half of which are floating-rate. Nuveen provides a helpful “coupon structure” document for JLS on its website. There were no changes for PIMCO or BlackRock CEFs.

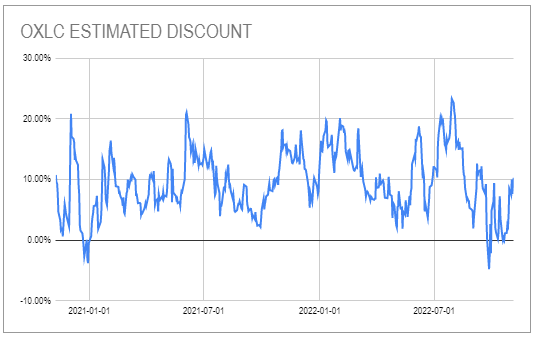

CLO Equity fund Oxford Lane Capital (OXLC) finally declared its Sep NAV which came in 14% below its August level. The estimated premium has bounced nicely from a flat level to around 10% and is no longer as reasonably priced as it was.

Systematic Income CEF Tool

CEF Tool Update

There were new funds added to the CEF Tool: Destra Multi-Alternative Fund (DMA) and Thornburg Income Builder Opportunities Trust (TBLD) in the Hybrid sector, Cohen & Steers Real Estate Opportunities and Income Fund (RLTY) in Real Estate and RiverNorth Managed Duration Municipal Income Fund II (RMMZ) in Munis. RLTY which is run by Cohen & Steers have a good reputation on their preferreds funds is worth a look for REIT CEF fans. RLTY has a hybrid structure with a third in debt and the rest in stocks. It also has a similar liability profile to its other CEFs which have a mostly fixed leverage cost, allowing it to keep its net income relatively stable. It’s trading at by far the widest discount in the sector at 16% vs a 4% average.

Be the first to comment